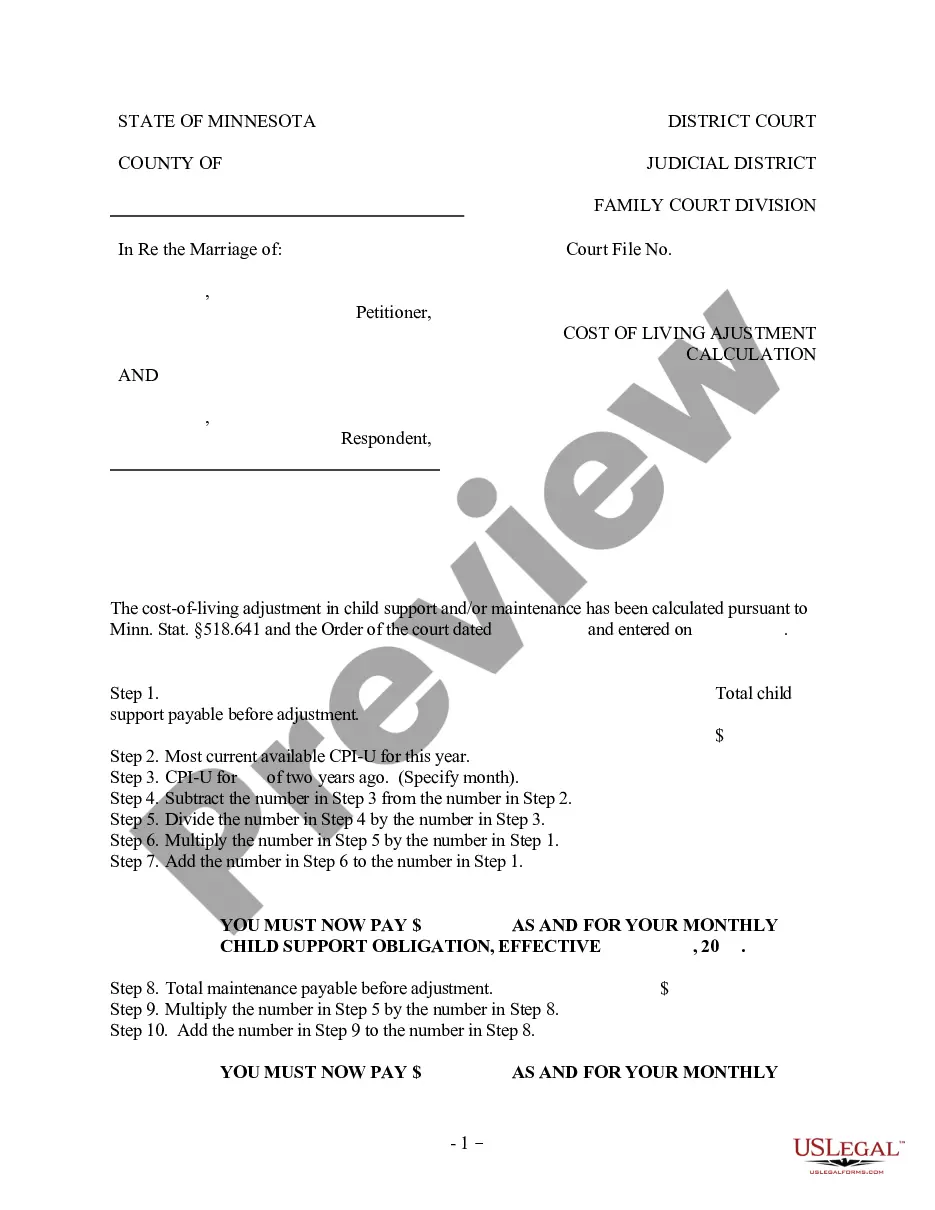

Minnesota Cost of Living Adjustment Calculation for Child Support

Description

How to fill out Minnesota Cost Of Living Adjustment Calculation For Child Support?

Obtain any template from 85,000 legal documents including Minnesota Cost of Living Adjustment Calculation for Child Support online with US Legal Forms. Each template is crafted and revised by state-authorized legal experts.

If you already possess a subscription, Log In. After reaching the form’s page, click on the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the steps below: Check the state-specific criteria for the Minnesota Cost of Living Adjustment Calculation for Child Support you wish to utilize. Read the description and preview the template. When you’re sure the template is what you require, click Buy Now. Select a subscription plan that genuinely fits your budget. Create a personal account. Make payment using either of the two convenient methods: by card or via PayPal. Choose a format to download the file in; two options are available (PDF or Word). Download the file to the My documents tab. Once your reusable template is downloaded, print it out or save it to your device.

- With US Legal Forms, you will always have immediate access to the appropriate downloadable sample.

- The platform provides access to documents and organizes them into categories to make your search more efficient.

- Utilize US Legal Forms to obtain your Minnesota Cost of Living Adjustment Calculation for Child Support quickly and effortlessly.

