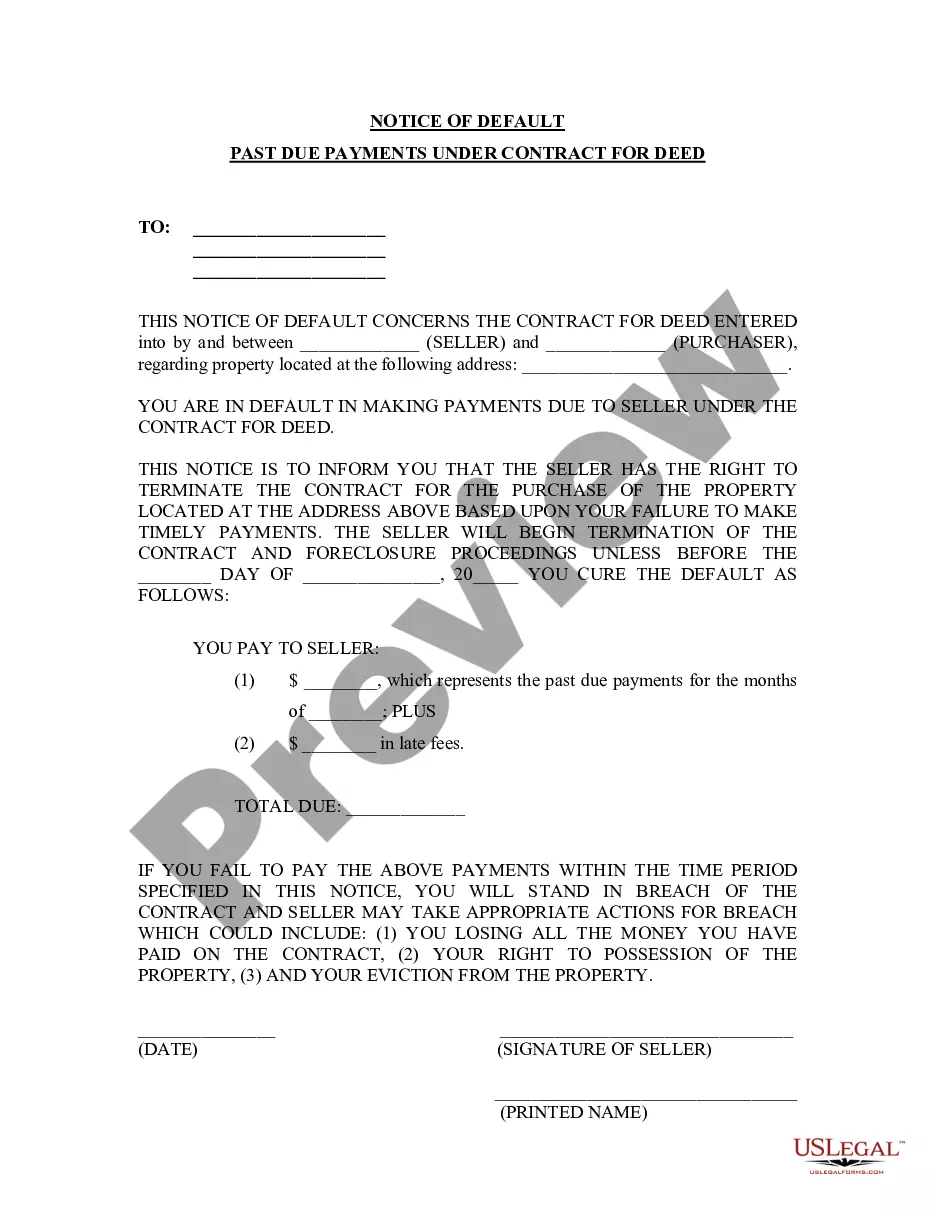

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

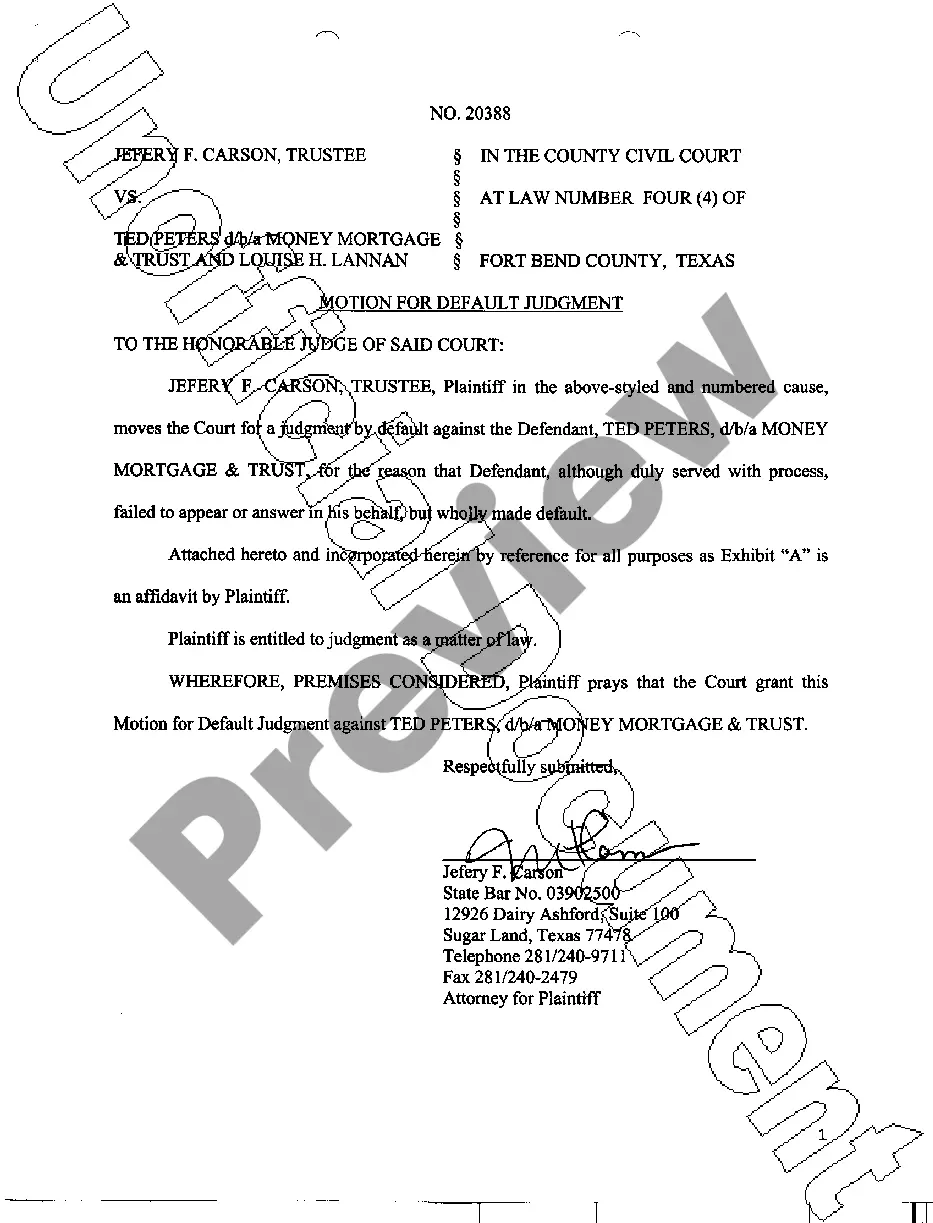

Notice Of Default Form Foreclosure

Description

How to fill out Notice Of Default Form Foreclosure?

Whether you handle paperwork frequently or you occasionally need to transmit a legal document, it is essential to secure a helpful resource where all examples are pertinent and current.

The initial action you should take with a Notice Of Default Form Foreclosure is to verify that it truly is its latest version, as it determines if it can be submitted.

