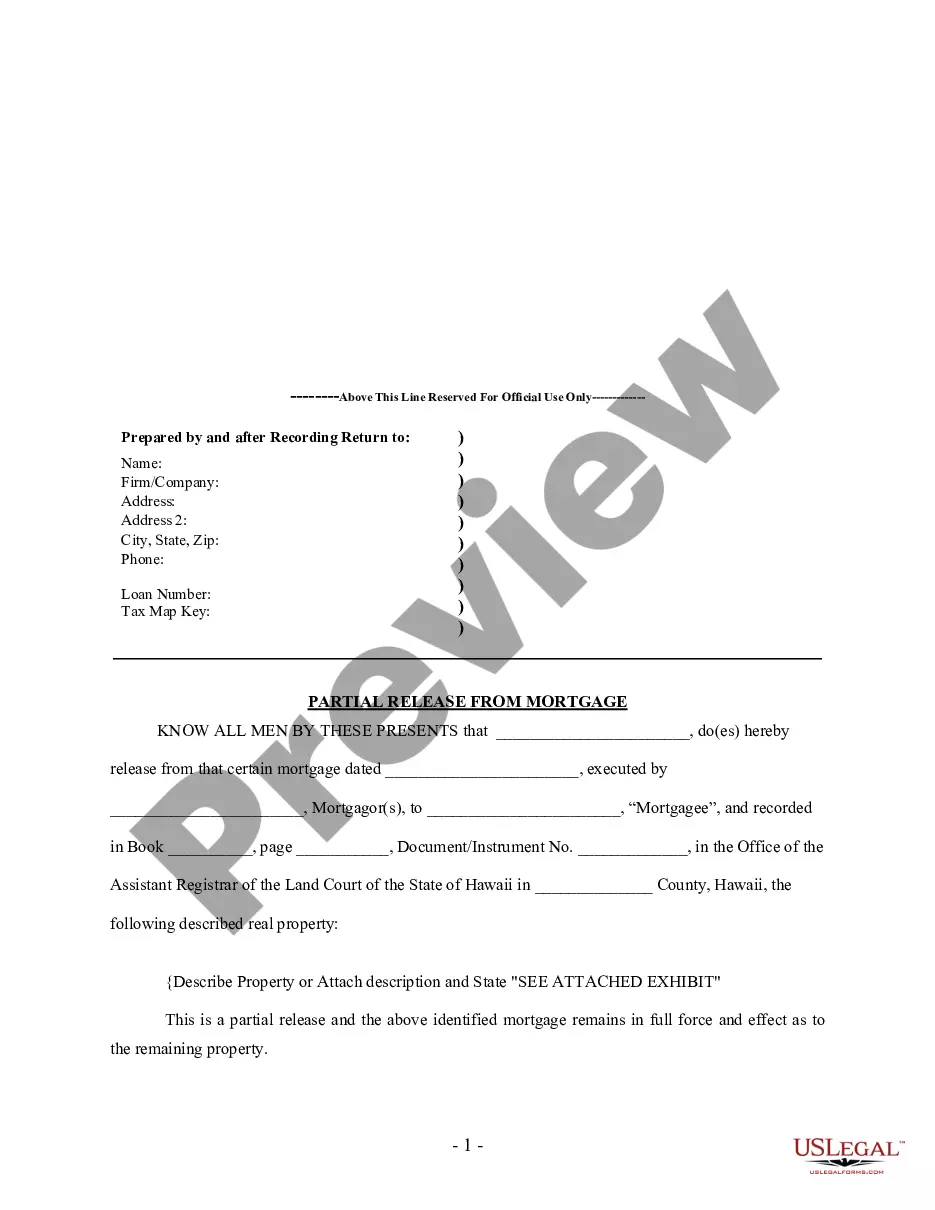

Hawaii Partial Release of Property From Mortgage by Individual Holder

Description

How to fill out Hawaii Partial Release Of Property From Mortgage By Individual Holder?

Utilize the most comprehensive collection of legal documents.

US Legal Forms provides a means to locate any state-specific paperwork in just a few clicks, such as Hawaii Partial Release of Property From Mortgage by Individual Holder examples.

No need to squander hours searching for a court-acceptable document.

Once everything is confirmed, click the Buy Now button. After selecting a pricing plan, create your account. Make your payment using a card or PayPal. Download the document to your device by clicking on the Download button. That's it! You should fill out the Hawaii Partial Release of Property From Mortgage by Individual Holder template and verify its accuracy. To ensure everything is correct, consult your local legal advisor for assistance. Sign up and easily access over 85,000 valuable templates.

- Our certified experts ensure that you receive the latest samples each time.

- To take advantage of the forms library, select a subscription and create an account.

- If you've already done so, simply Log In and press the Download button.

- The Hawaii Partial Release of Property From Mortgage by Individual Holder example will be promptly stored in the My documents section (a section for every document you save on US Legal Forms).

- To establish a new profile, refer to the brief instructions provided below.

- If you intend to use a state-specific document, ensure to select the correct state.

Form popularity

FAQ

Obtaining a partial release of a mortgage can vary in difficulty, but it often requires clear communication with your lender and proper documentation. Many lenders are open to partial releases, especially if there is significant equity in the property. Utilizing the USLegalForms platform can simplify this process by providing the necessary forms and guidance for a smooth Hawaii Partial Release of Property From Mortgage by Individual Holder.

An example of a partial release would be if a homeowner has a mortgage on a multi-family property and wishes to sell one unit. The lender might agree to a Hawaii Partial Release of Property From Mortgage by Individual Holder for just that specific unit, allowing the sale to proceed while maintaining the mortgage on the remaining units. This type of transaction can help you realize profits from part of your investment property without liquidating the entire asset.

