A Limited

Description

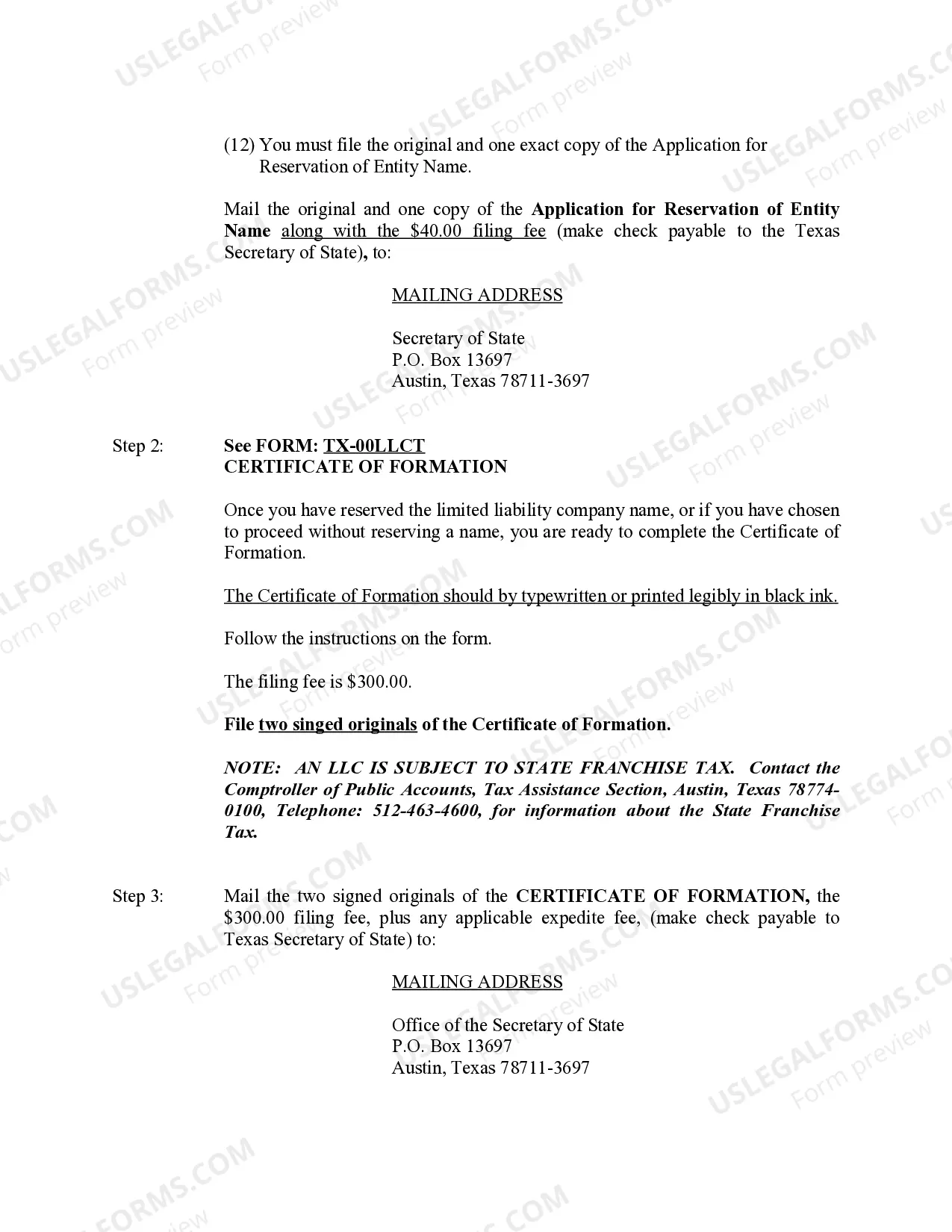

How to fill out Texas Limited Liability Company LLC Formation Package?

- Log in to your US Legal Forms account if you're an existing user. Download your required form template directly by selecting the Download button. Ensure your subscription remains activated, and if it has expired, be sure to renew it.

- For first-time users, begin by reviewing the Preview mode and reading the form description to confirm it meets your legal needs. Ensure it aligns with your local jurisdiction protocols.

- If you find the form unsuitable, utilize the Search feature to locate a more appropriate template that meets your requirements.

- Once you've identified your needed document, click the Buy Now button and select a subscription plan that fits your needs. Create an account to gain full access to the document library.

- Finalize your purchase by entering your payment details, or opt to use a PayPal account for convenience.

- Download the completed form to your device, allowing you to access it anytime from the My Forms section of your account.

Using US Legal Forms streamlines your legal processes, saving you time and ensuring you have the resources necessary to handle your documentation effectively.

Take control of your legal needs today by exploring the extensive library of forms available at US Legal Forms.

Form popularity

FAQ

The best program to start a limited liability company often includes services like US Legal Forms, which specializes in business formation. They provide a variety of resources, including customizable templates and expert advice tailored to your needs. Utilizing a reputable program can simplify the process, allowing you to focus on launching your business.

The best way to file for a limited liability company typically involves using an online service like US Legal Forms. This platform offers step-by-step assistance and state-specific documentation. Filing through them can streamline the process, ensuring compliance with state regulations and providing peace of mind.

Yes, you can file your limited liability company by yourself, but it requires careful attention to detail. You will need to research the necessary forms and requirements specific to your state. However, using a resource like US Legal Forms can provide guidance and resources to ensure your filing is correct, saving you time and potential headaches.

The best way to file for a limited liability company often involves using an online legal service like US Legal Forms. This platform simplifies the filing process by providing accurate, state-specific documents and clear instructions. Alternatively, you can file directly with the Secretary of State’s office, but online services can save you time and reduce errors.

