Assumed Name Corporation With File

Description

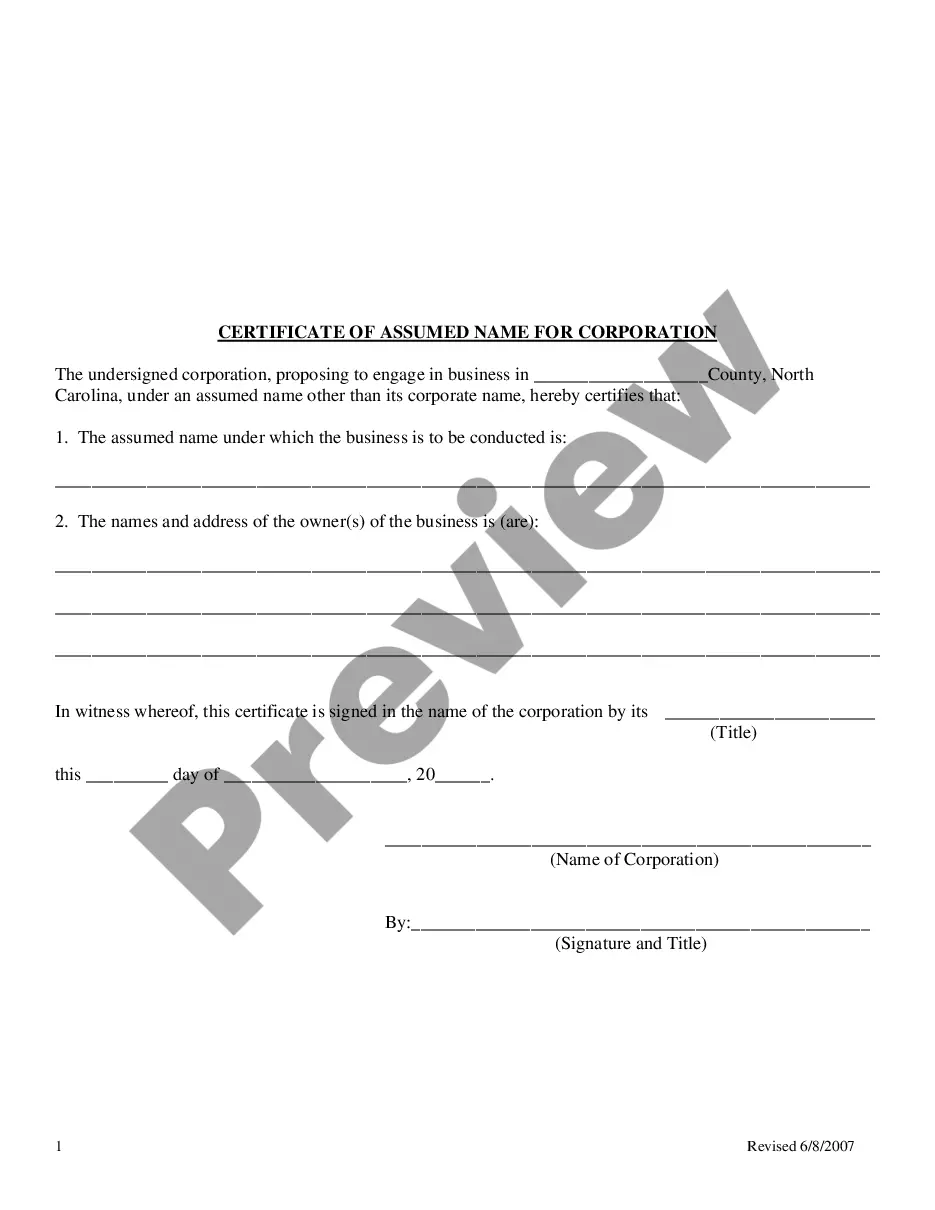

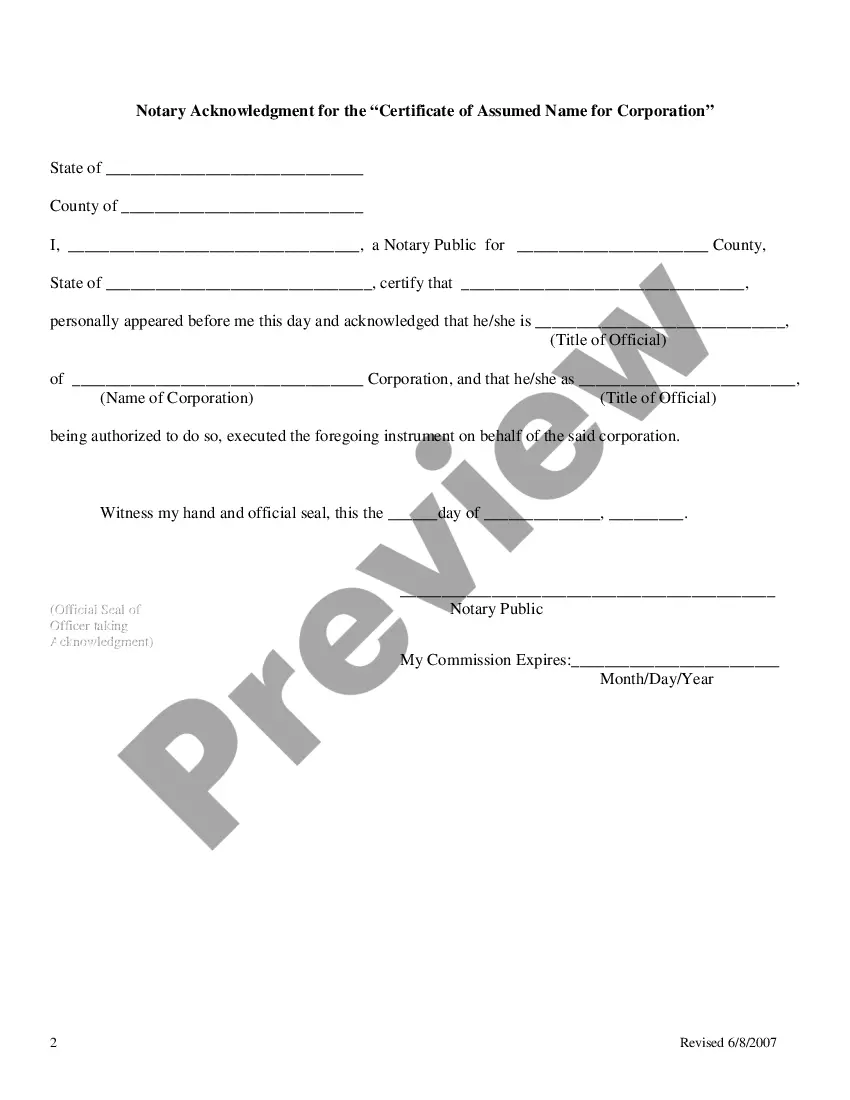

How to fill out North Carolina Certificate Of Assumed Name For A Corporation?

Bureaucracy requires meticulousness and exactness.

If you do not manage completing paperwork such as Assumed Name Corporation With File regularly, it may lead to certain confusions.

Selecting the appropriate sample from the outset will guarantee that your document submission proceeds smoothly and avert any hassles of re-sending a document or commencing the same task entirely from the beginning.

- US Legal Forms is the largest online repository of forms that contains over 85 thousand templates for various topics.

- You can find the latest and most applicable version of the Assumed Name Corporation With File by easily searching it on the website.

- Identify, store, and secure templates in your account or refer to the description to ensure you have the accurate one available.

- With a US Legal Forms account, you can gather, retain in one place, and navigate through the templates you have saved for quick access.

- When on the site, click the Log In button to sign in.

- Then, proceed to the My documents page, where your form history is maintained.

- Review the description of the forms and save those you need at any time.

- If you are not a subscribed user, finding the required sample will take a few extra steps.

Form popularity

FAQ

To set up a band account, first gather necessary documents such as your assumed name registration. Next, visit a bank where you can open a business account. Make sure to inquire about any fees that might apply. Using a platform like UsLegalForms can facilitate the assumed name corporation with file process, simplifying document preparation and compliance.

Yes, a band should have a separate bank account. This account helps manage the band's finances, keeping personal and business finances distinct. By doing so, you protect your personal assets and simplify accounting. For bands set up as assumed name corporations with file, having a dedicated bank account is often essential for legal and tax purposes.

DBA format involves clearly stating the legal entity and its assumed name. The structure should maintain clarity, typically resembling: 'Legal Entity Name, doing business as Assumed Name.' Effectively using the DBA format helps in establishing a recognizable brand while adhering to the regulations of an assumed name corporation with file.

