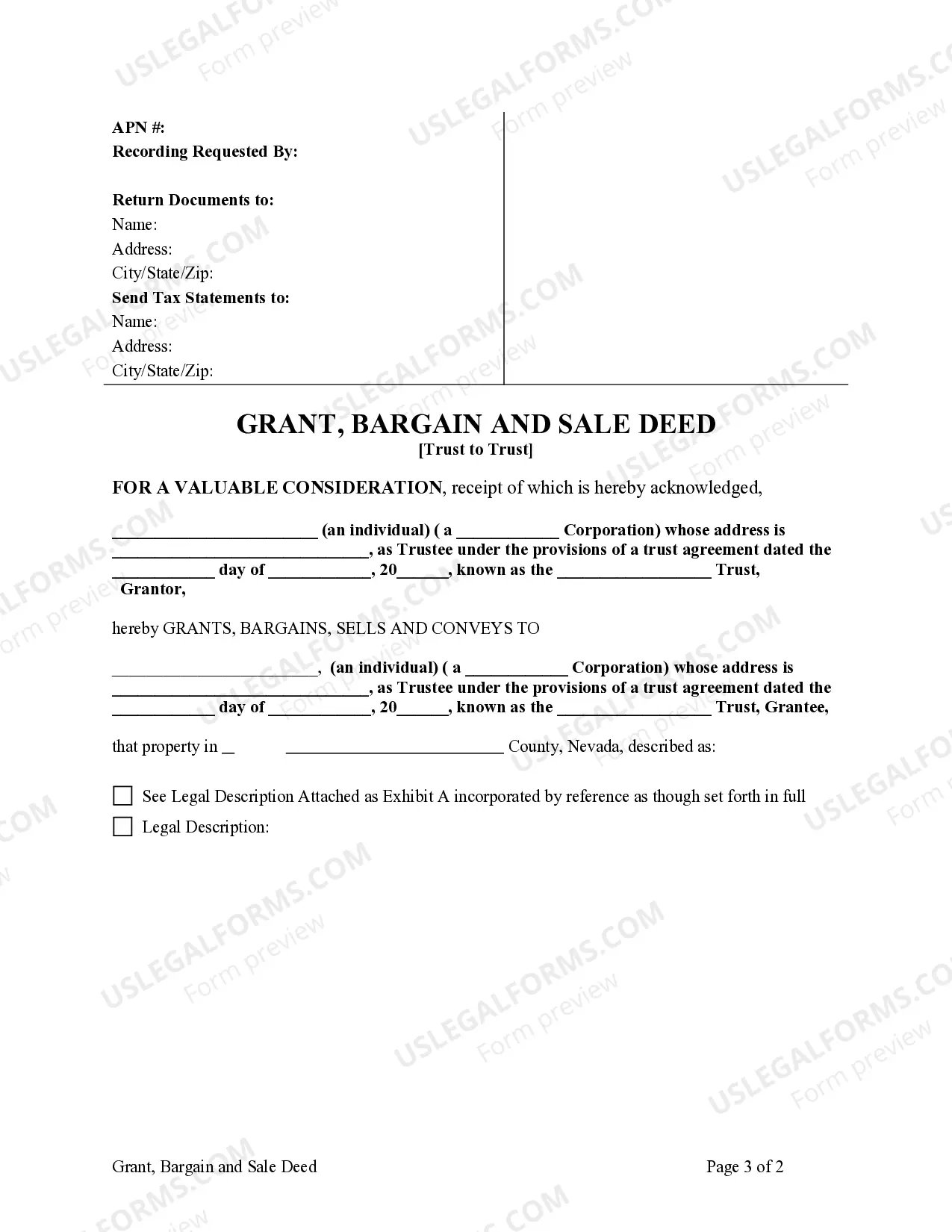

Trust Trust

Description

How to fill out Nevada Grant, Bargain And Sale Deed From A Trust To A Trust?

- If you're an existing member, log in to your account to access your forms. Verify that your subscription remains active; renew if necessary.

- For new users, start by exploring the Preview mode and checking the form descriptions to find the document that serves your unique needs while meeting local jurisdiction laws.

- If the initial form isn't suitable, use the Search tab to find other templates that align with your requirements.

- Once you've identified the correct document, click the Buy Now button and select your preferred subscription plan. You'll need to register an account for full access.

- Complete your purchase by entering your credit card details or using your PayPal account for payment.

- Download your finalized form to your device. It will also be stored in the My Forms section of your profile for future reference.

In conclusion, US Legal Forms provides an extensive collection of legal documents that are both accessible and customizable. With the steps above, you can easily trust that your legal needs are met swiftly and accurately.

Start your journey with US Legal Forms today and ensure your legal documents are handled with ease and professionalism.

Form popularity

FAQ

The rules of trust trust typically involve clarity, purpose, and legality. A trust must have clearly defined beneficiaries and a specific purpose to ensure it functions as intended. Additionally, establishing a legal framework ensures that trust is upheld and respected. Using platforms like uslegalforms can help you navigate the complexities of creating a trust and ensure compliance with relevant laws.

Generally, you do need to earn trust trust from others, as it is rarely given freely. Earning trust involves establishing credibility through your actions and maintaining open communication. By showing genuine interest in others and being dependable, you can gradually earn their trust. Remember, trust can take time to build, but it is worth the effort.

To gain trust trust from someone, focus on being transparent and honest in your interactions. Show empathy and actively listen to their concerns, which helps create a safe space. Additionally, consistently follow through on promises and demonstrate reliability in your actions to reinforce trust. Building relationships takes time, so be patient.

The 3 C's of trust trust stand for competence, character, and consistency. Competence involves demonstrating capability in your actions. Character reflects your integrity and ethical standards. Consistency means being reliable in your words and actions over time, which solidifies your reputation and builds trust.

Yes, trust trust operates on a mutual exchange. To receive trust from others, you must first offer your own trust to them. This reciprocity creates a strong foundation for relationships and encourages people to be more open and honest with one another. By extending trust, you invite others to respond in kind.

Trust trust is often seen as something that is earned rather than simply given. When individuals demonstrate reliability, honesty, and integrity, they cultivate an environment where trust can flourish. This exchange fosters deeper relationships and encourages open communication. Ultimately, building trust requires effort and consistent actions.

Generally, a trust trust does not need to be filed with the IRS unless it generates income. Irrevocable trusts typically require their own tax identification number and may need to file an income tax return. On the other hand, revocable trusts are often considered part of the grantor's estate for tax purposes and do not file separately. To understand your specific requirements, it is wise to consult a tax professional.

In New Jersey, a trust trust must comply with specific legal requirements to be valid. For instance, the trust document must clearly outline the trust's purpose, the trustee's duties, and the beneficiaries. Additionally, New Jersey law requires the trust to have a statute of limitations for contesting its validity, and there are rules on how assets must be managed. Always consult a legal professional familiar with New Jersey laws to ensure your trust meets all necessary criteria.

Creating a trust comes with some drawbacks. First, there are costs associated with setting up and maintaining a trust trust, including legal fees and ongoing management expenses. Second, you may lose some control over your assets, as a trust typically requires a trustee to manage them. Finally, trusts may not provide the same level of protection from creditors as some other estate planning tools.

The term 'trust' refers to a legal arrangement in which one party holds property or assets for the benefit of another. It fosters a relationship of confidence, ensuring that assets are managed according to the trustor's wishes. Trusts can serve various purposes, including estate planning, family asset protection, and supporting charitable organizations. Understanding how to utilize trust effectively is essential for safeguarding your legacy.