Accounting For Lease Purchase Option

Description

How to fill out North Carolina Lease Purchase Agreements Package?

Legal papers management may be overwhelming, even for the most experienced specialists. When you are interested in a Accounting For Lease Purchase Option and do not get the time to devote looking for the appropriate and up-to-date version, the processes may be demanding. A strong online form library might be a gamechanger for anyone who wants to handle these situations effectively. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you could have, from personal to business documents, all in one spot.

- Employ advanced tools to complete and deal with your Accounting For Lease Purchase Option

- Gain access to a resource base of articles, guides and handbooks and resources connected to your situation and requirements

Help save effort and time looking for the documents you will need, and use US Legal Forms’ advanced search and Review tool to locate Accounting For Lease Purchase Option and acquire it. In case you have a monthly subscription, log in to your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to find out the documents you previously saved and also to deal with your folders as you see fit.

If it is the first time with US Legal Forms, create an account and acquire limitless access to all benefits of the library. Listed below are the steps for taking after getting the form you need:

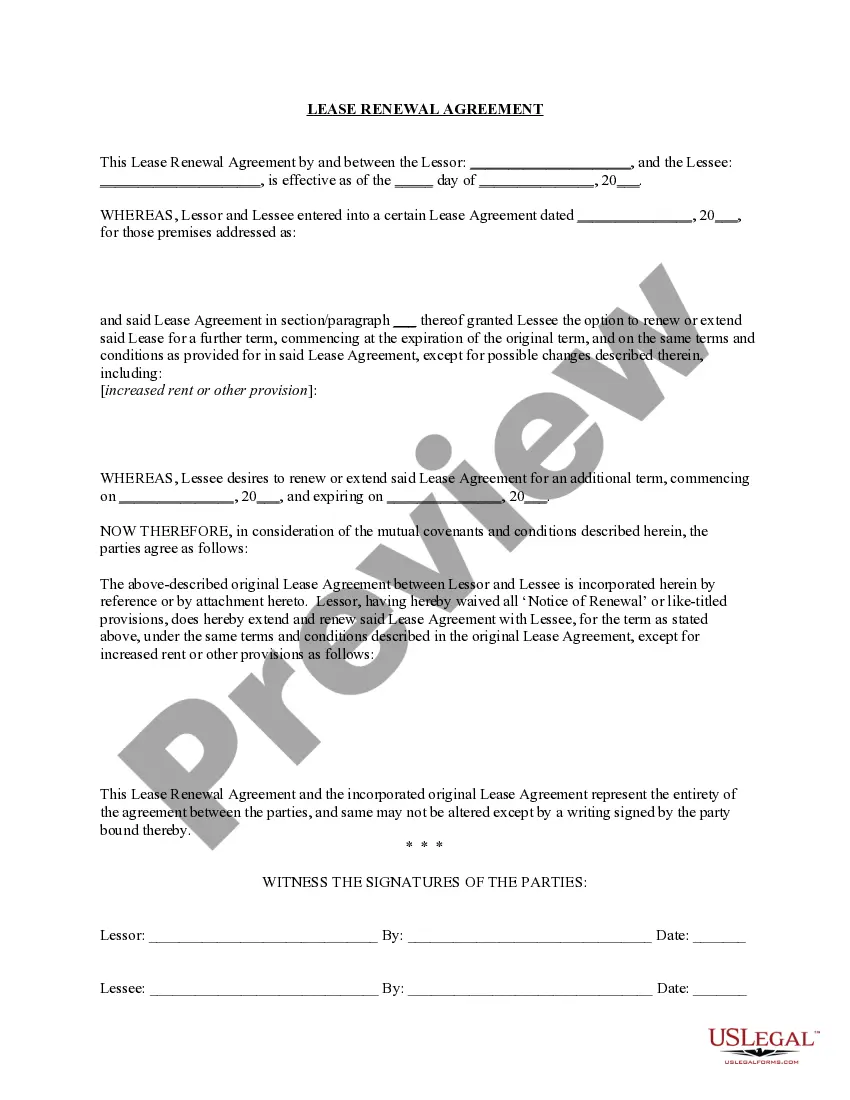

- Verify it is the proper form by previewing it and reading through its description.

- Ensure that the sample is accepted in your state or county.

- Select Buy Now when you are all set.

- Select a monthly subscription plan.

- Pick the format you need, and Download, complete, eSign, print out and send your document.

Enjoy the US Legal Forms online library, supported with 25 years of experience and trustworthiness. Transform your day-to-day document managing into a smooth and user-friendly process today.

Form popularity

FAQ

If the company exercises their option to purchase the asset at the end of the lease term, the lease asset and lease liability are extinguished, and the fixed asset is recorded on the company's balance sheet as a purchased fixed asset.

If a lease has a bargain purchase option, the lessee must record the asset as a capital lease in an amount equal to the present value of all minimum lease payments over the lease term.

Lease purchase options offer companies the flexibility to convert leases into fixed assets by exercising their right to purchase the leased asset. Understanding the intricacies of lease purchase options and their accounting implications under ASC 842 is crucial for accurate financial reporting.

Under ASC 842, leases containing a purchase option are accounted for as finance leases if the lease contains a purchase option the lessee is reasonably certain to exercise. Additionally, a title transfer at the end of a lease, designates the lease as finance.