Oregon Promissory Note Without Interest

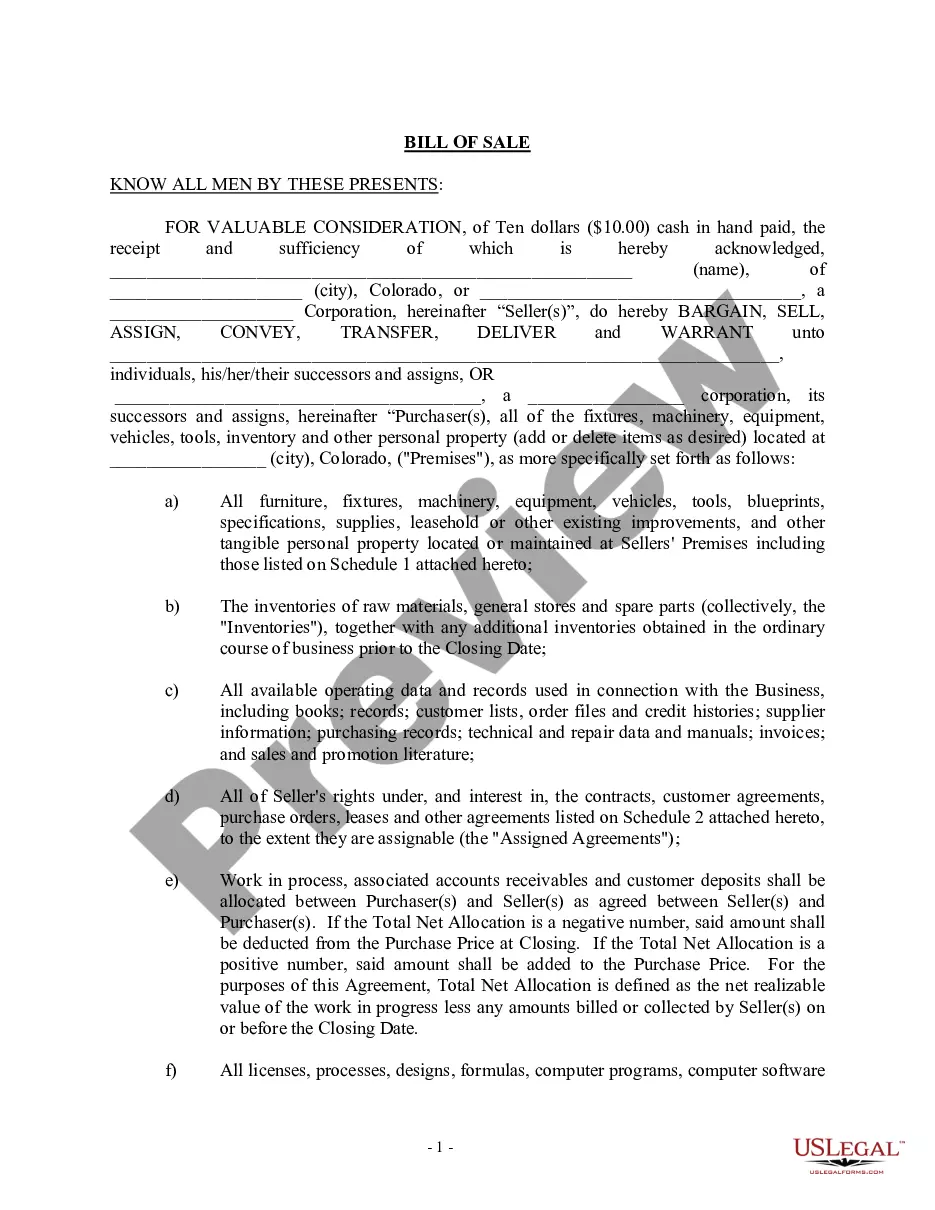

Description

How to fill out Oregon Complaint - Action On Promissory Note?

There's no longer a necessity to invest hours looking for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our site offers over 85,000 templates for various business and personal legal situations organized by state and purpose.

Completing legal documentation under federal and state regulations is quick and straightforward with our platform. Experience US Legal Forms today to keep your paperwork organized!

- All documents are expertly drafted and validated for accuracy, assuring you will obtain an up-to-date Oregon Promissory Note Without Interest.

- If you are acquainted with our service and have an account, ensure your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by navigating to the My documents section in your profile.

- If you're a first-time user, the process will require a few additional steps to complete.

- Here's how new users can discover the Oregon Promissory Note Without Interest in our catalog.

- Review the page content thoroughly to confirm it includes the example you need.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like or .

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

There is no legal requirement for most Oregon promissory notes to be notarized. Promissory notes related to real estate loans may require notarization. Most promissory notes in Oregon need to be signed and dated by the borrower and any applicable co-signer.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.