Montana Contract For Deed Laws

Description

How to fill out Montana Contract For Deed Package?

The Montana Contract For Deed Regulations presented on this page is a reusable formal document created by experienced attorneys in accordance with federal and state statutes.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal circumstance. It’s the quickest, simplest, and most dependable method to acquire the paperwork you require, as the service ensures bank-level data protection and anti-malware safeguards.

Finalize and sign the document. Print out the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a valid signature. Download your paperwork again whenever necessary. Access the My documents section in your profile to redownload any forms you previously saved. Register for US Legal Forms to have verified legal templates for all of life's situations readily available.

- Search for the document you need and review it.

- Browse through the file you searched and preview it or check the form description to ensure it meets your criteria. If it does not, use the search bar to locate the correct one. Click Buy Now once you have identified the template you require.

- Choose and Log In.

- Select the pricing plan that best fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

- Select the format you desire for your Montana Contract For Deed Regulations (PDF, DOCX, RTF) and store the sample on your device.

Form popularity

FAQ

If you're the buyer in a contract for deed arrangement, you need to be aware of the following risks. Property maintenance. One contract for deed drawback is the uncertainty over who's responsible for what. ... No foreclosure protection. ... Balloon payment. ... Seller retains title. ... Less consumer protection.

A Montana deed cannot be recorded unless the owner's signature is acknowledged before a notary. Mont. Code § 70-21-203(1). A deed's notary acknowledgment and seal are exempt from the ink color and margin requirements that otherwise apply to Montana deeds.

Whenever property is sold or gifted, a deed must be executed by the person or entity transferring ownership, the ?grantor,? and recorded with the Clerk and Recorder in the county where the property is located. The grantor will also need to file a Realty Transfer Certificate and pay the recording fee ($8 per page).

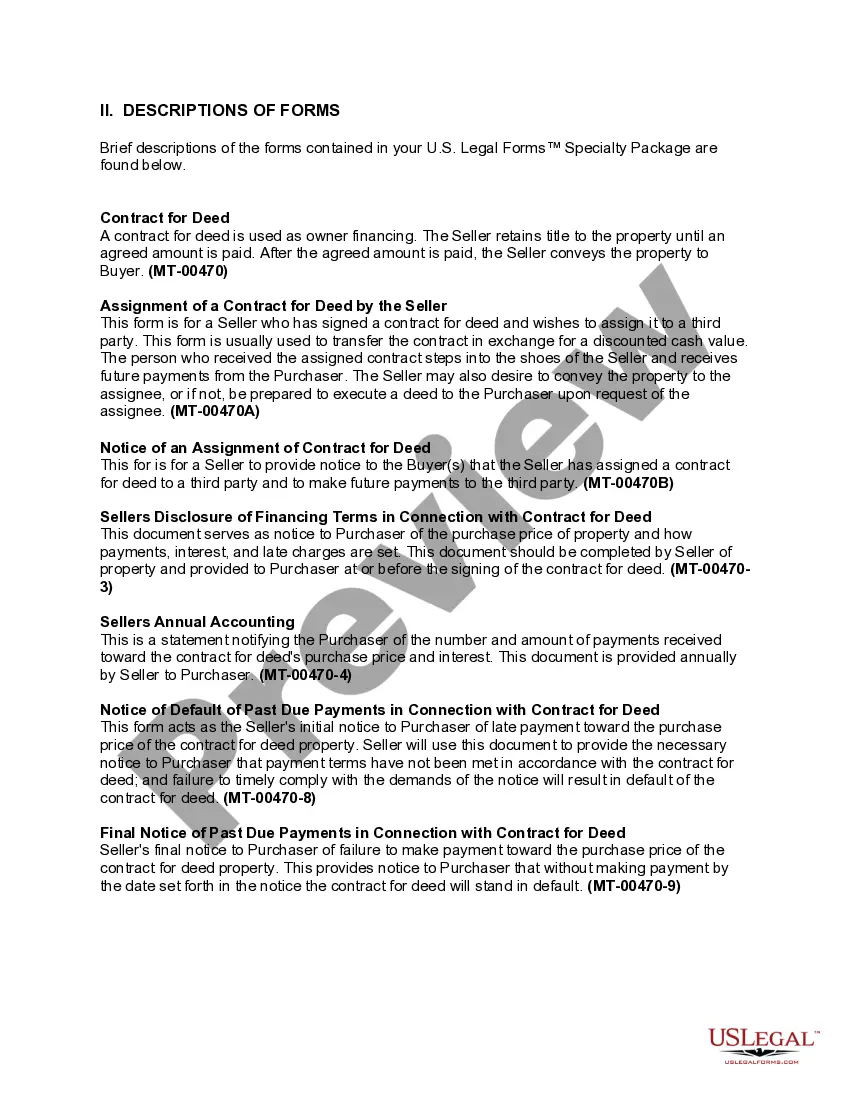

In a contract for deed, a contact is executed between a seller and a buyer whereby a seller agrees to transfer title to the property once the amount set forth in the contract has been paid in full. In a contract for deed, the seller retains legal title until the contract is paid and the buyer has equitable title.

The following should be in a contract for deed: Purchase price. Interest rate. Down payment. Number of monthly installments. Buyer and seller information. Party responsibilities. Legal remedies in the event of default.