Quitclaim Deed For Illinois

Description

How to fill out Oklahoma Quitclaim Deed From Husband And Wife To Five Individuals As Joint Tenants With Right Of Survivorship?

- Log into your US Legal Forms account. If you're a new user, create an account to access the forms library.

- Search for the quitclaim deed template specific to Illinois. Browse the available forms to find the one that suits your needs.

- Review the form preview and descriptions to confirm it meets your legal requirements for your jurisdiction.

- If you need a different template, utilize the search feature to find the correct one. Once found, proceed to the next step.

- Select the form and click on the Buy Now button. Choose your subscription plan that fits your needs to access all documents.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download your quitclaim deed. Save it securely on your device for easy access. You can also find it in the 'My Forms' section of your account whenever needed.

In conclusion, US Legal Forms provides an extensive library of legal documents, making it easier for you to complete a quitclaim deed efficiently. With access to numerous forms at your fingertips and additional expert assistance, you can ensure your legal documents are accurate and compliant. Get started today to streamline your legal process!

Visit US Legal Forms now to access your quitclaim deed for Illinois!

Form popularity

FAQ

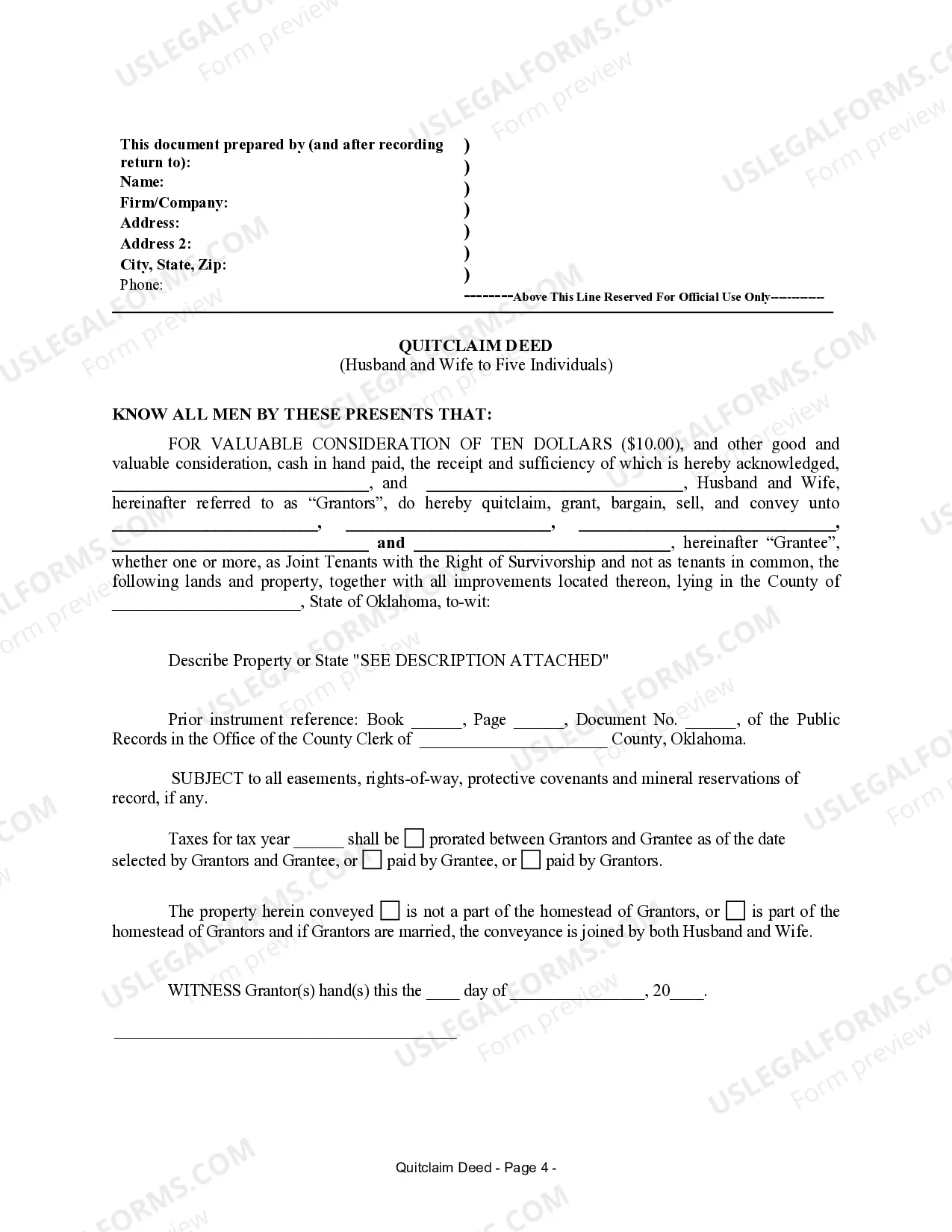

A quitclaim deed in Illinois serves to transfer ownership of property without guaranteeing that the title is clear. The grantor, or current owner, relinquishes their interest, allowing the grantee to acquire it. It is a straightforward process that requires completing the deed form and filing it with the county recorder's office. For added ease, you can use platforms like US Legal Forms to access templates and instructions tailored for Illinois.