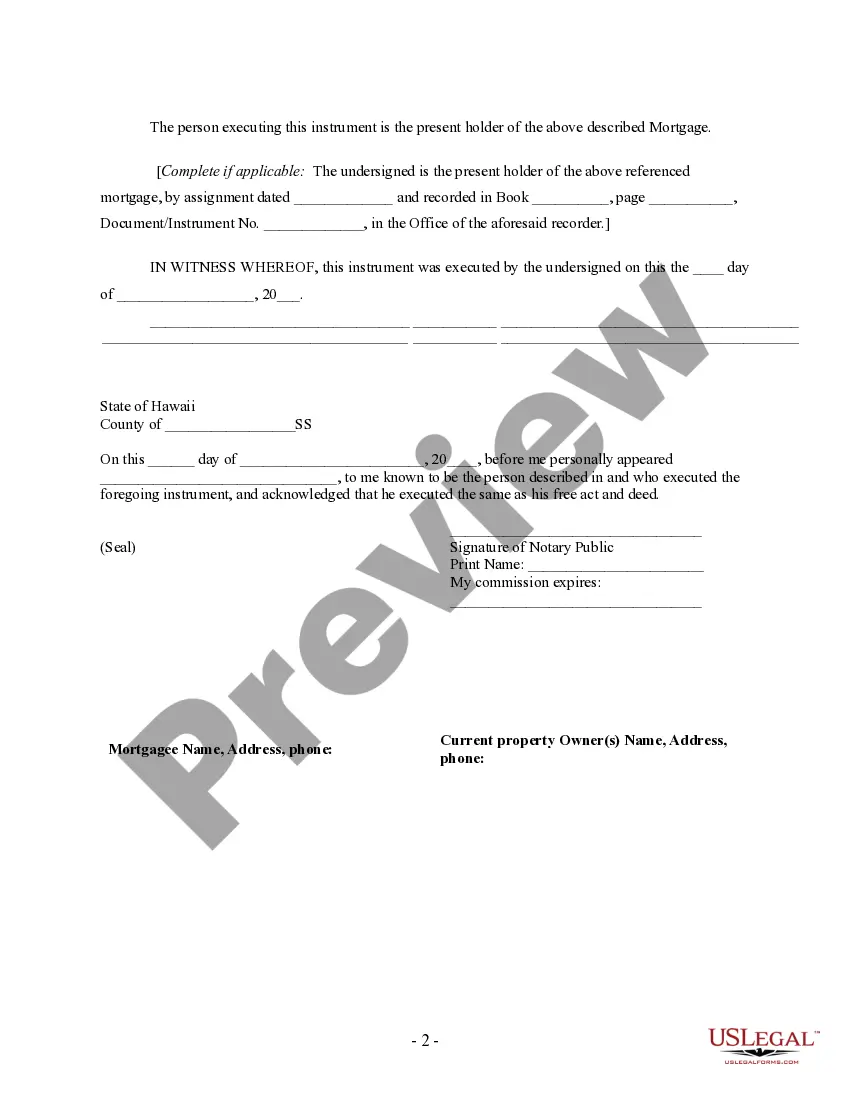

Recording a release of your mortgage in Hawaii involves submitting the release document to the county recorder’s office where the property resides. This document must be properly executed and contain pertinent information about the original mortgage. After its recording, the release serves as official notice that the specified property is no longer encumbered by the mortgage, benefiting both you and potential future buyers.

No, the lender is not the grantor on a mortgage; instead, the borrower is typically the grantor. The borrower grants the lender a security interest in the property through the mortgage. Understanding the roles involved is crucial, especially when dealing with the Hawaii Partial Release of Property From Mortgage by Individual Holder. Clear communication with your lender can help you navigate these relationships effectively.

The partial release of mortgage clause allows a borrower to release a portion of the collateralized property from a mortgage. This can be useful if you want to sell part of your property while keeping the mortgage intact. By using the Hawaii Partial Release of Property From Mortgage by Individual Holder, you can manage your property effectively without refinancing. It's important to understand the terms outlined in your mortgage agreement for a smooth process.

A partial discharge of a mortgage refers to the removal of a specific part of the secured property from the mortgage lien. This allows the borrower to sell or refinance that part while keeping the rest under the original mortgage security. It is similar to a partial release but may be used in different legal contexts. For clarity and assistance, engaging with USLegalForms can enhance your understanding of this process.

A partial release of a mortgage works by legally freeing part of the property from the total mortgage obligation. Once the borrower requests the release and meets the lender's conditions, the lender issues verification of the release. This allows the borrower to sell or refinance the released portion without affecting the entire mortgage. Our platform, USLegalForms, provides resources to simplify this process and ensure adherence to legal requirements.

The grantor on a partial release of a mortgage is the borrower or property owner who seeks to release a portion of the property from the mortgage agreement. They initiate the request and must adhere to the terms set by the lender. This person plays a vital role in ensuring the process aligns with their interests. Always remember that a well-documented process minimizes future disputes.

Mortgages that often include a partial release clause are commercial loans and some residential mortgages. These types of loans are designed to allow flexibility for property sales or refinancing. The clause can aid in managing large properties with different types of collateral. When considering Hawaii Partial Release of Property From Mortgage by Individual Holder, understanding the specifics of your mortgage is crucial.

To transfer ownership of a property in Hawaii, you typically need to complete a deed, which is a legal document that conveys property rights. You will also need to sign the deed in front of a notary public. Once signed, you must record the deed with the county clerk’s office to make the transfer official. For a smooth process, consider using our platform, USLegalForms, to find templates and guidance specifically for your needs.