Promissory Note Personal Property Without Paying For It

Description

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Personal Property?

There's no longer a need to squander hours hunting for legal documents to meet your local state regulations. US Legal Forms has gathered all of them in a single location and made them easy to access.

Our website offers over 85k templates for various business and personal legal situations organized by state and area of use. All forms are expertly drafted and verified for correctness, so you can trust in receiving an up-to-date Promissory Note Personal Property Without Paying For It.

If you're already acquainted with our platform and hold an account, ensure your subscription is active before accessing any templates. Log In to your account, choose the document, and click Download. You can also revisit all previously acquired documents anytime by opening the My documents section in your profile.

Print your form to fill it out manually or upload the sample if you prefer to work with an online editor. Completing legal paperwork under federal and state regulations is fast and straightforward with our library. Try US Legal Forms today to keep your documents organized!

- If you have not used our platform before, the process will involve a few extra steps to finish.

- Here's how new users can find the Promissory Note Personal Property Without Paying For It in our library.

- Read the content on the page carefully to confirm it contains the sample you need.

- To do this, utilize the form description and preview options if available.

- Use the Search bar above to look for another sample if the previous one does not fit your needs.

- Once you locate the right template, click Buy Now next to its name.

- Select the desired subscription plan and either register for an account or Log In.

- Complete your subscription payment using a card or via PayPal to proceed.

- Choose the file format for your Promissory Note Personal Property Without Paying For It and download it to your device.

