Texas Limited Liability Company LLC Formation Package

What this form package covers

The Texas Limited Liability Company LLC Formation Package is a comprehensive collection of legal forms and instructions tailored for establishing a Limited Liability Company (LLC) in Texas. This package stands out due to its detailed, step-by-step guidance and includes essential forms such as Articles of Formation and an Operating Agreement. It is designed to simplify the LLC formation process, making it accessible for those with little legal experience.

What’s included in this form package

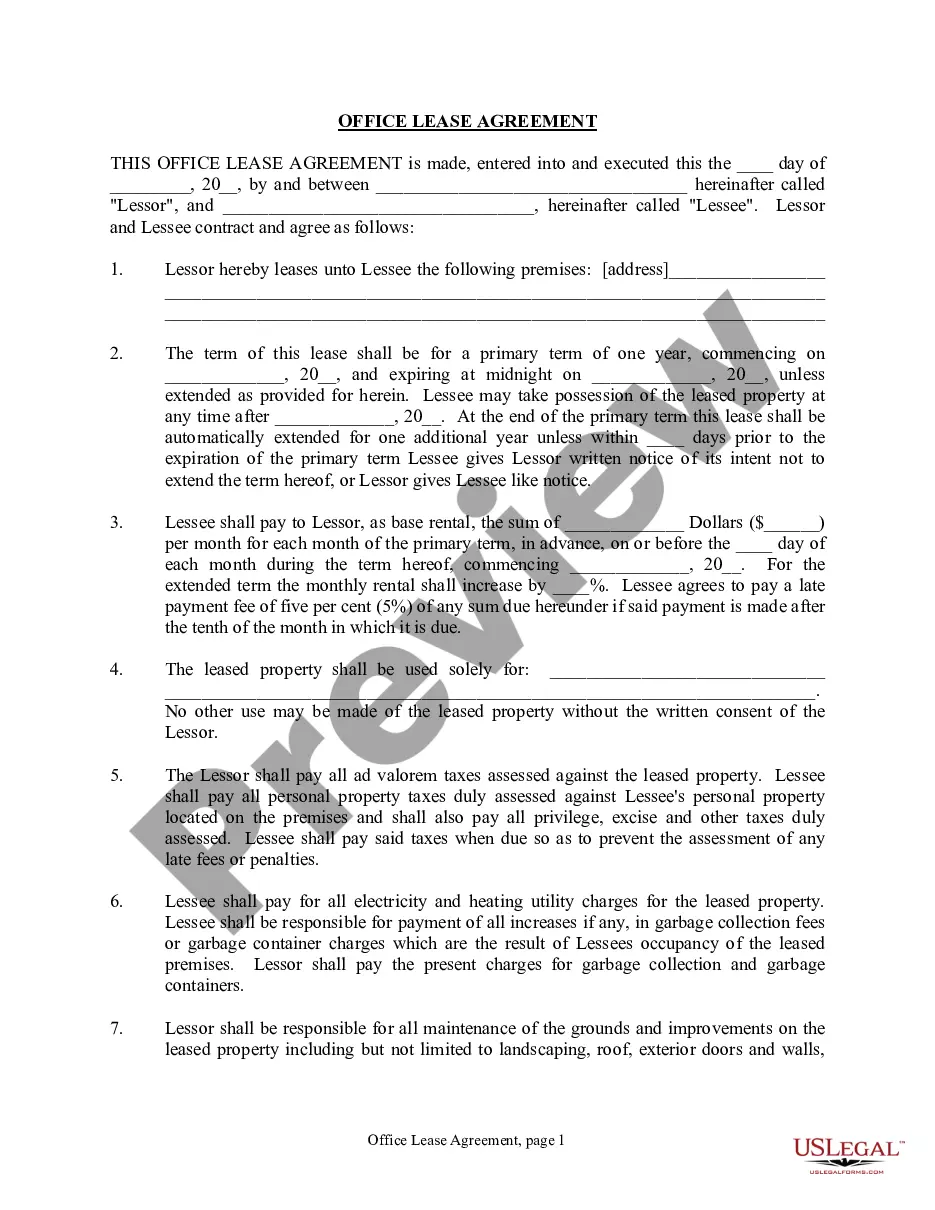

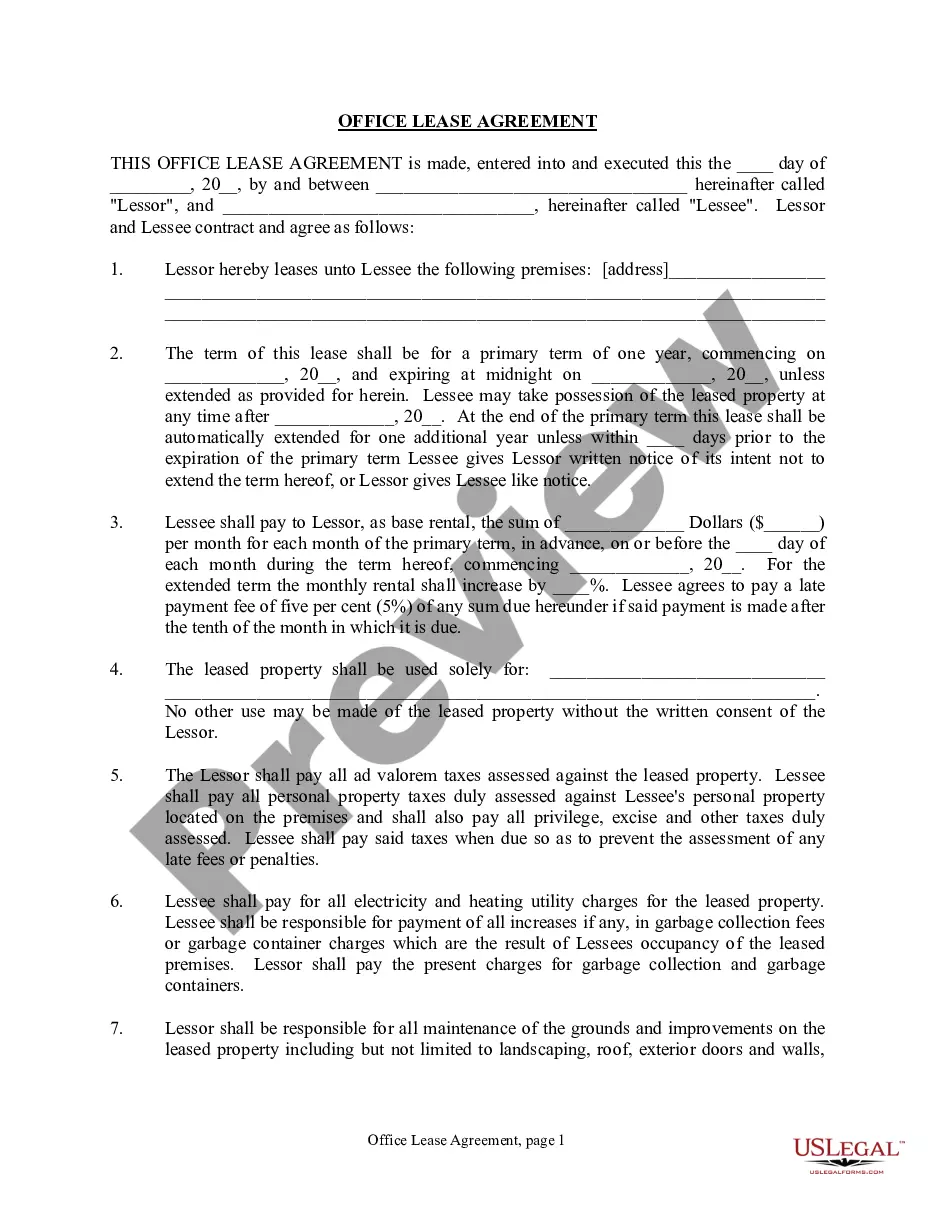

- Limited Liability Company LLC Company Agreement

- Single Member Limited Liability Company LLC Company Agreement

