Trust Account For Lawyer

Description

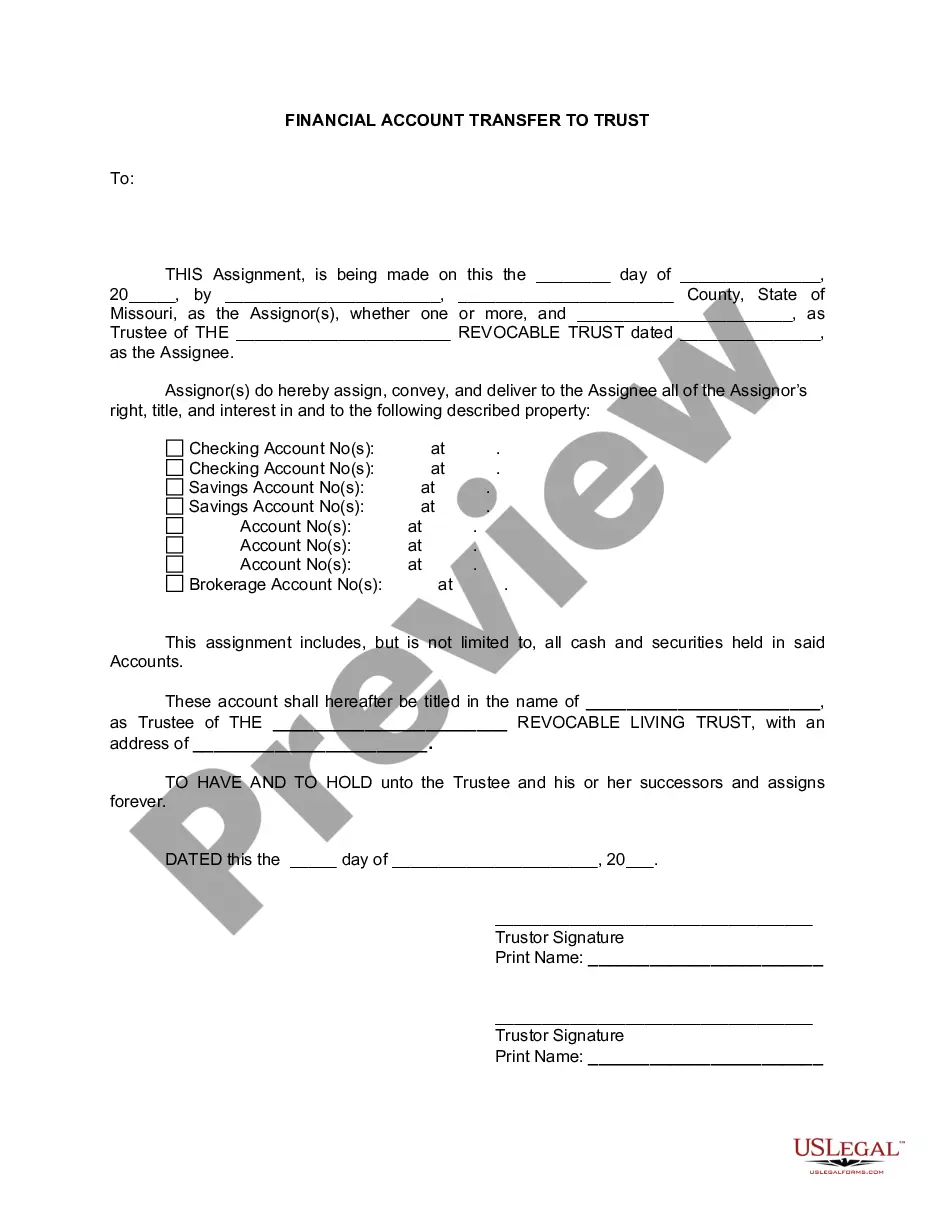

How to fill out Missouri Financial Account Transfer To Living Trust?

- Log into your US Legal Forms account or create a new account if you are a first-time user.

- Browse the extensive library and enter 'trust account for lawyer' in the search bar to find the appropriate template.

- Check the preview and ensure the form matches your specific legal needs and local requirements.

- If necessary, search for additional templates using the Search tab until you find what suits your needs.

- Select the document and click on the 'Buy Now' button to choose your desired subscription plan.

- Complete the registration process and make your payment using credit card or PayPal.

- Download the form to your device and access it later through the 'My Forms' section in your profile.

By following these steps, you can efficiently set up your trust account while ensuring that all necessary legal protocols are followed.

With US Legal Forms, you'll benefit from a robust collection of legal documents and access to experts, making your legal processes smoother. Get started today!

Form popularity

FAQ

To set up a trust fund for your property, you need to draft a trust agreement that outlines the terms of the trust. It’s important to choose a trustee who will manage the assets on behalf of the beneficiaries. To ensure the trust fund aligns with your goals, consider seeking assistance from a legal expert experienced in trust accounts for lawyer services.

Putting your house in a trust can complicate your ownership structure. While it can help avoid probate, it may limit your control over the property. Additionally, transferring ownership may have tax implications or affect your ability to qualify for certain benefits. Consulting a legal expert can clarify how a trust account for lawyer services can aid you in navigating these complexities.

When writing a check to an attorney trust account, ensure that the check is made payable to the attorney's name, along with the notation 'Trust Account' on the memo line. This clarification helps maintain accurate records for all transactions. It's also advisable to keep a copy of the check for your own records to track your finances efficiently.

To open a trust account for lawyer services related to your property, start by contacting a bank or financial institution that offers trust account services. Typically, you'll need to provide documentation that verifies your identity and details about the trust arrangement. It helps to have a legal professional guide you through this process to ensure all requirements are met efficiently.

A trust account is not considered an individual account, as it is established to hold funds on behalf of clients for specific purposes. While the lawyer may manage the account, the funds within belong to the clients and must be used exclusively for their intended legal matters. This structure helps maintain compliance with ethical standards, ensuring that a trust account for lawyer functions correctly and protects client rights.

Yes, a person can maintain multiple trust accounts, especially if they manage different clients or specific matters. Each trust account must accurately reflect the funds held for each client or purpose to ensure proper accounting practices. This approach allows for organized handling of client finances and efficient management of each project. A trust account for lawyer can help streamline the administration of multiple accounts.

Yes, a trust typically requires a separate bank account to hold the assets securely and distinguish them from personal funds. This separation protects the trust assets and ensures proper management in accordance with the trust's terms. Having a dedicated trust account can also help clarify financial transactions and support accurate accounting practices. A trust account for lawyer streamlines this separation effectively.

To perform an accounting for a trust, begin by documenting all transactions within the trust account, including deposits and withdrawals. Regularly reconciling the trust account with bank statements ensures accuracy and transparency in handling client funds. Additionally, maintain detailed records that show how the funds are used or disbursed. Using tools on platforms like USLegalForms can simplify this process, making trust accounting manageable and compliant.

Trust accounting for law firms involves carefully tracking client funds held in trust accounts. Law firms must maintain accurate records of all transactions, showing deposits and withdrawals while ensuring compliance with legal requirements. This meticulous accounting prevents misuse of client funds and fosters accountability. By utilizing an organized solution such as USLegalForms, law firms can streamline their trust accounting processes and maintain proper records.

A simple example of a trust is a revocable living trust, where a person creates a trust for their own benefit during their lifetime. This arrangement allows them to control assets while specifying how they should be handled after their passing. A trust account for a lawyer often comes into play when managing these assets, ensuring proper legal oversight during the trust’s administration. This approach simplifies the transition of assets and mitigates probate complications.