Tx Statement Claim Download With Payment

Description

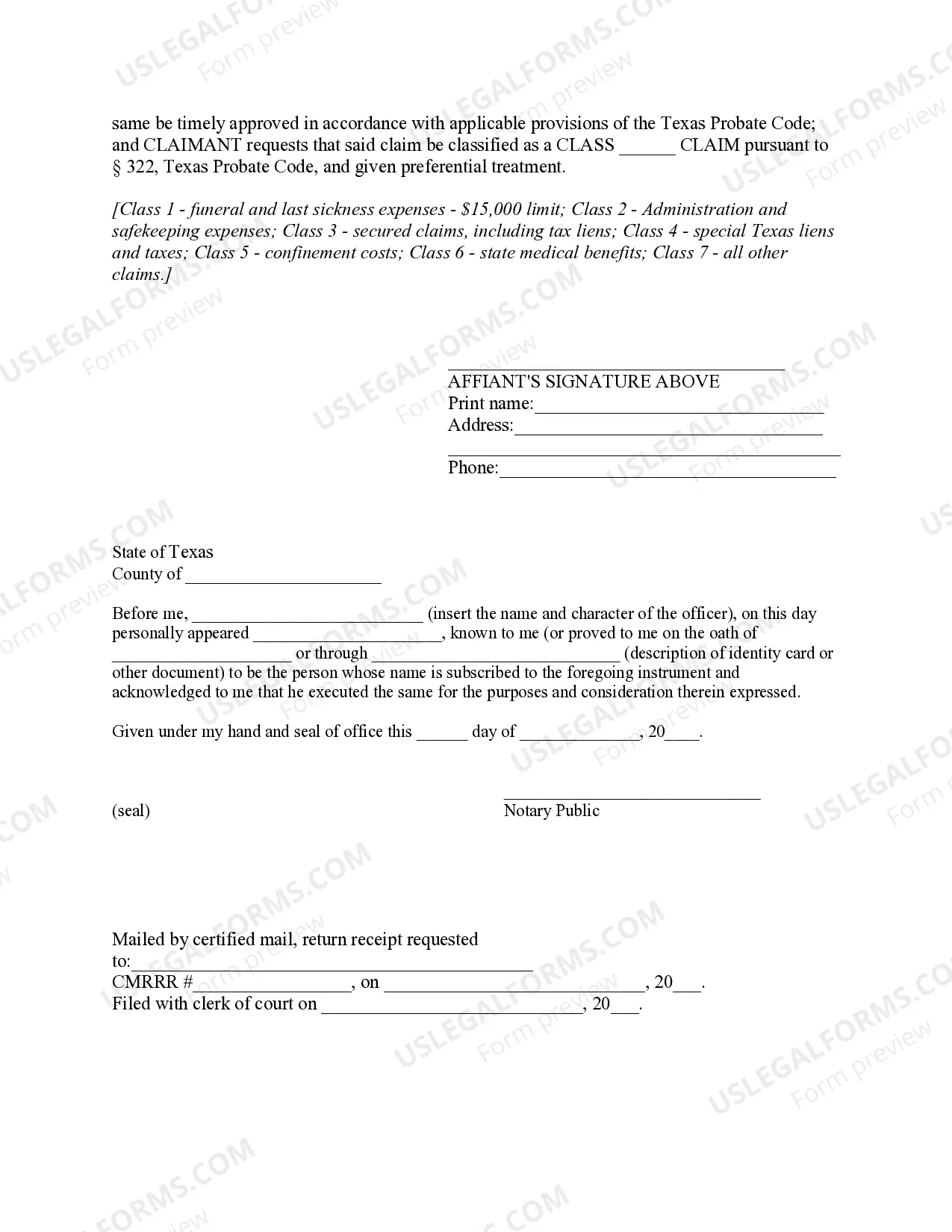

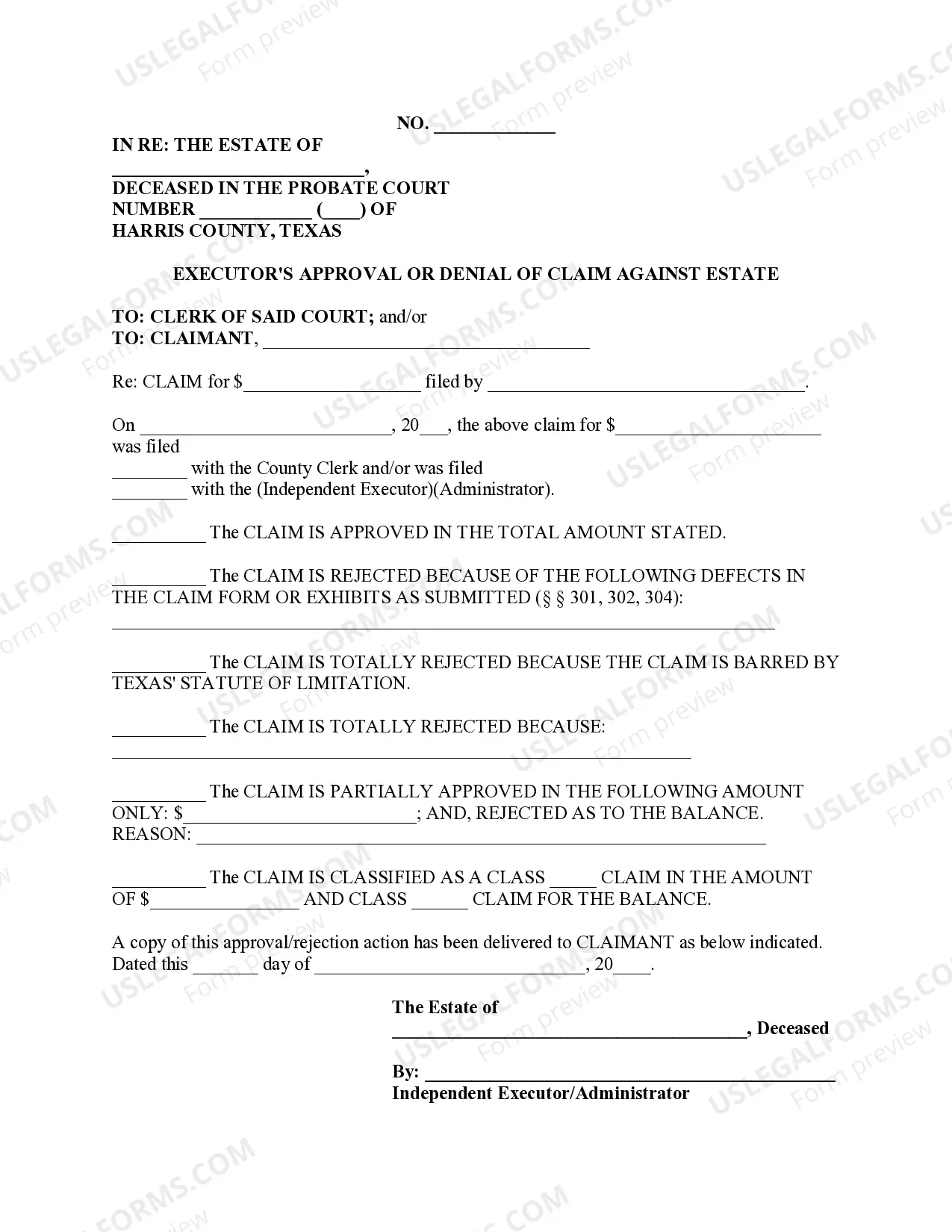

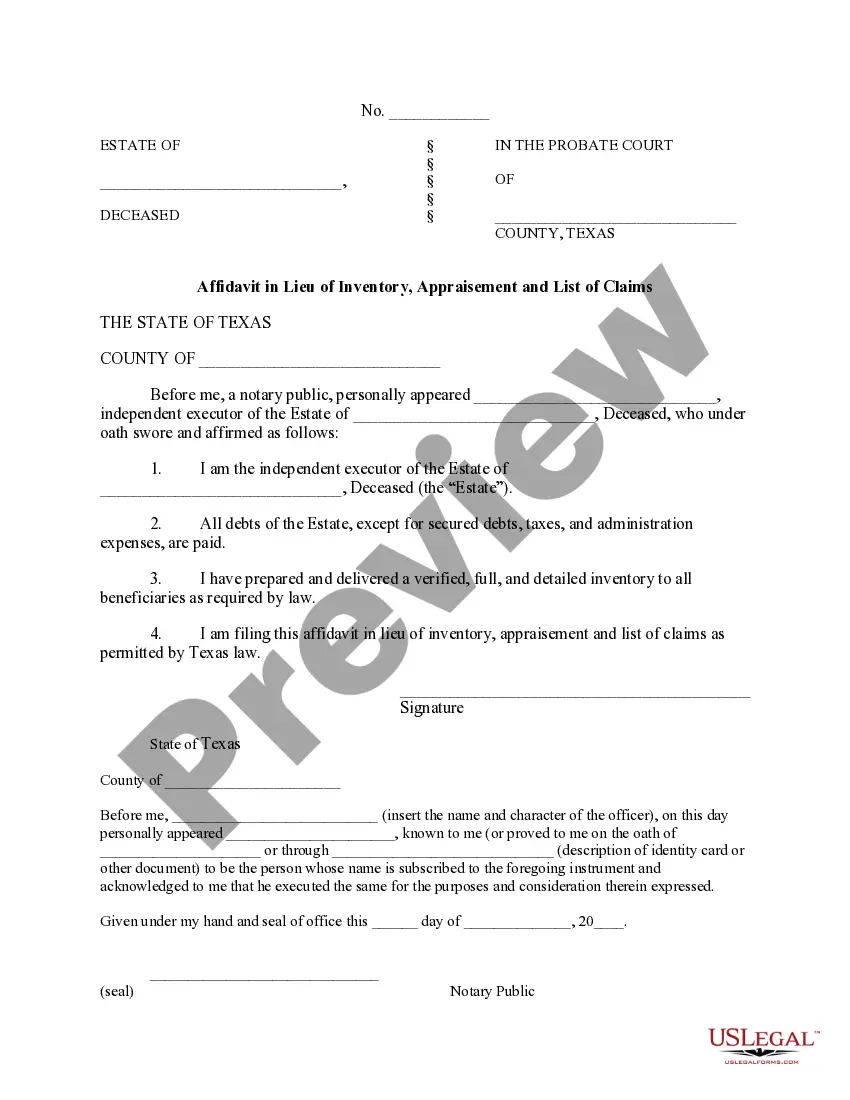

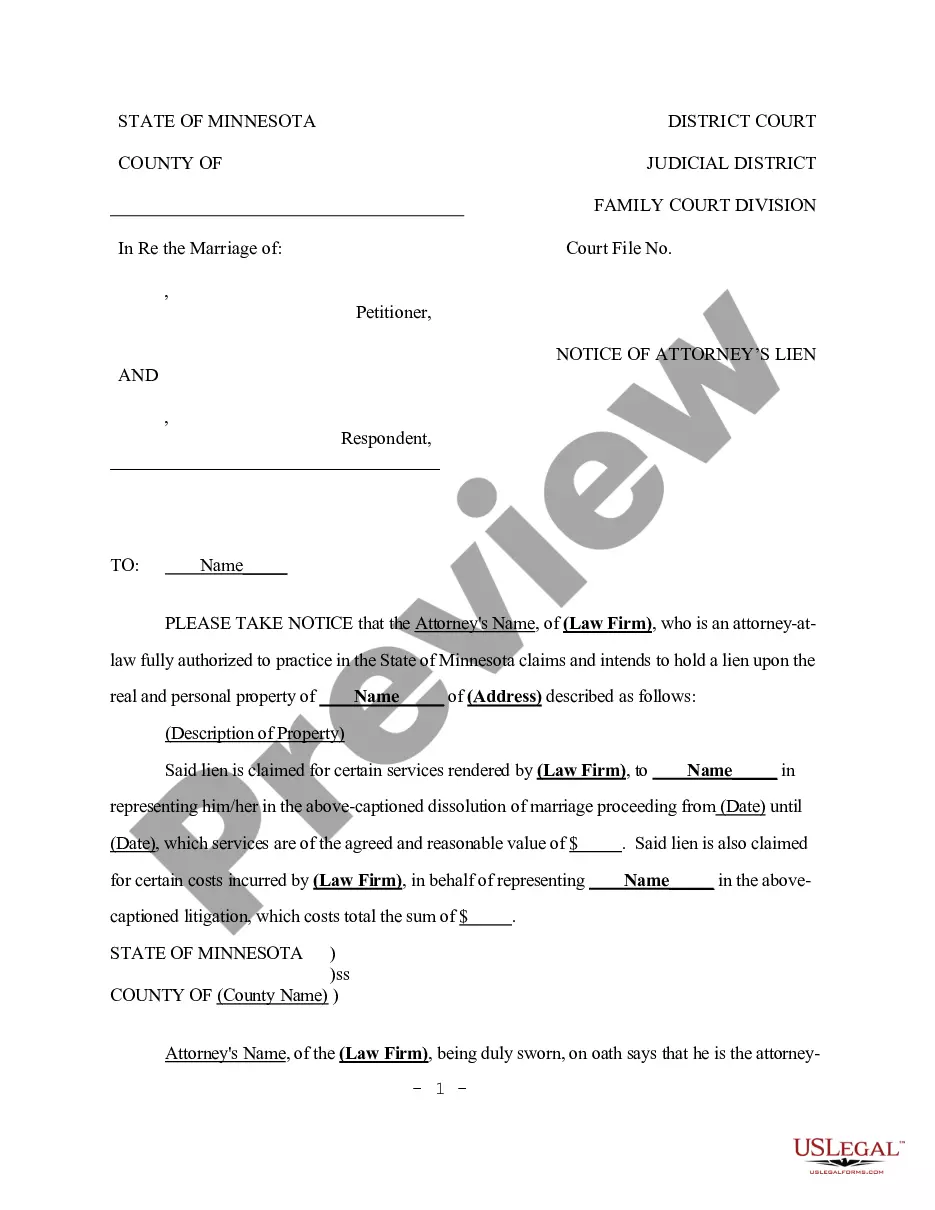

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

The Tx Statement Claim Download With Payment you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Tx Statement Claim Download With Payment will take you only a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to ensure it suits your needs. If it does not, make use of