DBA structure refers to the organization of a business's assumed name. This allows the business to operate officially under a name that may differ from its legal title. Implementing a DBA structure is vital for branding and can often involve the creation of an assumed name corporation with file to maintain legal clarity.

An example of a DBA is if a company named 'Smith Enterprises LLC' operates under the name 'Smith's Gourmet Catering.' In this case, the legal name remains 'Smith Enterprises LLC,' but the business presents a more appealing brand through the DBA. Utilizing an assumed name corporation with file helps in simplifying the process.

Yes, if you operate your business under a name different from the legal name in Canada, you will need to register a DBA. This is essential for legal recognition and compliance with local laws. Filing an assumed name corporation with file can help you establish credibility and protect your brand.

In Canada, you may require a DBA if your business operates under a name other than its registered legal name. Each province has different regulations, so it's crucial to verify local requirements. By filing an assumed name corporation with file, you ensure your business name is protected and recognized in your area.

A DBA is an alternative name under which a business operates, distinct from its registered legal name. This designation is important for branding and marketing purposes but doesn't create a separate legal entity. If you wish to operate under a different name, consider filing an assumed name corporation with file to ensure compliance with state regulations.

The DBA format typically involves the following structure: the legal name of the owner or entity followed by the assumed name. For example, if John Smith owns a company called 'John's Landscaping,' the DBA would be recorded as 'John Smith, doing business as John's Landscaping.' This format helps legally identify the owner of the assumed name corporation with file.

DBA stands for 'Doing Business As.' It refers to a business's assumed name, which can be different from its legal name. This designation allows a corporation or individual to operate under a name that reflects their brand while maintaining the legal business structure of an assumed name corporation with file.