Gift Deed Format For Immovable Property

Description

How to fill out Texas Gift Deed For Individual To Individual?

Acquiring legal document samples that adhere to federal and local regulations is crucial, and the web provides numerous alternatives to select from.

However, what's the purpose of expending time searching for the properly formulated Gift Deed Format For Immovable Property example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable templates created by attorneys for all business and personal situations. They are simple to navigate with all documents organized by state and intended use.

Discover another sample by utilizing the search tool at the top of the page if needed. Click Buy Now once you've found the appropriate form and select a subscription plan. Create an account or Log In and complete your payment using PayPal or a credit card. Choose the format for your Gift Deed Format For Immovable Property and download it. All documents you find through US Legal Forms are reusable. To re-download and fill out previously purchased forms, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Our experts stay informed about legislative updates, ensuring that your documentation is current and compliant when obtaining a Gift Deed Format For Immovable Property from our site.

- Acquiring a Gift Deed Format For Immovable Property is quick and easy for both existing and new users.

- If you already possess an account with a valid subscription, Log In and save the document sample you need in your desired format.

- If you are visiting our site for the first time, follow the instructions below.

- Examine the template using the Preview feature or review the text description to confirm it meets your requirements.

Form popularity

FAQ

There is no set gift deed format in Pakistan. Generally, when someone bequeaths their property to a loved one, the deed mentions that the gift was made voluntarily and without any coercion. It also clarifies the donor is not bankrupt and won't ever ask for the gift to be returned.

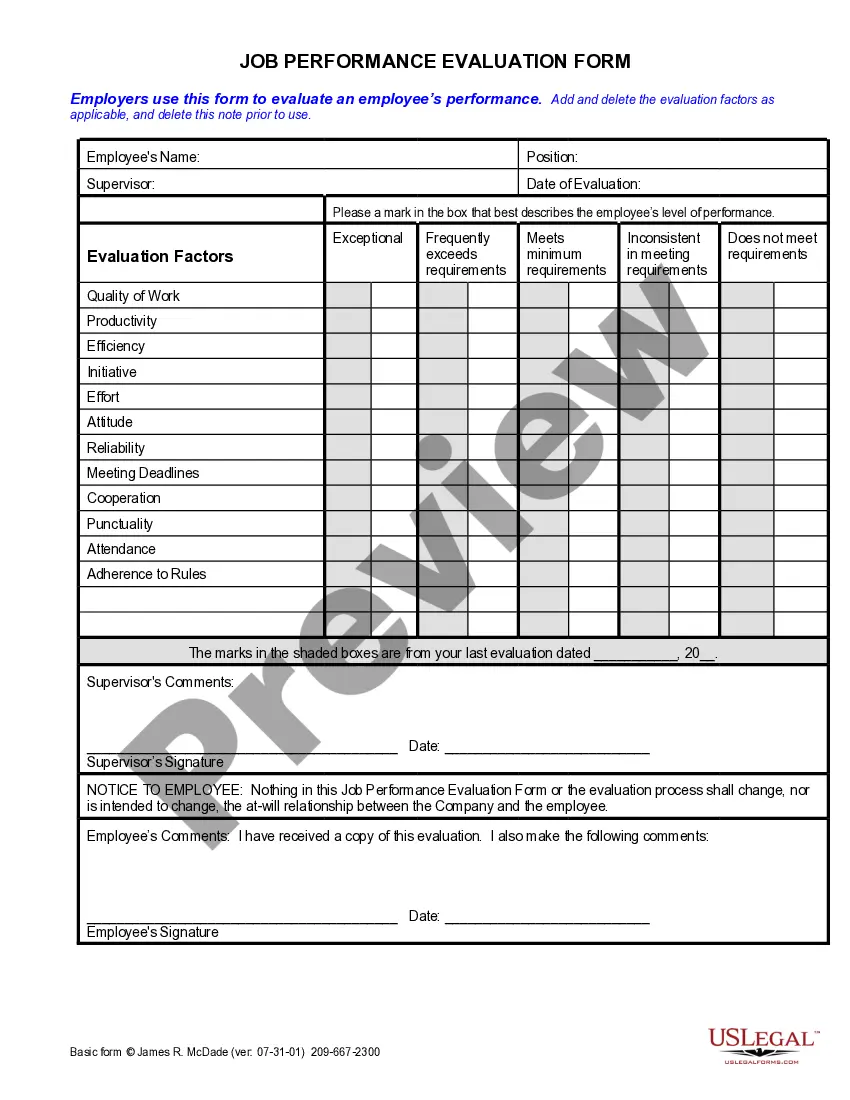

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Gift deeds in Texas are valid; however, there are strict requirements for gift deeds in Texas. Therefore, if you have a document that might be a gift deed or if someone is claiming they have a gift deed to a property that should be yours, you should contact an attorney as soon as possible.

The Gift Deed needs to be in writing. It must include the full name of the current owner and the full name, mailing address and vesting of the new owner. The property needs to be properly described.

However, Texas does not impose a gift tax on transfers of real estate between family members nor is there a capital gains tax in Texas, so you may only be liable for federal taxes. When transferring a house after death through a will or trust, estate taxes may come into play.