Limited Lliability

Description

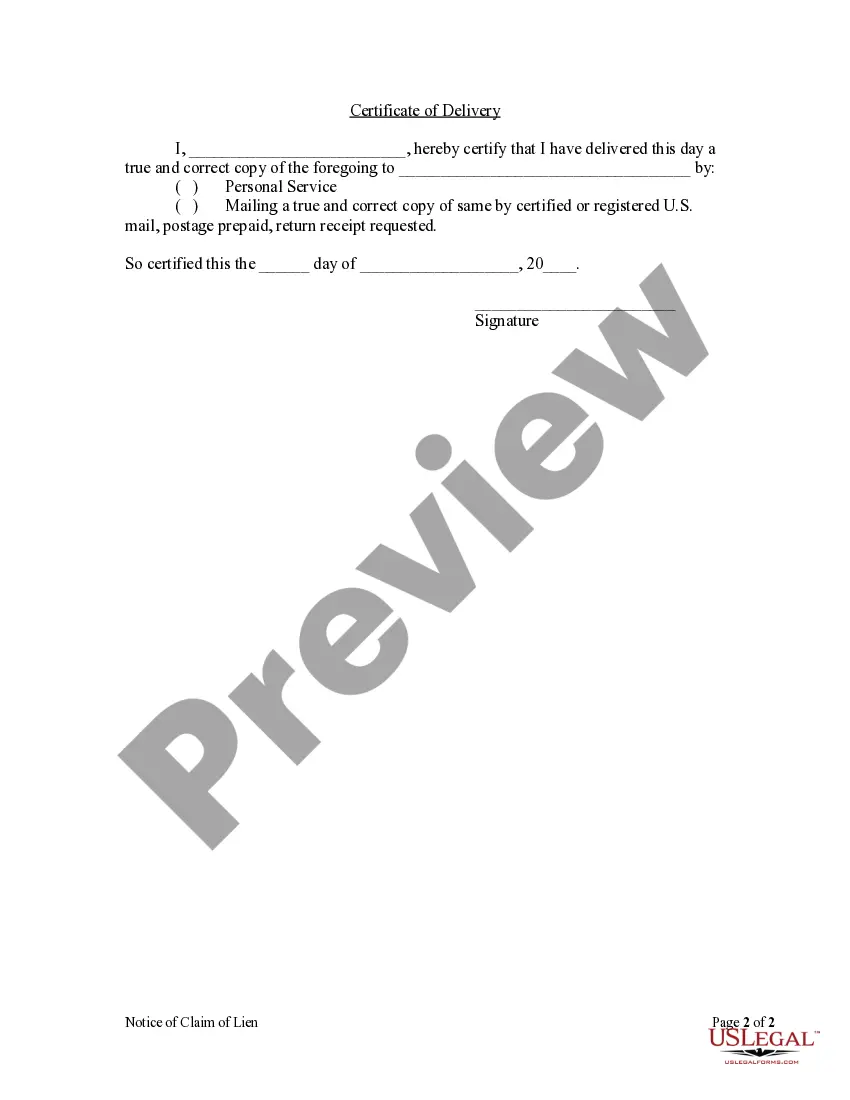

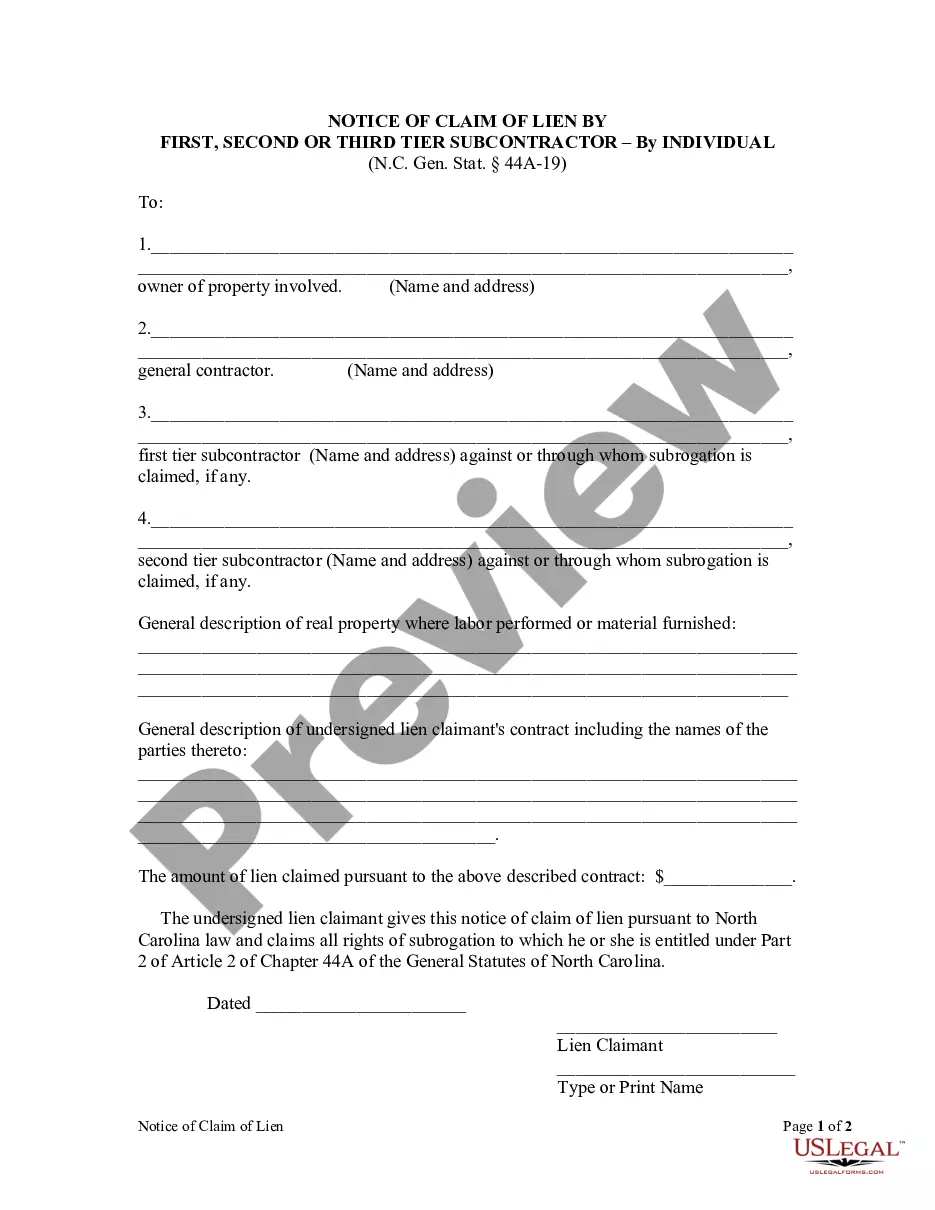

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- Log in to your US Legal Forms account if you're a returning user and click on the Download button for your required template. Be sure your subscription is active; otherwise, renew it as needed.

- For first-time users, start by previewing the templates. Examine the form descriptions to ensure the selected document aligns with your needs and complies with local regulations.

- If the initial template isn't suitable, utilize the Search function to locate the correct document for your situation.

- Once you've found the right template, click on the Buy Now button and select your preferred subscription plan. Creating an account will give you access to the extensive legal library.

- Complete your purchase by entering your credit card details or using your PayPal account for payment.

- Finally, download your chosen form to your device and access it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms provides a comprehensive and user-friendly service, empowering individuals and attorneys alike to manage legal needs efficiently.

Start protecting your interests today by using US Legal Forms for all your limited liability documentation needs!

Form popularity

FAQ

LLC should be written in a way that clarifies its legal nature. You should type 'Limited Liability Company' in full when first used in any official documents, followed by the abbreviated form, LLC in subsequent mentions. This ensures that readers understand the business structure while maintaining legal clarity about your limited liability status.

When writing a limited liability company, include both the full name and the designation. For instance, use 'XYZ Consulting Services, Limited Liability Company' or 'XYZ Consulting Services, LLC.' This format makes it clear that you are establishing a business structure that benefits from limited liability, safeguarding your personal assets from business debts.

To write an LLC example, start by drafting a name that reflects your business identity, which should include the term 'Limited Liability Company' or the abbreviation, LLC. You can illustrate this by creating a fictional business, like 'ABC Widgets, LLC.' This format clearly shows that you operate as a limited liability company under the law, protecting your personal assets.

