Harbor Freight Apply For Credit Card

Description

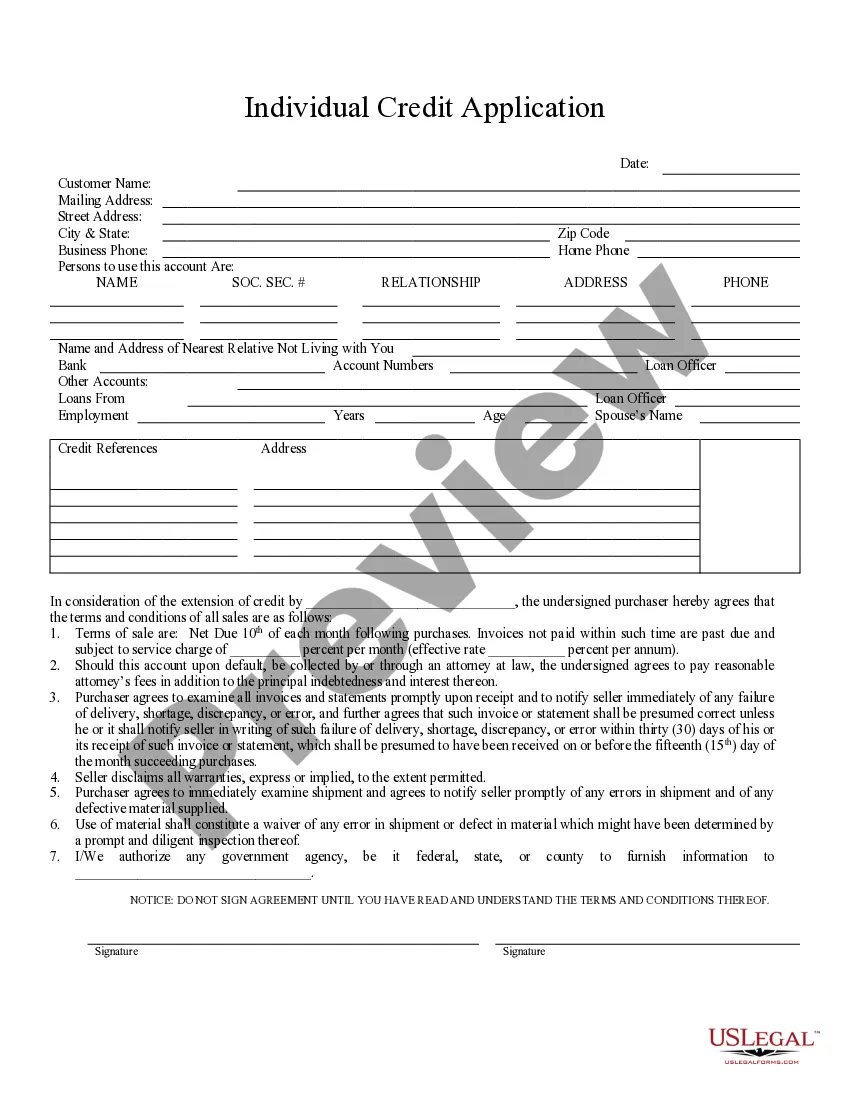

How to fill out North Carolina Individual Credit Application?

How to obtain professional legal documents that adhere to your state regulations and complete the Harbor Freight Apply For Credit Card without the need for a lawyer.

Many online services provide templates for various legal circumstances and requirements. However, it may require time to determine which of the offered samples satisfy both your intended use and legal standards.

US Legal Forms is a reliable platform that assists you in finding official documents drafted in compliance with the most recent state law revisions, helping you save on legal fees.

Review the webpage you have accessed and verify if the form suits your requirements.

- US Legal Forms is not just an ordinary online directory. It is a repository of over 85,000 verified templates for various business and personal scenarios.

- All documents are organized by category and jurisdiction to simplify your search process and enhance convenience.

- It also features robust utilities for PDF editing and electronic signing, enabling users with a Premium subscription to effortlessly complete their online paperwork.

- Acquiring the necessary forms demands minimal effort and time.

- If you already possess an account, Log In and verify that your subscription is current.

- Download the Harbor Freight Apply For Credit Card using the button next to the file title.

- If you are not registered with US Legal Forms, then follow the instructions below.

Form popularity

FAQ

The primary requirements for obtaining a Harbor Freight Credit Card include age, residency, and financial stability. Applicants should be at least 18 years old and a resident of the U.S. Additionally, showing a consistent income and managing existing debts well can strengthen your application when you decide to Harbor Freight apply for credit card.

While there isn't a strict minimum score, generally, a credit score of around 600 or higher is recommended for better approval chances. Lenders often consider other financial factors, too, such as income and existing debt. To improve your chances when you Harbor Freight apply for credit card, it might be beneficial to check and enhance your credit score beforehand.

To become eligible for a Harbor Freight Credit Card, you should meet specific requirements such as being a U.S. citizen or permanent resident. Additionally, a positive credit history will increase your chances of approval. Be sure to gather all necessary documentation before you Harbor Freight apply for credit card to simplify the process.

Once you complete your application, and it's approved, you can begin using your Harbor Freight Credit Card immediately. Usually, you'll receive a temporary card number to use for online purchases or immediate transactions. Therefore, if you're eager to start your shopping, you won’t have to wait long after you Harbor Freight apply for credit card.

To qualify for a credit card with Harbor Freight, you need to meet certain criteria, including being at least 18 years old and having a valid Social Security number. A steady source of income also helps demonstrate your ability to manage payments. It’s important to review your financial situation and have your personal information ready when you decide to Harbor Freight apply for credit card.

Typically, you can expect to receive your Harbor Freight Credit Card within 7 to 10 business days after approval. Once you apply for the Harbor Freight credit card, the review process takes just a short while, but it varies based on your application. To expedite things, ensure that all provided information is accurate and complete. This attention to detail will help streamline your approval journey.

For optimal chances of approval for the Harbor Freight Credit Card, aim for a credit score of around 640 or higher. Higher scores may lead to better credit limits and terms. It's wise to check your credit standing before applying. This way, you can tailor your application to maximize the benefits available through the card.

The Harbor Freight Credit Card is issued by Synchrony Bank. This trusted institution manages the application and management processes for the card. When you apply for the Harbor Freight credit card, you will interact with Synchrony's system for account management and customer service. They are committed to providing support during your credit journey.

While the specific credit score required can vary, a score in the mid-600s is generally favorable when you apply for the Harbor Freight credit card. However, it’s beneficial to have a better score for increased chances of approval. To prepare, check your credit report and address any discrepancies. This approach ensures you are in the best position to receive approval.

Harbor Freight credit cards are issued by Synchrony Bank. If you decide to apply for the Harbor Freight credit card, Synchrony Bank will evaluate your application. Their established reputation in the credit card industry allows Harbor Freight to provide quality benefits and services for their cardholders. Trust in their expertise as you explore your financing options.