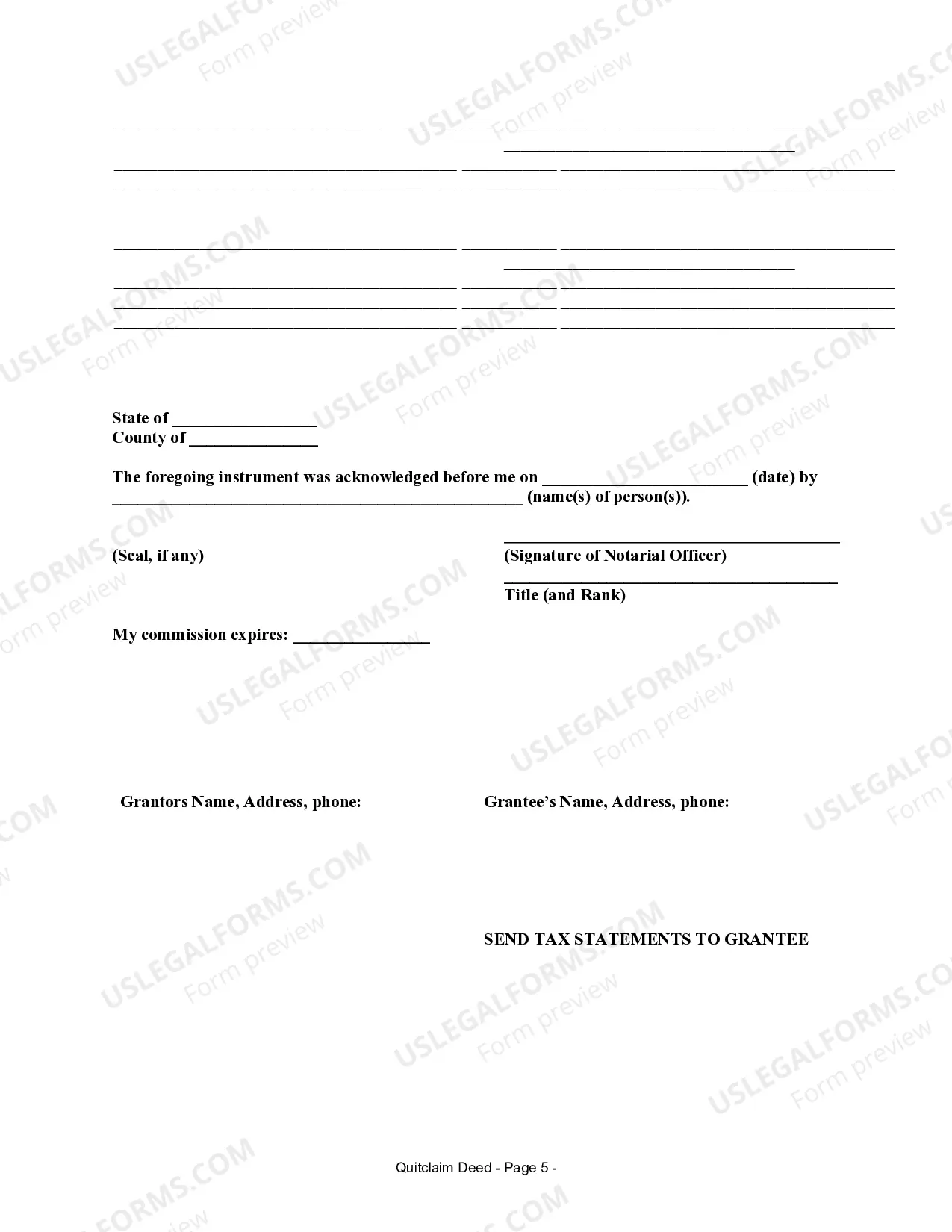

To obtain a quitclaim deed for Illinois, you first need to prepare the document with the necessary property and party details. Once completed, you must have the deed signed by the grantor in the presence of a notary. After notarization, the next step is to file it with the county clerk's office. US Legal Forms can assist you in this process by providing accurate templates and instructions.

Many people view quitclaim deeds with caution because they provide limited protection. Unlike warranty deeds, quitclaims do not guarantee that the title is clear, raising concerns about hidden claims. Therefore, it’s crucial to conduct thorough research and possibly obtain title insurance if proceeding with a quitclaim deed for Illinois.

You can indeed handle a quitclaim deed for Illinois on your own. This allows you to save on legal fees, but requires that you understand the necessary steps. The deed must be filled out correctly and filed with the proper county office to be valid. To simplify this process, consider using US Legal Forms, which offers templates and guidance.

Yes, a quitclaim deed for Illinois can be handwritten, but it must be clear and legible. Still, it is important to use the correct language and format to ensure it meets legal standards. Handwritten deeds may be more prone to error, so utilizing a professional template or service can help protect your interests.

Yes, you can prepare a quitclaim deed for Illinois yourself. The process involves filling out a template with the necessary details about the property and the parties involved. However, it is advisable to ensure you follow local laws and requirements to make the deed valid. Using a trusted service like US Legal Forms can make this process easier and compliant.

