Account Transfer Trust Withdrawal Order

Description

Form popularity

FAQ

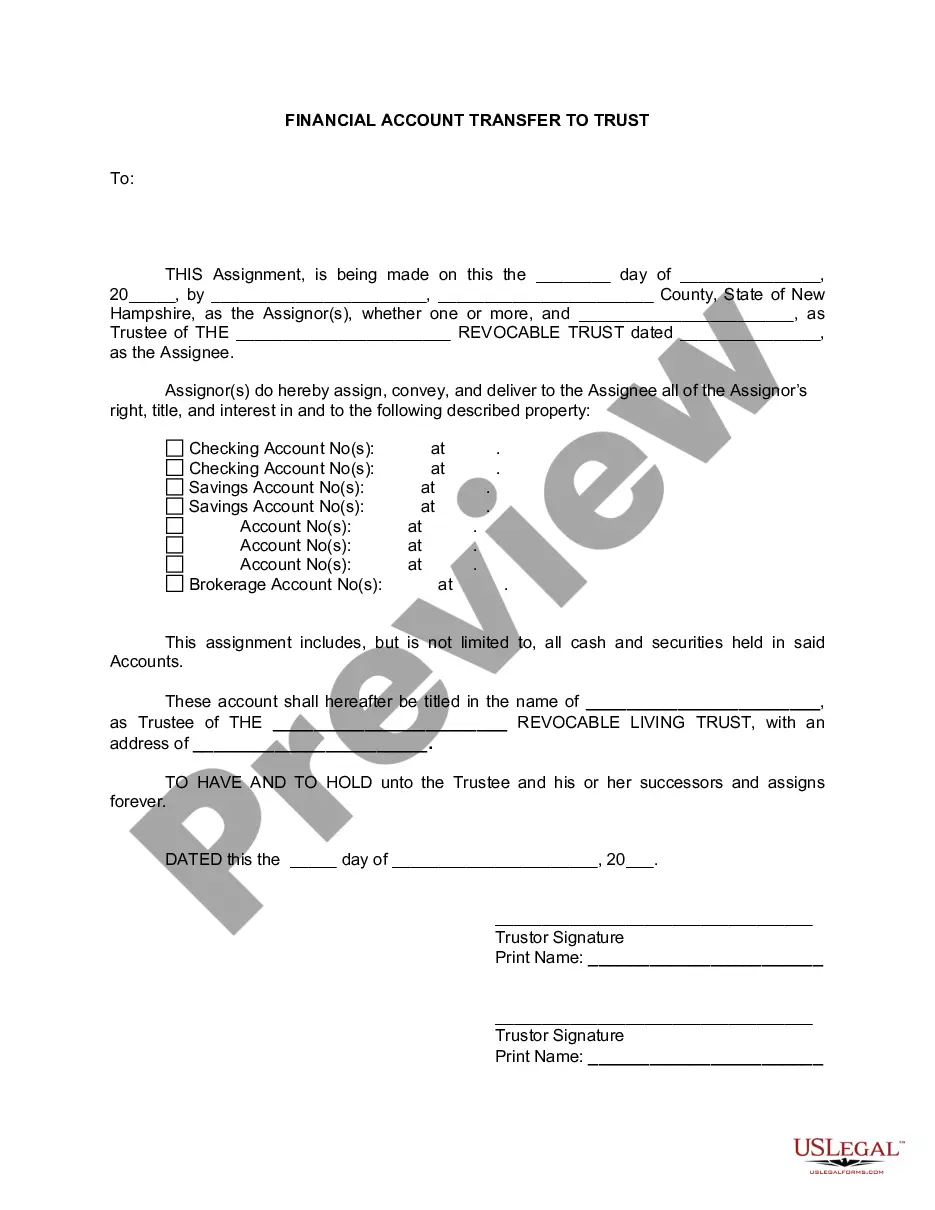

To withdraw from your trust account, first ensure you have the appropriate authority to do so. Next, you should prepare a formal request indicating your account transfer trust withdrawal order. After submitting your request, monitor your account for the transaction completion. If you encounter any issues, consider using the US Legal Forms platform, which provides guidance and resources to streamline this process.

Trust funds may create dependency among beneficiaries, where they rely too heavily on inherited wealth. This could potentially hinder their motivation or work ethic. Moreover, if not properly managed, trust funds can lead to disputes and complications during the account transfer trust withdrawal order process. Engaging with a dedicated platform such as US Legal Forms can help mitigate these risks and lay a strong foundation.

The downside of placing assets in a trust includes potential restrictions on access and use by the grantor. This can limit flexibility if financial circumstances change. Additionally, improper structuring can complicate the account transfer trust withdrawal order and lead to unintended tax consequences. It's essential to carefully consider how the trust will operate with guidance from credible sources like US Legal Forms.

One significant mistake parents often make is lacking clear communication about the trust's purpose and details. If they do not discuss their intentions, it can lead to confusion or resentment among heirs when the time comes to execute the account transfer trust withdrawal order. Furthermore, not updating the trust when life changes occur can cause complications. Leveraging US Legal Forms can help ensure clarity and make necessary adjustments.

While trusts offer benefits, some view them negatively due to their complexity and potential costs. Establishing a trust can involve legal fees and ongoing maintenance, which may concern families. Additionally, improper management can lead to disputes among beneficiaries, impacting the intended account transfer trust withdrawal order. Understanding these challenges helps families weigh their options carefully.

Deciding whether to place assets in a trust is an important consideration for your parents. A trust can help with managing wealth and ensuring a smooth account transfer trust withdrawal order. It can also provide clear instructions for asset distribution according to their wishes, potentially avoiding probate. Using a platform like US Legal Forms can simplify the trust setup process.

You cannot typically deposit a trust check directly into a personal account. Trust checks should be handled according to their specific terms and regulations. When you encounter an account transfer trust withdrawal order, it is crucial to follow the trust's guidelines. Using a trusted platform like US Legal Forms can help you navigate this process smoothly and ensure compliance with legal requirements.