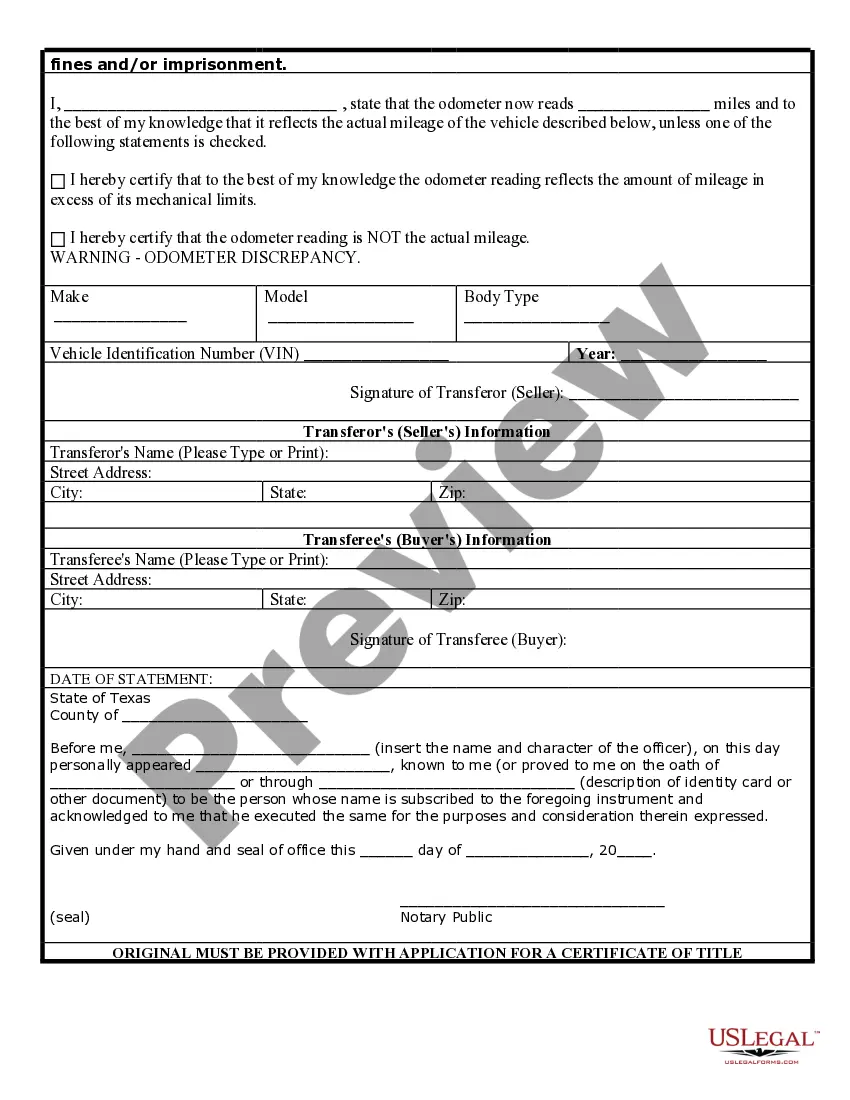

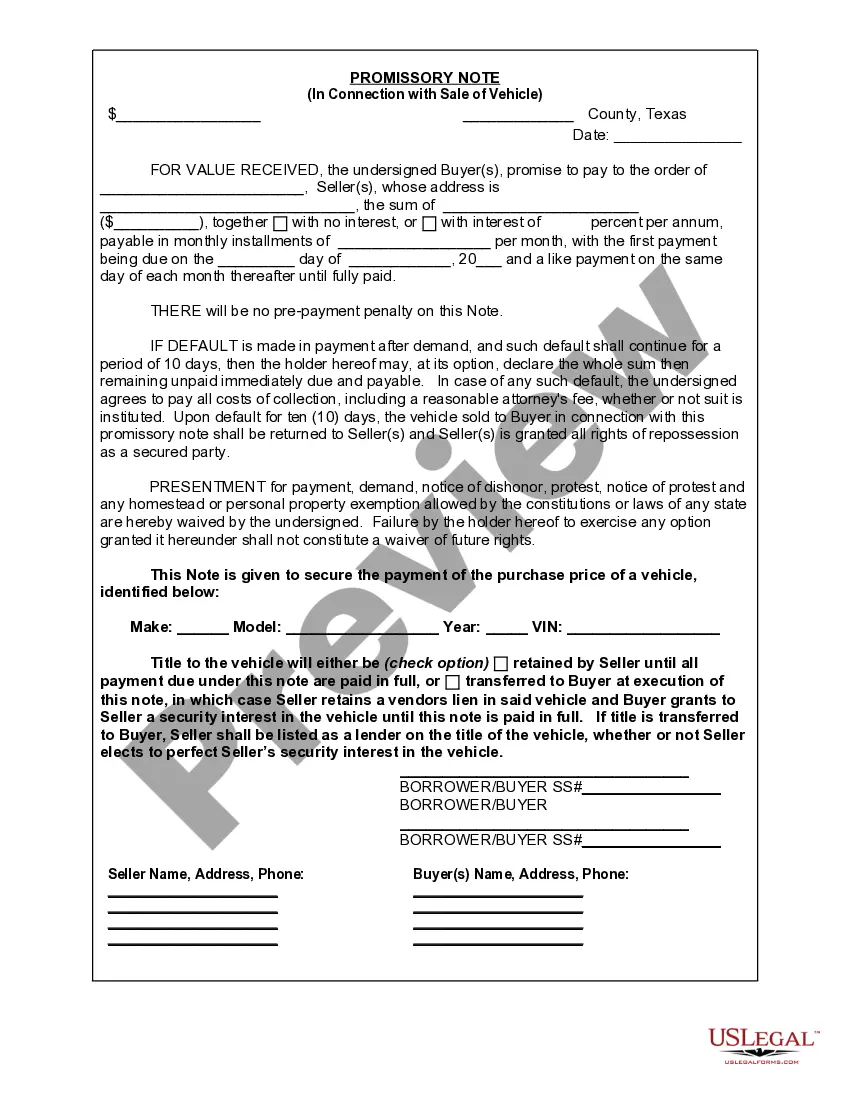

Texas Odometer Disclosure Statement With Lien Release

Description

How to fill out Texas Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

Whether for commercial intentions or for individual affairs, everyone inevitably encounters legal circumstances at some point in their lives.

Filling out legal documents requires meticulous focus, beginning with selecting the correct form template.

With an extensive US Legal Forms catalog available, you no longer need to waste time searching for the suitable template online. Utilize the library’s straightforward navigation to find the correct template for any situation.

- Acquire the template you need by utilizing the search box or catalog navigation.

- Review the form’s details to ensure it fits your circumstances, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the wrong form, revert to the search option to find the Texas Odometer Disclosure Statement With Lien Release template you require.

- Obtain the template if it aligns with your needs.

- If you already possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Texas Odometer Disclosure Statement With Lien Release.

- Once it is downloaded, you can fill out the form using editing software or print it and fill it out by hand.

Form popularity

FAQ

Yes, the Florida Division of Corporations does allow an individual in an LLC to act as the Registered Agent for the business. But, it's an added responsibility on top of all the tasks a business owner has to carry out, so many entrepreneurs use a dedicated Registered Agent service instead.

