South Carolina Notice to Owner by Corporation

About this form

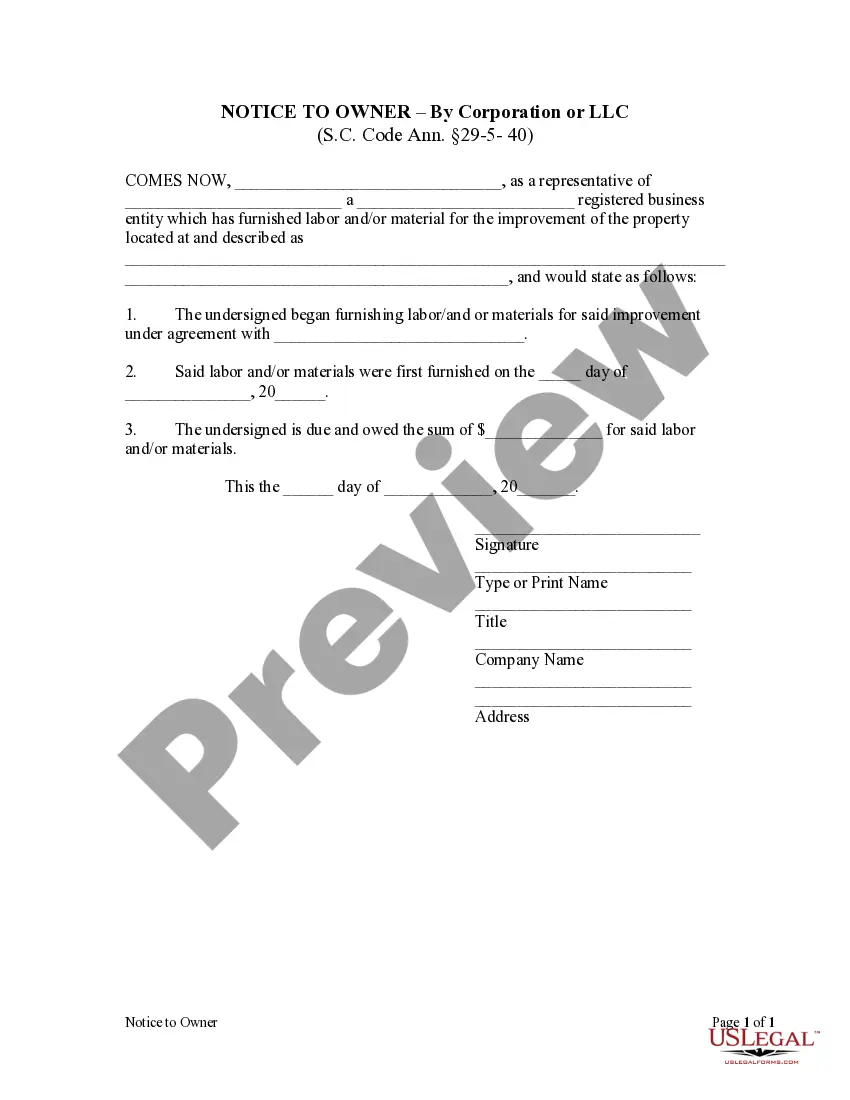

The Notice to Owner by Corporation is a legal document used by corporations to formally notify property owners that they have supplied labor or materials for improvements on a property. This notice is essential as it establishes the corporation's right to a lien against the property for the amount owed, ensuring that they can seek payment if necessary. This form is distinct from other lien notices as it specifically addresses notifications from corporations rather than individuals or sole proprietors.

What’s included in this form

- Identification of the corporation submitting the notice.

- Details of the property where labor or materials were provided.

- Information regarding the agreement with the contractor.

- The date the labor and/or materials were first supplied.

- The total amount owed for the work performed or materials supplied.

- Signature of the authorized representative from the corporation.

Common use cases

This form should be used when a corporation provides labor or materials for the improvement of real estate based on a contract with a contractor or another entity. It is typically necessary when the property owner has not contracted directly with the corporation and serves to secure the corporation's right to enforce a lien in case of non-payment.

Who should use this form

This form is intended for:

- Corporations supplying labor or materials for construction or improvements.

- Contractors who work with corporations in managing real estate projects.

- Legal and administrative representatives handling contracts and notices for corporations.

Completing this form step by step

- Identify the corporation that provided labor or materials and enter its name.

- Specify the property where the work was performed by providing a detailed description.

- Enter the name of the contractor associated with the project.

- Fill in the date when labor or materials were first supplied.

- State the total amount owed for the labor and/or materials.

- Have the authorized representative sign the document and print their name and title.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide complete and accurate property descriptions.

- Neglecting to include the correct dates for when labor or materials were supplied.

- Not having the document signed by an authorized representative of the corporation.

Advantages of online completion

- Easy and quick access to the form allows for immediate use without waiting for a professional to draft it.

- The form can be filled out and edited as needed, ensuring accuracy before submission.

- Using online legal forms provides reliability and access to documents that adhere to current legal standards.

Legal use & context

- The Notice to Owner by Corporation is a legally recognized document that enforces the right to a mechanic's lien on a property.

- Failure to serve this notice in accordance with legal requirements may affect the ability to enforce the lien.

Looking for another form?

Form popularity

FAQ

If you are a Limited Liability Company (LLC), professional organization, or other association taxed as a corporation and not exempt under SC Code Section 12-20-110, you must submit a CL-1 and include a $25 payment.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.

To form an LLC in South Carolina you will need to file the Articles of Organization with the South Carolina Secretary of State, which costs $110. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your South Carolina Limited Liability Company.

What does this mean? Most LLCs are member-managed, where all the owners run the business and day-to-day operations. An LLC can also be manager-managed, where one, or a few designated people, run the business and day-to-day operations (while the members play more of a passive/investor role).

Aside from that, just about anyone can legally serve as an LLC organizer.The most common options are a member/owner of the LLC, the LLC's registered agent, a lawyer, an accountant, and online business formation services. In our experience, we highly prefer having someone with experience serve as your LLC organizer.

Step 1: Visit the Business Name Database. Go to the South Carolina Secretary of State website. Step 2: Search your Business Name. Enter the name you would like to use in the Search by Business Name field. Step 3: Review Results.

Manager-Managed LLCs: The members or owners of a member-managed LLC are responsible for the day-to-day operations of the business, while only certain designated members (or even outside appointees -- for example, a board of directors) run the operations of manager-managed LLCs.

State Business Tax By default, LLCs themselves do not pay income taxes, only their members do.In South Carolina, the corporate tax generally is a flat 5% of the business's entire net income. Use the state's corporation income tax return (Form SC-1120) to pay the tax to the Department of Revenue (DOR).