Revocation Living Trust With A Trustee

Description

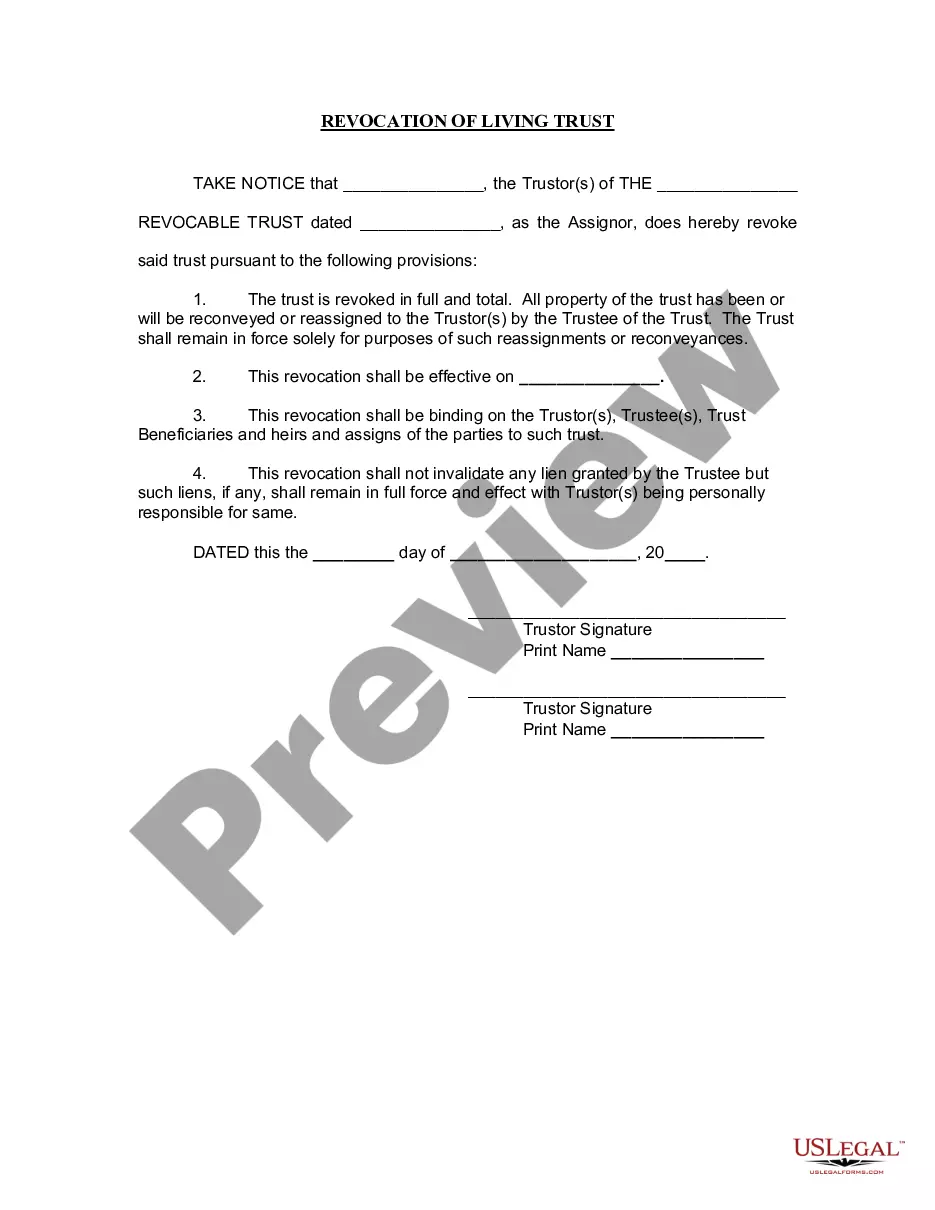

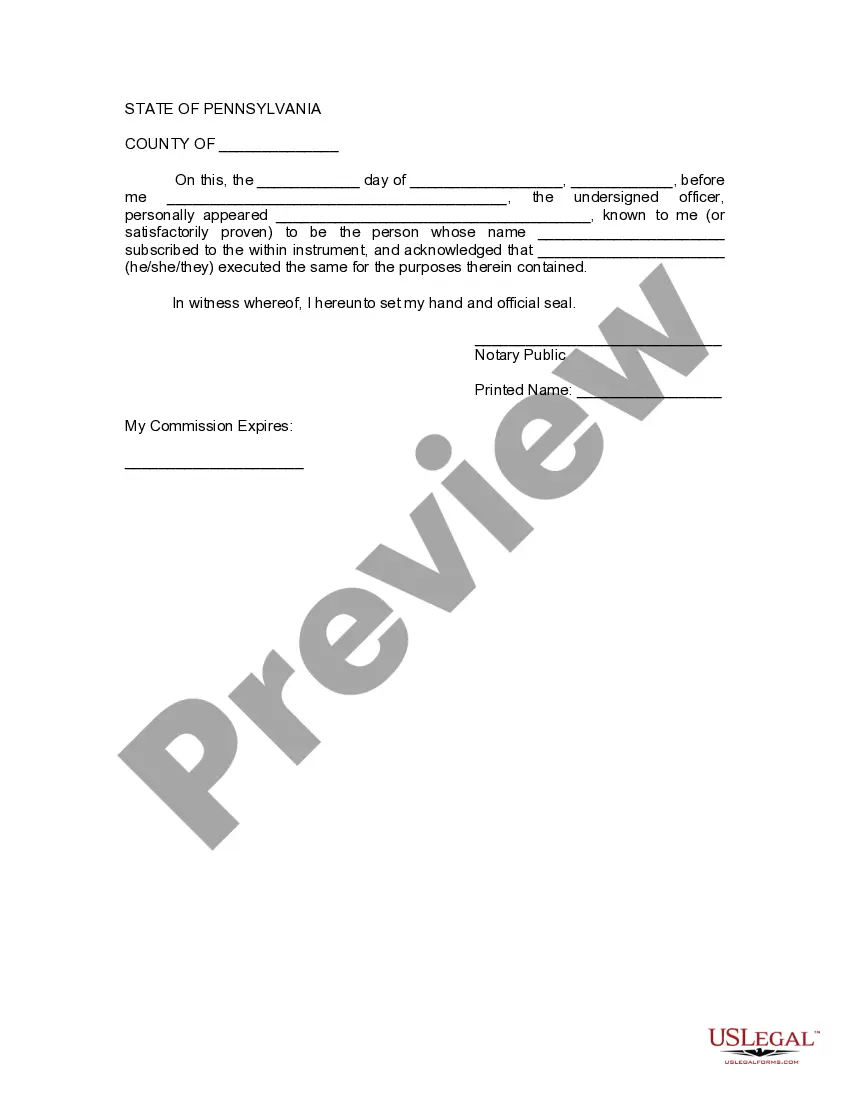

How to fill out Pennsylvania Revocation Of Living Trust?

- Log in to your account on US Legal Forms. Make sure your subscription is active to access the library.

- Search for the revocation living trust form. Use the Preview mode to confirm that it meets your requirements and local jurisdiction.

- If necessary, explore additional templates by using the Search tab to find the correct form tailored to your needs.

- Select the form and click the Buy Now button. Choose your preferred subscription plan and register for an account if you haven’t already.

- Complete your purchase by entering your payment information via credit card or your PayPal account.

- Download your completed form to your device. Access it anytime through the 'My Forms' section in your profile.

With US Legal Forms, you benefit from a robust collection of over 85,000 editable legal documents. This extensive online library helps both individuals and attorneys create precise legal documents effortlessly.

In conclusion, revoking a living trust is straightforward with US Legal Forms. Get started today and ensure your legal documents are handled accurately. Visit US Legal Forms now!

Form popularity

FAQ

Revoking a revocable trust is generally a straightforward process. Depending on the trust's terms, you may need to provide written notice or fill out specific forms to formally revoke it. This revocation essentially returns the assets to your control, giving you the flexibility to manage them as you wish. Utilizing uslegalforms can guide you through the necessary steps for a smooth revocation process.

To remove trustees, you must first review the terms of your revocation living trust with a trustee carefully. Most trusts provide a clear procedure for removal, usually requiring written documentation and potentially the appointment of a new trustee. If disputes arise, seeking professional advice can help you navigate any legal complexities and protect your interests. Uslegalforms provides resources that can simplify this task.

Yes, a trustee can be removed from a revocable trust if the trust document allows it. The process often requires a written notice and adherence to specific guidelines set forth in the trust. If the trustee is not performing their duties or is unfit, you have the right to make such a change. Consulting with an attorney can provide clarity and ensure compliance with legal standards.

To remove a trustee from a revocable living trust, you first need to follow the steps outlined in the trust agreement. This usually involves formally notifying the trustee and possibly getting consent if the trust specifies such a requirement. Additionally, you should document the removal and consider appointing a successor trustee to maintain the trust's effectiveness. Using uslegalforms can help streamline this process.

