Oregon Real Estate Requirements

Description

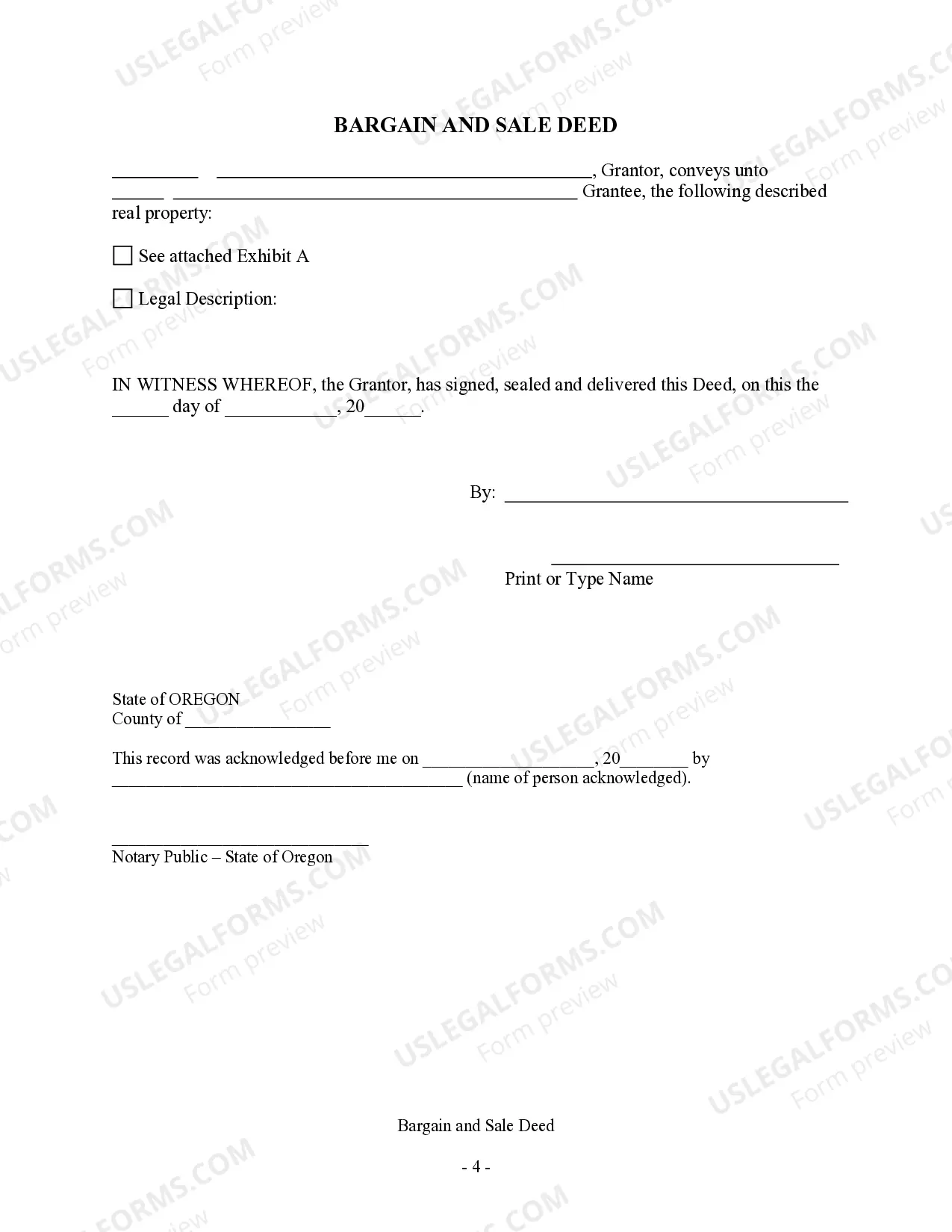

How to fill out Oregon Bargain And Sale Deed - Individual To Individual?

It’s clear that you cannot become a legal expert instantly, nor can you rapidly learn how to draft Oregon Real Estate Requirements without possessing a distinct skill set.

Crafting legal documentation is an elaborate task that necessitates specific education and expertise. So why not entrust the development of the Oregon Real Estate Requirements to the professionals.

With US Legal Forms, which features one of the most extensive collections of legal templates, you can find everything from court documents to templates for internal corporate correspondence. We recognize how vital compliance with federal and state regulations is. Therefore, on our platform, all templates are localized and updated.

Select Buy now. Once the payment is processed, you can download the Oregon Real Estate Requirements, complete it, print it, and send or mail it to the appropriate individuals or organizations.

You can regain access to your forms anytime from the My documents section. If you’re an existing user, you can simply Log In and find and download the template from the same section.

Regardless of your document's purpose—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Begin with our website to obtain the document you require in just a few minutes.

- Utilize the search bar at the top of the page to find the form you need.

- If available, preview it and review the accompanying description to determine if Oregon Real Estate Requirements fits your needs.

- If you are looking for another template, restart your search.

- Create a free account and choose a subscription plan to purchase the template.

Form popularity

FAQ

Use Vermont Form IN-111, Vermont Income Tax Return to file your amended return. Verify you are using the form for the correct year and that you are including all schedules (IN-112, IN-113, IN-153, etc.) submitted with your original filing even if the information on these schedules has not changed.

The Vermont Sales and Use Tax is 6%. To determine tax due, multiply the sales amount by 6% (or 7% if the sale is subject to local option tax), and round up to the nearest whole cent ing to the following rules: Tax computation must be carried to the third decimal place, and.

An official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

Some customers are exempt from paying sales tax under Vermont law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

To verify a Vermont resale certificate, you may call the Department of Taxes at 802-828-2505 Option 2 to verify the Vermont Tax Account Number provided in the Form S-3 is valid and active.

The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. Exemption certificates are not filed with the Vermont Department of Taxes, but the seller must produce an exemption certificate when it is requested by the Department.

Sales tax exemption certificates expire after five years. The Department reviews each exemption certificate sixty (60) days before the current certificate expires. When a Florida governmental entity remains in effect, a new exemption certificate will be mailed to the governmental entity.