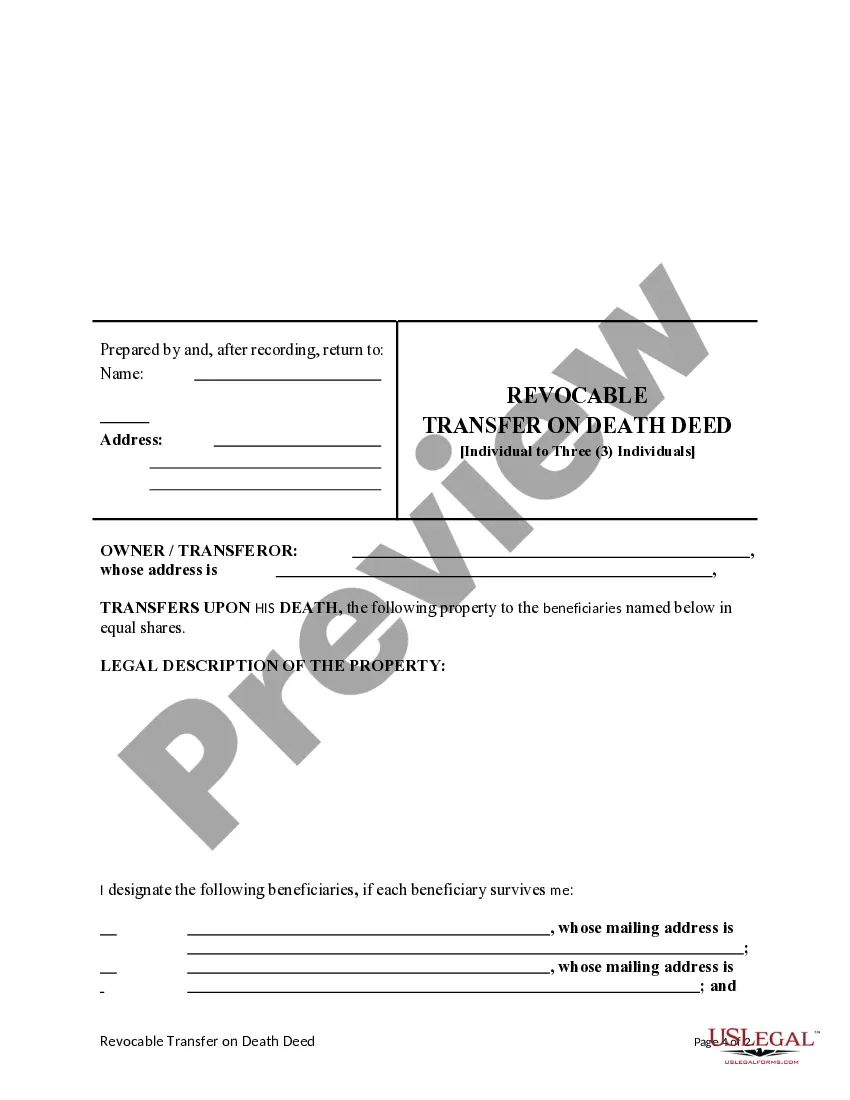

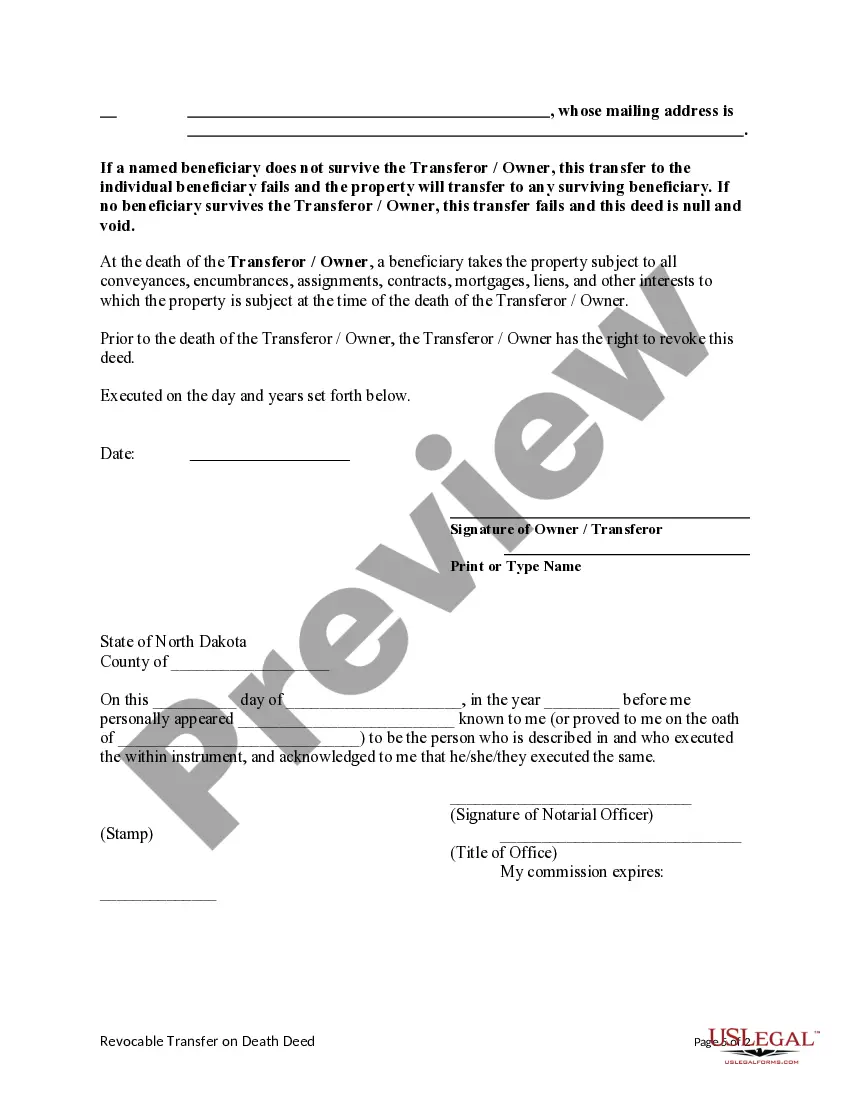

Transfer on Death Deed - North Dakota - This deed is used to transfer the title of a parcel of land, including any existing liens or covenants, upon the death of the Transferor / Grantors, or last surviving Transferor / Grantor to the Grantee. It must be recorded prior to the death of Transferor / Grantors at the local recorder and should be executed in front of a Notary Public. Does not include provisions for alternate beneficiaries in the event a name beneficiary fails to survive the transferor / owner.

North Dakota Transfer On Death Deed Form For Trust

Description

How to fill out North Dakota Transfer On Death Deed Or TOD - Beneficiary Deed From An Individual To Three (3) Individuals?

Legal papers management can be frustrating, even for the most skilled specialists. When you are searching for a North Dakota Transfer On Death Deed Form For Trust and do not get the a chance to devote searching for the correct and updated version, the procedures may be stress filled. A strong web form library could be a gamechanger for anyone who wants to deal with these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you might have, from individual to enterprise documents, in one location.

- Employ advanced resources to finish and manage your North Dakota Transfer On Death Deed Form For Trust

- Access a resource base of articles, guides and handbooks and resources related to your situation and requirements

Help save effort and time searching for the documents you will need, and utilize US Legal Forms’ advanced search and Preview tool to locate North Dakota Transfer On Death Deed Form For Trust and download it. If you have a membership, log in in your US Legal Forms account, search for the form, and download it. Take a look at My Forms tab to see the documents you previously downloaded as well as to manage your folders as you see fit.

Should it be the first time with US Legal Forms, register a free account and get unlimited use of all benefits of the library. Listed below are the steps for taking after getting the form you need:

- Confirm this is the right form by previewing it and reading its description.

- Be sure that the sample is recognized in your state or county.

- Select Buy Now when you are ready.

- Select a monthly subscription plan.

- Pick the formatting you need, and Download, complete, sign, print and deliver your document.

Take advantage of the US Legal Forms web library, supported with 25 years of experience and trustworthiness. Transform your daily document managing in a smooth and intuitive process today.

Form popularity

FAQ

Invalidation and Probate The transfer on the death deed is rendered ineffective if the designated recipient passes away before the property owner. This could cause the property to enter probate without adequate planning or execution, negating the goal of using a transfer on the death deed to avoid probate.

The way it differs from a TOD deed is that a living trust can be used for any type of asset, not just real estate. So if you have stocks, savings accounts, valuable belongings, or other assets that you want to transfer to someone after your death, a living trust is a way to do it.

Cons To Using Beneficiary Deed Property transferred may be taxed. No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits.

Cent. Code § 30.1-32.1-02. An individual may transfer property to one or more beneficiaries effective at the transferor's death by a transfer on death deed.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.