Texas Corporation Forms

Description

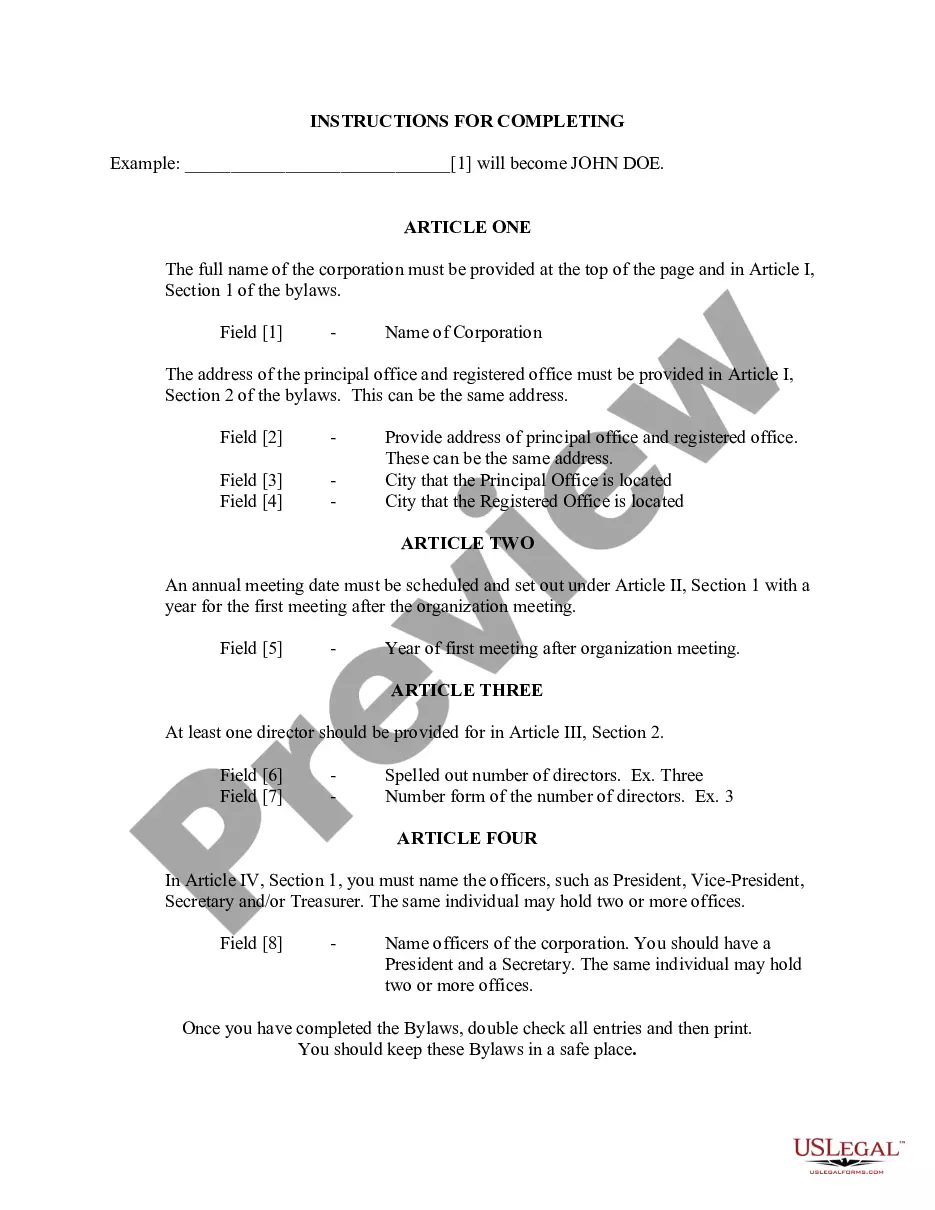

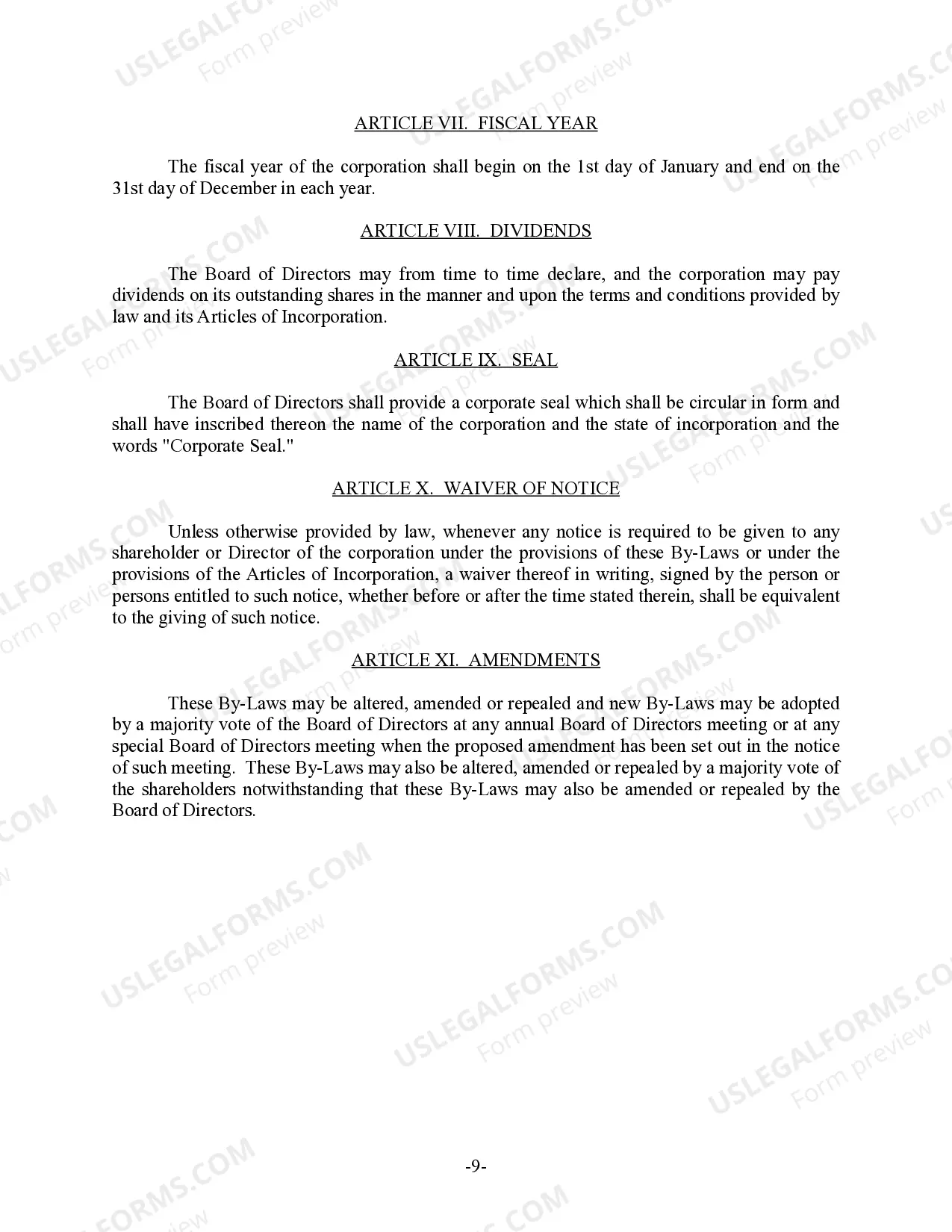

How to fill out Texas Bylaws For Corporation?

Whether you handle paperwork regularly or occasionally need to submit a legal document, it is essential to have a resource where all the samples are connected and current.

One thing you should ensure when using Texas Corporation Forms is that it is the most updated version, as this determines its submit-ability.

If you wish to simplify your search for the latest document examples, look for them on US Legal Forms.

