Revocation Living Trust With A Beneficiary

Description

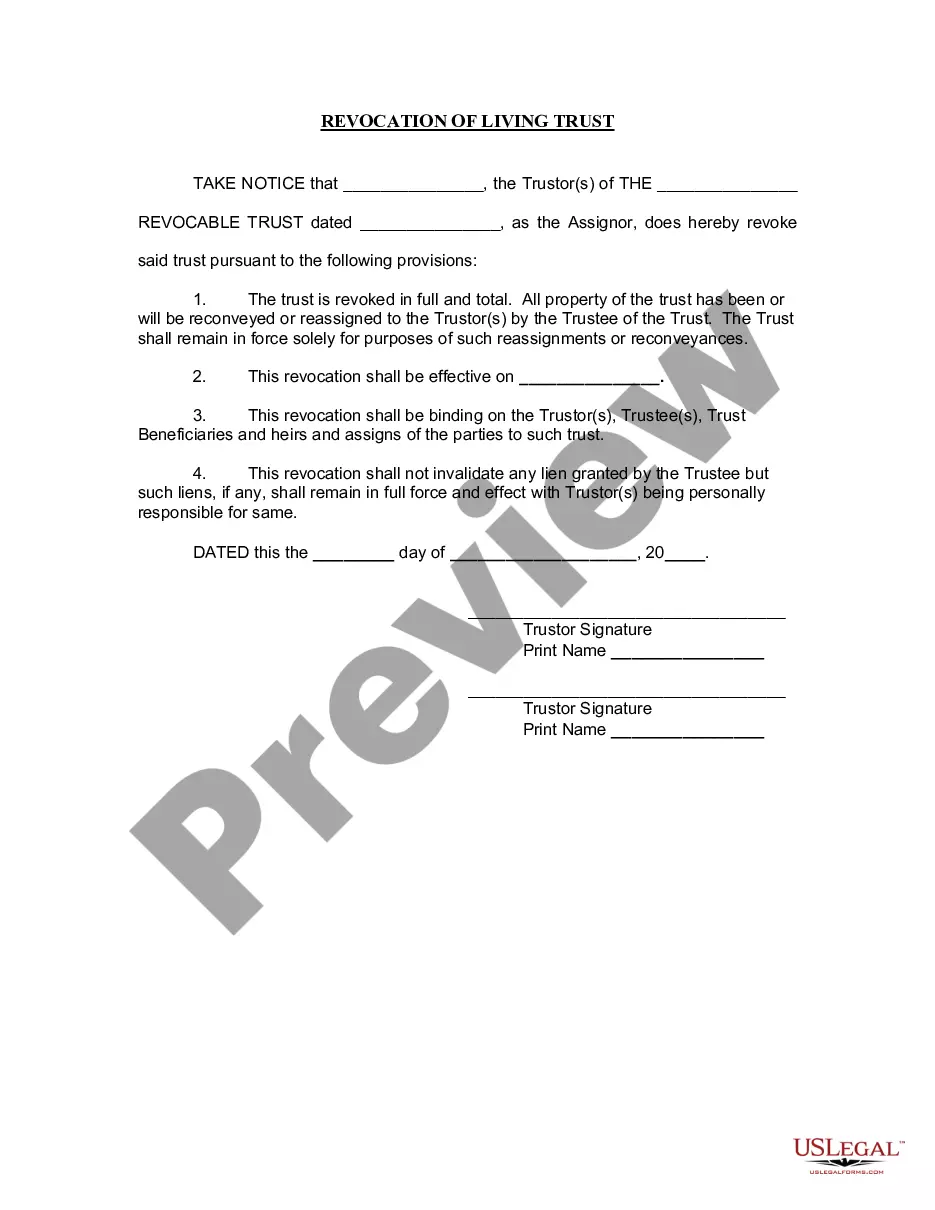

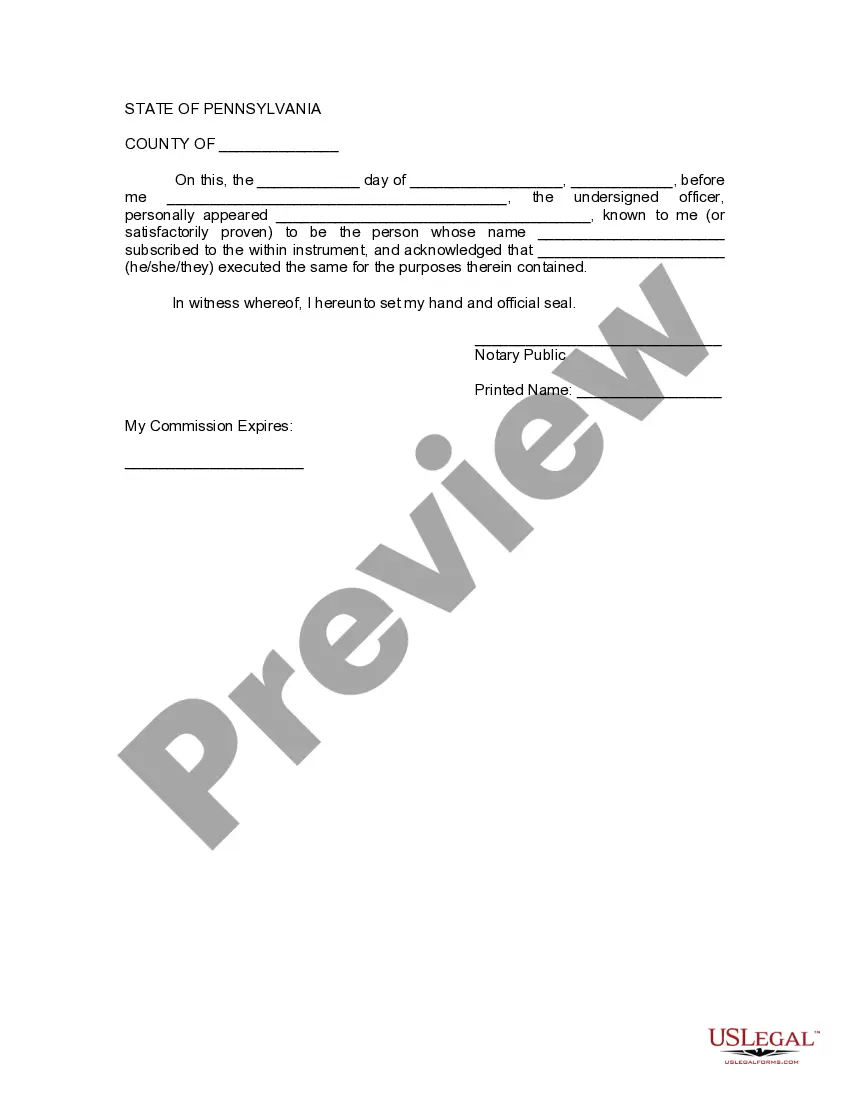

How to fill out Pennsylvania Revocation Of Living Trust?

- If you have an existing account, log in and check your subscription status before downloading your form template.

- Review the Preview mode and read the form description to confirm it matches your specific requirements.

- If adjustments are needed, utilize the search function to find another appropriate template.

- Purchase the desired document by clicking the Buy Now button and selecting your preferred subscription plan.

- Complete your transaction by providing payment details, either through a credit card or PayPal.

- Download and save your completed form from the My Forms section for future access.

Using US Legal Forms not only provides you access to a vast library boasting over 85,000 legal forms but also connects you with premium experts for personalized assistance. This ensures that your documents are tailored accurately and comply with legal standards.

Don't wait any longer to manage your estate effectively. Start today with US Legal Forms and explore our extensive library for all your legal needs.

Form popularity

FAQ

Revoking a revocable trust is a straightforward process. You simply need to follow the conditions laid out in your trust agreement. Generally, you can revoke the trust by creating a formal written document stating your intent to do so. Utilizing uslegalforms, you can access templates and resources that help streamline this process, ensuring your revocation living trust with a beneficiary is handled properly.

Yes, you can modify a revocable trust at any time while you are alive. This flexibility is one of the key benefits of a revocation living trust with a beneficiary. To make changes, you typically need to follow the guidelines outlined in the trust document itself. If you use our platform, uslegalforms, you can easily generate the necessary documents to amend your trust.

Typically, a living trust does not override a beneficiary designation on other documents, like bank accounts or insurance policies. However, it does play a significant role in distributing assets that are part of the trust. Therefore, if you've established a revocation living trust with a beneficiary, it’s essential to ensure consistency across all your estate planning documents. This will help deliver your intentions clearly and effectively.

In general, a trust does not override beneficiaries, but it can influence how assets are distributed. If a revocation living trust with a beneficiary exists, the terms of the trust dictate who receives what after your passing. However, if there are changes to the trust or its revocation, beneficiaries need to be aware of these adjustments to avoid confusion in the future.

