South Carolina Notice Owner Form

Description

How to fill out South Carolina Notice To Owner By Corporation?

Individuals often link legal documentation with something intricate that only an expert can handle.

In a certain sense, this is accurate, as creating the South Carolina Notice Owner Form demands in-depth knowledge of subject matter criteria, including state and local laws.

However, with US Legal Forms, matters have become more straightforward: pre-prepared legal templates for any life and business event specific to state statutes are gathered in a single online repository and are now accessible to everyone.

All templates in our library are reusable; once purchased, they remain saved in your profile, allowing access whenever necessary via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 updated forms categorized by state and area of use, making it easy to find the South Carolina Notice Owner Form or any other specific template within minutes.

- Existing users with a valid subscription must Log In to their account and click Download to receive the form.

- New users will first need to register for an account and subscribe prior to being able to store any documentation.

- Here is a step-by-step guide on how to obtain the South Carolina Notice Owner Form.

- Carefully review the page content to ensure it meets your requirements.

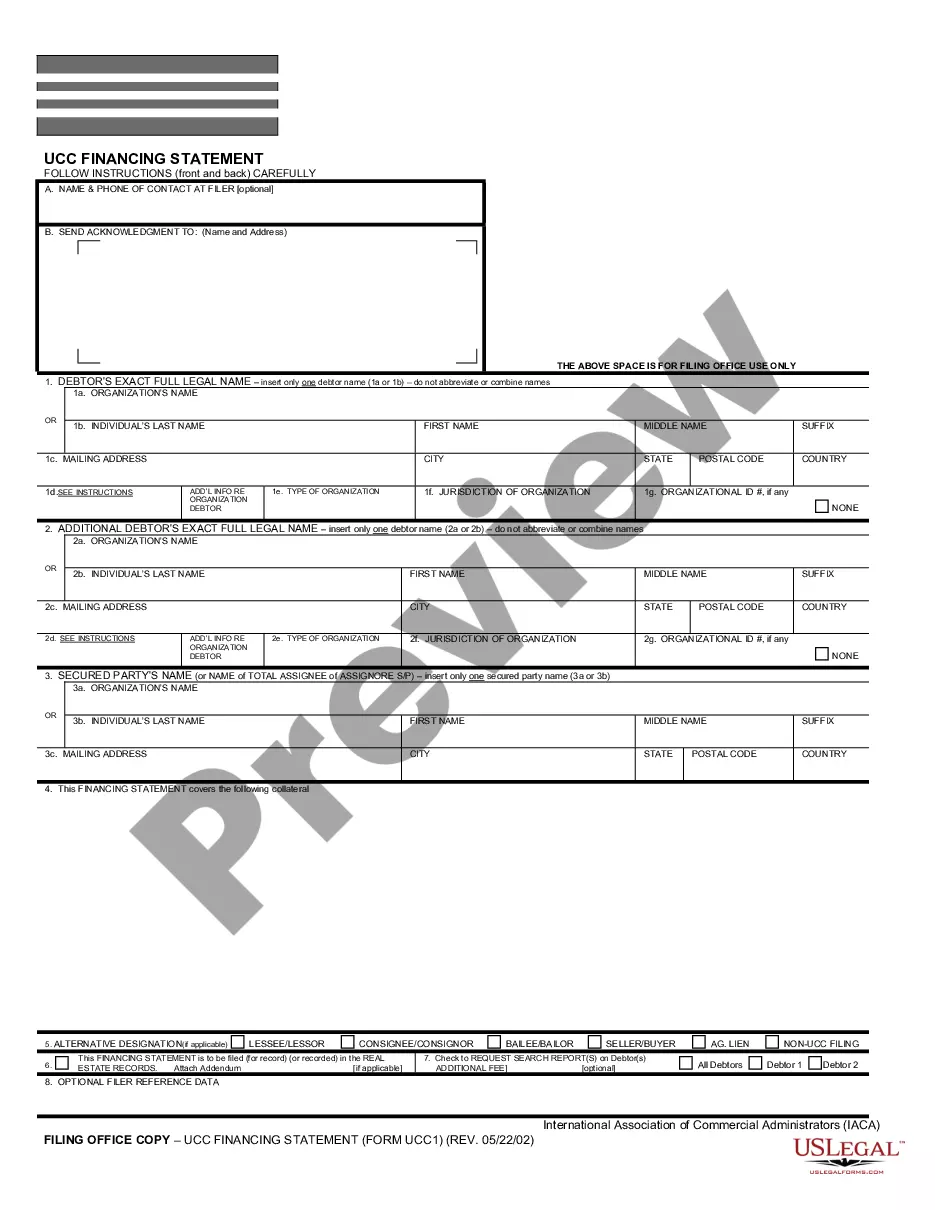

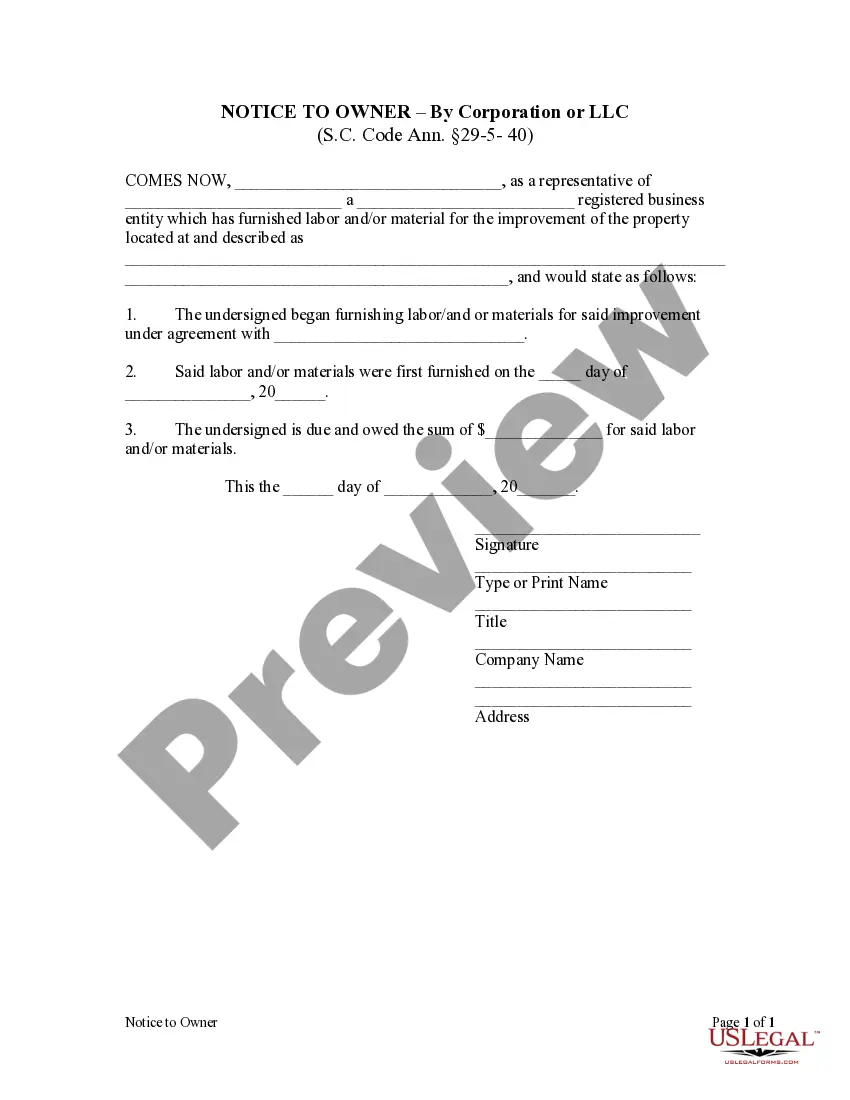

- Read the form description or check it through the Preview feature.

- If the previous example does not meet your needs, search for another template using the Search field located in the header.

- When you locate the appropriate South Carolina Notice Owner Form, click Buy Now.

- Choose a pricing plan that aligns with your needs and budget.

- Create an account or Log In to proceed to the payment page.

- Complete the payment for your subscription using PayPal or your credit card.

- Select the format for your document and click Download.

- You can print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

A letter of intent to place a lien is a preliminary communication that informs a property owner about the creditor's intention to file a lien due to outstanding debts. This letter is vital as it provides the owner with an opportunity to settle the debt before the lien is formally filed. Understanding this letter can help you avoid future legal issues. Utilizing resources like the South Carolina notice owner form can also assist you in navigating this process efficiently.

A lien filing notice is a document that declares an individual's or entity's legal right to make a claim against a property due to unpaid debts. This notice protects creditors by formally recording their interests in the property. When you receive a lien filing notice, it is crucial to understand its implications and your responsibilities. To clarify this process, check out the South Carolina notice owner form for guidelines and templates that simplify your tasks.