Form popularity

FAQ

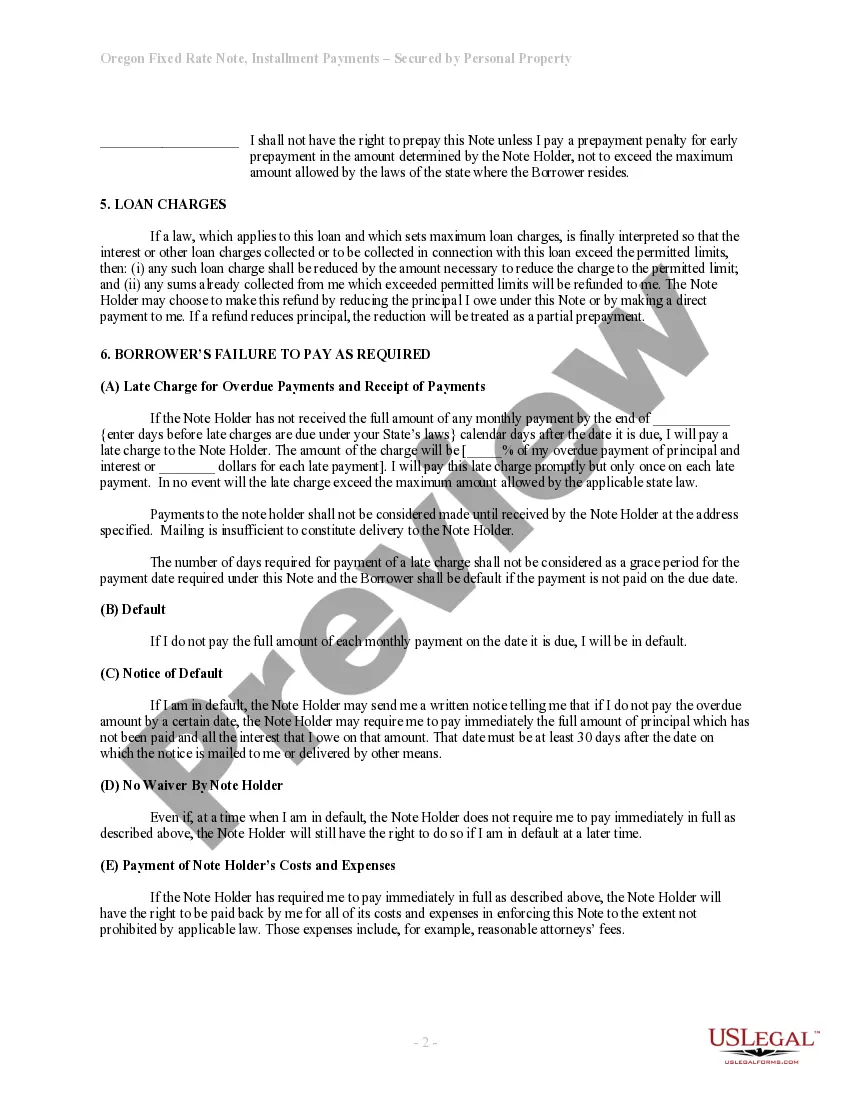

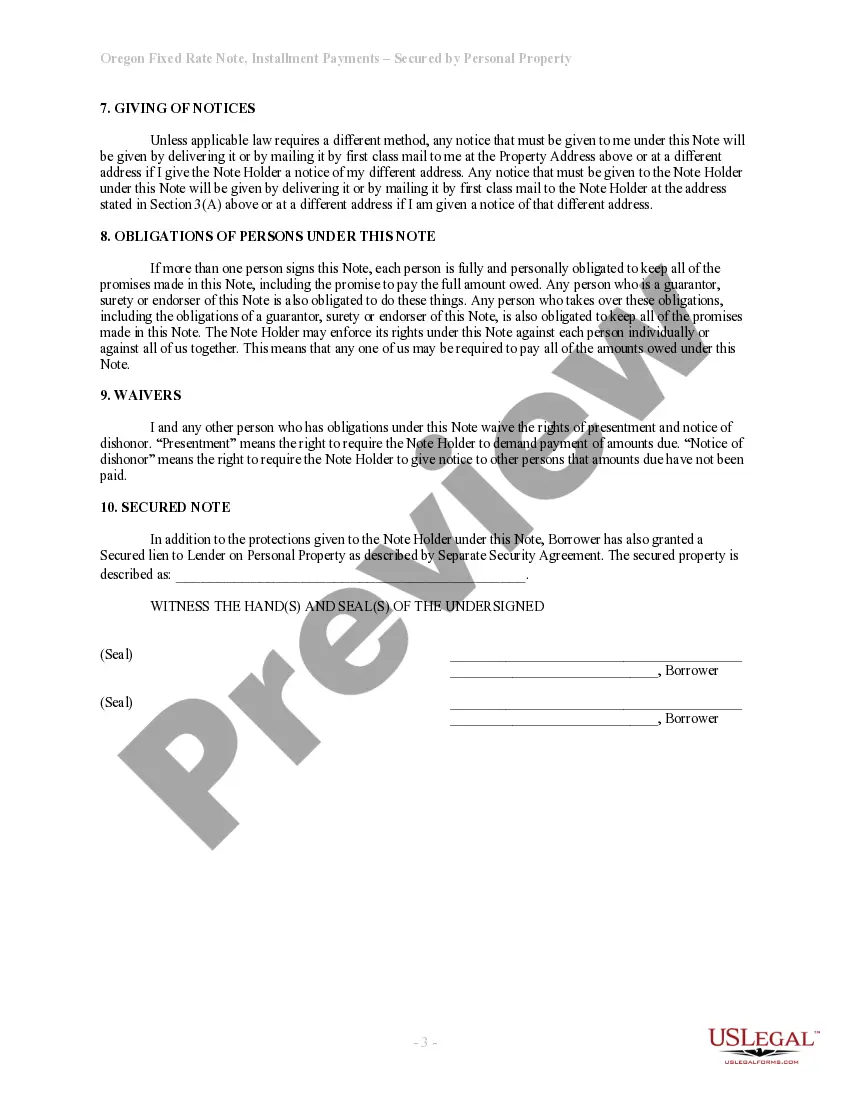

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

It should always be in hand written. The agreement must state, in writing, the terms of instrument, extent of liability (amount), maker's and payee's name and the amount to be paid, among other things. The promise to re-pay money and no other conditions should be mentioned in PN.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.