Oklahoma Executor Deed Form With Executor

Description

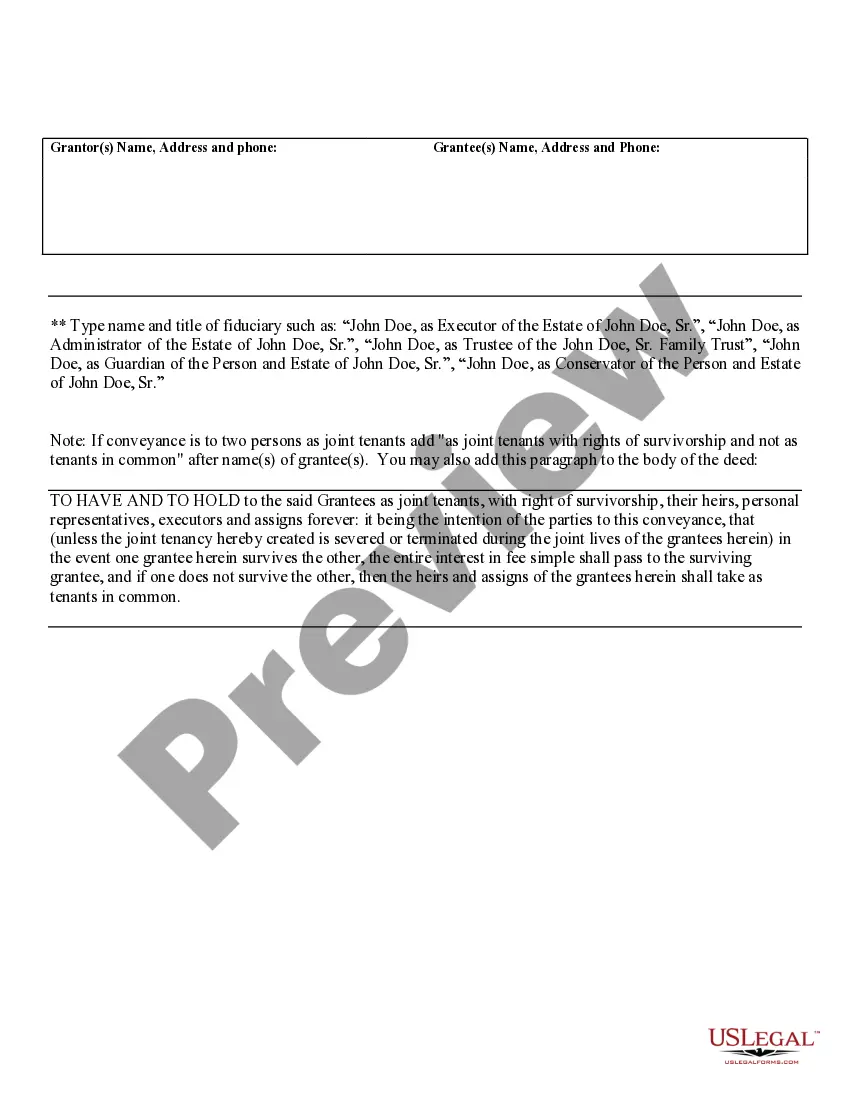

How to fill out Oklahoma Executor Deed Form With Executor?

Bureaucracy demands exactness and correctness.

If you do not manage completing documents like Oklahoma Executor Deed Form With Executor regularly, it can result in some misunderstanding.

Selecting the appropriate template from the beginning will ensure that your document submission will proceed smoothly and avoid any complications of resubmitting a document or repeating the same task from scratch.

If you are not a subscribed user, locating the needed sample will take a few extra steps.

- You can always locate the suitable template for your documentation in US Legal Forms.

- US Legal Forms is the most extensive online forms repository that houses over 85 thousand templates for various fields.

- You can obtain the latest and most pertinent version of the Oklahoma Executor Deed Form With Executor by simply looking it up on the website.

- Find, save, and download templates in your profile or verify with the description to ensure you have the correct one available.

- With an account at US Legal Forms, it is feasible to obtain, accumulate in one location, and browse the templates you have saved for quick access.

- When on the site, click the Log In button to authenticate.

- After that, navigate to the My documents page, where your document history is maintained.

- Review the description of the forms and download those you require at any time.