If you desire to streamline your quest for the most recent document samples, look for them on US Legal Forms.

Utilize the search bar to locate the form you require. Review the Notice Of Default Form Foreclosure preview and outline to ensure it is precisely what you are looking for. After verifying the form, click Buy Now. Select a subscription plan that suits you. Create an account or Log Into your existing one. Provide your credit card information or PayPal account to finalize the purchase. Choose the document format for download and confirm it. Eliminate any confusion associated with legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a compilation of legal documents that has nearly every type of sample you might seek.

- Search for the templates you need, assess their relevance instantly, and discover more about their application.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Find the Notice Of Default Form Foreclosure examples in just a few clicks and save them at any time in your account.

- A US Legal Forms account assists you in obtaining all the samples you require with ease and fewer hassles.

- You only need to click Log In in the website header and navigate to the My documents section to access all the forms you need without wasting time searching for the appropriate template or verifying its relevance.

- To acquire a form without an account, follow these instructions.

Form popularity

FAQ

To respond to a notice of default, first review the document carefully to understand the specific reasons for the default. You should then gather relevant information and any supporting documents to address the default issues. It's essential to communicate your intentions and proposed solutions to your lender in writing. Utilizing a Notice of default form foreclosure can help structure your response clearly, ensuring all necessary details are included.

Yes, a notice of default is a public record. This document indicates that a borrower has missed mortgage payments, leading to potential foreclosure. You can usually access this information through your local county clerk's office or online databases. Understanding that the notice of default form foreclosure is public can help you stay informed about your situation and those of nearby properties.

To obtain a copy of your foreclosure, start by contacting the lender or mortgage servicer involved in the process. They typically keep records and can provide you with the necessary paperwork. If you need the notice of default form foreclosure, consider using a service like US Legal Forms, where you can find and access essential documents. Keeping copies of these records is crucial for your reference and legal options.

Getting a foreclosure letter can be straightforward. You can request one from your lender or the bank handling the foreclosure process. Additionally, using online platforms like US Legal Forms can simplify obtaining the notice of default form foreclosure, as it offers a variety of templates and resources. Ensuring you have the necessary documents is essential for managing your situation effectively.

To download a foreclosure letter, you can visit relevant legal or government websites that provide public records. Many of these sites offer easy access to forms, including the notice of default form foreclosure. You may need to enter specific property information to locate the correct documents. Once found, follow the site's instructions to download and save the letter.

Yes, foreclosure documents, including those related to the notice of default form foreclosure, are typically public records. This means anyone can access this information, which is often filed with local government offices. By checking these records, you can gain insight into the status of a foreclosure for a particular property. Understanding this can also be beneficial when navigating your own foreclosure situation.

When you receive a foreclosure letter, it is crucial to act promptly. First, review the contents of the letter thoroughly to understand the details. Next, consider consulting legal advisors who can guide you through using the notice of default form foreclosure process. Responding quickly can help you explore options and prevent further complications.

Defaulting is not the same as foreclosure, but it is the initial step toward that process. When a borrower defaults, they fail to make scheduled mortgage payments, prompting the lender to send a notice of default. Foreclosure, on the other hand, occurs when the lender takes legal action to reclaim the property due to the prolonged lack of payment. Understanding this distinction is essential for homeowners to manage their financial obligations effectively.

Dealing with a default notice requires a proactive approach. Begin by identifying the reason for the default, which may vary from financial hardship to administrative oversights. Following this, explore available options to either make the missed payments or negotiate new terms with your lender. Platforms like USLegalForms can assist you in creating the necessary documentation to negotiate effectively.

Responding to a notice of default involves acknowledging the notice and taking necessary steps to rectify your mortgage situation. You can start by reaching out to your lender to express your intention to correct the missed payments. You might also want to create a plan for how to address the outstanding balance. Additionally, consider utilizing resources like the USLegalForms platform to find templates for communication with your lender.