Filling out an LLC involves several key steps. First, choose your business name ensuring it includes 'Limited Liability Company' or its abbreviation, LLC. Next, you will need to file the Articles of Organization with your state, detailing information about your business. To simplify the process, consider using USLegalForms, which provides templates and guidance specifically for limited liability companies.

Yes, you can file your LLC by itself if you choose to treat it as a separate tax entity. Forming an LLC does not automatically require your personal taxes to merge with your business taxes. This separation reinforces the benefits of limited liability, allowing you to protect your personal assets while maintaining compliance.

member LLC files taxes as a sole proprietorship unless it elects otherwise. This means it reports its income and expenses on Schedule C, attached to the owner's personal tax return. This streamlined process provides easy management of both personal and limited liability company finances.

The tax form a limited liability company files depends on its tax classification. If it's a single-member LLC, it often uses Schedule C with the owner's personal tax return, while multi-member LLCs typically file Form 1065. Utilizing the right forms ensures compliance with the IRS and maximizes your tax benefits.

An LLC must file taxes regardless of its income, even if it makes zero dollars in a tax year. The IRS requires all limited liability companies to report earnings or losses, which keeps your tax records accurate. Keep in mind, even a minimal income still necessitates proper tax filing to maintain your LLC's good standing.

Filing your personal and business taxes together is generally not advisable. By keeping them separate, you uphold the integrity of your limited liability status, which protects your personal assets from business liabilities. This clear distinction simplifies tax reporting and helps avoid potential legal complications.

Yes, you file taxes separately from your LLC. Limited liability companies provide you with the flexibility to choose how you want to be taxed, but typically, the LLC is considered a separate entity. This means any earnings generated by the LLC should be reported separately from your personal income.