Changing a trustee in a revocation living trust with a trustee can be relatively straightforward, depending on the trust's terms. Typically, the document outlines the process for making changes, including adjusting power and duties. You may need to follow specific procedures, such as notifying the current trustee and documenting the change formally. Seeking legal assistance can ensure that you adhere to all requirements.

A trust can be terminated in three primary ways: through revocation by the grantor, through the fulfillment of its purpose, or by court order. For those managing a revocation living trust with a trustee, it’s essential to follow specific legal procedures for an effective termination. Understanding the nuances of each method can help to navigate this process smoothly. For clarity and assistance, consider utilizing US Legal Forms, which offers a variety of resources to aid in trust management.

A trust becomes void when it lacks essential elements, such as clear intent, proper creation, or an identifiable beneficiary. If the grantor of a revocation living trust with a trustee fails to meet state requirements or creates contradictory terms, the trust may also be considered void. It's vital to ensure that all elements of the trust are properly addressed, as any omissions could jeopardize its validity. Working with a reliable platform like US Legal Forms can prevent these issues.

Yes, trustees can revoke a trust, but only if the trust document explicitly grants that authority. In the context of a revocation living trust with a trustee, this typically means that the grantor reserves the right to cancel or modify the trust during their lifetime. Communicating openly with the trustee is crucial for a successful revocation process. If you're unsure about the procedure, consider using resources like US Legal Forms for detailed guidance.

A trust can be deemed invalid for several reasons, such as a lack of legal capacity from the grantor, improper execution, or failure to meet state laws. When managing a revocation living trust with a trustee, it’s important to ensure all requirements are met to prevent invalidation. Additionally, if the terms of the trust are unclear or contradictory, courts may rule it invalid. Seeking guidance from legal professionals can help maintain the trust's validity.

The 5 year rule for trusts refers to regulations that govern how assets can be transferred and treated for tax purposes. This rule is crucial when considering a revocation living trust with a trustee, as it can affect the taxation of the grantor's assets. If properties are transferred within five years, they may still be considered part of the grantor's estate, impacting tax obligations. Therefore, understanding this rule is essential for effective estate planning.