Power Attorney Powers With Dementia

Description

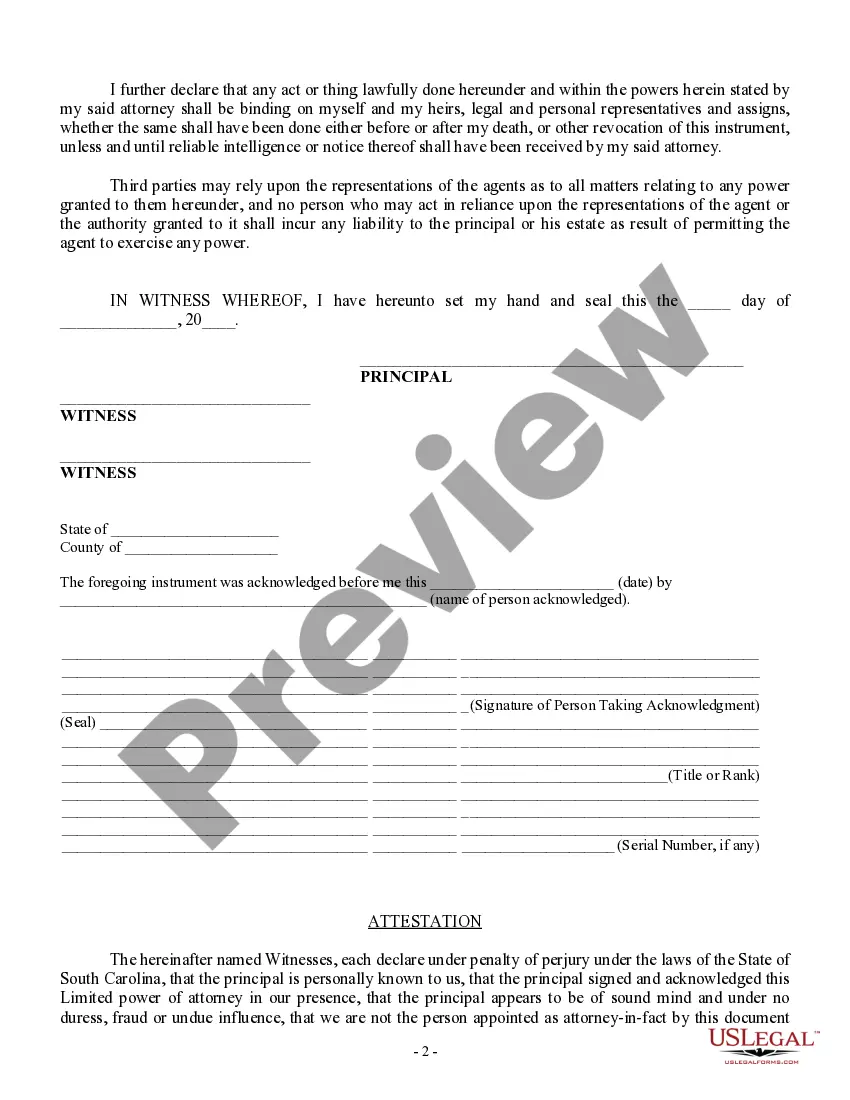

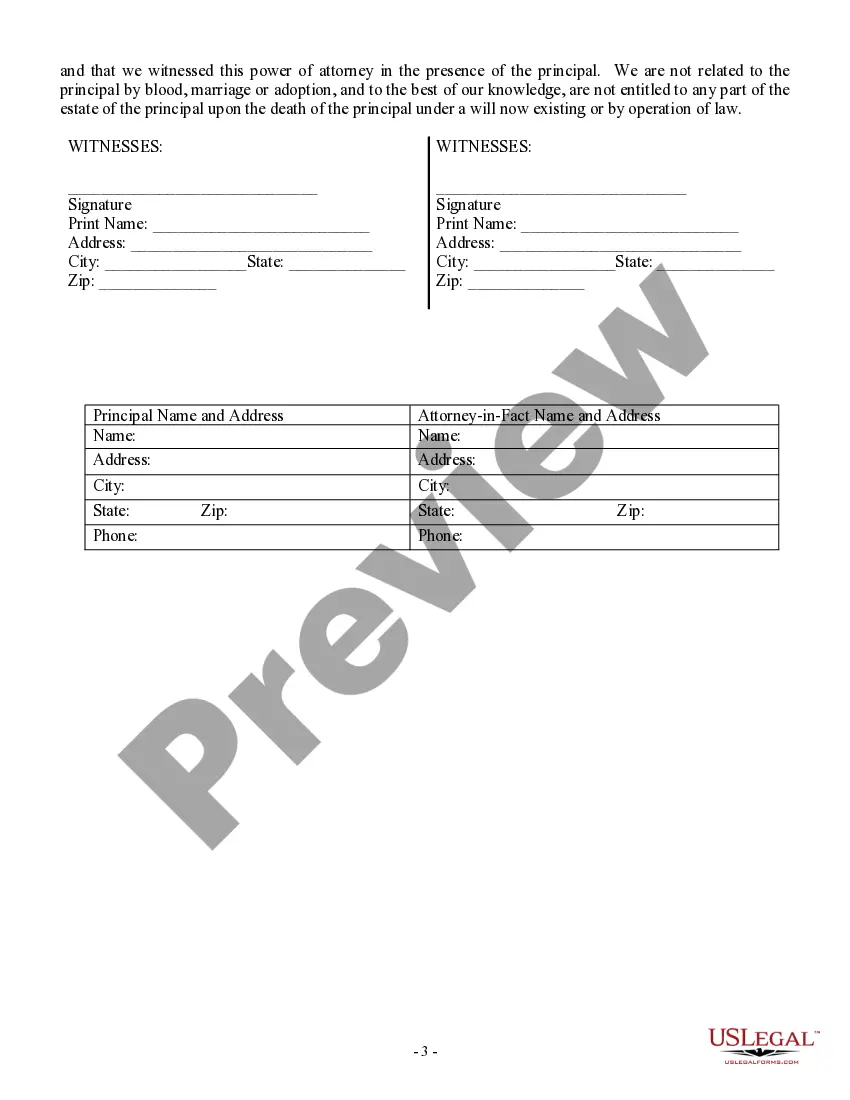

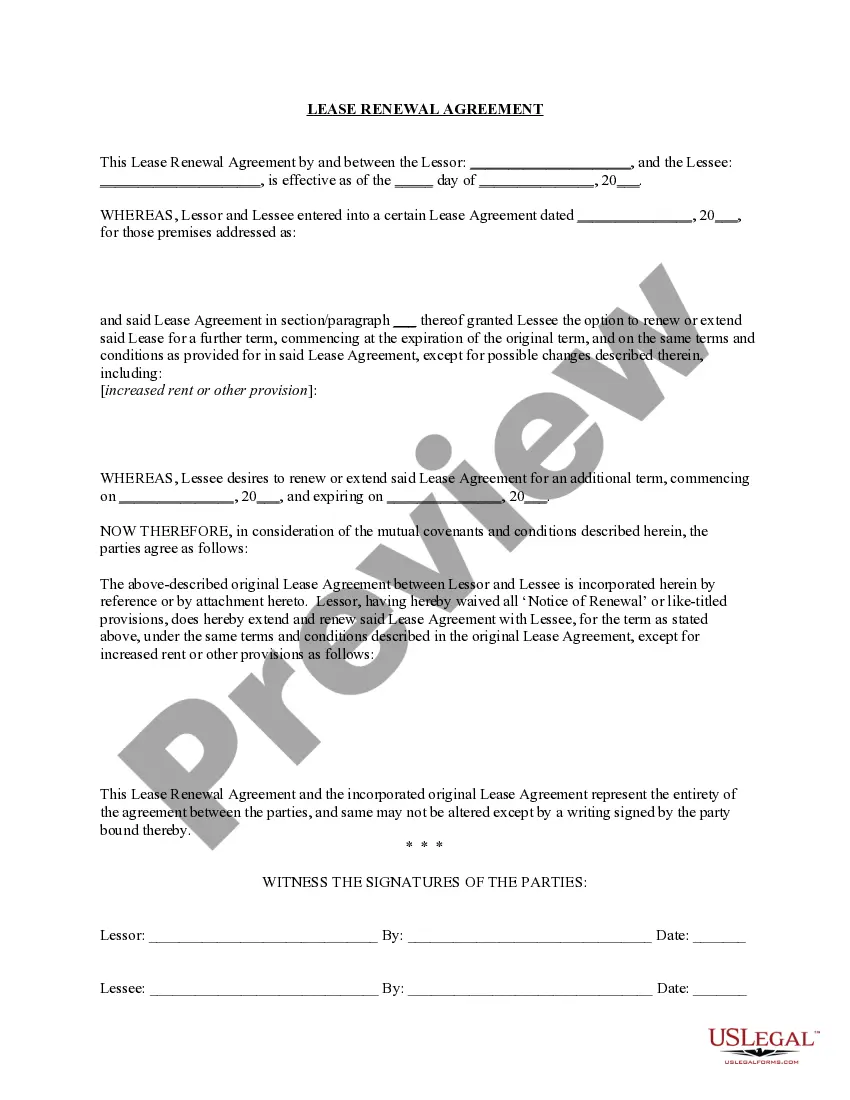

How to fill out South Carolina Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Whether you routinely handle documents or occasionally need to submit a legal report, it is crucial to obtain a resource where all the templates are pertinent and current.

The first step when using a Power of Attorney Powers With Dementia is to verify that it is indeed the latest version, as it determines its acceptability.

If you wish to simplify your hunt for the most recent document samples, search for them on US Legal Forms.

Utilize the search menu to locate the form you need. Preview the Power of Attorney Powers With Dementia description to confirm it is specifically what you are looking for. After verifying the form, click Buy Now. Choose a subscription plan that fits your needs. Create an account or Log In to your existing one. Use your credit card or PayPal information to complete the purchase. Select the file format for download and verify it. Say goodbye