Form popularity

FAQ

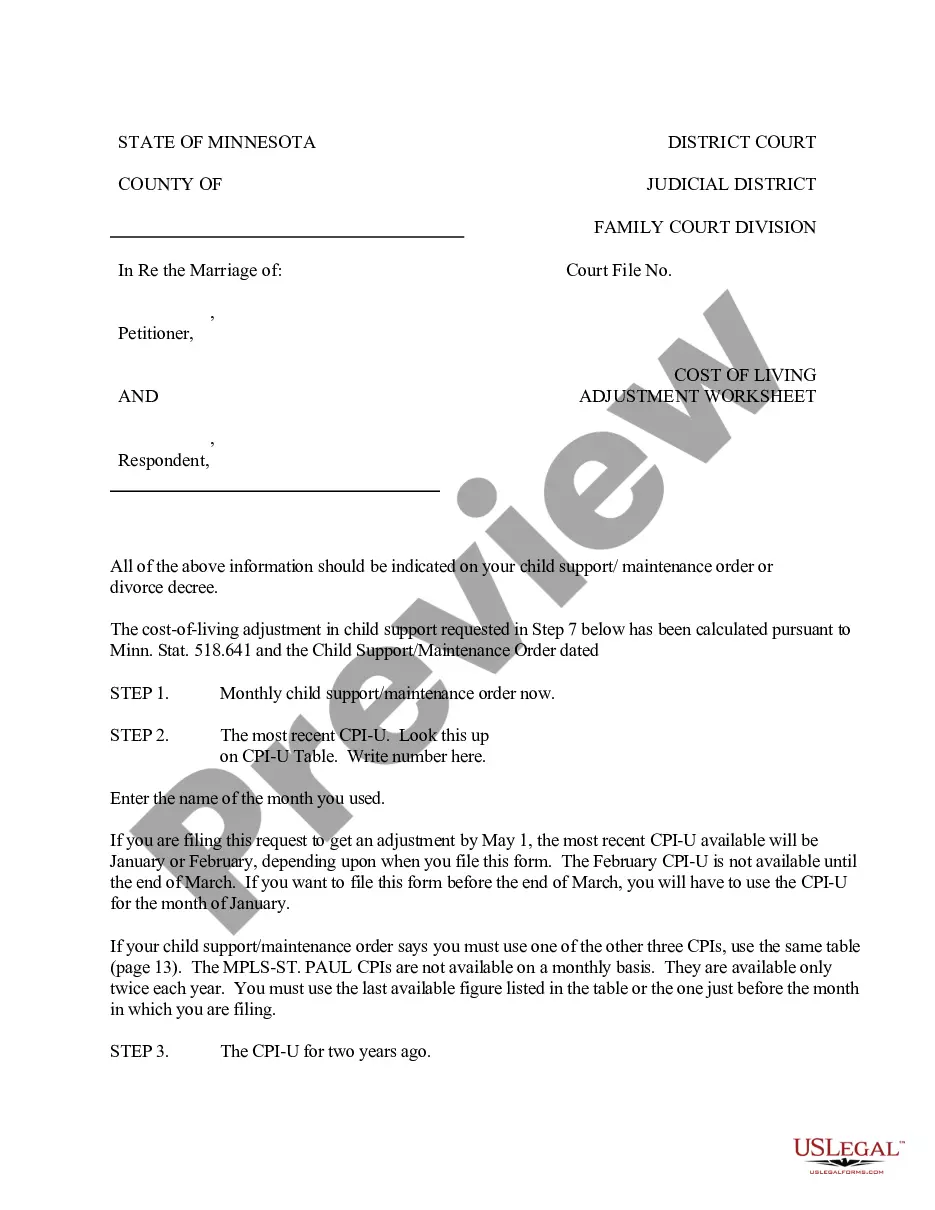

Yes, Minnesota does have a cost-of-living adjustment for child support. This adjustment is designed to help parents adjust their support obligations based on changes in the economy. With the Minnesota Cost of Living Adjustment Calculation for Child Support, parents can ensure that their payments remain relevant and sufficient for their children's needs.

ofliving adjustment, or COLA, for child support is a change made to the support amount based on inflation or changes in the cost of living. This adjustment ensures that child support payments remain fair and adequate over time. In Minnesota, the Minnesota Cost of Living Adjustment Calculation for Child Support helps parents keep pace with economic changes, ensuring that children's needs are met adequately.

The biggest factor in calculating child support is how much the parents earn. Some states consider both parents' income, but others consider only the income of the noncustodial parent. In most states, the percentage of time that each parent spends with the children is another important factor.

Whichever parent has/will have physical custody of the children for the lesser amount of time during a given year, multiply that parent's percentage of the combined income (his/her income divided by the parties' total combined income) by the total child support obligation.

You give annual salary cost of living adjustments, so you raise each employee's wages by 1.5%. So, if you have an employee who earns $35,000 per year, you would add 1.5% to their wages. Due to the cost of living increase of 1.5%, this employee will now earn $35,525.

The 2020 COLA is based on the 3.12% average increase in the Consumer Price Index (CPI) measured from February 2019 to February 2020 for the Los Angeles and San Francisco metropolitan areas. The UCRP COLA formula generally matches the annual increase in the CPI up to 2.0%.

Per the state's guidelines at that time, the maximum amount of support that could be paid for one child was $1,000.Today, the limits for child support are set forth in Chapter 518A. 35 of the MN Statutes. In 2020, only the first $15,000 of combined monthly parental income is used to determine the basic support amount.

Changing Compensation Costs in the Minneapolis Metropolitan Area December 2020. Total compensation costs for private industry workers increased 1.6 percent in the Minneapolis-St. Paul, MN-WI, metropolitan area for the year ended December 2020, the U.S. Bureau of Labor Statistics reported today.

A cost-of-living adjustment (COLA) is an increase in benefits or salaries to counteract inflation. Inflation for the Social Security COLA is calculated annually using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

A parent can ask the court to change an existing child support order by filing either a Stipulation (agreement) or a Motion to Modify Support. The law on changing a child support order is online at Minn. Stat. § 518A.