- Texas Articles of Organization for Domestic Limited Liability Company LLC

- LLC Notices, Resolutions and other Operations Forms Package

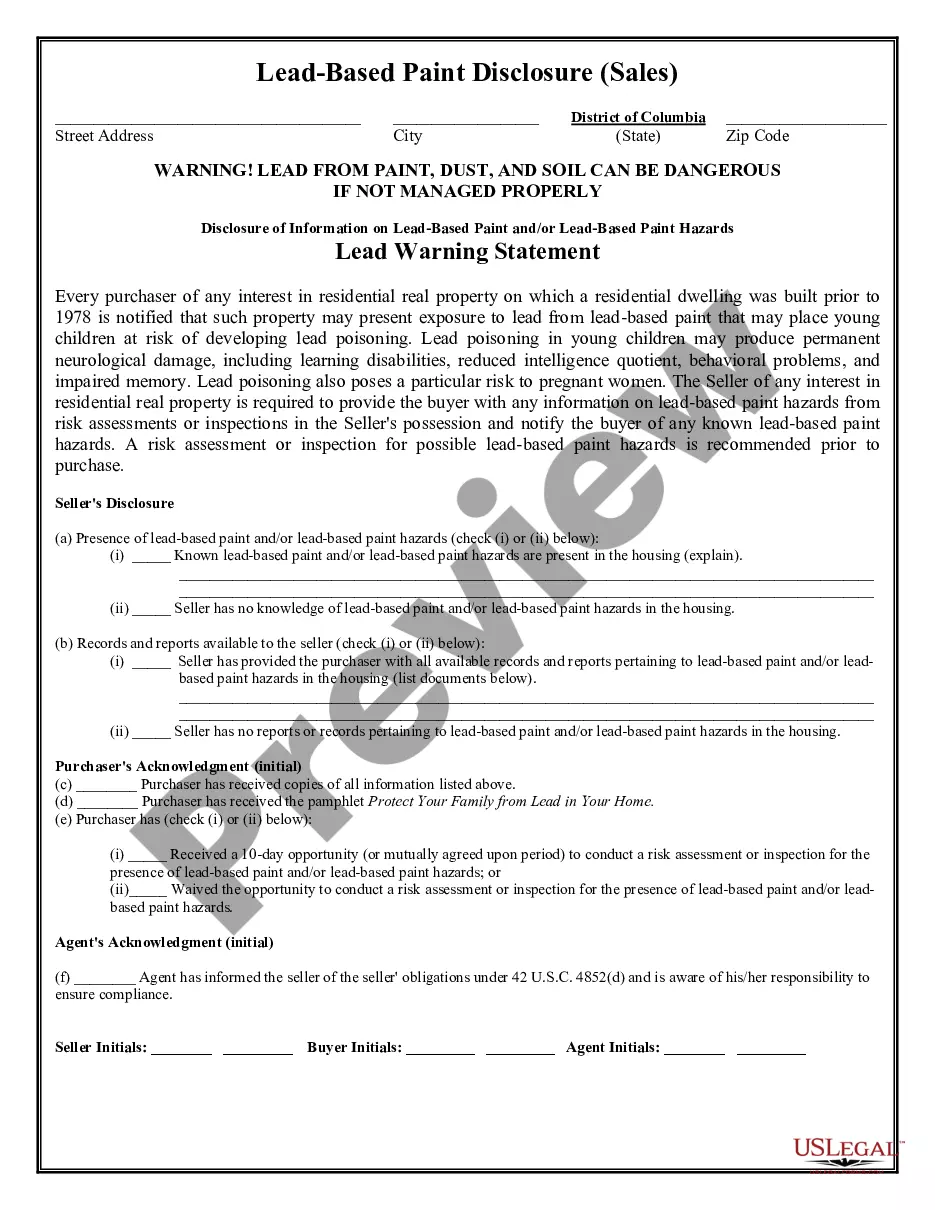

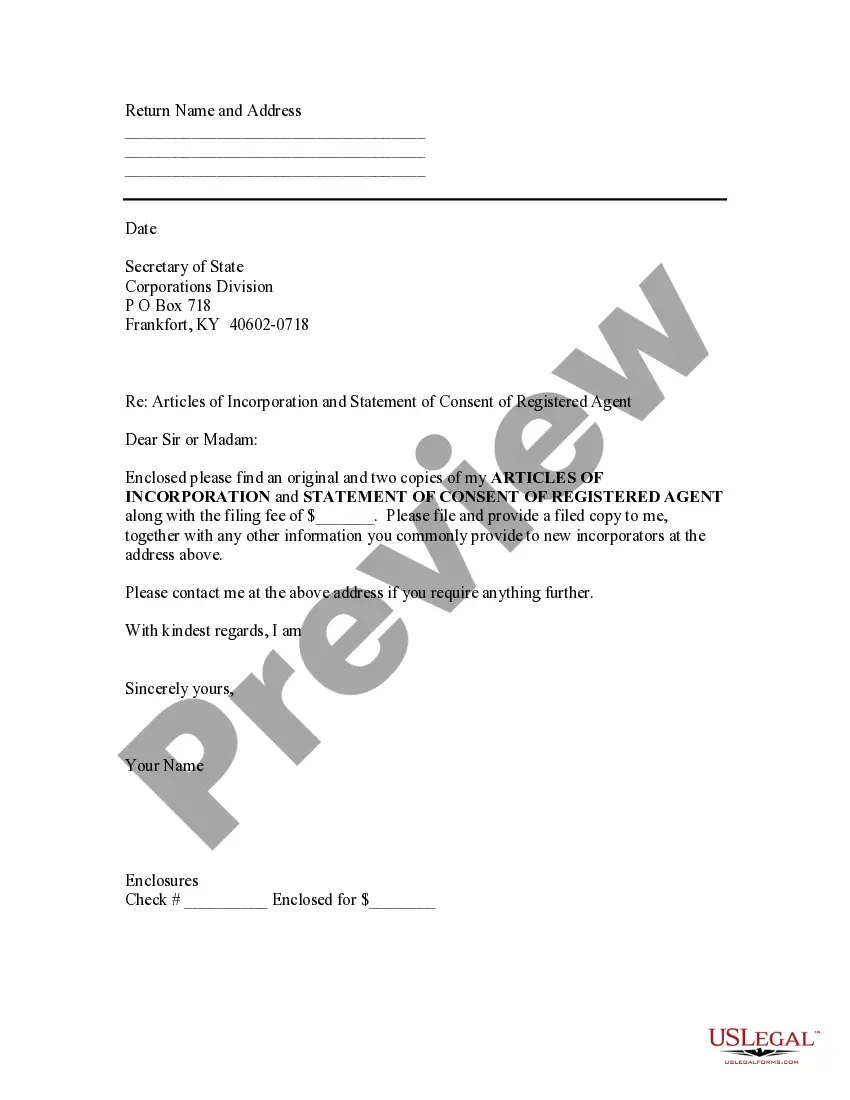

- Sample Cover Letter for Filing of LLC Articles or Certificate with Secretary of State

- Application for Name Reservation

- I.R.S. Form SS-4 (to obtain your federal identification number)

Common use cases

This package should be used when you want to start a business in Texas and prefer the flexible structure of an LLC. It's ideal for entrepreneurs looking to protect their personal assets while benefiting from potential tax advantages. Use this package if you plan to operate a business, engage in partnerships, or seek investment under a limited liability structure.

