Rhode Island Trust Foreclosure Auctions

Description

How to fill out Rhode Island Amendment To Living Trust?

Dealing with legal documents and procedures might be a time-consuming addition to the day. Rhode Island Trust Foreclosure Auctions and forms like it often require you to search for them and understand the best way to complete them correctly. Therefore, if you are taking care of economic, legal, or personal matters, having a comprehensive and hassle-free web library of forms at your fingertips will significantly help.

US Legal Forms is the number one web platform of legal templates, boasting over 85,000 state-specific forms and a variety of tools to assist you complete your documents easily. Check out the library of pertinent papers accessible to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered at any time for downloading. Protect your papers managing procedures by using a high quality service that lets you prepare any form within a few minutes without having extra or hidden fees. Simply log in to the account, locate Rhode Island Trust Foreclosure Auctions and download it straight away in the My Forms tab. You may also access previously downloaded forms.

Would it be the first time using US Legal Forms? Register and set up your account in a few minutes and you’ll get access to the form library and Rhode Island Trust Foreclosure Auctions. Then, stick to the steps below to complete your form:

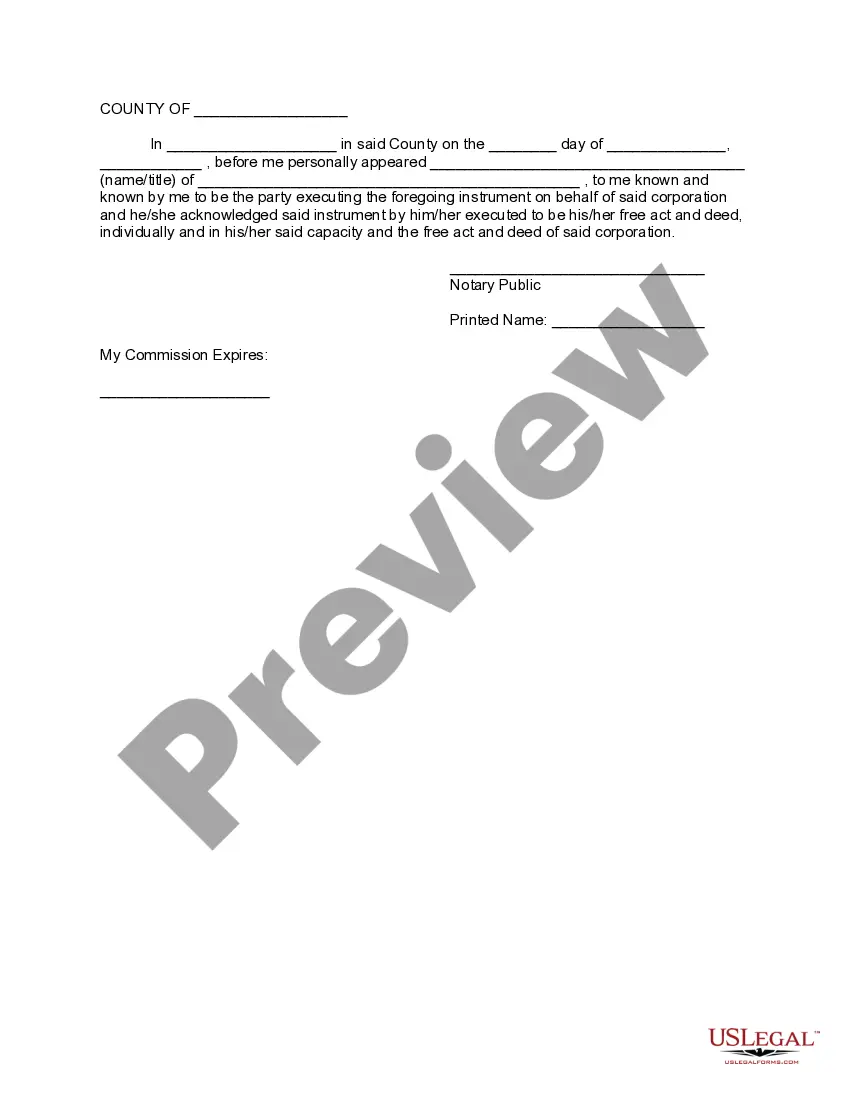

- Ensure you have found the correct form by using the Preview feature and reading the form information.

- Select Buy Now as soon as ready, and select the monthly subscription plan that fits your needs.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of expertise helping consumers manage their legal documents. Get the form you need today and streamline any operation without having to break a sweat.

Form popularity

FAQ

(a) In a sale of real property and associated tangible personal property owned by a nonresident, the buyer shall deduct and withhold on the payments an amount equal to six percent (6%) of the total payment to nonresident individuals, estates, partnerships, or trusts, and seven percent (7%) of the total payment to ...

The lender must give notice of the sale by publication in some public newspaper at least once a week for three (3) successive weeks before the sale, with the first publication of the notice being at least twenty-one (21) days before the day of sale, including the day of the first publication in the computation.

Redemption Period After a Property Tax Sale in Rhode Island In Rhode Island, the purchaser must wait one year after the sale before starting the foreclosure to wipe out your right of redemption. (R.I. Gen. Laws § 44-9-25.)

How Can I Stop a Foreclosure in Rhode Island? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

(a) In a sale of real property and associated tangible personal property owned by a nonresident, the buyer shall deduct and withhold on the payments an amount equal to six percent (6%) of the total payment to nonresident individuals, estates, partnerships, or trusts, and seven percent (7%) of the total payment to ...