North Dakota Agreement Withholding Guide

Description

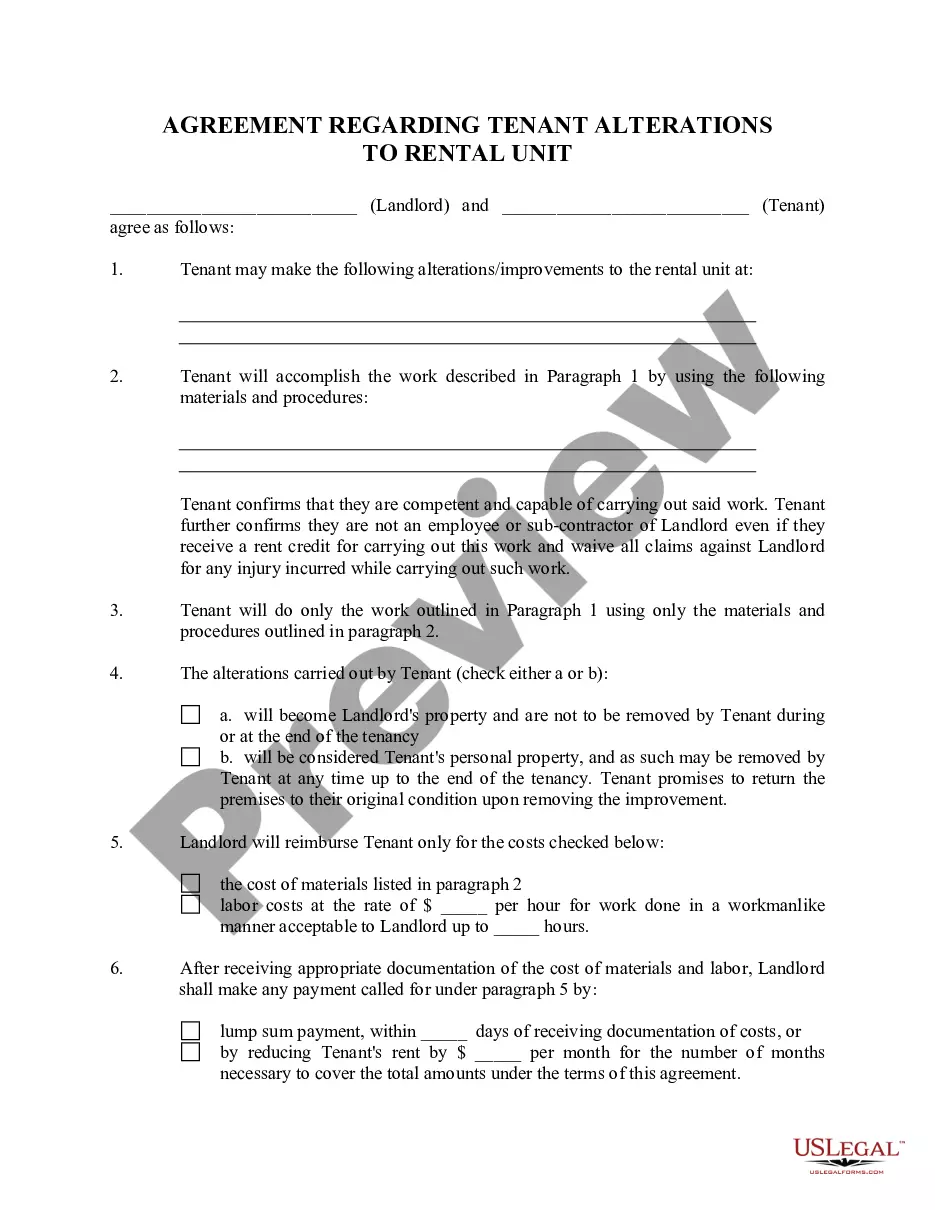

How to fill out North Dakota Landlord Agreement To Allow Tenant Alterations To Premises?

How to obtain legal documents that meet your state's regulations and draft the North Dakota Agreement Withholding Guide without the need to consult an attorney.

Numerous online services provide templates for various legal situations and requirements. However, it may require some time to determine which samples fulfill both your use case and legal standards.

US Legal Forms is a well-regarded platform that assists you in locating official documents created in accordance with the latest updates to state law, helping you save on legal costs.

Review the opened webpage and verify if the form meets your requirements. To do this, utilize the form description and preview options if available. Look for another template in the header indicating your state if needed. Click the Buy Now button when you locate the suitable document. Select the most appropriate pricing plan, then Log In or create an account. Choose your payment method (by credit card or via PayPal). Adjust the file format for your North Dakota Agreement Withholding Guide and click Download. The obtained templates will remain yours: you can always access them under the My documents tab of your profile. Register for our library and prepare legal documents independently like an experienced legal professional!

- US Legal Forms is not just a typical web directory. It is a repository of over 85k validated templates for diverse business and personal scenarios.

- All documents are organized by area and state to streamline your searching process and make it easier.

- Additionally, it connects with powerful tools for PDF editing and electronic signatures, enabling users with a Premium subscription to swiftly finalize their paperwork online.

- It requires minimal time and effort to acquire the necessary documentation.

- If you already possess an account, Log In and confirm that your subscription is active.

- Download the North Dakota Agreement Withholding Guide using the corresponding button next to the file name.

- If you do not have an account with US Legal Forms, follow the instructions below.

Form popularity

FAQ

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold.

When your Federal income tax withholding is calculated, you are allowed to claim allowances to reduce the amount of the Federal income tax withholding. In 2017, each allowance you claim is equal to $4,050 of income that you expect to have in deductions when you file your annual tax return.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.