Limited Business

Description

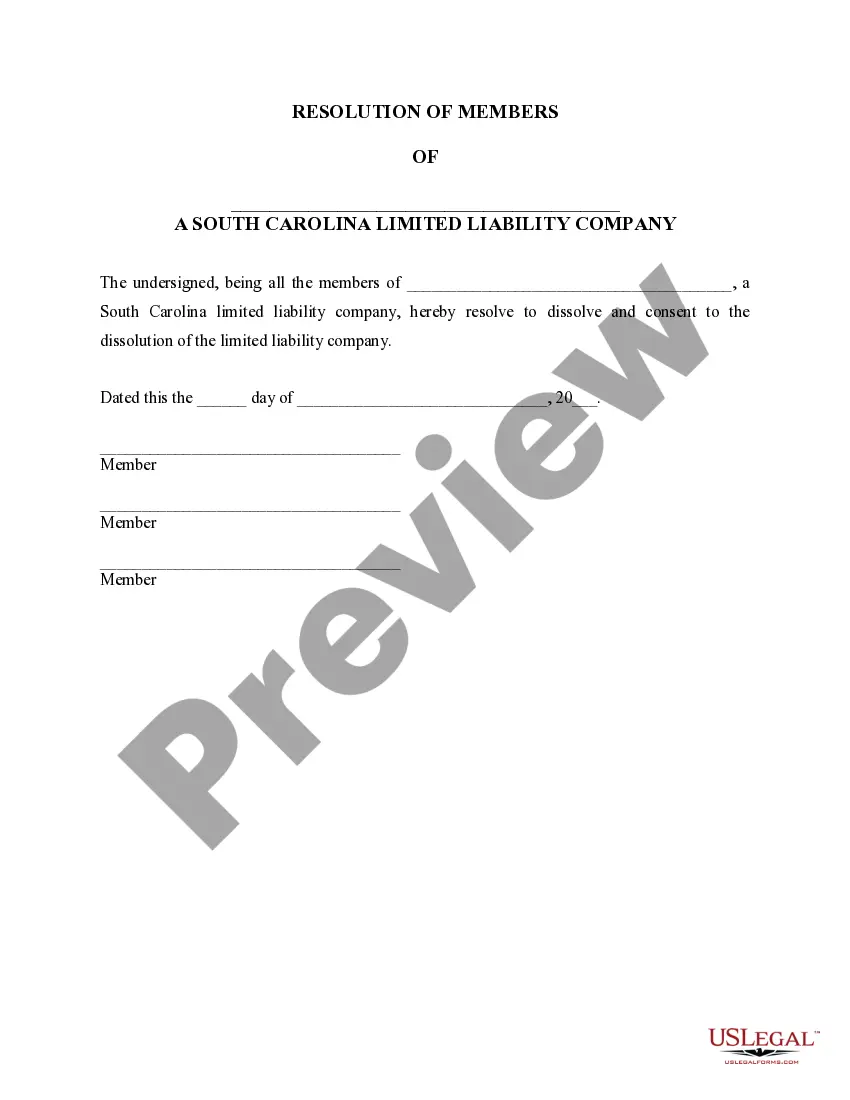

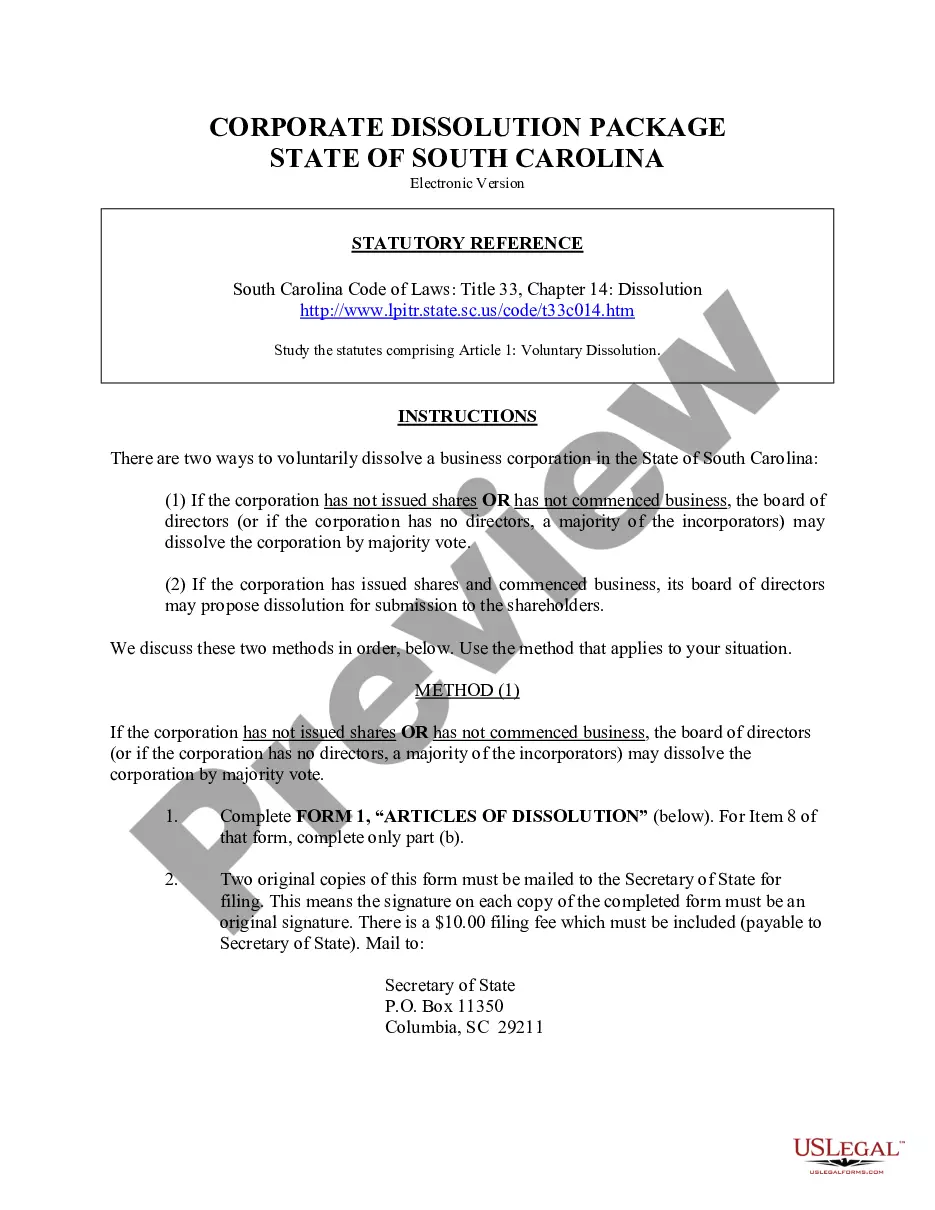

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're a returning user, log in to your account to access your documents. Ensure your subscription is still active; if not, renew it according to your chosen plan.

- For first-time users, start by browsing or searching for your desired form in the extensive library of over 85,000 legal templates. Be sure to preview the form to confirm it meets your specific needs and jurisdiction.

- If the form isn't quite right, use the Search tab for more options that suit your requirements.

- Once you've found the right form, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account to access the library fully.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Finally, download your completed form directly to your device and manage it easily in the My Forms section of your profile.

US Legal Forms not only empowers you to quickly access essential forms but also ensures your documents are comprehensive and legally sound, thanks to access to premium experts.

Start navigating your legal requirements effortlessly today with US Legal Forms. Don't wait—begin your journey to hassle-free legal documentation now!

Form popularity

FAQ

You need to report all your business income, regardless of the amount. There’s no specific threshold that exempts you from filing taxes; even modest earnings must be declared. This ensures compliance with tax laws for your limited business activities. Keeping accurate records and seeking professional advice can simplify this process.

Certainly, you can run a business without an LLC. However, this may expose you to greater personal liability should any issues arise. Without the protection of a limited business structure, your personal assets, like savings or property, could be at risk. Therefore, it’s wise to weigh the benefits of forming an LLC to enhance your protection.

Yes, obtaining an LLC for your small business is often worth the investment. It provides liability protection, which can be crucial if your business faces legal troubles or debts. Additionally, an LLC can offer tax benefits and improve your business image. We recommend exploring the options on platforms like uslegalforms to set up your limited business efficiently.

