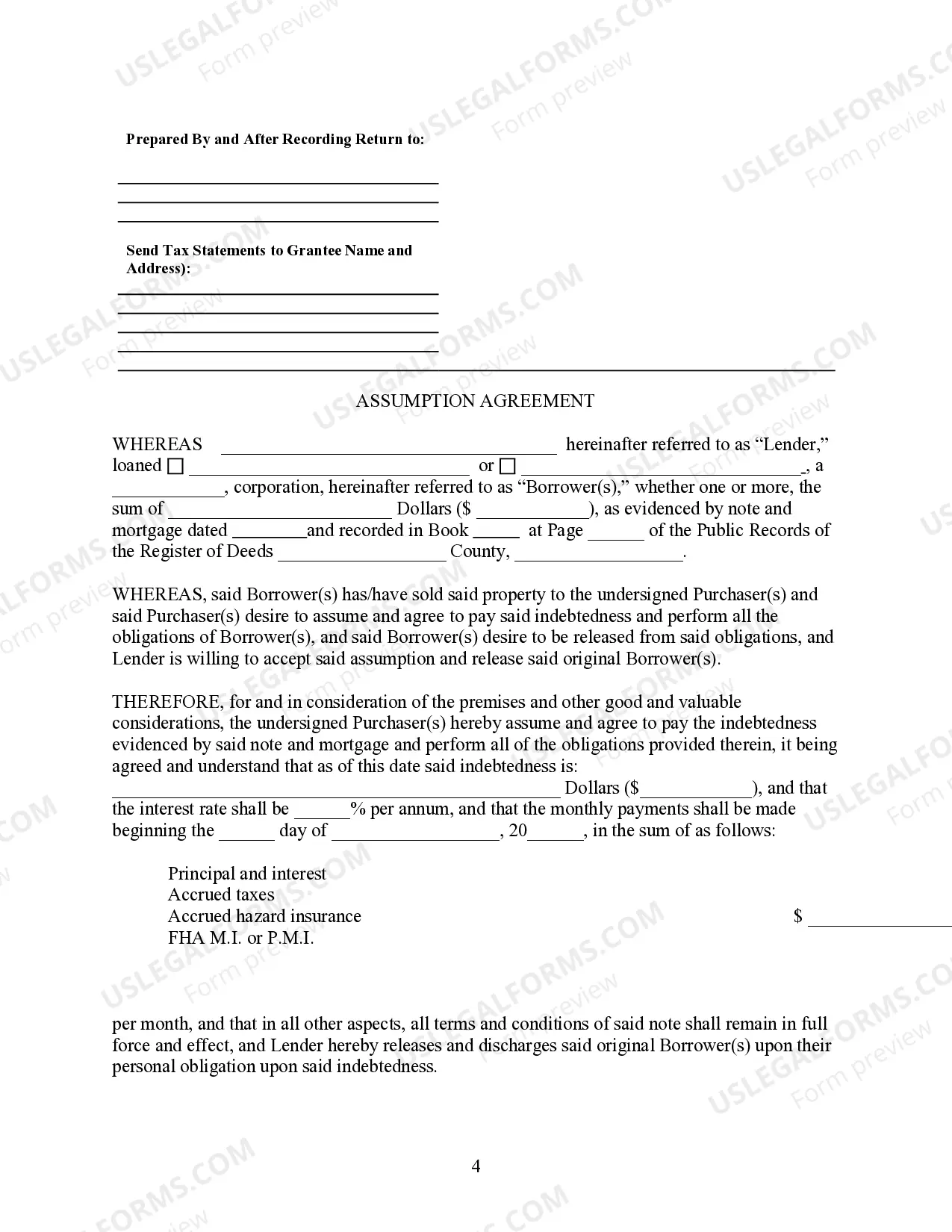

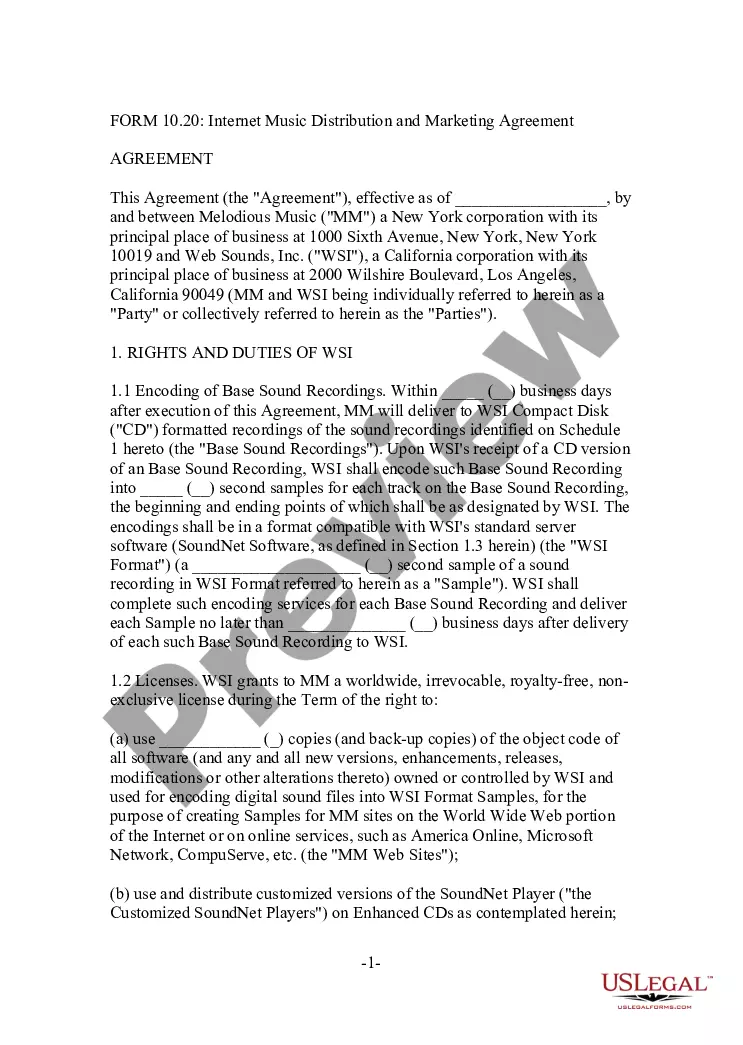

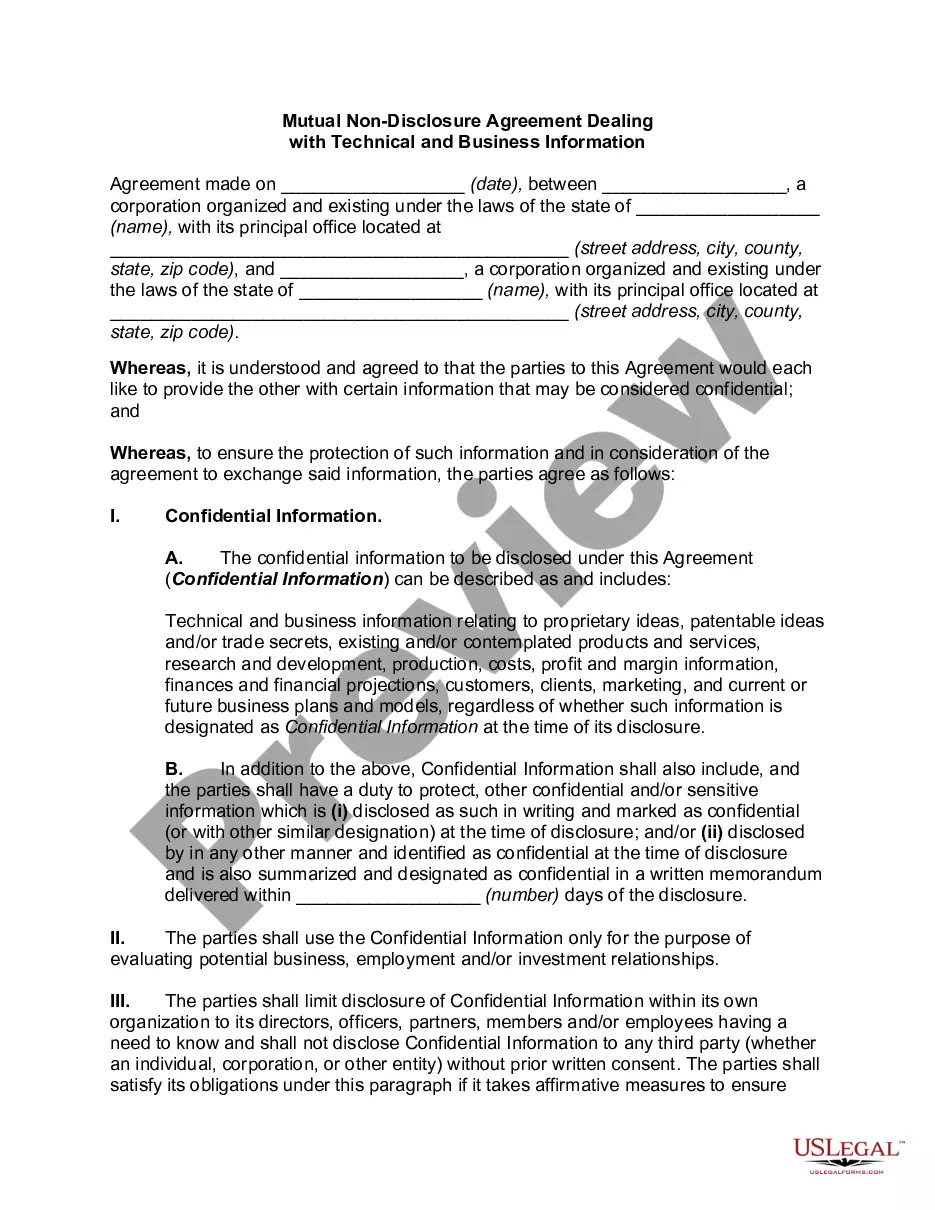

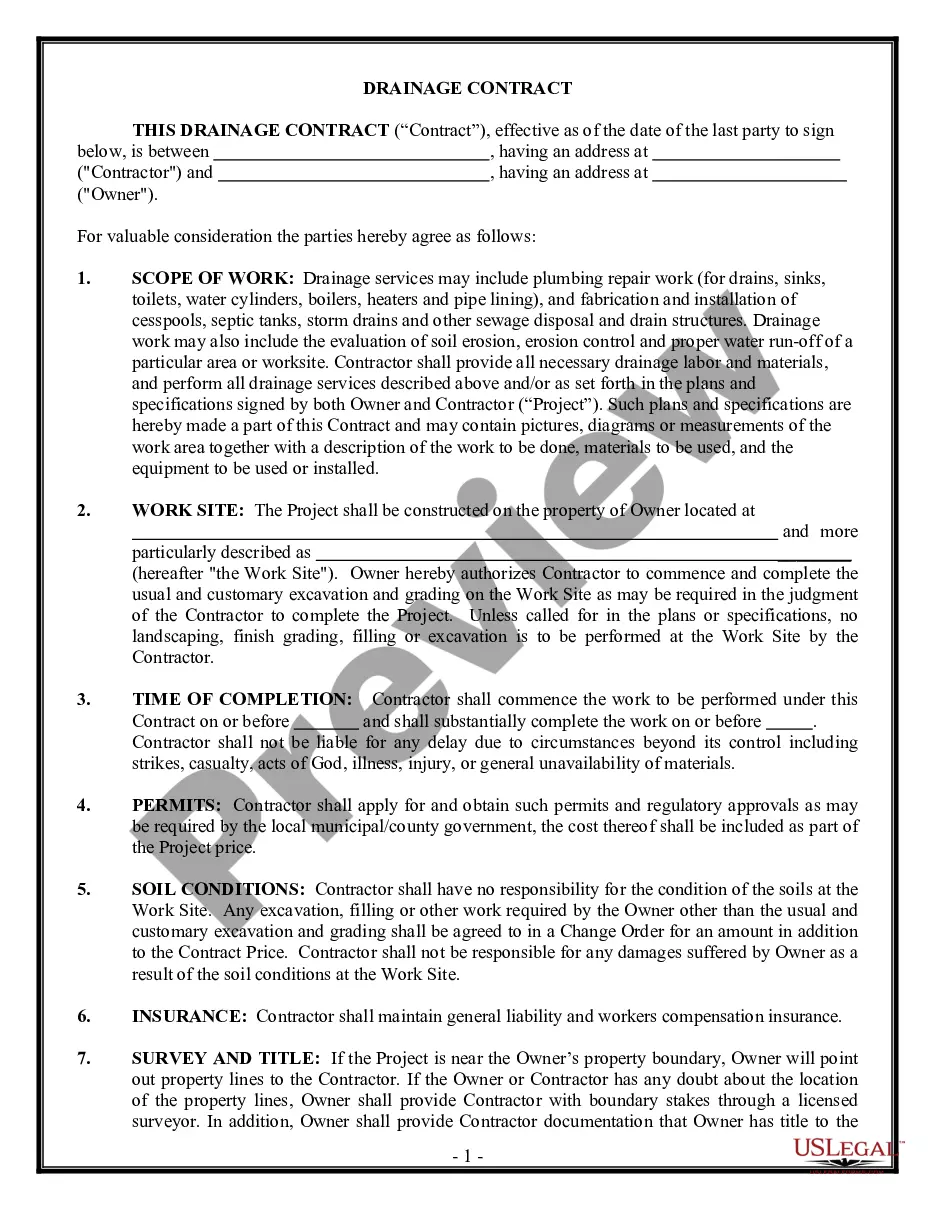

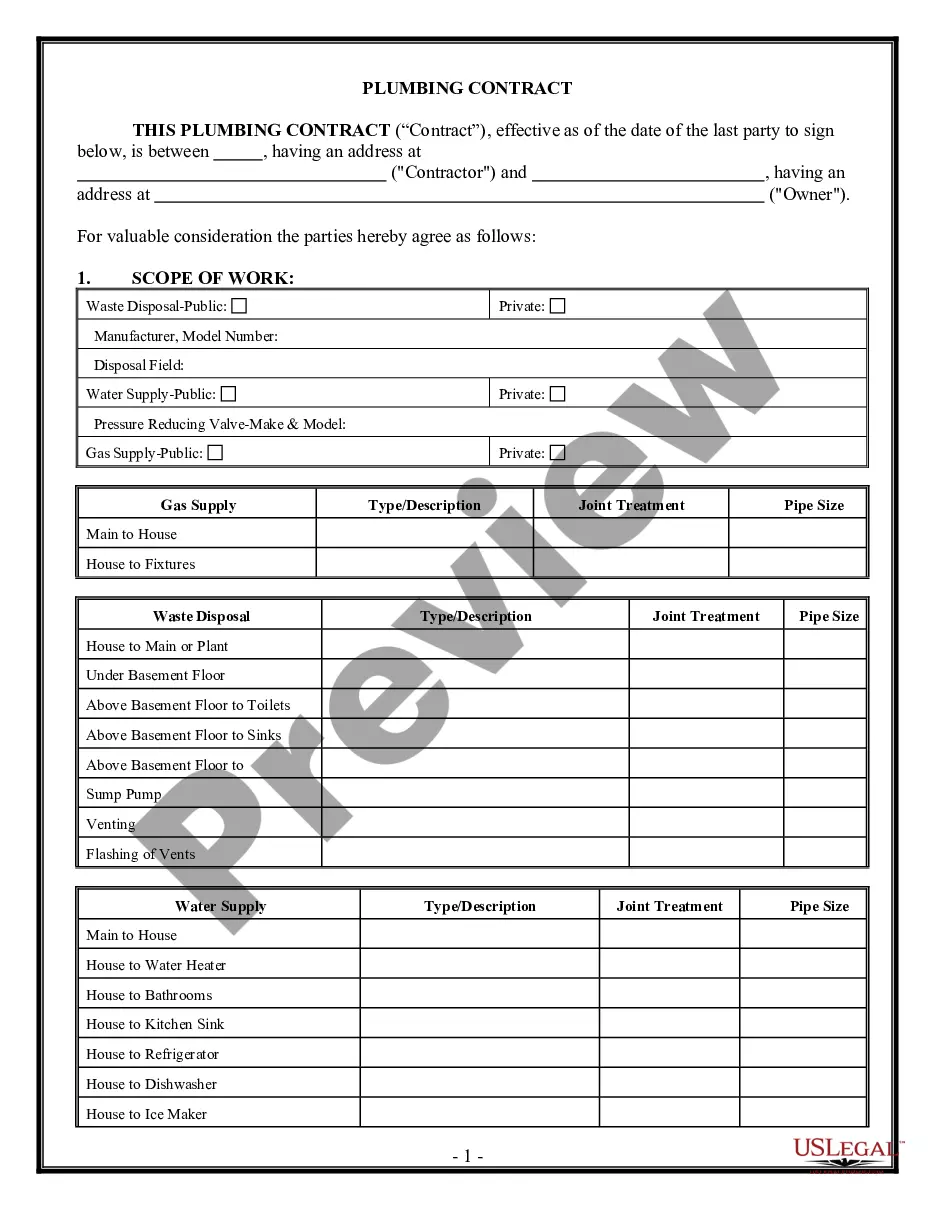

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Wisconsin Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Wisconsin Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Out of the large number of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates before buying them. Its comprehensive library of 85,000 templates is grouped by state and use for efficiency. All the forms on the service have been drafted to meet individual state requirements by accredited lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, click Download and obtain access to your Form name from the My Forms; the My Forms tab holds all your downloaded documents.

Stick to the guidelines below to obtain the form:

- Once you find a Form name, make certain it is the one for the state you really need it to file in.

- Preview the template and read the document description just before downloading the sample.

- Search for a new sample via the Search field in case the one you’ve already found isn’t appropriate.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

Once you have downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most up-to-date version in your state. Our platform provides quick and simple access to templates that fit both lawyers as well as their customers.

Form popularity

FAQ

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

The loan assumption addendum is a piece of paperwork that will be provided to the individual that is assuming the loan. This paperwork is going to provide them with important information about assuming the loan and how the process will work.

People can just let the home go to foreclosure, and this will affect their scores for seven years. Or they can do a deed in lieu of foreclosure. With a deed in lieu, you voluntarily give your home to the lender in exchange for the cancellation of your loan. This, too, can create a negative mark on your credit history.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.