Form popularity

FAQ

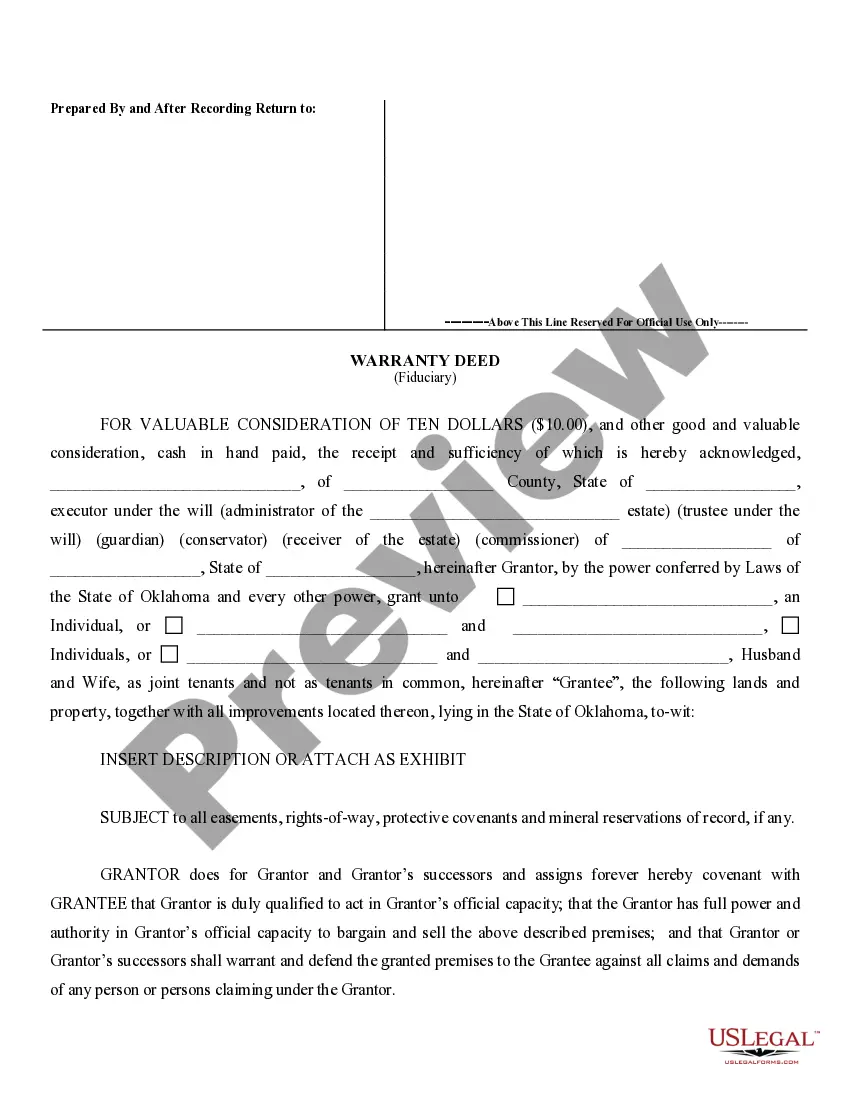

To add an executor, you typically need to complete an Oklahoma executor deed form with executor. This form allows you to legally designate the person responsible for managing the estate's affairs. You should gather the necessary information about the executor, such as their full name and address, before completing the form. Once you fill it out, submit it according to your local court's requirements to ensure everything is processed correctly.

A ladybird deed in Oklahoma is a special type of deed that allows you to retain control over the property during your lifetime while specifying beneficiaries to receive the property upon your death. This deed can help you avoid probate while also providing flexibility in management. To create such documents and ensure they align with your wishes, consider using an Oklahoma executor deed form with executor.

Transferring property on death in Oklahoma can be done through a transfer on death deed or a ladybird deed. These legal instruments allow property to pass directly to beneficiaries without going through probate. Choosing the right documentation, such as an Oklahoma executor deed form with executor, helps in avoiding delays and complications.

