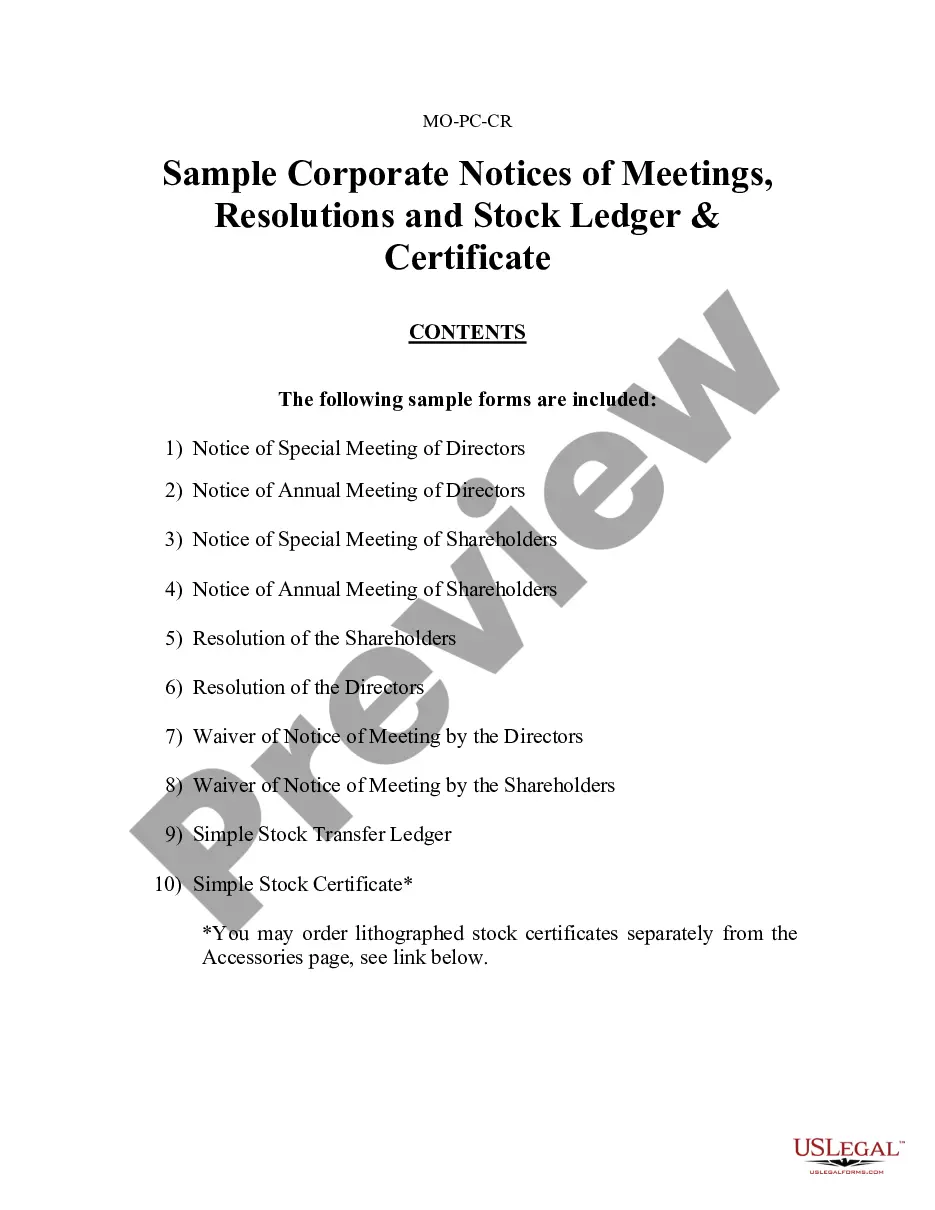

Texas Gift Form Application For Car

Description

How to fill out Texas Gift Deed For Individual To Individual?

