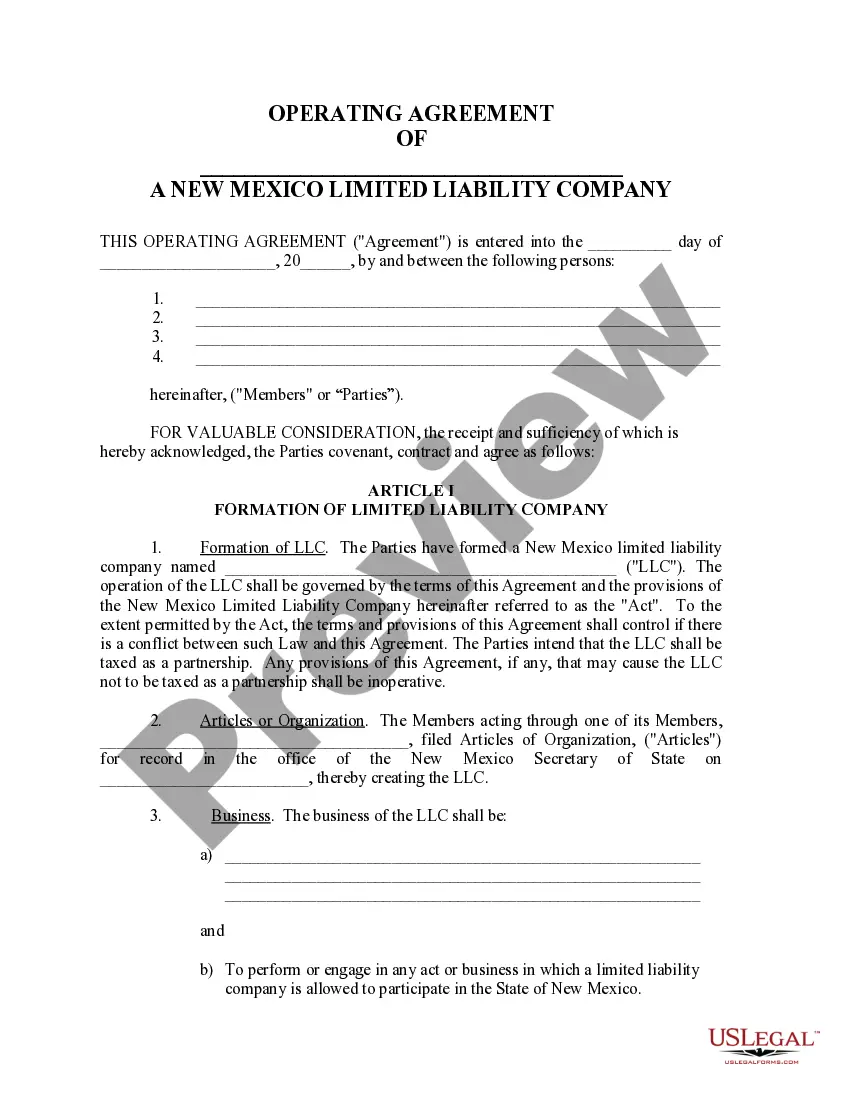

New Mexico Llc Operating Agreement Form For Llc

Description

How to fill out New Mexico Limited Liability Company LLC Operating Agreement?

Whether for commercial reasons or for individual matters, everyone encounters legal circumstances at some point in their lives. Completing legal documentation requires meticulous attention, starting from selecting the appropriate form template. For example, if you select an incorrect version of a New Mexico Llc Operating Agreement Form For Llc, it will be declined upon submission. Thus, it is crucial to find a reliable source for legal documents like US Legal Forms.

If you need to acquire a New Mexico Llc Operating Agreement Form For Llc template, follow these simple steps: Get the template you require by using the search bar or catalog navigation. Review the form’s details to ensure it suits your situation, state, and county. Click on the form’s preview to examine it. If it is the wrong form, return to the search feature to find the New Mexico Llc Operating Agreement Form For Llc sample you need. Obtain the file if it meets your requirements. If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents. If you don’t have an account yet, you can acquire the form by clicking Buy now. Select the appropriate pricing option. Complete the account registration form. Choose your payment method: you can use a credit card or PayPal account. Select the document format you desire and download the New Mexico Llc Operating Agreement Form For Llc. Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

- With a vast US Legal Forms catalog available, you never have to waste time searching for the right template online.

- Use the library’s straightforward navigation to find the appropriate form for any situation.

