Nc Limited Liability Company Withholding

Description

How to fill out North Carolina Sample Cover Letter For Filing Of LLC Articles Or Certificate With Secretary Of State?

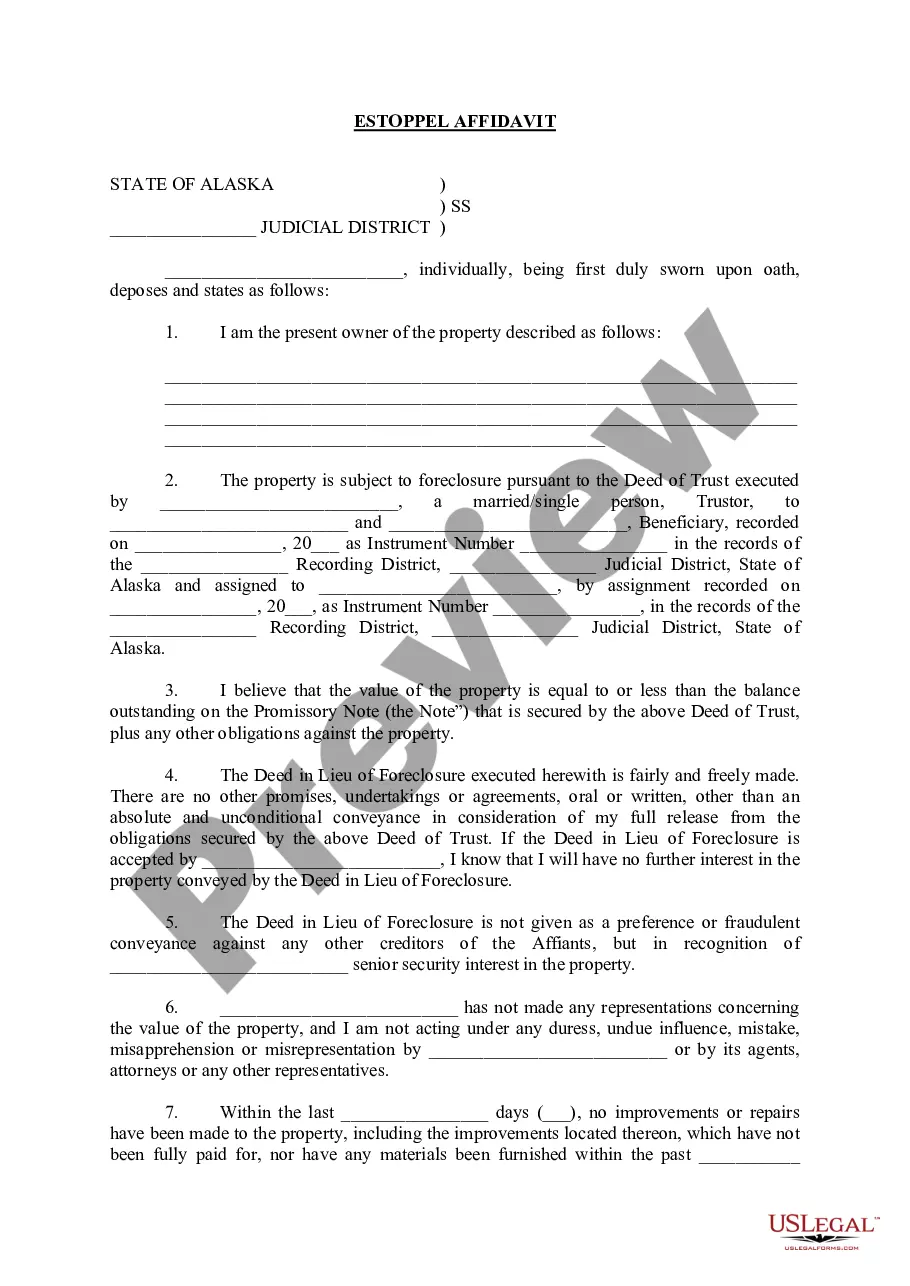

Whether for business purposes or for individual matters, everyone has to deal with legal situations at some point in their life. Completing legal papers demands careful attention, beginning from selecting the right form sample. For instance, when you pick a wrong edition of a Nc Limited Liability Company Withholding, it will be declined when you submit it. It is therefore crucial to have a trustworthy source of legal papers like US Legal Forms.

If you have to get a Nc Limited Liability Company Withholding sample, follow these easy steps:

- Get the template you need using the search field or catalog navigation.

- Look through the form’s description to make sure it suits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to find the Nc Limited Liability Company Withholding sample you require.

- Get the file when it matches your requirements.

- If you have a US Legal Forms profile, simply click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Pick the file format you want and download the Nc Limited Liability Company Withholding.

- After it is downloaded, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time looking for the appropriate template across the web. Take advantage of the library’s simple navigation to find the appropriate template for any situation.

Form popularity

FAQ

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

Claiming 1 on Your Taxes Claiming 1 reduces the amount of taxes that are withheld, which means you will get more money each paycheck instead of waiting until your tax refund. You could also still get a small refund while having a larger paycheck if you claim 1.

FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the N.C. Standard Deduction or the N.C. Child Deduction Amount (but no other N.C. deductions), and you do not plan to claim any N.C. tax credits. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA.

North Carolina Median Household Income Every taxpayer in North Carolina will pay 4.99% of their taxable income for state taxes.

State withholding taxes must be withheld from employee wages and remitted to the North Carolina Department of Revenue. To register with the State of North Carolina, complete an Application for Income Tax Withholding (Form NC-BR), apply online or contact the Department of Revenue at (877) 252-3052.