In no event shall the aggregate amount of any liens filed by a sub-subcontractor or supplier exceed the amount due by the contractor to the subcontractor to whom the sub-subcontractor or supplier has supplied labor, material, or services unless the sub-subcontractor or supplier has provided notice of furnishing labor or materials by certified or registered mail to the contractor.

Notice Of Furnishing Negative Information

Description

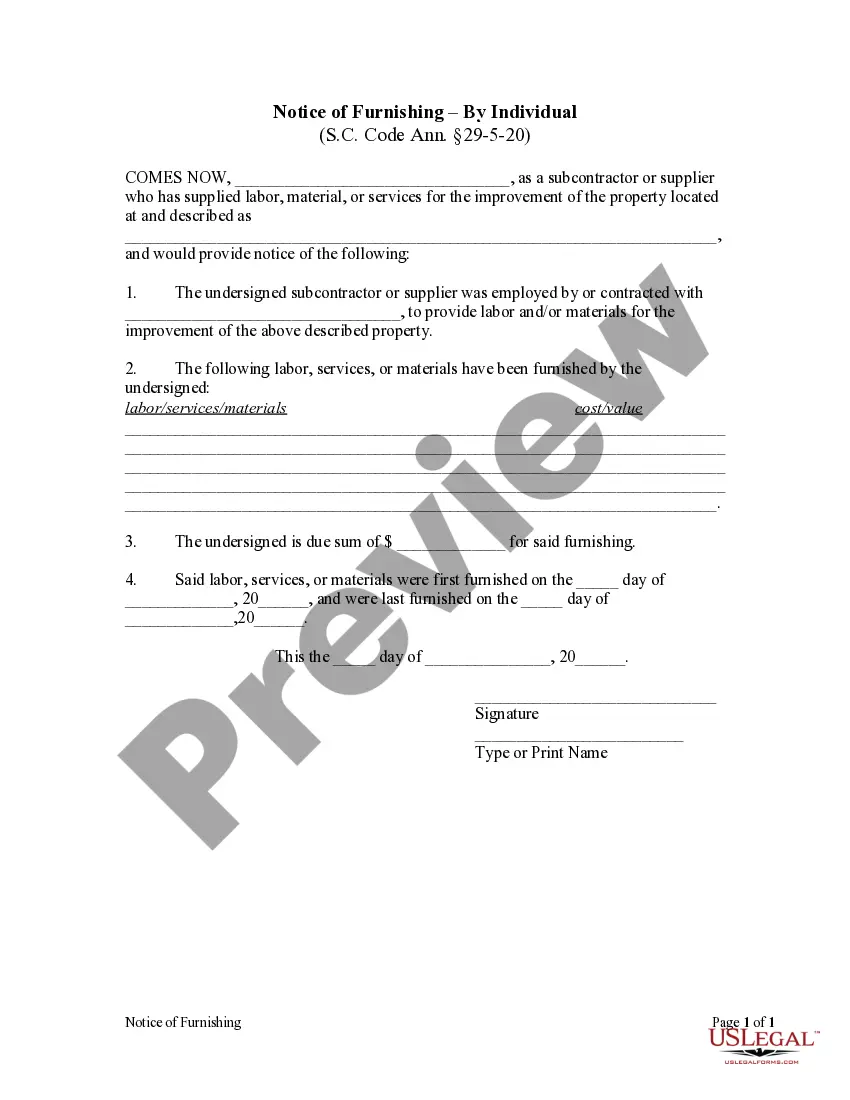

How to fill out South Carolina Notice Of Furnishing - Individual?

Individuals often link legal documentation with complexity that only an expert can manage.

In some respects, this is accurate, as crafting a Notice Of Furnishing Negative Information necessitates a deep understanding of subject requirements, including state and local laws.

However, with US Legal Forms, everything has been simplified: pre-made legal documents for any personal and business circumstance tailored to state statutes are gathered in one online repository and are now accessible to everyone.

All templates in our catalog are reusable: once acquired, they remain stored in your profile. You can access them anytime you need via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- Scrutinize the content of the page thoroughly to ensure it fulfills your requirements.

- Read the form overview or view it through the Preview feature.

- Find another example using the Search bar above if the previous one does not meet your needs.

- Click Buy Now once you discover the appropriate Notice Of Furnishing Negative Information.

- Select a payment plan that aligns with your requirements and financial situation.

- Create an account or Log In to move to the payment page.

- Pay for your subscription using PayPal or with your credit card.

- Choose the format for your document and click Download.

- Print your file or upload it to an online editor for a faster completion.

Form popularity

FAQ

Negative information refers to data that suggests a person has failed to meet financial obligations. It encompasses late payments, bankruptcies, and accounts in collections. When a notice of furnishing negative information is issued, it serves to alert creditors and help them assess the risk of lending to you. Understanding how this information affects your credit can help you manage your financial health more effectively.

A notice of negative information is a communication that informs consumers about adverse information that has been recorded in their credit file. This notice helps consumers stay informed about their credit standing and understand how certain actions could influence their financial future. Recognizing the implications of the notice of furnishing negative information is crucial for maintaining good credit health. For assistance with such notices, USLegalForms offers valuable tools and templates to enhance your understanding.

The notice of report of negative credit information is a document that alerts consumers about negative entries made to their credit reports. It outlines the type of negative information reported and the creditor responsible for the reporting. Being aware of this notice equips consumers to dispute inaccuracies or understand the implications of the negative report. When dealing with such situations, platforms like USLegalForms can provide helpful resources and templates.

The negative information notice requirement mandates that lenders and financial institutions provide consumers with a notice when they report negative information to credit agencies. This requirement ensures transparency and gives consumers an opportunity to understand their credit situation. Familiarity with this requirement is essential for anyone looking to maintain a healthy credit profile. Using services like USLegalForms can help you navigate these communications effectively.

A notice of report of negative credit information is a formal communication sent to consumers when negative information is reported about them to credit bureaus. This notice serves to inform individuals that their credit history may contain adverse data, which could impact their credit score. Understanding this notice allows consumers to take action, address inaccuracies, or improve their financial habits. By knowing about the notice of furnishing negative information, you can better manage your credit health.

Yes, negative marks can occasionally be removed from your credit report, but it's not guaranteed. You can challenge inaccuracies, negotiate settlements with creditors, or seek assistance from credit repair services. Consider utilizing platforms like US Legal Forms to access resources that can help you navigate this process effectively. With the right strategies, you can work towards improving your credit profile, despite the presence of negative information.

The notice of negative information must be provided to you within a reasonable timeframe after negative information has been reported to the credit bureaus. Generally, lenders are required to send this notice no later than 30 days after the adverse information is reported. Being aware of such timelines ensures you stay informed about your credit status, allowing you to act swiftly. Remember that a timely notice of furnishing negative information can help you understand your credit standing.

A notice of furnishing negative information is a communication sent by a lender or creditor to inform you that they have reported negative details to credit bureaus. This notice alerts you that your credit report now contains unfavorable information, which can impact your credit score. Understanding this notice can help you take proactive steps to manage your credit situation effectively. Stay informed to tackle any negative marks on your credit report.

To remove negative information from your credit report, you should first review your report for errors or inaccuracies. If you find any, you can file a dispute with the credit bureaus to request corrections. In addition, you may consider negotiating with creditors to settle debts, which can sometimes result in them removing the negative information. Lastly, remember that a notice of furnishing negative information will inform you about the status of your accounts.