Limited Company Meaning

Description

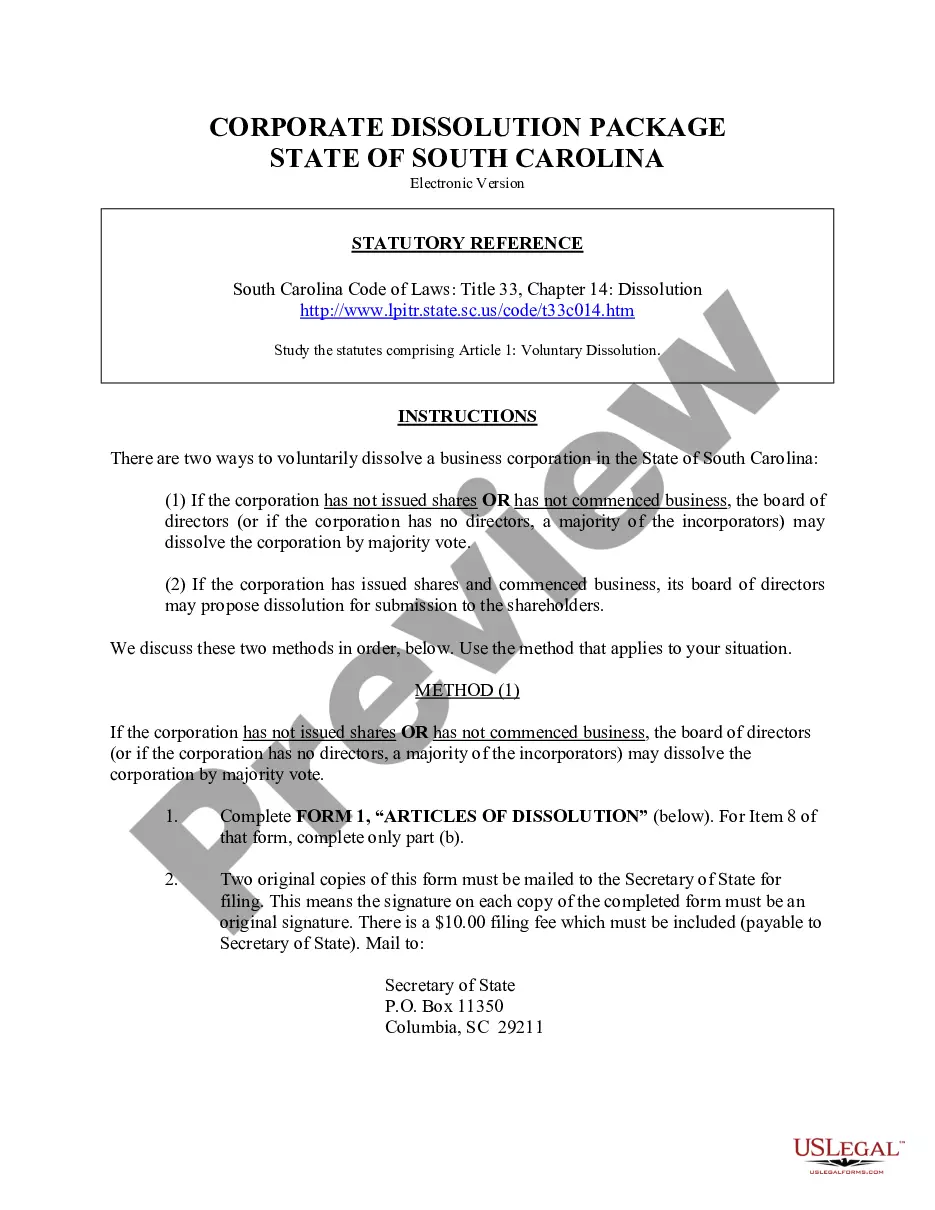

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account if you are a returning user to download your required form. Ensure your subscription is active, and renew it if necessary.

- Preview the available forms and check the descriptions to verify that you are selecting the correct legal document that aligns with your local jurisdiction.

- If the form doesn’t meet your requirements, use the Search tab to find alternative templates that may suit your needs.

- Proceed to purchase your chosen document by clicking the Buy Now button. Choose a subscription plan and create an account to access the full library.

- Complete your payment using a credit card or your PayPal account to finalize your subscription and document access.

- Download the form to your device, making it easy to complete your legal documentation and revisit it later through the My Forms section of your profile.

In conclusion, by leveraging US Legal Forms, you can access a robust collection of over 85,000 legal documents designed for easy use. This service not only simplifies the document creation process but also provides access to premium experts, ensuring your legal forms are accurate and compliant.

Start your journey to business compliance today with US Legal Forms!

Form popularity

FAQ

You become a limited company by formally registering your business through the necessary legal processes. This includes submitting key documents to the appropriate regulatory authorities, fulfilling specific requirements, and obtaining a company registration number. Additionally, maintaining compliance with ongoing legal obligations is necessary to retain your status as a limited company. Gaining insight into the limited company meaning can clarify the responsibilities and advantages associated with this business structure.

Choosing to operate as a limited company offers several advantages, such as limited liability, which protects your personal assets. It also enhances your business credibility, making it easier to attract investors and gain trust from clients. Furthermore, limited companies have the potential for tax benefits, which can help you keep more of your profits. Understanding the limited company meaning can assist you in recognizing these benefits and making informed decisions.

You can determine if you are a limited company by checking your business registration documents and official status with state or federal agencies. Limited companies usually have 'Limited' or 'Ltd' in their name, indicating their status. Additionally, you would have filed specific articles of organization, and you may be required to follow particular legal and tax obligations. Clarifying the limited company meaning can help you identify your business structure accurately.

A limited company typically qualifies as a business structure where the owner's liability is limited to their investment in the company. This means that personal assets are generally protected from business debts. Limited companies often must register with the appropriate government agency and comply with specific regulations, ensuring transparency and accountability. Understanding the limited company meaning is essential for anyone looking to structure their business in this way.

An LLC, or Limited Liability Company, provides flexibility in management and fewer formalities compared to a standard limited company. While both structures offer limited liability protection, an LLC can have varying taxation options. Understanding the limited company meaning alongside LLC characteristics can empower you to choose the right structure for your business.

In simple terms, a limited company is a business structure that limits the liability of its shareholders. This means that shareholders are not personally responsible for the company's debts beyond their investment in shares. Knowing the limited company meaning helps potential business owners evaluate if this structure suits their needs.

The primary difference lies in their structure and legal implications. A limited company typically refers to a corporation or private limited company, while an LLC, or Limited Liability Company, combines features of corporations and partnerships. Both offer limited liability, but an LLC often provides more flexibility in management and taxation. Grasping the limited company meaning can clarify these distinctions.

Being a limited company signifies that the firm is registered under specific regulations, which grants it distinct legal rights. This status provides benefits such as limited liability, which safeguards owners from personal financial loss in case of insolvency. Familiarizing yourself with the limited company meaning can aid you in making informed business choices.

A limited company means that the business is a separate legal entity from its owners. This structure limits the personal liability of the owners for the company's debts. If the company faces financial issues, the owners’ personal assets remain protected. Understanding the limited company meaning helps entrepreneurs manage risks effectively.

When a company has 'limited' in its name, it signifies that the owners have limited liability for the company's debts. This means that if the company faces financial difficulties, the personal assets of the owners are generally protected. This structure fosters an environment for growth, as it encourages investment without the fear of losing personal wealth. Understanding the limited company meaning is crucial for anyone considering starting a business.