Revocation Living Trust For Property

Description

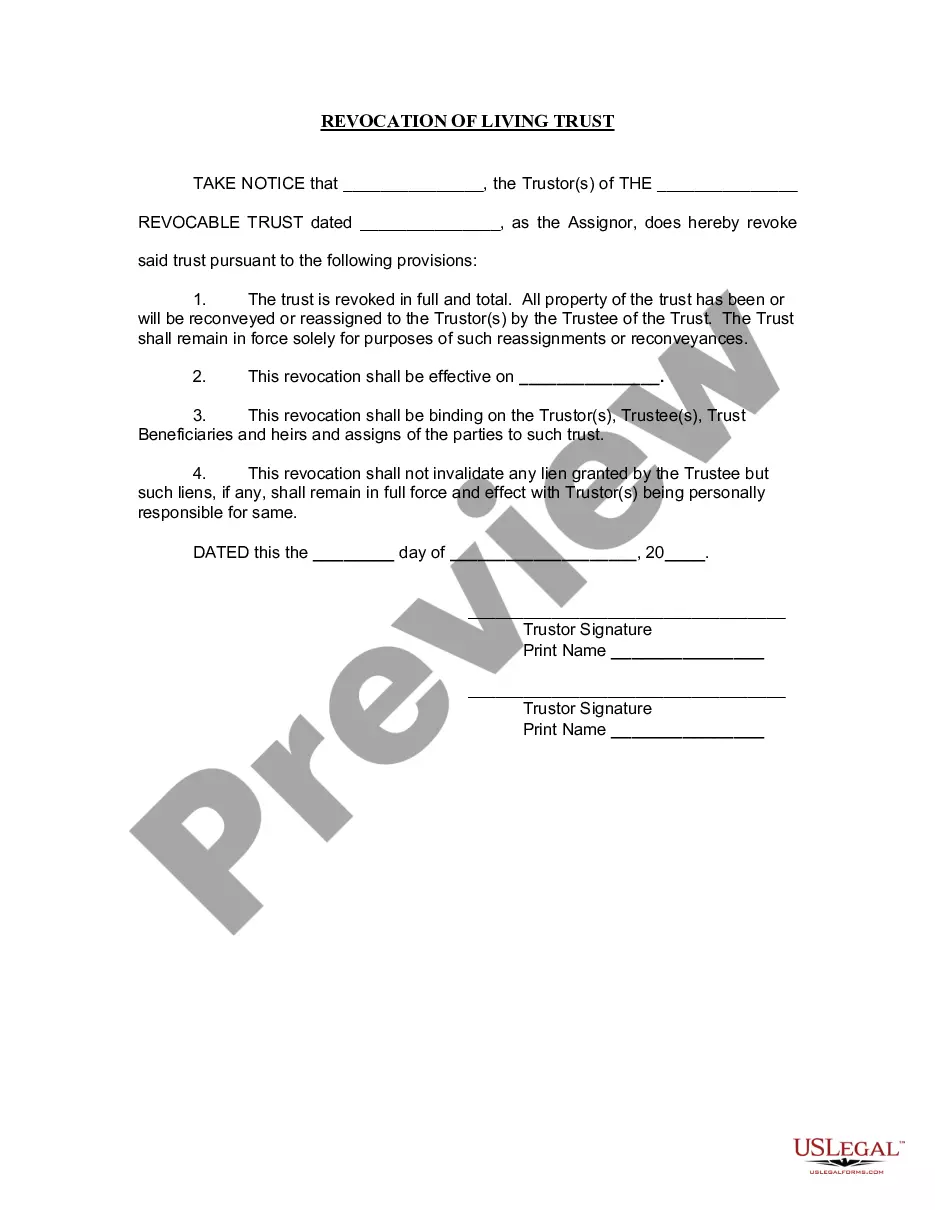

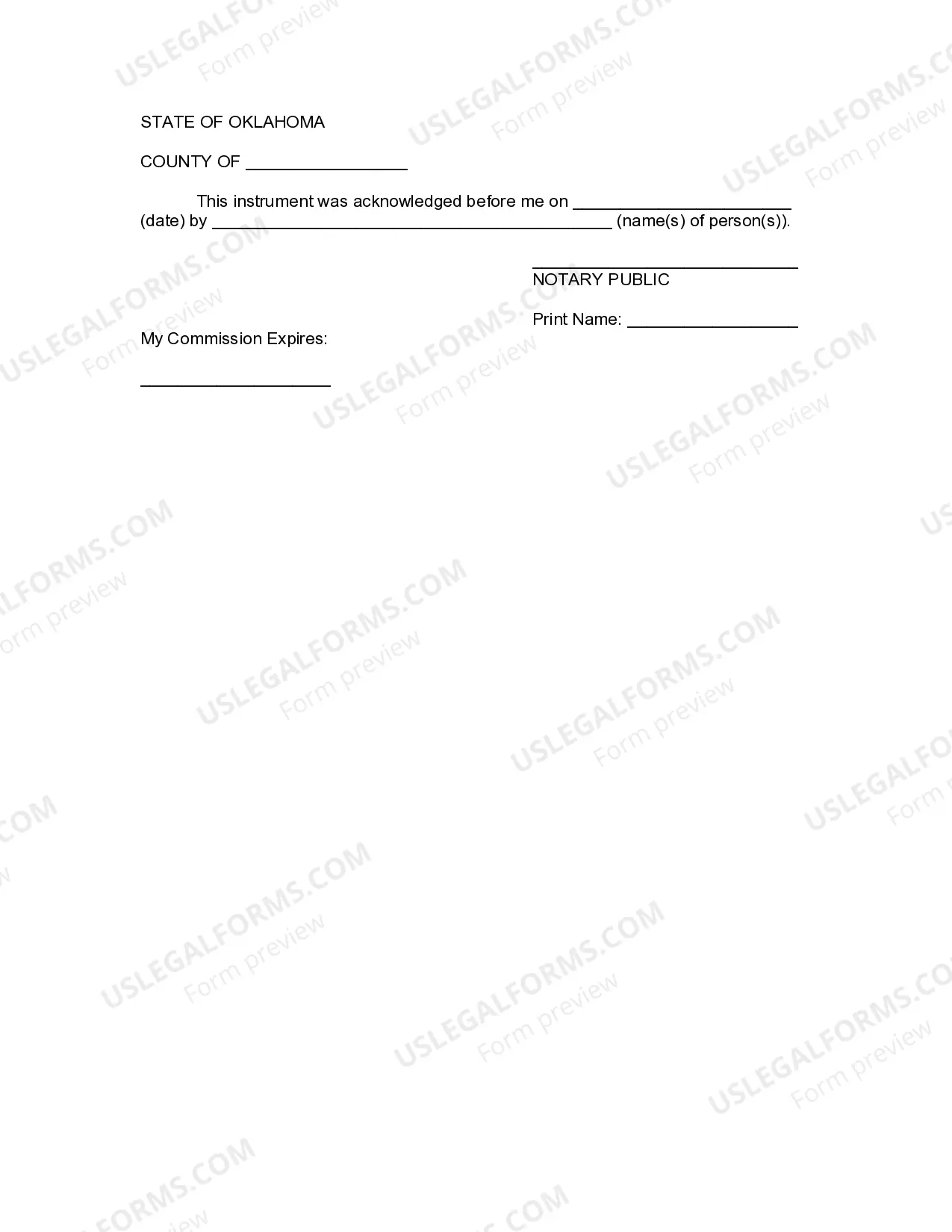

How to fill out Oklahoma Revocation Of Living Trust?

- If you're a returning user, log into your account and ensure your subscription is active to download the desired form by clicking the Download button.

- For first-time users, start by checking the Preview mode to review the form description. Confirm that the selected form aligns with your needs and adheres to your local jurisdiction's requirements.

- If the form doesn’t fit your criteria, utilize the Search feature to find the appropriate template. Ensure any adjustments resonate with your specifications before proceeding.

- Select the document you need. Click on the Buy Now button to choose your subscription plan; registering for an account will be required to access all resources.

- Complete the transaction by entering your payment details or using your PayPal account for a seamless purchase.

- Once your payment is confirmed, download the form directly to your device. You can find it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms not only provides a robust collection of over 85,000 legal documents but also ensures that users can access expert assistance for precise form completion. This resource is invaluable for anyone looking to manage their legal paperwork efficiently.

Start your journey by visiting US Legal Forms today to simplify your legal documentation process.

Form popularity

FAQ

Trusts can be invalidated due to a variety of reasons. Common causes include lack of proper execution, absence of required signatures, or failure to meet statutory requirements. Another reason could be the intent behind creating a revocation living trust for property not being clearly expressed. To create a valid trust, consider using platforms like uslegalforms, where you can find guidance and templates tailored to your needs.

Revoking a revocable trust is a straightforward process. Typically, the trust document outlines the steps required to revoke it, which often involves creating a written notice or amendment. Many people choose a revocation living trust for property due to this simplicity, allowing them to adjust their estate plans as life changes. Remember, consulting with a legal professional can provide clarity and ensure compliance with the necessary steps.

A trust can become void due to several factors. For instance, if the trust lacks a clear purpose or is created without the necessary legal formalities, it may be considered invalid. Additionally, if there is evidence of fraud or undue influence in the creation of the trust, it can be declared void. Understanding the properties of a revocation living trust for property helps ensure that it remains valid.

