Breach Of Promissory Note For Personal Loan

Description

How to fill out Montana Complaint For Breach Of Promissory Note?

When you are required to complete a Breach Of Promissory Note For Personal Loan that adheres to your local state's statutes and regulations, there are many alternatives available.

You don't have to examine every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a trustworthy service that can assist you in acquiring a reusable and current template on any subject.

Acquiring correctly drafted formal documents becomes simple with US Legal Forms. Additionally, Premium users can also take advantage of the strong integrated options for online document editing and signing. Experience it today!

- US Legal Forms holds the largest online collection with an archive of over 85k ready-to-use documents for business and personal legal matters.

- All templates are confirmed to comply with each state's regulations.

- Thus, when you download the Breach Of Promissory Note For Personal Loan from our platform, you can be assured that you possess a legitimate and current document.

- Obtaining the necessary template from our platform is exceedingly simple.

- If you already have an account, just Log In to the system, verify your subscription validity, and save your chosen file.

- Afterward, you can access the My documents section in your profile and have access to the Breach Of Promissory Note For Personal Loan whenever needed.

- If this is your first time using our library, please adhere to the instructions below.

- Review the suggested page and ensure it meets your specifications.

Form popularity

FAQ

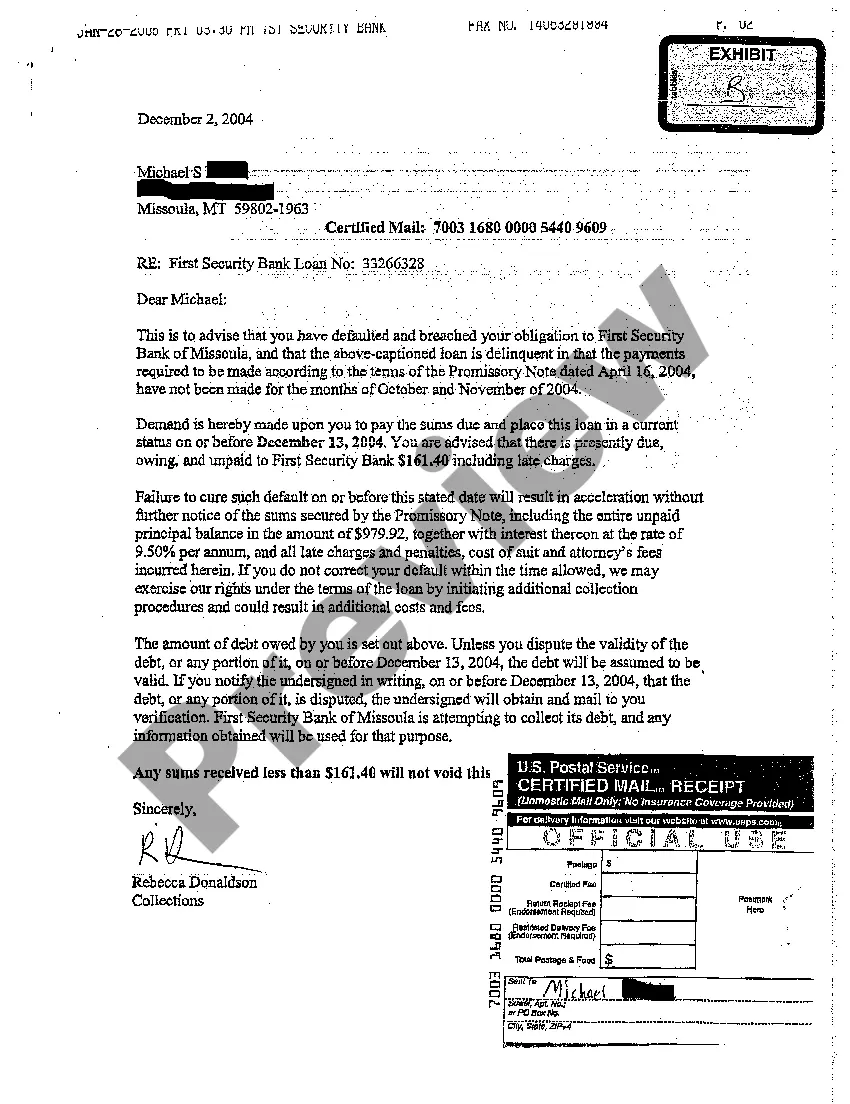

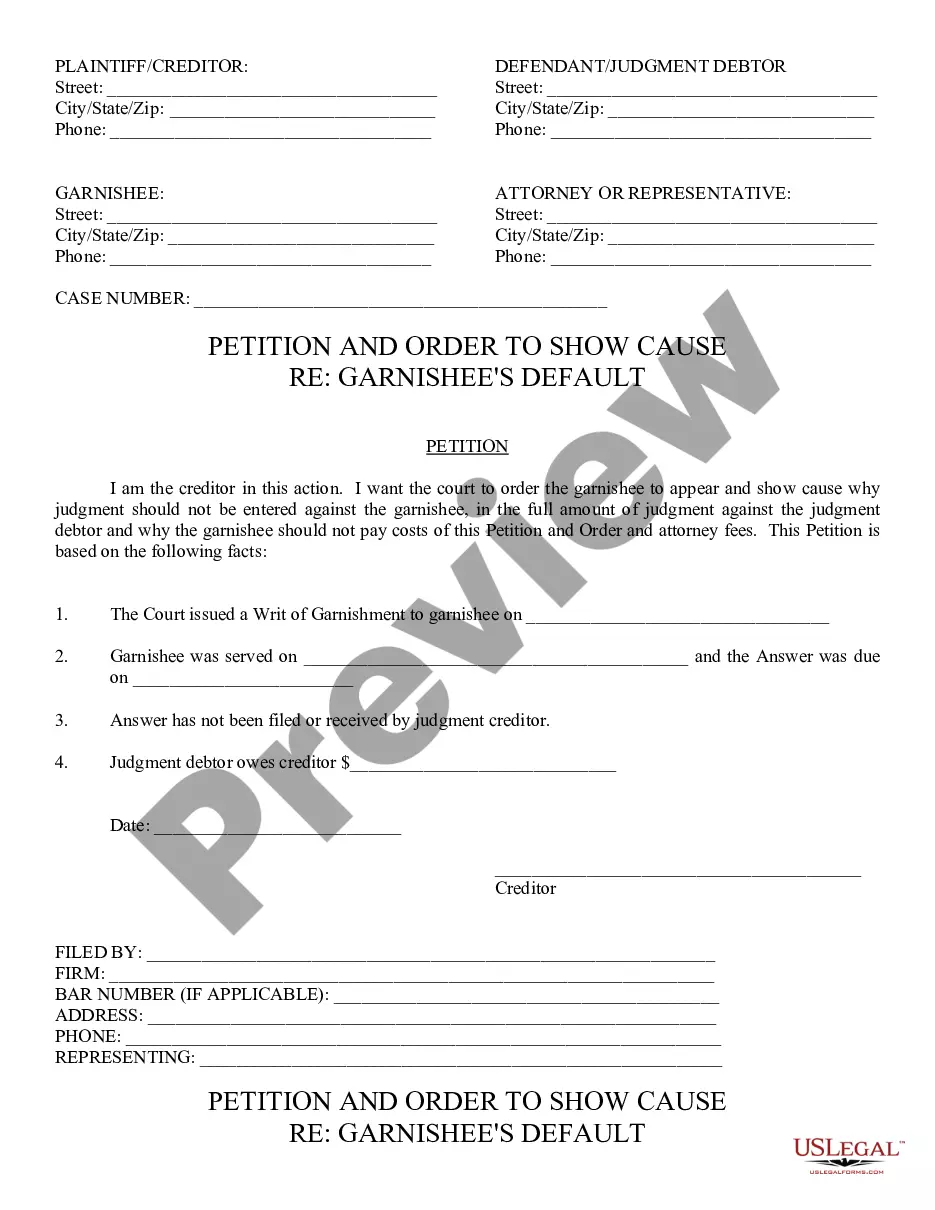

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

If the debtor refuses to pay the promissory note voluntarily, a civil lawsuit against the person may be necessary. If your suit is successful, the judge will issue a judgment in your favor. A judgment is a powerful collection tool.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.