Who can use this document

- New business owners in Texas seeking to establish an LLC.

- Entrepreneurs looking for personal liability protection.

- Individuals looking to formalize business agreements among members.

- Single individuals or partners wanting to maintain flexibility in business management.

How to prepare this document

- Review the included forms and instructions to understand the requirements.

- Reserve a unique name for your LLC or proceed to the Certificate of Formation.

- Complete the Articles of Organization, ensuring all required information is accurate.

- Draft an Operating Agreement to outline the management structure and responsibilities of members.

- File the completed forms with the Texas Secretary of State along with the required fees.

- Conduct necessary post-formation tasks such as obtaining a Federal Tax Identification Number and opening a business bank account.

Do documents in this package require notarization?

Forms in this package usually don’t need notarization, but certain jurisdictions or signing circumstances may require it. US Legal Forms provides a secure online notarization option powered by Notarize, accessible 24/7 from anywhere.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to accurately check the availability of the LLC name prior to submission.

- Neglecting to prepare an Operating Agreement, which can lead to disputes among members.

- Not understanding tax obligations associated with LLC operations in Texas.

- Submitting incomplete forms or incorrect fees, which can delay processing.

Benefits of completing this package online

- Convenient access to necessary forms and instructions from anywhere.

- Ability to edit downloadable forms to fit your specific business needs.

- Reliability of forms prepared by licensed attorneys, ensuring legal compliance.

- Time-saving steps and streamlined instructions that guide you through the LLC formation process effectively.

Legal use & context

- The LLC formation is recognized as a valid business structure in Texas.

- Compliance with state regulations is crucial for enforceability of the LLC.

- Operating without proper documentation could expose members to personal liability.

Summary of main points

- This package makes starting an LLC in Texas straightforward and accessible.

- Understanding and following the provided instructions is essential for successful LLC formation.

- Legal protection for members is one of the primary benefits of forming an LLC.

Looking for another form?

Form popularity

FAQ

The LLC must have a physical address and you cannot use a P.O. Box. The address should also be in the state of Texas. You can list additional members on an attachment and include with the certificate of formation.

How much does it cost to form an LLC in Texas? The Texas Secretary of State charges a $300 filing fee, plus an additional state-mandated 2.7% convenience fee to file an LLC Certificate of Formation.

Step 1: Choose a Name for Your LLC. Step 2: Choose a Registered Agent in Texas. Step 3: Obtain Texas Business Permits. Step 4: File Certificate of Formation. Step 5: Draft an LLC Operating Agreement. Step 6: Pay Taxes, and File Information Report.

The form may be mailed to P.O. Box 13697, Austin, Texas 78711-3697; faxed to (512) 463-5709; or delivered to the James Earl Rudder Office Building, 1019 Brazos, Austin, Texas 78701. If a document is transmitted by fax, credit card information must accompany the transmission (Form 807).

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

It takes 1 - 3 business days (from start to finish) to form a Texas LLC. The LLC formation process starts when a Certificate of Formation is filed with the Texas Secretary of State. The Secretary approves online filings in 1 - 3 business days (5 - 7 business days for fax filings).

How much does it cost to form an LLC in Texas? The Texas Secretary of State charges a $300 filing fee, plus an additional state-mandated 2.7% convenience fee to file an LLC Certificate of Formation.

Texas limited liability company benefits include tax benefits, asset protection and ongoing support from the Texas Secretary of the State. Primarily, the benefit of a forming your small business as a limited liability company combines the characteristics of corporations and partnerships.

A very popular entity choice in the state of Texas The Texas LLC is a very popular entity choice. In fact, there were 192,284 LLCs filed in Texas in 2018 compared to only 24,135 corporations filed. The primary reason for forming an LLC is to obtain the personal liability protection for the owners of the business.