Dissolution Dissolve Corporation For 2 Years

Description

How to fill out South Carolina Dissolution Package To Dissolve Corporation?

- Begin by logging into your existing US Legal Forms account. Ensure your subscription is active, otherwise, follow the steps to renew your plan.

- If you're new to our service, search for the form you need by checking the detailed descriptions and preview modes available on our site.

- Should you encounter any discrepancies or if the form doesn't meet your needs, utilize the Search tab to find the correct document.

- Once you've found the appropriate form, click on the Buy Now button. Select your desired subscription plan and create an account for full access.

- Complete your purchase by entering your payment information through credit card or PayPal.

- After payment, navigate to the My Forms section in your profile. Download the template directly to your device, ensuring you have it readily available for completion.

In conclusion, US Legal Forms stands out with its extensive collection of over 85,000 legal forms and packages, empowering you to tackle legal paperwork with ease. Our platform connects you to premium experts who ensure your documents are accurate and compliant with legal standards.

Start your journey toward corporate dissolution today by visiting US Legal Forms and experience the convenience of quick, reliable document preparation.

Form popularity

FAQ

Filing an article of dissolution requires you to prepare and submit the appropriate form, which varies by state. Generally, you'll need to provide details such as the corporation’s name, date of dissolution, and reason for dissolving. If you've maintained your S Corp status for two years, ensure that all financial obligations are settled prior to this filing. For a smooth process, consider visiting the uslegalforms platform for state-specific templates and instructions.

To dissolve an S Corp in California, you must file Form DS-1, the Certificate of Dissolution. This form officially initiates the dissolution process and must include details about your corporation. If your corporation has operated for two years, you should confirm you have fulfilled all tax obligations beforehand. For additional guidance, you can utilize the resources available on the uslegalforms platform.

Dissolving an S corporation involves several steps that you need to follow carefully. First, hold a meeting with the shareholders to approve the dissolution. Next, file the appropriate dissolution paperwork with your state, keeping in mind that these requirements can vary. For corporations active for two years, it is essential to resolve all outstanding debts before the final dissolution to ensure a smooth process.

Yes, S Corps must file Form 966 when they dissolve their corporation. This form notifies the IRS about the dissolution and ensures proper tax treatment. If your corporation has been in business for two years or more, filing this form is crucial to complete the dissolution process legally. For detailed assistance, you can check resources on the uslegalforms platform.

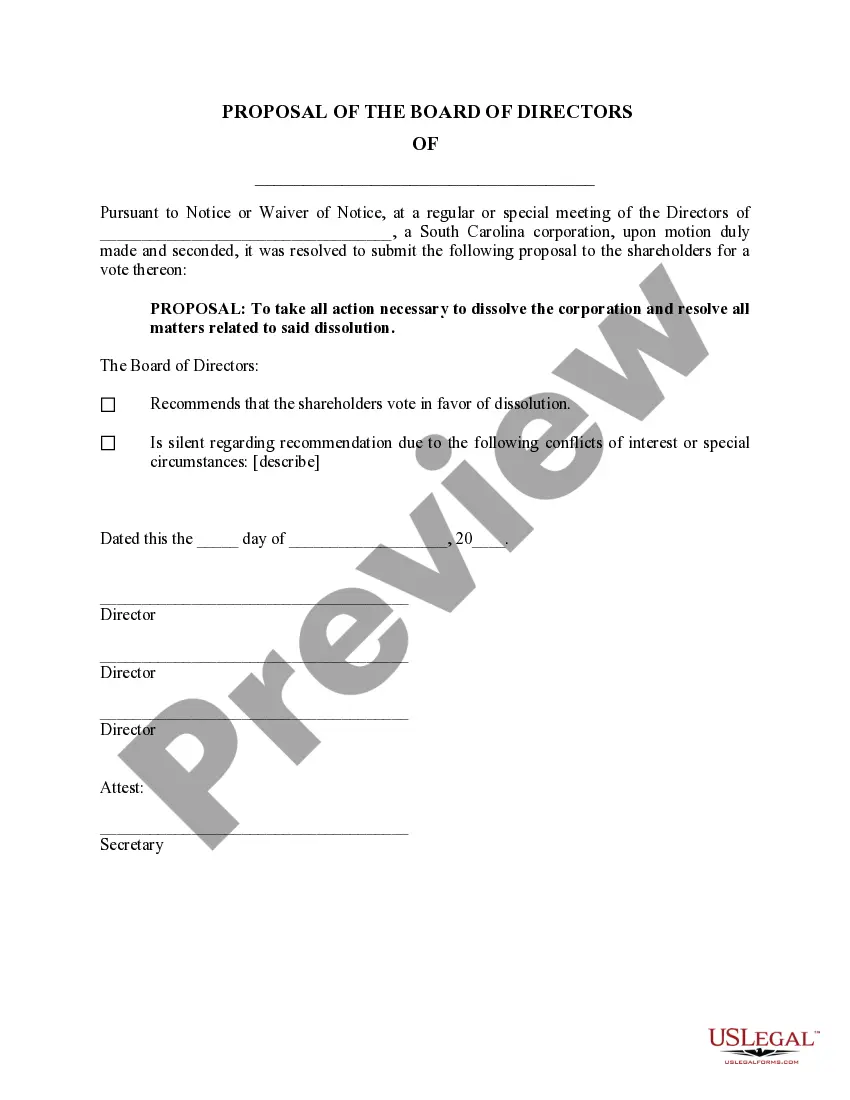

Writing a dissolution involves drafting a clear statement of intent to dissolve the corporation, along with the reasons for this action. Ensure you include the corporation's name, effective date, and any required approvals or consent. Following this structure can simplify the process, especially for those looking to dissolve a corporation that has been active for 2 years.

Filling out the articles of dissolution involves providing specific details such as the corporation's name, the date of dissolution, and a declaration that the dissolution was approved by its shareholders. It's important to double-check that all information is complete and accurate to avoid issues during the dissolution process. Platforms like uslegalforms can guide you through this process, specifically designed for those seeking to dissolve a corporation for 2 years.

The steps to dissolve a corporation typically include holding a board meeting to approve the dissolution, filing articles of dissolution with the state, and settling any remaining debts. After these steps, you must notify all stakeholders and creditors of the decision to dissolve the corporation. These measures ensure an effective dissolution that serves corporations that have operated for 2 years.

To complete articles of dissolution, start by gathering the necessary information about your corporation, such as its name and the reason for dissolution. Then, visit your state's business filing website to access the required form. Fill out the form accurately and ensure that all details align with the purpose of dissolution to dissolve a corporation that has been active for 2 years.

There are voluntary and involuntary dissolutions of a corporation. Voluntary dissolution occurs when the shareholders and board of directors agree to terminate the corporation. Involuntary dissolution can happen through legal actions or failure to meet state compliance requirements. Understanding these types is vital if you wish to efficiently dissolve a corporation for 2 years.

To write a notice of dissolution, start by including the corporation's name, the resolution for dissolution, and the effective date. Clearly state the reasons for the dissolution and inform stakeholders about the process. Ensure the notice is signed by authorized individuals. By providing a well-structured notice, you facilitate a clearer understanding during your journey to dissolve a corporation for 2 years.