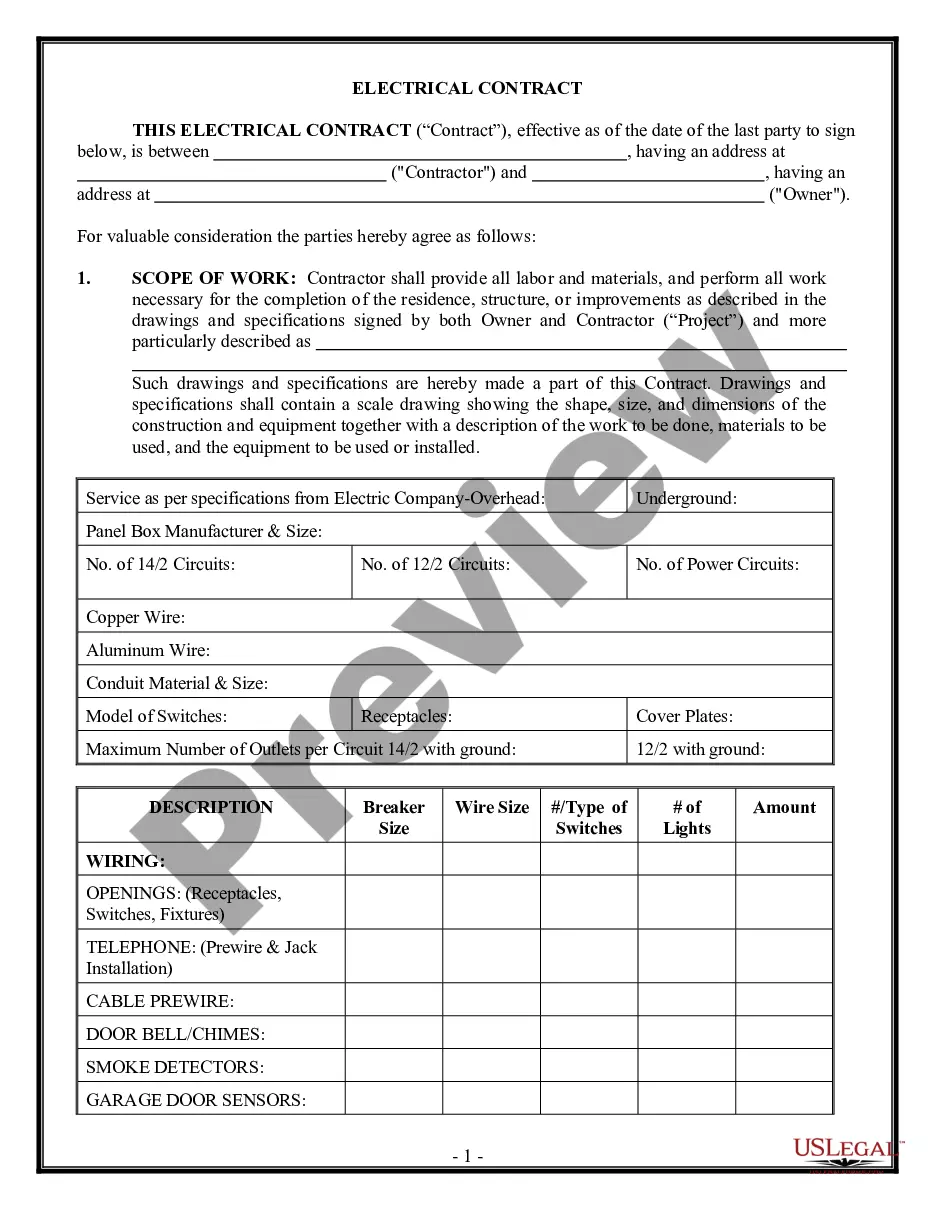

Whether for business purposes or for personal affairs, everyone has to handle legal situations at some point in their life. Filling out legal documents requires careful attention, starting with choosing the correct form template. For example, if you select a wrong edition of a Texas Gift Form Application For Car, it will be declined once you submit it. It is therefore crucial to have a trustworthy source of legal papers like US Legal Forms.

If you have to obtain a Texas Gift Form Application For Car template, follow these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, get back to the search function to locate the Texas Gift Form Application For Car sample you need.

- Get the file if it meets your requirements.

- If you already have a US Legal Forms profile, just click Log in to gain access to previously saved templates in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the profile registration form.

- Select your transaction method: use a bank card or PayPal account.

- Pick the document format you want and download the Texas Gift Form Application For Car.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time looking for the right sample across the internet. Use the library’s straightforward navigation to get the correct template for any occasion.

Form popularity

FAQ

Taxable Transfers The transaction is subject to motor vehicle tax and standard presumptive value (SPV) procedures may apply. The $10 gift tax is due when a motor vehicle is transferred between eligible family members for no consideration. Family Transfers - Motor Vehicle Tax Guide - Texas.gov texas.gov ? taxes ? publications ? fam... texas.gov ? taxes ? publications ? fam...

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Gifting a Vehicle The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Buying or Selling a Vehicle | TxDMV.gov txdmv.gov ? motorists ? buying-or-selling-a-... txdmv.gov ? motorists ? buying-or-selling-a-...

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas. Motor Vehicle Tax Guide - Texas.gov texas.gov ? taxes ? oos-mv-transports texas.gov ? taxes ? oos-mv-transports

A $10 tax is due on a gift of a motor vehicle to an eligible party. The gift tax is the responsibility of the eligible person receiving the motor vehicle, and the person pays the gift tax to the county tax assessor-collector (CTAC) at the time the person titles and registers the motor vehicle.