Trust Account With Bank

Description

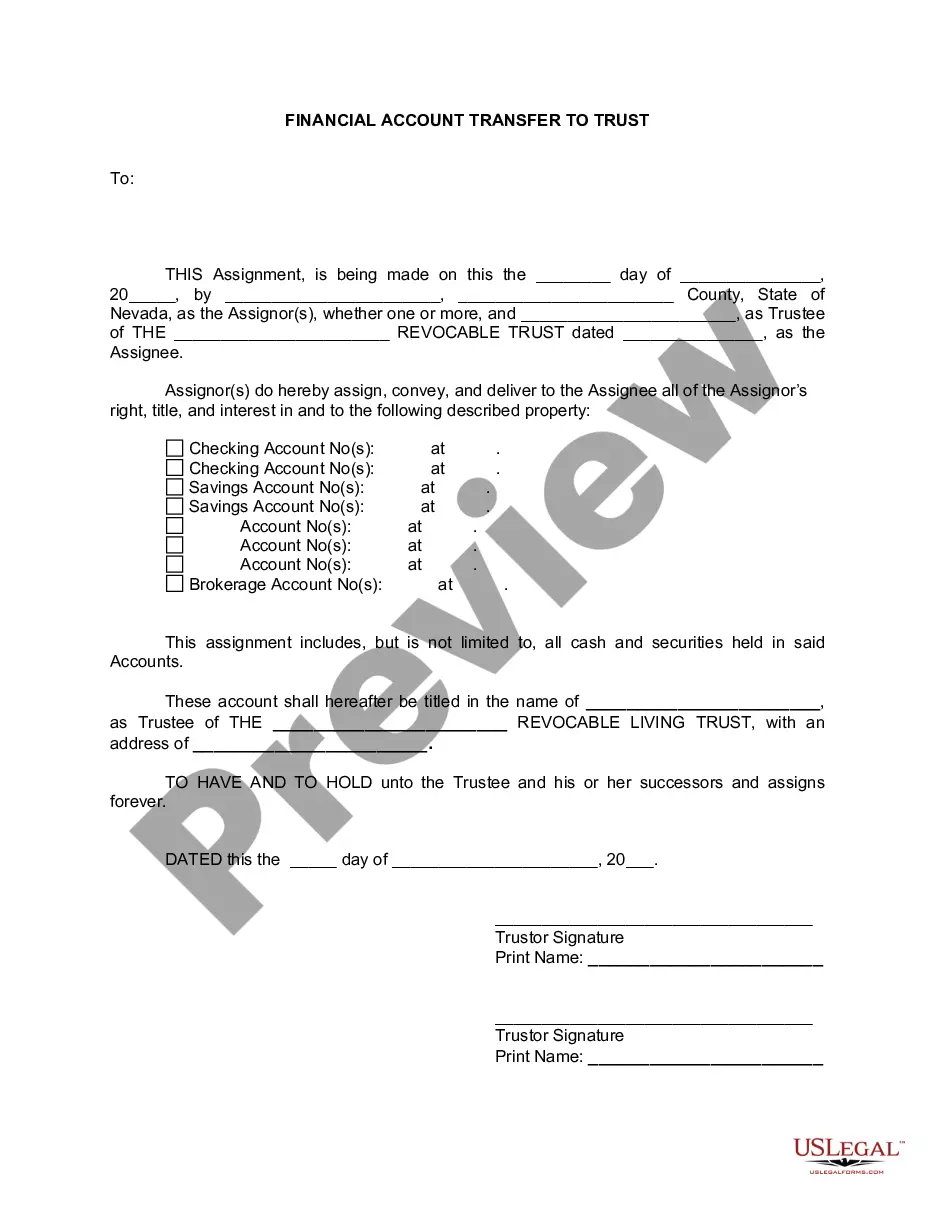

How to fill out Nevada Financial Account Transfer To Living Trust?

