New York Trust Withdrawal Form

Description

Form popularity

FAQ

The mailing address for your NYS tax form depends on the type of form and your specific situation. Generally, for personal income tax forms, you will send them to the New York State Department of Taxation and Finance, with different addresses for different forms and situations. Always refer to the form's instructions for guidance. Correct addressing is vital for the efficient processing of your New York trust withdrawal form.

You need to mail NYS form IT-370 to the New York State Department of Taxation and Finance, P.O. Box 551, Albany, NY 12205-0551. This is the correct address to ensure your extension request is processed properly. Double-check to ensure that you use the right mail options to avoid delays. This attention to detail is essential when dealing with your New York trust withdrawal form.

To send your tax forms by mail, carefully place the completed forms in an envelope, and address it to the correct tax authority. Make sure to include any required signatures and supporting documentation. Utilize certified mail for a reliable delivery option, which provides proof that your forms were sent. A smooth mailing process ensures timely handling of your New York trust withdrawal form.

Anyone who is a resident beneficiary of a New York trust or estate that has received distributions must file IT-205. This applies to individuals receiving income from a trust, thus needing to report it for tax purposes. If you are unsure whether you qualify, services like US Legal Forms can help clarify your obligations. Completing your New York trust withdrawal form correctly is crucial.

Your New York State Corporation tax return should be mailed to the address specified for corporate filings in the instructions provided with the form. Typically, this would be the New York State Department of Taxation and Finance, P.O. Box 15164, Albany, NY 12212-5164, for most corporations. Always double-check the form instructions to ensure it reaches the correct department for processing. This attention to detail helps expedite any related matters, including a New York trust withdrawal form.

To file income from a trust, report the income on the appropriate tax forms, like Form 1041 for federal returns or Form IT-205 for New York. It is important to ensure all distributions and income allocations are accurately reported. If you're unsure how to handle this, platforms like US Legal Forms can provide the necessary guidance and templates to simplify the filing process. This ensures that you efficiently file your New York trust withdrawal form.

Mail your tax extension form to the address provided on the form based on your residence. If you are using the federal Form 4868, you should send it to the appropriate IRS service center. If you are filing a New York extension, send it to the New York State Department of Taxation and Finance at P.O. Box 553, Albany, NY 12205-0553. Proper addressing is crucial to prevent delays in processing your New York trust withdrawal form.

You should mail your NY form IT-205 to the appropriate address based on your location. If you live in New York City, send it to the Department of Taxation and Finance, P.O. Box 555, Albany, NY 12205-0555. For other locations, the address may differ, so it's essential to check the instructions on the form. Ensuring correct mailing will help process your New York trust withdrawal form smoothly.

It is possible to lose your NYS pension if you don't meet certain criteria. For instance, if you withdraw your funds without completing necessary requirements or make decisions that impact your account negatively, you may lose benefits. It is vital to stay informed and submit the New York trust withdrawal form correctly to safeguard your pension. Always consider consulting with an expert for tailored advice.

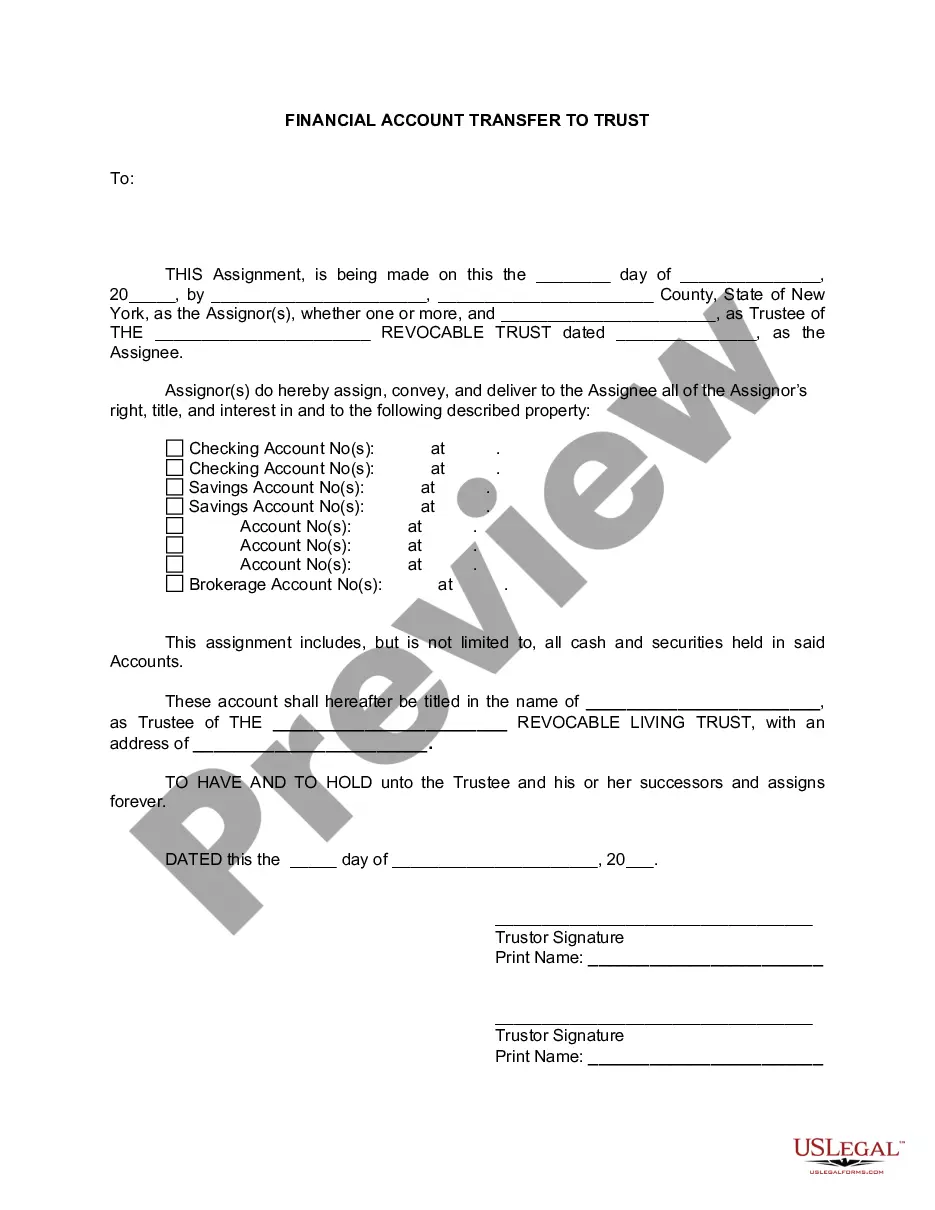

Withdrawing from the New York State and Local Retirement System (NYSLRS) involves a structured process. First, complete the New York trust withdrawal form and submit it to the appropriate office. Be sure to check your membership type, as it influences your withdrawal options and benefits. Utilize the US Legal Forms platform for convenient access to necessary documentation and step-by-step instructions.