The 5 year rule for trusts generally refers to tax considerations related to transferring assets into a trust. This rule impacts how gifted or inherited property is treated for tax purposes within a certain period. Understanding this rule is important when establishing or revoking a living trust for property, especially in relation to potential tax implications.

The primary purpose of a revocable living trust is to manage an individual's assets during their lifetime and streamline the distribution process upon death. This type of trust allows for flexibility, as the grantor can alter or revoke the trust at any time. Ultimately, it simplifies the transfer of property and helps avoid probate, making the revocation of living trust for property a strategic choice in estate planning.

A trust can be deemed null and void if it lacks the necessary legal components, such as a clear definition of trust property, competent beneficiaries, or is created without following local laws. Furthermore, if the trust was established under fraudulent pretenses, it can be invalidated. Understanding these factors is crucial for managing the revocation of living trust for property effectively.

One disadvantage of placing a house in a revocable trust is the ongoing administrative responsibility it imposes on the grantor. Additionally, a revocable trust does not protect assets from creditors and does not provide tax benefits during the grantor's lifetime. Therefore, it is vital to consider these factors when thinking about the revocation of living trust for property.

A revocation of living trust is the formal process of cancelling the trust and its provisions. This process involves the grantor signing a document that states their intention to revoke the trust. This action is essential for ensuring the proper distribution of the grantor's assets and reflects a significant change in estate planning strategy.

Revoking a living trust means nullifying its terms and returning the assets to the original owner. This action allows the grantor to regain control of their property and choose how to distribute it going forward. Understanding the revocation of living trust for property is crucial as it affects estate planning and asset management.

A trust can be terminated in three main ways: by the terms set forth in the trust document, by mutual agreement of all beneficiaries, or by a court's decision. Each of these methods involves specific protocols to ensure that the revocation of the living trust for property is executed legally and effectively. It's important to follow these processes carefully to avoid complications.