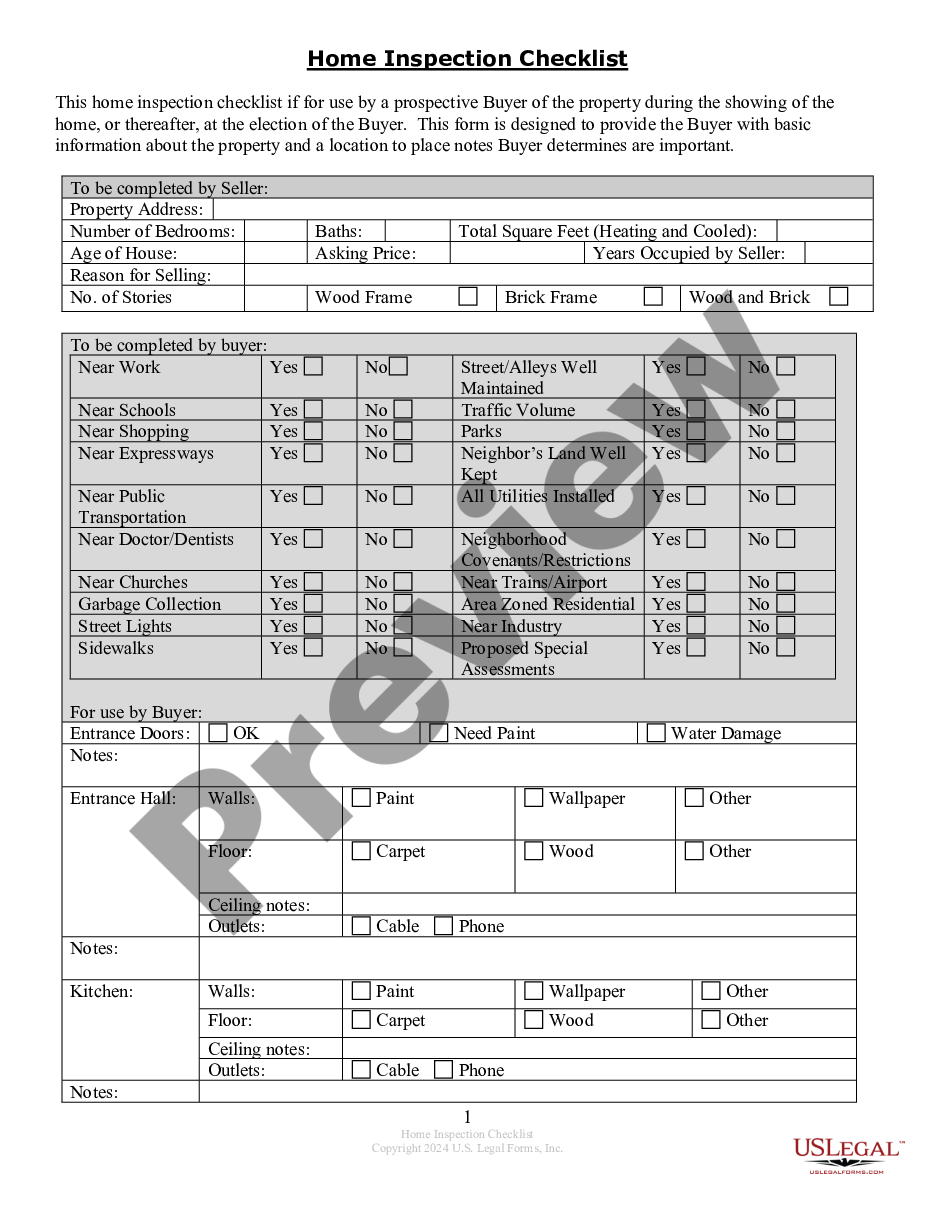

Contractor Mississippi With Material Purchase Certificate

Description

How to fill out Mississippi Site Work Contractor Package?

Accurately composed official documentation is one of the crucial assurances for preventing issues and legal disputes, but obtaining it without a legal professional's help may require time.

Whether you need to swiftly locate an updated Contractor Mississippi With Material Purchase Certificate or any other forms related to employment, family, or business matters, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms database. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Additionally, you can retrieve the Contractor Mississippi With Material Purchase Certificate at any time, as all the documents ever acquired on the platform remain accessible within the My documents section of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

- Ensure that the document is appropriate for your needs and locality by reviewing the description and preview.

- Search for an additional example (if necessary) using the Search bar in the header.

- Hit Buy Now when you discover the suitable template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment option to purchase the subscription (via credit card or PayPal).

- Choose PDF or DOCX file format for your Contractor Mississippi With Material Purchase Certificate.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

501 A contractor's Material Purchase Certificate (MPC) number will be issued to a qualified contractor for each contract. The MPC number allows the contractor and his subcontractors to make tax-free purchases of materials and services that become a component part of the structure covered by the qualified contract.

Material Contractor means any contractor (including General Contractor) or subcontractor who executes a Material Contract.

The Sales Tax Law levies a 3.5% contractor's tax on all non-residential construction activities when the total contract price or compensation received exceeds $10,000.00. Prior to beginning work, the prime contractor(s) is required to apply for a MPC for the contract . You may apply for a MPC on TAP.

The Sales Tax Law levies a 3.5% contractor's tax on all non-residential construction activities when the total contract price or compensation received exceeds $10,000.00. Material Purchase Certificate (MPC) Prior to beginning work, the prime contractor(s) is required to apply for a MPC for the contract .

DOR. Declaration of Readiness to Proceed.