Texas Estates Code Copy Of Will

Description

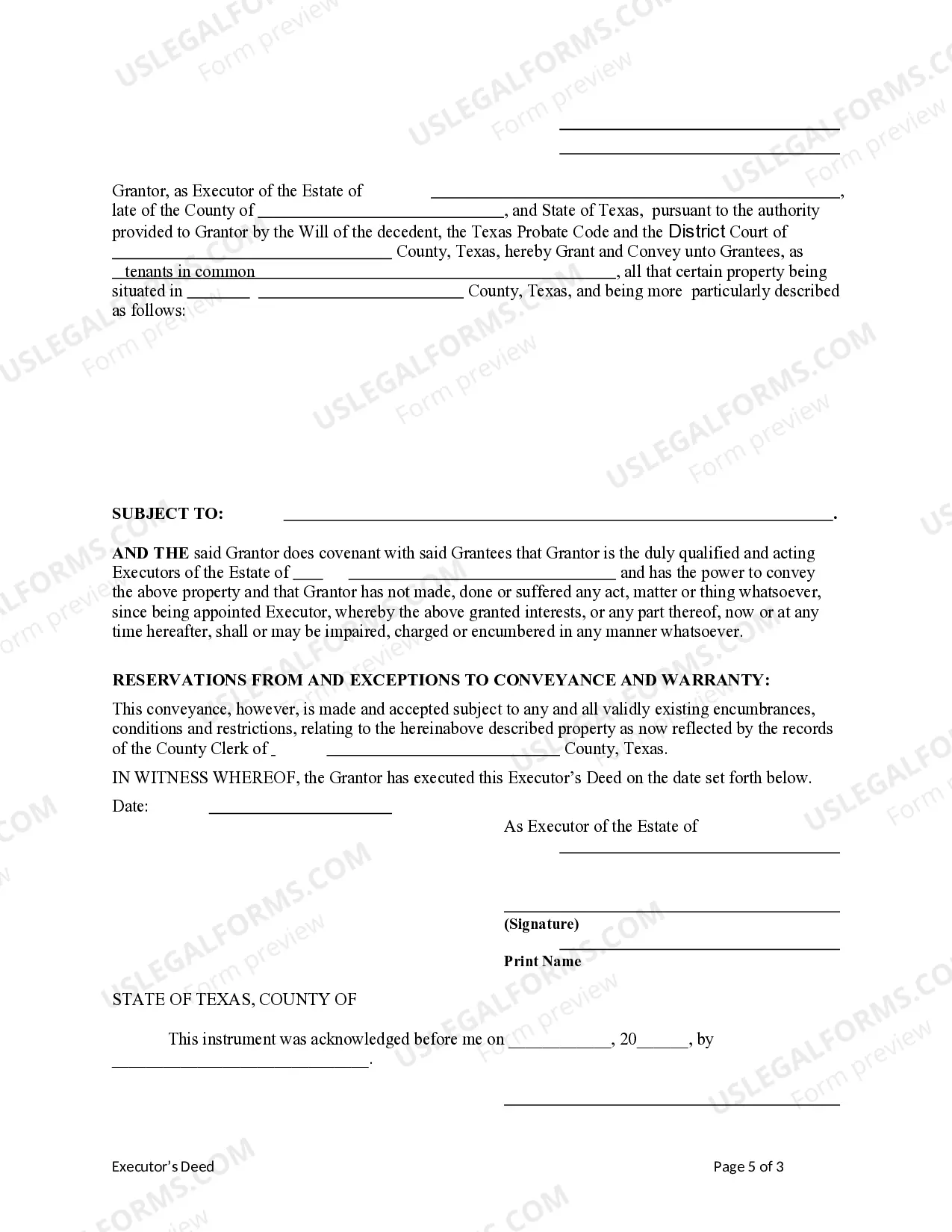

How to fill out Texas Executor's Deed - Estate To Five Beneficiaries?

It’s clear that you cannot transform into a legal expert in a single night, nor can you quickly learn to craft a Texas Estates Code Copy Of Will without a specific set of expertise.

Producing legal documents is an extended process that necessitates specialized training and skills.

So why not delegate the drafting of the Texas Estates Code Copy Of Will to the specialists.

You can revisit your documents from the My documents section at any time. If you’re an existing user, you can simply Log In, and find and download the template from the same section.

No matter the aim of your documentation—be it financial, legal, or personal—our site has you covered. Experience US Legal Forms today!

- Locate the document you need by utilizing the search bar at the top of the site.

- Preview it (if this option is available) and review the accompanying description to determine if Texas Estates Code Copy Of Will is what you are looking for.

- Restart your search if you require a different document.

- Create a free account and choose a subscription plan to acquire the document.

- Select Buy now. After the payment is finalized, you can download the Texas Estates Code Copy Of Will, fill it out, print it, and send or deliver it to the appropriate individuals or organizations.

Form popularity

FAQ

In the case of ignoring the beneficiary, the court intervention could be enough to prod the Trustee to action. If an unresponsive trustee has demonstrated animosity toward the beneficiary that results in unreasonable refusal to distribute assets or has a conflict of interest, the court may remove the Trustee.

Utah Code 75-7-816 defines that ?when title to real property is granted to a person as trustee, the terms of the trust (the name of the trustee, the address of the trustee, and the name and date of the trust) may be given either in the deed of transfer; or in an instrument signed by the grantor and recorded in the same ...

Once you send your written demand to the Trustee, the Trustee has 60 days to provide you with a copy of the Trust. Your written request may prompt a trustee to do the right thing by sending you a copy of the Trust.

A qualified disclaimer can be useful in cases where someone has not set up an exemption trust prior to their death. The qualified disclaimer enables the beneficiary to refuse part or all of the assets, rather than to receive them.

(3) A trustee shall send to the qualified beneficiaries who request it, at least annually and at the termination of the trust, a report of the trust property, liabilities, receipts, and disbursements, including the amount of the trustee's compensation or a fee schedule or other writing showing how the trustee's ...

Many clients also wish to name one or more of their children as the trustee of that trust, but are not sure if that is allowed by the law. The short answer is yes, a beneficiary can also be a trustee of the same trust?but it may not always be wise, and certain guidelines must be followed.

The trust must be irrevocable and the words ?asset protection trust? must appear in the title. The trust must have a corporate trustee, and at least some of the trust assets must be held in the form of cash or stocks in an account with the trustee.