The best filing status for a limited liability company can vary based on your business goals. Most LLCs opt for pass-through taxation, meaning profits and losses pass through to the owners’ personal tax returns. However, you might consider electing to be taxed as an S-Corp or C-Corp for potential tax advantages. This decision should align with your overall business strategy.

A limited liability company (LLC) offers many advantages, but there are downsides. One downside includes the complexity of ongoing compliance requirements, such as annual reports and fees. Additionally, some states impose higher taxes on LLCs, which can impact profitability. Understanding these factors is crucial before starting a limited.

A limited partnership may be preferable over an LLC for several reasons. Limited partnerships enable you to bring in passive investors without granting them management control, which can be beneficial for funding purposes. This structure also allows limited partners to reduce liability while enjoying potential profits. Each business is unique, so consider speaking with a legal expert or using platforms like US Legal Forms for further insights.

You can use 'limited' instead of LLC, but it's crucial to recognize the distinctions. While many people use these terms interchangeably, each signifies a different business structure with unique legal obligations. Assess your business goals and consult legal resources to understand which designation best suits your situation. Your choice will impact how your business operates and how you manage liability.

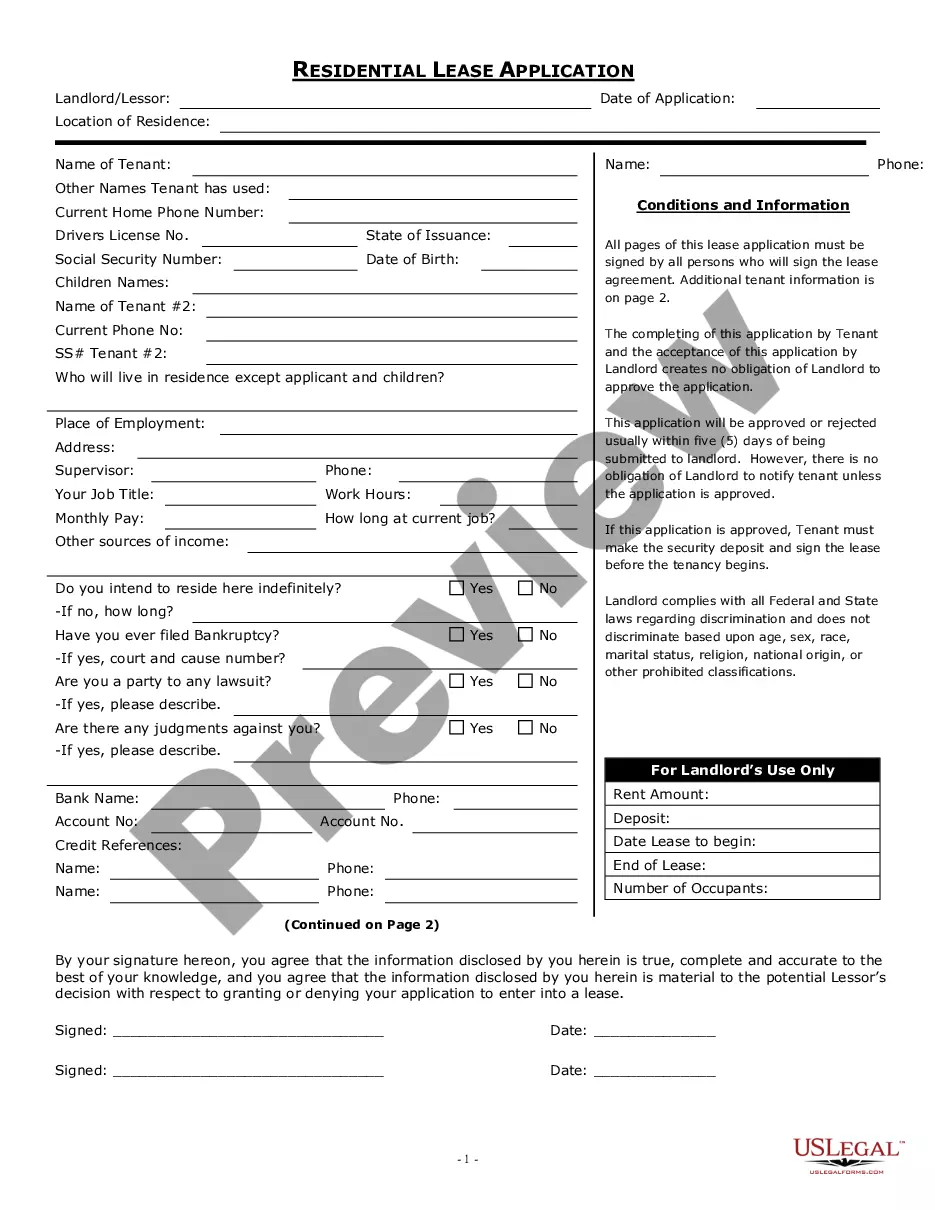

Filling out a limited power of attorney form can be straightforward if you understand the requirements. Begin by specifying the powers you wish to grant and be clear about the duration of the authority. Trust platforms like US Legal Forms to provide templates that guide you through the process seamlessly. Taking these steps wisely ensures that your document is valid and serves your intended purpose.

Yes, you can use 'limited' in some contexts instead of LLC, but it's essential to understand the legal implications. When you choose to form a limited company, it denotes a specific type of business structure that often operates under different rules than an LLC. Make sure to check the naming regulations in your state, as you want to avoid any legal complications. Proper terminology helps clarify your business type to your clients and partners.