Form popularity

FAQ

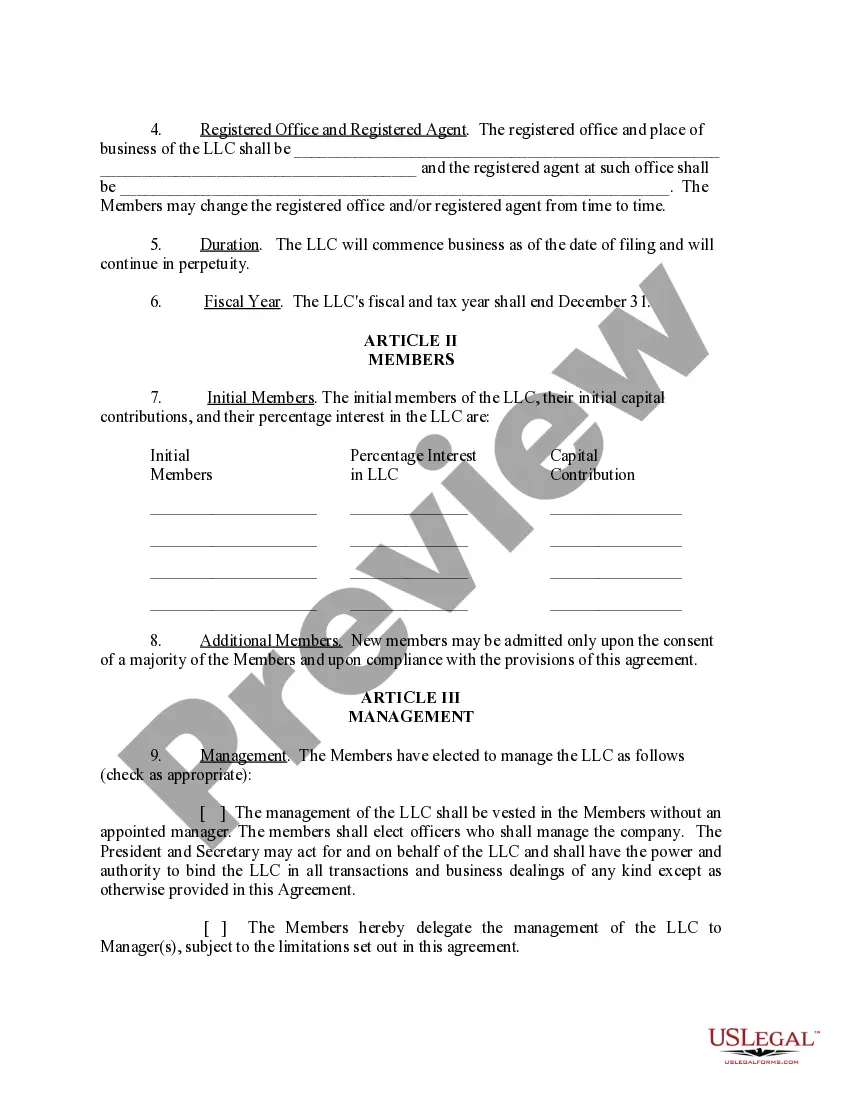

Although fees vary by state when it comes to forming an LLC and keeping it in compliance, New Mexico is considered one of the best states to form an LLC in. This is because there is no annual fee.

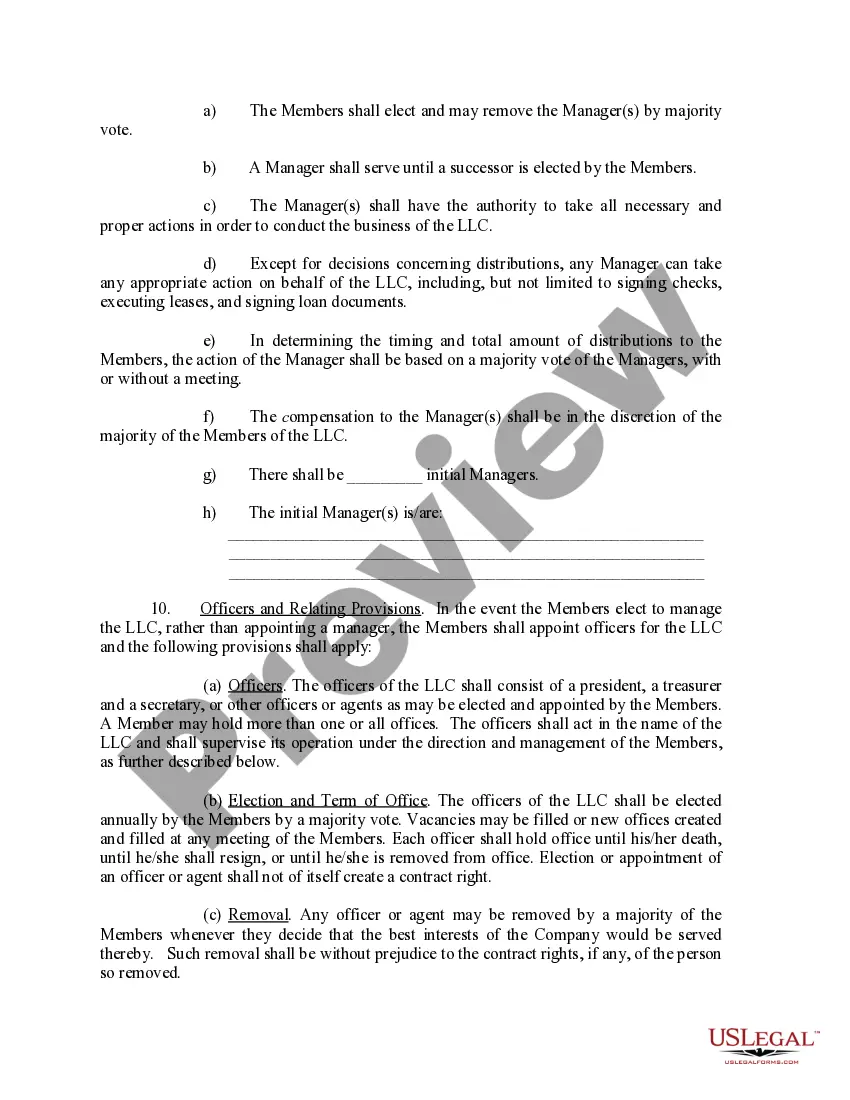

An operating agreement is a document that outlines the way your LLC will conduct business. An operating agreement isn't required in New Mexico, but it is an essential component of your business.

As the owner of an LLC, you must pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your New Mexico LLC is paying the correct amount.

New Mexico's LLC is highly sought after because there are no annual reports. No annual report also means no annual fee. The Secretary's only requirement is that you maintain a registered agent in New Mexico. So long as you have an agent your company will remain in good standing.

New Mexico statutes state that every corporation and LLC must maintain a registered agent, whether you formed your company in New Mexico or you're a foreign entity operating here.