North Dakota Revocation For Foreign Nationals

Description

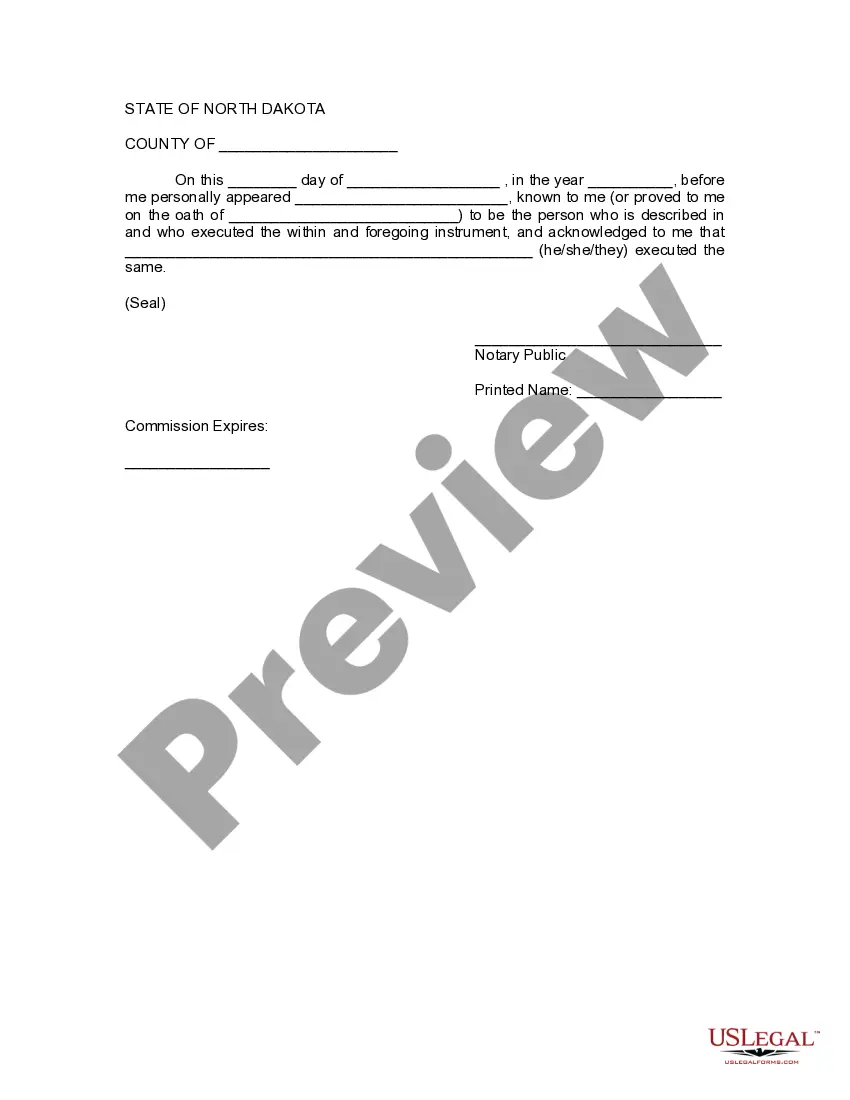

How to fill out North Dakota Revocation Of Living Trust?

- If you are a returning user, log into your US Legal Forms account and download the required template by clicking the Download button. Ensure your subscription is active to avoid any interruptions.

- For first-time users, start by checking the Preview mode and form description to confirm the template meets your needs and adheres to local jurisdiction requirements.

- If the selected form doesn't fit your needs, utilize the Search tab to find an alternative template that suits your circumstances.

- Once you've chosen the correct document, click the Buy Now button and select your preferred subscription plan. Registration is necessary to access the full range of resources.

- Complete the purchase with your credit card or PayPal details. Ensuring payment is processed successfully will grant you access to your document.

- Finally, download and save the legal form onto your device. You can also find it in the My Forms section of your profile whenever you need it again.

In conclusion, US Legal Forms simplifies your journey to acquiring essential legal documents like the North Dakota revocation form for foreign nationals. With a robust collection of forms and expert assistance, you can confidently navigate legal requirements.

Start your legal document journey today with US Legal Forms!

Form popularity

FAQ

You can live in another state for up to six months without changing your residency in North Dakota, provided you keep your ties to North Dakota. However, if you remain away from North Dakota for an extended period, it may be viewed as a change in residency. Being aware of North Dakota revocation for foreign nationals plays a significant role in ensuring you keep your residency status intact while living elsewhere.

To qualify as a resident of North Dakota, you typically need to demonstrate physical presence for at least 180 days within a 12-month period. This timeframe helps establish your intent to make North Dakota your home. Understanding the implications of North Dakota revocation for foreign nationals is essential during this transition, as residency status affects various rights and responsibilities.

After moving to North Dakota, you have 60 days to change your driver's license to a North Dakota license. This requirement ensures that all residents uphold state regulations and maintain accurate identification. It’s crucial to adhere to this timeline to avoid complications, especially if you face issues related to North Dakota revocation for foreign nationals.

Yes, North Dakota does tax non-residents on income generated within the state. The tax rate applies to earnings derived from North Dakota businesses or properties. If you're worried about navigating tax obligations related to North Dakota revocation for foreign nationals, US Legal Forms offers resources to simplify this process.

Proof of residence in North Dakota can include various documents such as utility bills, bank statements, or a rental agreement that clearly displays your name and North Dakota address. Additionally, having your North Dakota driver's license or state ID serves as strong proof of residency. Keep in mind how North Dakota revocation for foreign nationals may influence what documentation is required for your situation.

Yes, as a non-resident, you may need to file taxes in North Dakota if you have income sourced from the state. Non-residents are typically taxed on income earned within state borders. It's wise to consult tax resources or platforms like US Legal Forms for guidance on filing and understanding the implications of North Dakota revocation for foreign nationals.

To become a North Dakota resident, you must establish a physical presence in the state. This typically involves living in North Dakota for at least 180 days per year and demonstrating intent to make it your home, such as obtaining a North Dakota driver’s license, registering vehicles, and registering to vote. It's important to understand the North Dakota revocation for foreign nationals process, as it may affect your status and residency claims.

Claiming residency in a state where you do not reside can lead to complicated legal issues. Generally, you need to physically live in the state to qualify as a resident for legal and tax purposes. This is especially critical for foreign nationals navigating situations involving North Dakota revocation.

Establishing residency in North Dakota involves meeting specific criteria set by the state. You should live in North Dakota for at least 12 consecutive months and show proof of physical presence. By fulfilling these requirements, you can smoothly transition through issues like North Dakota revocation for foreign nationals.

To get North Dakota residency, you must establish your primary home in the state and demonstrate your intent to reside there. This can involve obtaining a North Dakota driver's license, registering to vote, or paying state taxes. Understanding these requirements helps in dealing with North Dakota revocation for foreign nationals effectively.