- Log in to your US Legal Forms account if you are a returning user to download your required form template. Ensure your subscription is active; if not, renew it under your payment plan.

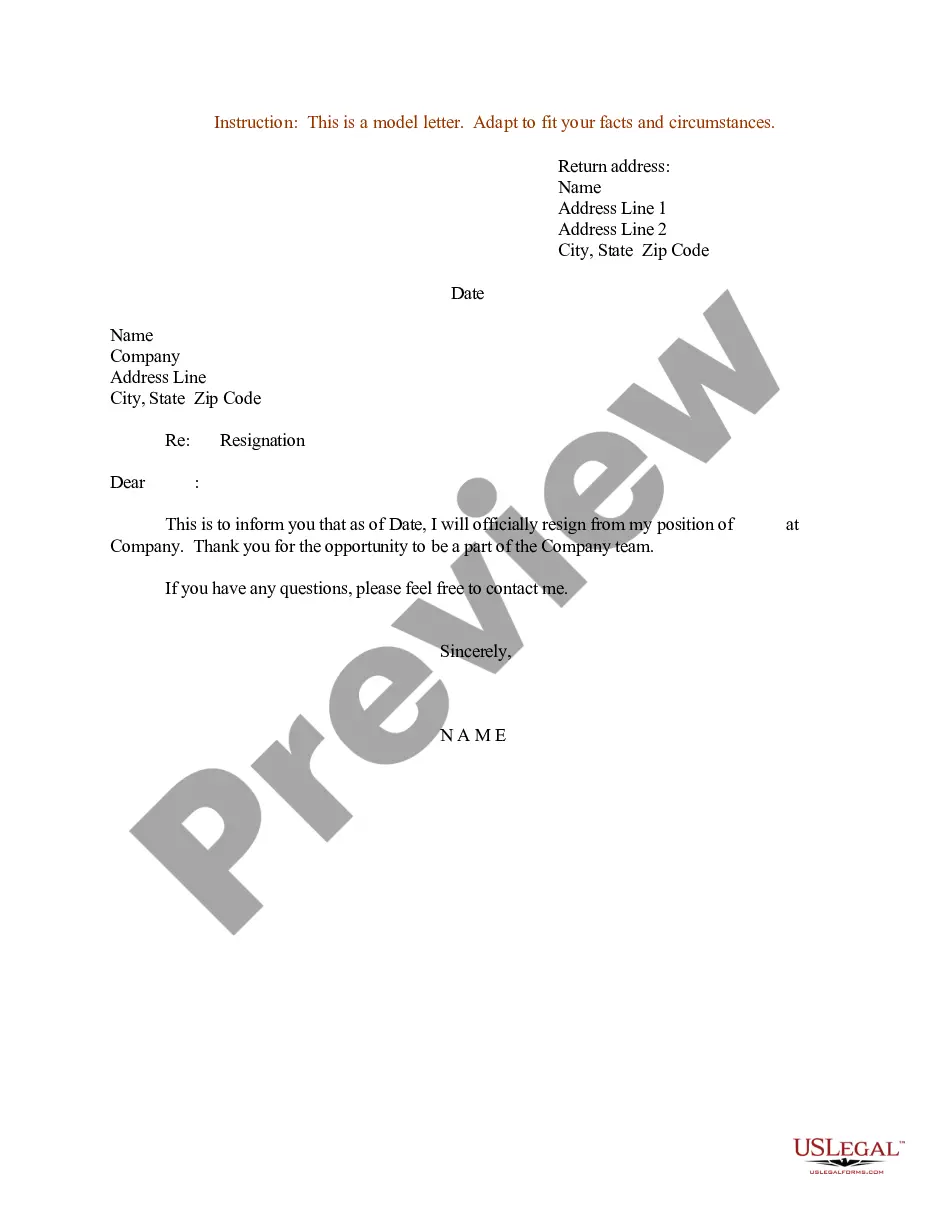

- For first-time users, start by browsing the extensive library. Check the Preview mode and descriptions to find forms that comply with your local jurisdiction.