to the confusion of handling legal documents. All your templates will be systematically organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that contains nearly any document template you might need.

- Look for the templates you seek, evaluate their relevance immediately, and discover more about their application.

- With US Legal Forms, you have access to over 85,000 form templates across various fields.

- Find the Power of Attorney Powers With Dementia templates in just a few clicks and retain them anytime in your account.

- A US Legal Forms account enables you to access all the samples you need with added ease and less hassle.

- Simply click Log In in the site header and navigate to the My documents section where you’ll have all the forms at your fingertips, eliminating the need to spend time searching for the right template or assessing its relevance.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

Capacity and Dementia A person is without capacity if, at the time that a decision needs to be taken, he or she is unable by reason of mental disability to make a decision on the matter in question, or unable to communicate a decision on that matter because he or she is unconscious or for any other reason.

Most of the care for people with dementia takes place at home, and the unpaid, informal caregivers are often spouses or other relatives. Providing long-term informal care at home for someone with dementia is psychologically, physically, and financially draining.

In most cases, if a person living with dementia is able to understand the meaning and importance of a given legal document, he or she likely has the legal capacity (the ability to understand the consequences of his or her actions) to execute (to carry out by signing it).

Typically, as long as dementia is minor or nonexistent, a person in the beginning stages of a dementia-causing disorder will be deemed mentally competent in the eyes of the law.

One way to protect your marital assets is to have your spouse create a durable power of attorney for finance. A power of attorney allows the individual to designate someone to make financial decisions for them should he or she become incapacitated. In the case of a married couple, this is usually the person's spouse.