Irs Form W 4 2022

Description

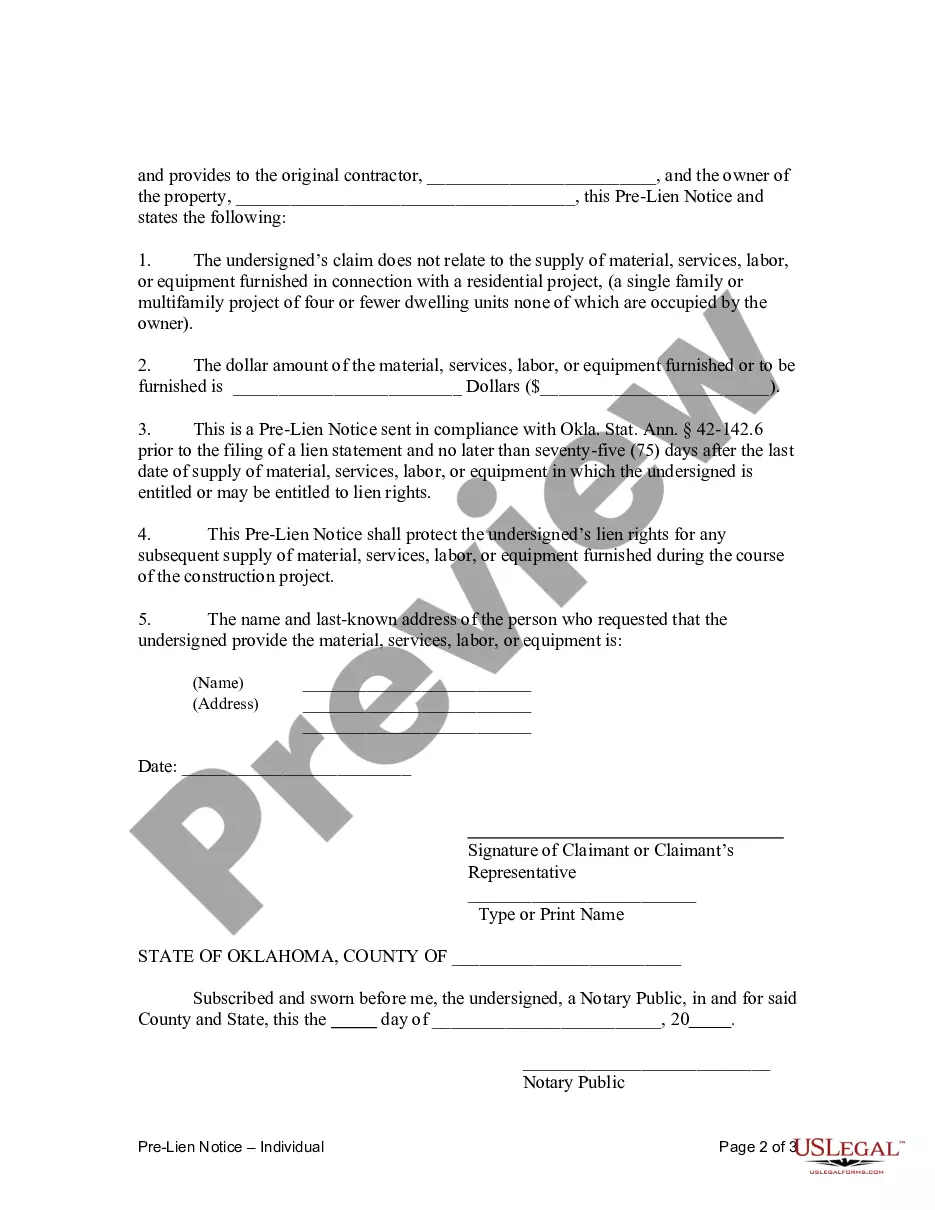

How to fill out Oklahoma Pre-Lien Notice - Individual?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active for uninterrupted access.

- For new users, review the Form W-4 2022 preview and description to confirm it meets your needs and adheres to local requirements.

- If necessary, utilize the Search function to locate additional templates that better suit your specifications.

- Once satisfied, click the Buy Now button to select your subscription plan, and if prompted, create an account to access the full library.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Download the IRS Form W-4 2022 and save it on your device, accessible later from 'My Forms' in your profile.

By following these straightforward steps, you can confidently complete the IRS Form W-4 2022 while benefiting from US Legal Forms' robust collection of forms and expert assistance.

Start today by visiting US Legal Forms for all your legal documentation needs!

Form popularity

FAQ

Filling out the IRS form W 4 2022 involves several steps. Start by providing your personal information, including your name, address, and filing status. Then, indicate additional income or deductions if applicable. For detailed guidance, US Legal Forms offers resources that simplify the process, helping you make the best choices for your tax situation.

While some employers allow electronic submission of the IRS form W 4 2022, you should check with your employer first. Some may still require a physical copy due to company policy. Platforms like US Legal Forms can help streamline the completion process, ensuring you're ready to submit your W4 however your employer prefers.

Yes, the IRS form W 4 2022 can be filled out electronically in many cases. Various platforms allow you to complete the form online, making the process quick and convenient. US Legal Forms provides a user-friendly interface to help you fill out your W4 accurately and efficiently.

Yes, you can use the IRS form W 4 2022 to adjust your tax withholding. This form allows you to indicate how much federal income tax should be withheld from your paycheck. For simplified completion, consider tools available on US Legal Forms that guide you through the process of creating an effective W4 based on your financial situation.

Certain IRS forms, including some versions of the IRS form W 4 2022, may not qualify for electronic filing. Typically, forms that require signatures or specific documentation must be submitted by mail. Always verify the current requirements on the IRS website or consult with platforms like US Legal Forms for clarity on filing options.

To submit the IRS form W 4V, you need to complete the form and provide it to your payer, which is typically your employer or income provider. Ensure that all required information is accurate to avoid delays. You can find helpful resources on the US Legal Forms platform, which makes completing and submitting the IRS form W 4V easier.

Sending your IRS form W 4 2022 over email can pose some security risks. It's important to consider that email is not a fully secure method of sharing sensitive information. If you must send your W4 this way, ensure your email is encrypted. Alternatively, consider using secure services or platforms like US Legal Forms for submitting your IRS form W 4 2022 safely.

The total number of allowances is not strictly the same as your number of dependents. While dependents can influence the number of allowances you claim on the IRS Form W-4 2022, other factors also come into play. It's essential to consider your income levels and tax situations for accurate withholding.

To figure out the correct number of allowances, review your financial situation on the IRS Form W-4 2022. This involves considering your overall income, filing status, and any deductions you expect to claim. Leveraging resources available on the IRS website or tools provided by US Legal Forms can simplify this process and help ensure accuracy.

The ideal number of deductions to claim on your W-4 largely depends on your financial situation. Generally, aiming for a balance can be beneficial: enough to keep your tax burden manageable but not so many that you risk owing taxes at the end of the year. Utilizing tools offered on the IRS website can guide you in determining the best number for your specific circumstances.