Pennsylvania Revocation Trust With A Foreigner

Description

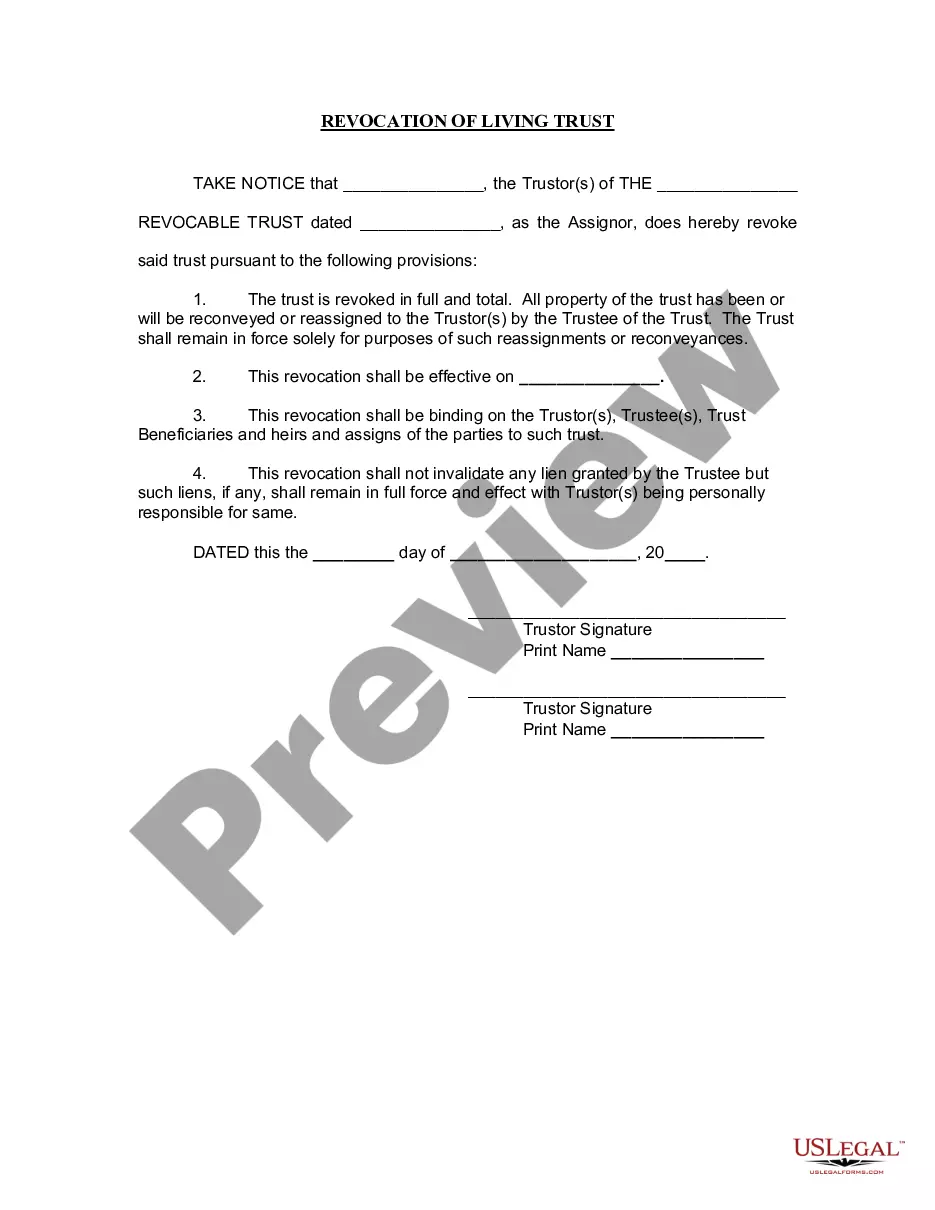

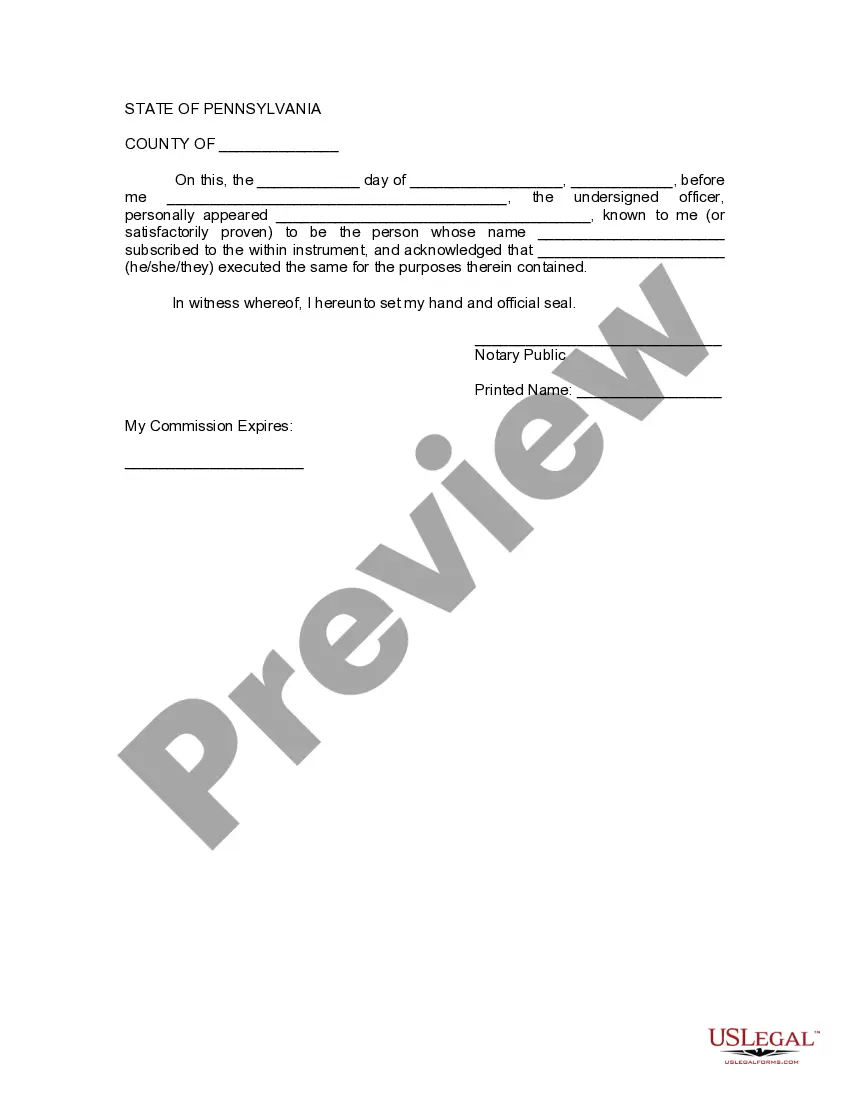

How to fill out Pennsylvania Revocation Of Living Trust?

- If you are a returning user, log into your account and easily download the Pennsylvania revocation trust form you need. Confirm your subscription is active, and if it's not, renew according to your existing payment plan.

- For first-time users, begin by reviewing the form preview and description. Make sure you've selected the correct Pennsylvania revocation trust template that aligns with your specific needs and local jurisdiction.

- If the chosen template doesn't fit, utilize the search functionality to find an alternative. Once you have identified the correct document, proceed to the next step.

- Purchase your selected document by clicking the Buy Now button and choose from the various subscription options available. Registering an account will provide you with full access to their extensive collection of legal forms.

- Complete your payment by entering your credit card information or using your PayPal account for a seamless transaction.

- Finally, download the form and save it to your device. You can also find it later in your account's My Forms section.

In conclusion, US Legal Forms offers a robust selection of over 85,000 legal documents, empowering users to navigate the complexities of legal processes efficiently. Their platform not only saves time but ensures that documents are precise and legally compliant.

Start your journey to establishing a Pennsylvania revocation trust with a foreigner today by exploring the vast resources available at US Legal Forms.

Form popularity

FAQ

To create a revocable trust in Pennsylvania, start by drafting a trust document that outlines your intentions. This is particularly important for a Pennsylvania revocation trust with a foreigner, as it should clearly specify the roles of the beneficiaries. Once the document is prepared, you will need to fund the trust with your assets. Professional services, like those from UsLegalForms, can guide you in drafting and establishing a trust that meets your needs.

Yes, a foreign trust generally needs to file Form 1041 if it has income effectively connected with a US trade or business. This includes situations involving a Pennsylvania revocation trust with a foreigner. Filing this form ensures that the IRS is aware of the trust's income sources. It is advisable to consult a tax professional to navigate the complexities of trust tax requirements.

The PA 41 form is needed for estates and trusts, including those with foreign beneficiaries. If you establish a Pennsylvania revocation trust with a foreigner, the trust may need to file this form if it meets certain income thresholds. This filing informs the state of the income and distributions from the trust. Legal assistance can help ensure compliance with these regulations.