A revocation of a living trust is the legal process of canceling a trust document. This action effectively nullifies the trust, meaning that any assets previously included in the trust revert to the grantor’s ownership. When considering a revocation living trust with a beneficiary, it's important to clearly communicate with them about this change. This ensures that the beneficiary understands the updated estate plan.

A trust can be deemed null and void if it does not meet certain legal requirements, such as lacking proper execution or if the grantor lacked the capacity to create it. Additionally, if the purpose of the trust is illegal or against public policy, it can also be invalidated. Understanding these nuances is crucial for maintaining a valid revocation living trust with a beneficiary. UsLegalForms provides valuable guidance on ensuring your trust remains valid and effective.

An example of a revocation of a trust can occur when a grantor decides to change their estate plans. For instance, if you created a revocation living trust with a beneficiary and later choose to dissolve it, you would execute a revocation document. This document officially nullifies the trust's provisions and reallocates assets as per your new wishes. Using tools from UsLegalForms can help you navigate this transition smoothly.

To revoke a revocable living trust with a beneficiary, you must follow specific procedures outlined in the trust document. This often includes drafting a formal revocation document and notifying all interested parties, including beneficiaries. Furthermore, ensuring that you properly dispose of any assets held in the trust is essential. UsLegalForms offers resources that guide you through this revocation process effectively.

Yes, you can remove a beneficiary from a revocation living trust with a beneficiary. This process typically involves drafting an amendment to the trust document, which must be signed and executed according to state laws. It's advisable to consult with a legal professional to ensure all necessary steps are followed. Using platforms like UsLegalForms can simplify this process and provide the necessary templates.

The biggest mistake parents often make when setting up a trust fund is failing to communicate their intentions clearly with their beneficiaries. This can lead to confusion and potential disputes down the line. Additionally, neglecting to fund the trust adequately or not reviewing it regularly can undermine its effectiveness. Using tools like USLegalForms can guide parents in setting up a comprehensive plan that aligns with their goals.