- If necessary, utilize the Search tab to find alternative templates that suit your requirements better; consistency with your needs is key.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan, requiring account registration for full library access.

- Complete your payment using a credit card or PayPal, finalizing your subscription.

- Download your form and save it onto your device for later use. You can also find and access it anytime in the My Documents section of your profile.

Utilizing US Legal Forms, you benefit from a vast collection of over 85,000 fillable legal documents, far surpassing competitors in variety and value. You'll also have access to premium legal experts to assist you in form completion, ensuring that your documents are accurate and legally compliant.

In conclusion, setting up a trust account with a bank through US Legal Forms not only streamlines your legal documentation process but also guarantees accuracy and compliance. Start today by visiting our website to explore the full range of forms available!

Form popularity

FAQ

Yes, U.S. Legal Forms provides essential resources for managing trust accounts with bank services. Their platform offers various legal forms and templates to help you establish and maintain a trust account effectively. With U.S. Legal Forms, you can ensure that all necessary documentation is in place, making it easier to navigate the complexities of trust management. You can rely on their comprehensive tools to simplify your experience with bank trust accounts.

To open a bank account for a trust, you first need to gather the required paperwork, which includes the trust document and your identification. Next, find a bank that offers trust accounts with bank features and visit a local branch or their website. Once there, present your documents and apply for the account, ensuring you understand the bank’s policies on managing trust funds. For a straightforward process, consider using U.S. Legal Forms to access the right templates for your trust documentation.

Yes, you can open a bank account for a trust, and doing so is a crucial step in managing trust assets effectively. A trust account with bank features allows for proper asset management and compliance with legal requirements. Ensure you have the necessary documentation, including the trust agreement, to facilitate the process. If you need help understanding the requirements, platforms like uslegalforms can provide useful resources.

Some banks have reduced their offerings of trust accounts due to regulatory challenges and economic factors affecting the banking industry. Additionally, low-interest rates have led to decreased profitability for certain types of trust accounts with bank features. However, many banks still offer trust accounts that meet specific customer needs. If you're unsure about options, uslegalforms can assist you in finding a bank that supports your trust account requirements.

The best place to open a trust typically includes banks that have a dedicated trust department offering personalized services. A trust account with bank features provides advantages such as professional management and estate planning expertise. Additionally, local credit unions may offer competitive options for trust accounts with bank capabilities. Consider exploring uslegalforms for guidance on different types of trusts and their ideal locations.

Choosing the right bank for a trust account with bank services involves evaluating factors like fees, account features, and customer support. Look for banks that specialize in trust management and offer favorable interest rates. It’s also beneficial to select a bank that has a strong reputation for security and reliability. To make an informed decision, consider using resources like uslegalforms to compare options and understand the specific needs of your trust.

The best type of bank account for a trust is usually an interest-bearing trust account with bank. This account type not only safeguards trust assets but also allows for growth through interest accumulation. When selecting an account, consider factors like fees, accessibility, and the bank's expertise in trust management to ensure the account meets your trust's needs.

Yes, a trust typically requires a special bank account, often referred to as a trust account with bank. This type of account is specifically designed to hold the assets of the trust and manage funds according to the provisions outlined in the trust agreement. It is essential to keep trust assets separate from personal assets to maintain legal compliance.

The best bank account for a trust is one that aligns with your trust's objectives and offers suitable features. Consider accounts that provide competitive interest rates, no maintenance fees, and easy online access. Additionally, ensure that the bank has a strong reputation for managing trust accounts with transparency and efficiency.

Creating a bank account for a trust begins with reviewing your trust agreement and obtaining the necessary identification numbers. Next, contact your preferred bank to open a trust account with bank. The bank representatives will assist you in filling out the required forms and provide guidance to ensure compliance with legal requirements.