To access a form without an account, follow these instructions: Use the search feature to locate the form you desire. Review the preview and outline of the Texas Corporation Forms to verify it is exactly what you are looking for. After confirming the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card information or PayPal account to complete the transaction. Choose the document format for download and confirm it. Eliminate confusion when handling legal documents. All your templates will be organized and authenticated with an account at US Legal Forms.

- US Legal Forms is a repository of legal forms that includes nearly any document template you may need.

- Search for the templates you require, evaluate their relevance immediately, and learn more about their application.

- With US Legal Forms, you can access more than 85,000 document templates across various fields.

- Locate the Texas Corporation Forms samples in just a few clicks and save them anytime in your profile.

- A US Legal Forms account will assist you in obtaining all the samples you need conveniently and with minimal hassle.

Form popularity

FAQ

Establishing a company in Texas varies in time due to the type of business structure you choose and your preparation. Generally, after filing Texas corporation forms, it can take up to a couple of weeks to receive approval. Preparation time includes deciding on a business name, preparing required documents, and meeting state regulations. Utilizing uslegalforms can help you navigate these steps efficiently, saving time and ensuring compliance with all legal requirements.

Forming a corporation in Texas can take anywhere from a few days to a few weeks, depending on several factors. First, you need to prepare and file Texas corporation forms with the Secretary of State. After filing, the approval process may take around 3 to 10 business days. To streamline this process, consider using uslegalforms, which offers simplified access to necessary documents and guidance for faster completion.

Registering a corporation in Texas typically takes between 3 to 10 business days, with online filings being the quickest option. If you choose a mail-in method, be prepared for longer wait times due to postal delays. To streamline the process, consider using platforms like uslegalforms, which provide guidance and assistance with your Texas corporation forms. This support can help you navigate the registration process smoothly and swiftly.

In Texas, registering a company can take anywhere from 3 to 10 business days, depending on the filing method. Online submissions usually result in a faster approval process compared to paper submissions. If you utilize programmable tools like the ones offered by uslegalforms, you can ensure your Texas corporation forms are submitted without hiccups, reducing potential delays significantly. Staying organized and following the guidelines can also help speed up your registration.

The time it takes to register a company in the US varies by state and the type of business entity you choose. Generally, it can take anywhere from a few days to several weeks. If you submit your Texas corporation forms online and follow the state guidelines closely, you may expedite the process significantly. Remember, using a professional service can help ensure that all requirements are met without delays.

The fastest way to get an LLC in Texas is to file your Texas corporation forms online through the Texas Secretary of State's website. By choosing online filing, you can often receive a faster processing time compared to mail submissions. Additionally, using a service like uslegalforms streamlines the process, ensuring that your forms are filled out correctly and submitted efficiently. This approach saves you time and reduces the chances of errors.

To file an LLC in Texas, you need to complete the Certificate of Formation for a Limited Liability Company. This form includes details about the LLC's name, duration, address, and registered agent. With the right guidance, US Legal Forms helps ensure you file the correct paperwork and meet all requirements for Texas corporation forms.

The benefits of an S corporation in Texas include pass-through taxation, which helps avoid the double taxation faced by C Corporations. Additionally, S Corps may offer greater income splitting potential for shareholders, allowing for potential tax savings. Access to certain tax credits can also be an advantage. When assessing Texas corporation forms, consider these benefits in your decision.

A notable disadvantage of an S corporation is the restriction on the number and type of shareholders. S Corps cannot have more than 100 shareholders, and they must be U.S. citizens or residents. This limitation can hinder the ability to raise capital compared to a C Corp. Carefully explore your options among Texas corporation forms before deciding.

Whether an S Corp or C Corp is better depends on your business needs. S Corps offer pass-through taxation, which can benefit smaller businesses or those planning to distribute profits. Conversely, C Corps might be more advantageous for larger companies seeking to reinvest profits. Evaluate the features of Texas corporation forms to find the best fit.