A quit claim deed can be problematic mainly due to its lack of title guarantees and legal protections for the buyer. Since this deed offers no assurances about the property’s condition or any existing liens, buyers may end up facing unforeseen challenges. It is essential to approach quitclaim deeds with caution and consider other options if you're unsure about the seller's intent. Utilizing resources like US Legal Forms can provide clarity and assistance when navigating quitclaim deed for Illinois.

One major disadvantage for buyers receiving a quitclaim deed in Illinois is the lack of warranties regarding the property's title. Unlike other deeds, a quitclaim deed does not guarantee that the seller holds clear title, which means the buyer might encounter unexpected claims or liens. This can pose significant financial risks if issues arise after the transfer. Therefore, it's crucial for buyers to conduct thorough due diligence before accepting a quitclaim deed for Illinois.

Typically, people use a quitclaim deed in Illinois to transfer property ownership without the complexities of traditional sales. Common reasons include transferring property between family members, clearing up title issues, or resolving disputes over ownership. By simplifying the transfer process, this deed offers a practical solution when parties trust each other but want to formalize an agreement. A quitclaim deed for Illinois serves as a valuable tool for these straightforward transactions.

The primary beneficiaries of a quitclaim deed in Illinois are often family members or individuals involved in informal transactions. This type of deed allows one person to transfer interest in a property to another, typically without a lengthy legal process. Therefore, parties involved in inheritance or easing property transfers during life events may find this deed particularly useful. By using a quitclaim deed for Illinois, you can streamline the transfer of property rights.