Filling out a South Carolina title when selling involves providing the correct information about the vehicle and both the buyer's and seller's details. You should accurately record the odometer reading and sign the title. Moreover, using the South Carolina notice owner form can streamline the transaction and ensure you meet all legal requirements. This way, both parties can confidently complete the sale and transfer ownership smoothly.

A notice of intent to foreclose lien is a document that informs a property owner about the lien against their property and the actions that may follow. This notice serves as an official warning that legal action could occur if the debt remains unpaid. By understanding this notice, property owners can take necessary steps to resolve the issue. You can find useful resources related to handling such notices through a South Carolina notice owner form.

To change LLC ownership with the IRS, you must first complete the appropriate tax forms, including Form 1065 for partnerships or Form 1120 for corporations, as applicable. It’s vital to ensure that you also file a South Carolina notice owner form to update state records simultaneously. Clearly documenting the ownership transfer with both the IRS and state will prevent any potential tax complications. Consulting with a tax professional can ensure a smooth transition.

Adding a member to your LLC in South Carolina involves a few key steps. First, update the operating agreement to reflect the new member's role and ownership percentage. Next, fill out a South Carolina notice owner form to inform the state about the change. This ensures that all records are accurate and compliant with legal requirements, thereby safeguarding your business.

In South Carolina, a landlord must generally provide at least 30 days' notice to tenants when terminating a month-to-month lease. For different lease terms, the notice period may vary, so it’s essential to understand your specific lease agreement. Always document your communications to maintain clear records. Consider drafting a South Carolina notice owner form to formalize this notice process for clarity.

To remove a member from an LLC in South Carolina, begin by reviewing the operating agreement for any specific procedures. Generally, you will need a formal agreement among remaining members to execute the removal. After the agreement, submit a South Carolina notice owner form to the Secretary of State, which officially updates the ownership records. This step protects all parties involved by maintaining accurate and lawful documentation.

You may need a CL 1 form in South Carolina if you are noticing changes to the membership of your LLC. This form serves as an official declaration to inform the state about who currently holds ownership roles within your entity. Ensure you consult with a legal professional or check the specific requirements for your LLC type. Using the South Carolina notice owner form may help simplify this process.

To change ownership of an LLC in South Carolina, you need to file a South Carolina notice owner form with the Secretary of State. This form notifies the state about the changes in membership and ownership. It is crucial to also update the operating agreement and inform all existing members of the changes. Keeping these documents current ensures compliance with state regulations.