How to Start a corporation in Florida Choose a name for your business. ... Designate a Registered Agent in Florida. ... File Articles of Incorporation in Florida. ... Create your Corporate Bylaws. ... Appoint your Corporate Directors. ... Hold the First Meeting of the Board of Directors. ... Authorize the issuance of shares of stock.

If you need legal advice when creating your business, there are law firms that focus on LLC formation services. However, you do not need an attorney or professional services to register your own business by law.

LLC Fees Annual Report (& Supplemental Fee)$ 138.75Filing Fee (Required)$ 100.00Registered Agent Fee (Required)$ 25.00Total Fee For New Florida/Foreign LLC$ 125.00Change of Registered Agent$ 25.0018 more rows

Create Your Florida LLC in Five Steps Step 1: Choose a Name for Your Florida LLC. ... Step 2: Appoint a Registered Agent for Your Florida LLC. ... Step 3: Prepare and File Your Articles of Organization. ... Step 4: Prepare Your Operating Agreement. ... Step 5: Obtain an EIN for Your Florida LLC.

Starting a Florida LLC is Easy To create a Florida LLC, you will need to submit the Articles of Organization ? a legal document that officially establishes your business ? to the Florida Division of Corporations. You can apply online at the SunBiz website or by mail, and the filing fee is $125.

To form your LLC, you'll need to pay the mandatory state fee of $125 to file your articles of organization. If you need to hire a Florida Registered Agent, it will cost an additional $25.

Name your Florida LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number. ... Obtain your Florida business license. ... Establish a bank account.