Any individual or entity that earns income in Pennsylvania may be required to file a PA tax return. This includes those with income from a Pennsylvania revocation trust with a foreigner. There are specific thresholds that determine filing obligations, so it's beneficial to review your situation closely. Engaging with an accounting professional can clarify your requirements.

In Pennsylvania, a PA inheritance tax return must be filed by the estate of a deceased individual. This applies if the estate includes taxable property or if there is a beneficiary who is not a direct heir. The inheritance tax is crucial for estates with foreign components, such as a Pennsylvania revocation trust with a foreigner. Each case can differ, so seeking legal advice is essential.

Yes, a US trust can have a foreign beneficiary. This applies especially to a Pennsylvania revocation trust with a foreigner. It's important to understand the tax implications, as certain reporting requirements may arise. Consulting a legal expert can help you navigate these complexities.

Certain categories of individuals are exempt from Pennsylvania inheritance tax. Close relatives, such as a spouse, parent, or child, often qualify for exemptions. If your estate involves a Pennsylvania revocation trust with a foreigner, you might still face some tax liabilities for non-relatives. It's wise to seek expert advice to navigate these rules effectively.

Yes, Pennsylvania inheritance tax applies to non-residents if they inherit Pennsylvania-situs property. Therefore, if a foreigner inherits property in Pennsylvania, this tax still applies. If you have created a Pennsylvania revocation trust with a foreigner, this factor becomes crucial in estate planning. It's essential to understand the tax implications when dealing with non-resident beneficiaries.

Yes, Pennsylvania offers certain exemptions for inheritance tax. For example, transfers to a surviving spouse and to charities are typically exempt from this tax. However, if you have established a Pennsylvania revocation trust with a foreigner, you should consult a tax professional about possible exemptions. Understanding these exemptions can significantly impact your tax planning.

Individuals who have an estate with Pennsylvania-situs property must file PA 41. This includes decedents who were residents of Pennsylvania or those with property in the state. If you have created a Pennsylvania revocation trust with a foreigner, you may also need to file depending on the estate's specifics. Filing ensures compliance with state tax obligations.