No, you do not need an LLC to run a small business, but it's highly advisable. An LLC provides legal protection and separates your personal assets from your business liabilities. This limited business structure enhances your professionalism and credibility in the eyes of clients and vendors. Ultimately, forming an LLC can support your growth and safeguard your investments.

Typically, the IRS allows single-member LLC owners to file their personal taxes using their personal tax return. The LLC's income is reported on Schedule C of your personal tax form. However, if your LLC has multiple members, you will file a separate partnership return. Understanding these distinctions can help you navigate your limited business tax responsibilities effectively.

Yes, you do need to report all business income, even if it is under $600. The IRS requires you to report any earnings you receive from your limited business activities. Therefore, keeping accurate records of all your income is important, regardless of the amount. It’s best to be transparent about your earnings to avoid issues with tax compliance.

Whether you need an LLC for your side hustle depends on how you operate your business. If your side venture generates income and you want to protect your personal assets, an LLC can be a beneficial choice. It offers liability protection and may enhance your business credibility. Overall, considering a limited business structure can provide peace of mind.

You should consider forming an LLC when your business begins to take shape and generate income. An LLC, or limited liability company, helps protect your personal assets from business debts. If you're making profits, it's time to look into limited business structures like an LLC to secure your financial future. Protecting yourself legally early on can save you from potential troubles down the road.

In business, 'limited' stands for limited liability, which refers to the financial protection it offers to its owners or shareholders. This concept serves as a safeguard, ensuring that personal assets are not at risk due to business debts. By understanding what limited means in this context, entrepreneurs can better navigate their responsibilities and benefits under this legal structure.

To be a limited company means that the business operates under a specific legal framework that protects its owners from personal liability. In such a company, shareholders are typically only liable for the amount they invested. This structure encourages investment, as individuals feel more secure knowing that their personal assets remain protected, thus allowing them to focus on growing their limited business.