Texas Gift Form Application With Spouse

Description

How to fill out Texas Gift Deed For Individual To Individual?

Handling legal papers and procedures can be a time-consuming addition to your entire day. Texas Gift Form Application With Spouse and forms like it usually require that you look for them and navigate the way to complete them properly. For that reason, regardless if you are taking care of economic, legal, or personal matters, having a comprehensive and practical web library of forms on hand will significantly help.

US Legal Forms is the best web platform of legal templates, featuring over 85,000 state-specific forms and a variety of tools to assist you complete your papers quickly. Check out the library of pertinent documents available to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any time for downloading. Protect your papers administration processes using a high quality service that lets you prepare any form within minutes without any additional or hidden fees. Simply log in in your account, identify Texas Gift Form Application With Spouse and download it immediately within the My Forms tab. You can also access formerly saved forms.

Would it be the first time using US Legal Forms? Register and set up up your account in a few minutes and you will have access to the form library and Texas Gift Form Application With Spouse. Then, adhere to the steps below to complete your form:

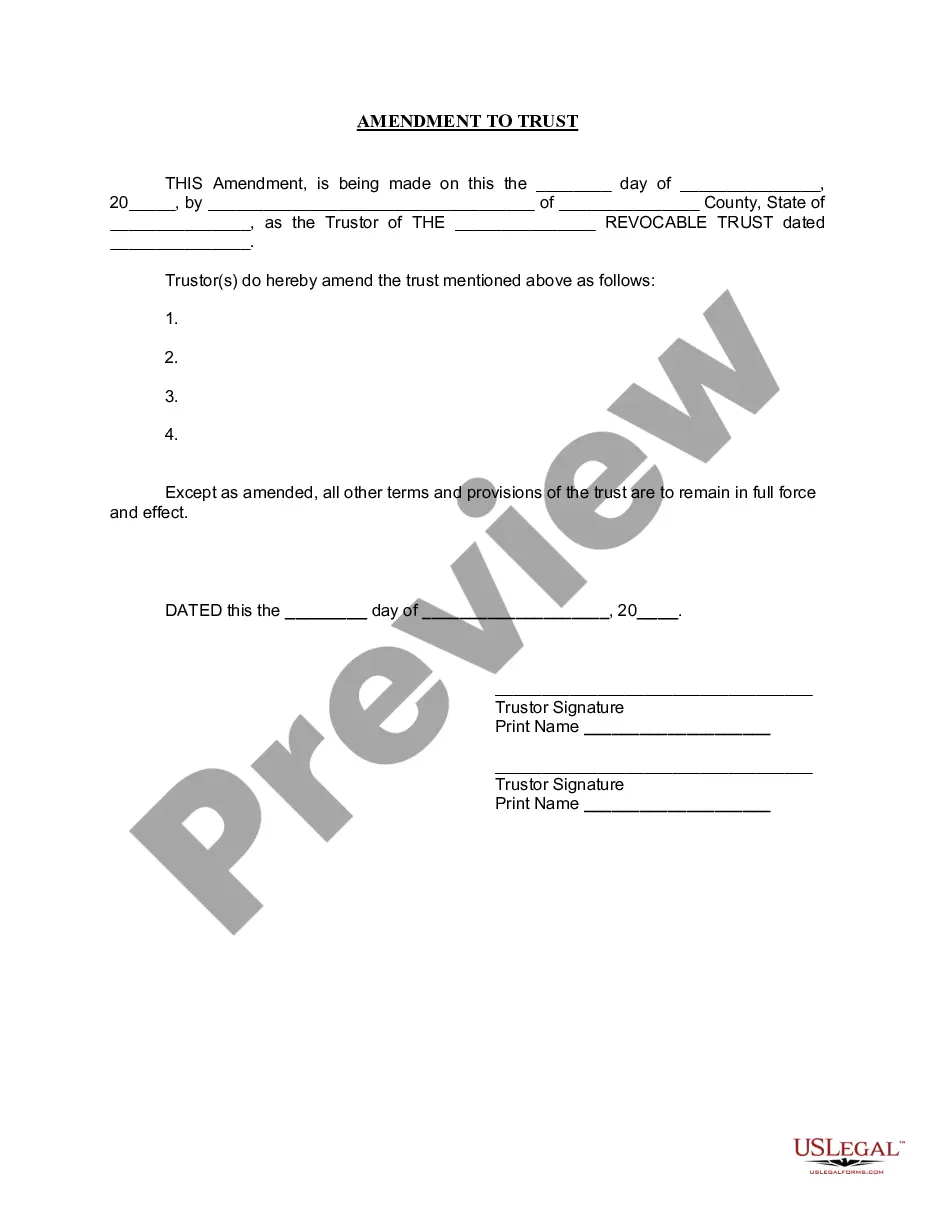

- Ensure you have discovered the right form by using the Preview option and looking at the form description.

- Pick Buy Now as soon as ready, and choose the subscription plan that is right for you.

- Select Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience assisting users deal with their legal papers. Discover the form you require right now and improve any process without breaking a sweat.

Form popularity

FAQ

Needed Documents The donor and recipient must complete a joint notarized Affidavit of Motor Vehicle Gift Transfer (form 14-317) and must be filed in person by either the donor or recipient.

If there is more than one seller named on the title and their names are separated by ?and? or ?and/or? then both sellers need to sign the title before it is transferred to the buyer. If nothing separates the owner names, both must sign. The same applies to multiple buyers.

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

The transaction is subject to motor vehicle tax and standard presumptive value (SPV) procedures may apply. The $10 gift tax is due when a motor vehicle is transferred between eligible family members for no consideration.

In addition to completing Form 130-U, Application for Texas Title and/or Registration (PDF), both the donor and person receiving the motor vehicle must complete a required joint notarized Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and ...