the search bar to get the right one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Tx Statement Claim Download With Payment (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a valid.

- Download your papers one more time. Utilize the same document again anytime needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

The LLC needs to file a 1065 Partnership Return and issue a Schedule K-1 to the LLC owners. The K-1s report each owner's distributive share of profits. And the K-1 income ?flows through? to the owners. The income taxes are then paid by each owner on their personal income tax return (Form 1040).

Texas is one of only a few states with no corporate or individual income tax. So Texas LLCs only need to pay federal income tax. No wonder so many business owners choose to set up shop in Texas! You will, however, need to file an Annual Franchise Tax Return.

How to File Your Texas Franchise Tax Report Determine your due date and filing fees. Complete the report online OR download a paper form. (Paper forms not allowed for No Tax Due Information Report.) Submit your report to the Texas Comptroller of Public Accounts.

Assigned Taxes/Fees: Taxes or fees listed in the Assigned Taxes/Fees column have been registered to your User ID in the system. Available Taxes/Fees: Taxes or fees listed in the Available Taxes/Fees column can be filed and/or paid using this system.

There are a number of ways to file/report: eSystems/Webfile. eSystems is a secure portal for a variety of online transactions, including Webfile. ... Electronic Data Interchange (EDI) ... Downloadable Forms. ... TeleFile. ... Franchise 3rd Party Providers.