Account Transfer Trust For The Future

Description

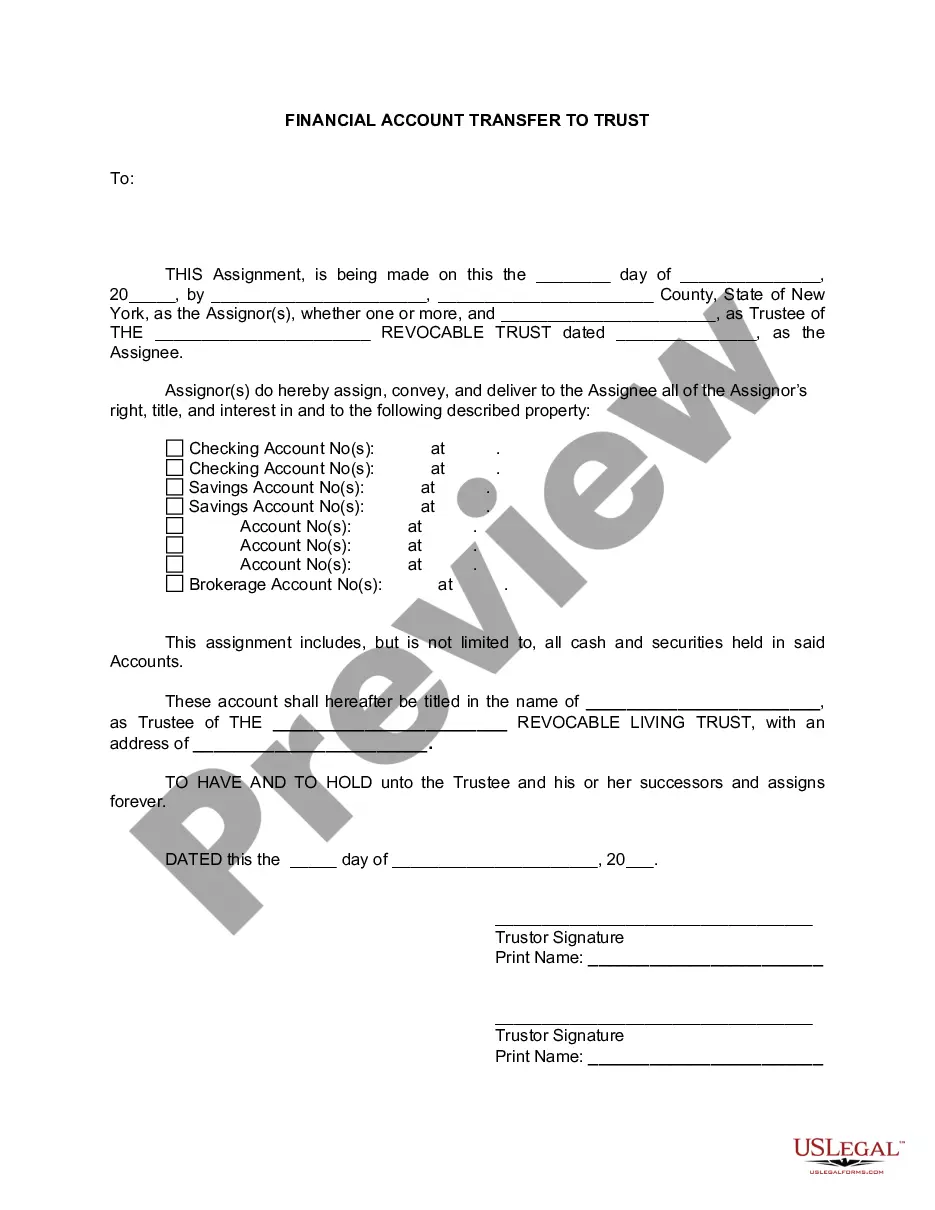

How to fill out New York Financial Account Transfer To Living Trust?

- Log in to your existing account on the US Legal Forms website and verify your subscription status.

- If necessary, renew your subscription to maintain access to the document library.

- Explore the form descriptions and preview modes to find the legal template that best fits your requirements.

- If you need to search for additional templates, utilize the Search feature available on the site to find the right document tailored to your jurisdiction.

- Select and click on the Buy Now button for your chosen document, and choose from the available subscription plans.

- Complete your purchase by entering your payment information, either through a credit card or PayPal.

- Lastly, download the form to your device, ensuring that you can easily access it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms not only offers an unparalleled selection of legal templates but also supports users with expert assistance for accurate document completion. This ensures that you can confidently execute legal documents.

Start your journey today and experience the benefits of having a trustworthy legal resource at your fingertips!

Form popularity

FAQ

Yes, you can transfer assets from one trust to another, which is especially beneficial when considering an account transfer trust for the future. This process usually involves changing the trustee or updating the trust documents to reflect the asset transfer. It's important to consult with a legal expert to ensure compliance with state laws and to avoid potential tax implications. At US Legal Forms, you can find the necessary resources and guidance to facilitate a smooth trust transfer.

To transfer a bank account into a trust, you typically need to contact your bank and request their specific forms for transferring ownership. You will provide information on the trust and its beneficiaries to ensure the account is properly designated. An account transfer trust for the future simplifies this process by ensuring your assets are managed according to your instructions, helping to avoid complications down the line.

Filling out a trust fund involves gathering the necessary information about the grantor, the beneficiaries, and the assets being placed in the trust. It’s crucial to be detailed and accurate, especially when establishing an account transfer trust for the future. Using a platform like US Legal Forms can simplify this process, providing clear templates and guidance to ensure everything is completed correctly.

To avoid inheritance tax with a trust, consider setting up a revocable or irrevocable trust that aligns with your estate planning strategies. By placing assets into an account transfer trust for the future, you can minimize the taxable estate and potentially reduce the burden on your heirs. Consulting with financial advisors can provide tailored strategies to protect your legacy.

One major mistake parents often make is not clearly communicating their intentions regarding the trust fund. Without clear guidelines, beneficiaries may misunderstand the purpose of the account transfer trust for the future, leading to disputes and mismanagement. It’s essential to document your wishes thoroughly and discuss them with potential beneficiaries to avoid confusion down the line.

The 5-year rule for trusts refers to the requirement that assets placed in a trust may affect eligibility for Medicaid services if they were transferred within the last five years. This is important for anyone considering an account transfer trust for the future, as it helps determine how and when to transfer assets without incurring penalties. Planning ahead can ensure your loved ones benefit from your trust when you need it most.

Yes, an irrevocable trust can be subject to the 5-year rule. This rule applies to certain government eligibility requirements and affects how assets are treated for Medicaid planning. Understanding this rule is crucial when setting up an account transfer trust for the future, as it ensures that the trust aligns with your financial goals and obligations.

The downside of putting assets in a trust, such as an account transfer trust for the future, includes potential costs of establishing and maintaining the trust. Additionally, your parents may sacrifice some level of control over the assets while they are held in the trust. Consulting with legal professionals can provide clarity and assist in mitigating these concerns.

Choosing between a trust and a transfer on death (TOD) account depends on individual needs and goals. An account transfer trust for the future typically offers more comprehensive estate planning options, while a TOD may be simpler and less expensive to set up. Evaluating the specific circumstances and future desires will guide the best choice.

Deciding to put bank accounts in an account transfer trust for the future can be beneficial. It ensures that funds are accessible to your chosen trustee after your parents' passing, thus streamlining the transition of control. However, it’s essential to weigh the implications and potential operational challenges when setting this up.