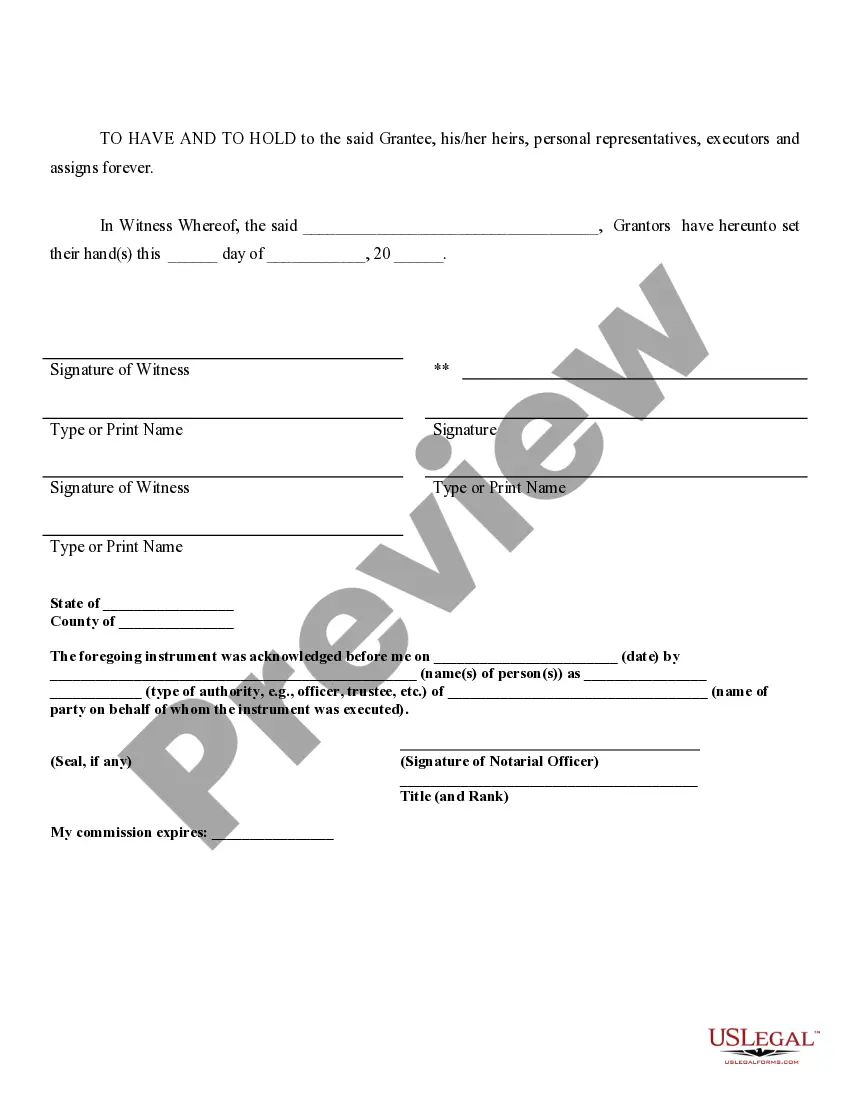

To file a transfer on death deed in Oklahoma, you need to complete the appropriate form that designates your beneficiaries. This deed must be signed, notarized, and recorded in the county where the property is located. Using an Oklahoma executor deed form with executor simplifies this process, ensuring your intentions are clearly documented and legally binding.

In Oklahoma, the order of inheritance follows a specific hierarchy. First, the spouse and children receive shares of the estate. If there are no direct heirs, parents and siblings may inherit next. To ensure clarity and legal compliance, many choose to utilize an Oklahoma executor deed form with executor for property transfers.

When someone dies without a will in Oklahoma, their property is distributed according to state intestacy laws. This means that the court determines who inherits the property based on familial relationships. Typically, the spouse and children receive priority. If you want to manage such situations effectively, using an Oklahoma executor deed form with executor can streamline the process.

To become the executor of an estate in Oklahoma, you must be nominated in the deceased's will or, if there is no will, be the closest relative. You will need to file a petition with the probate court to initiate the process. The court will review your qualifications and accept your appointment if everything is in order. Remember that an Oklahoma executor deed form with executor is essential for handling the real estate portion of the estate effectively.

To file for executor of an estate in Oklahoma, you must submit a petition for probate along with the deceased's will, if available. This petition outlines your request to be appointed as the executor. The court will then hold a hearing to assess your eligibility and approve your appointment. Filling out an Oklahoma executor deed form with executor will help you manage property transfers once you are appointed.

In general, real estate requires probate in Oklahoma unless it is held in a trust or designated with a transfer on death deed. The probate process ensures the estate is settled lawfully and the property is transferred to the rightful heirs. Real estate without a will must go through this process, but using an Oklahoma executor deed form with executor can often streamline the transfer. Consulting with a legal expert is advisable for tailored guidance.

If your parent passed away without a will in Oklahoma, you may need to go through the probate process to transfer property legally. The estate will be distributed according to Oklahoma's intestate succession laws, which determine the rightful heirs. You can file the necessary forms in the local probate court to initiate this process. An Oklahoma executor deed form with executor can assist you in managing the property transfer more smoothly.