Irrevocable Trust Trustor For The Trust

Description

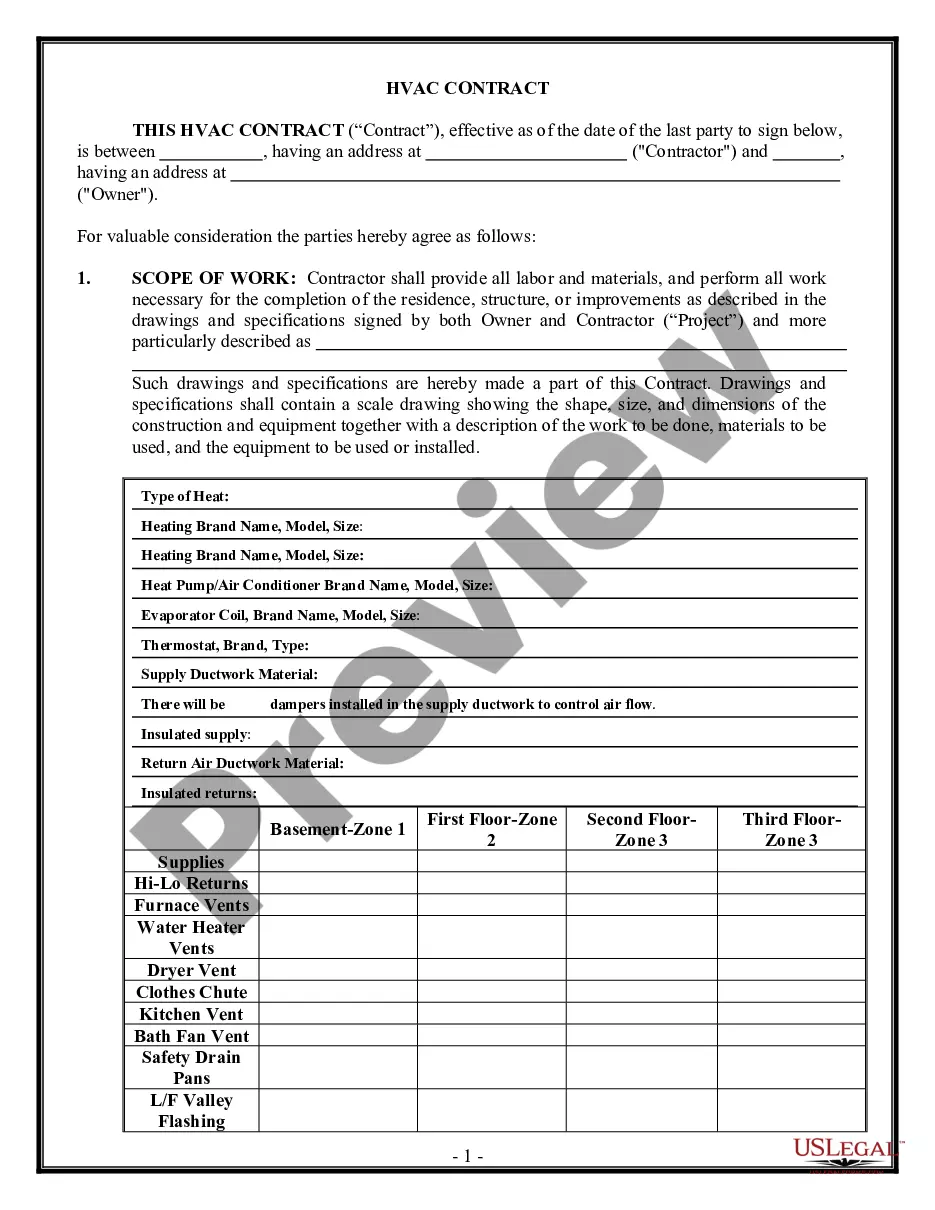

How to fill out Missouri Self-Settled Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

- Start by logging into your US Legal Forms account. If you're a new user, create an account first to get full access to their extensive library.

- Search for the irrevocable trust form in the preview mode. Make sure it fits your needs and complies with the local jurisdiction requirements.

- If necessary, use the search feature to find an alternative template. Confirm that it meets all your criteria.

- Select the desired form and click on the 'Buy Now' button. Choose a subscription plan that best suits your requirements.

- Proceed with the payment using your credit card or PayPal account to finalize your subscription.

- Once your purchase is complete, download the form to your device. You can also find it at any time in the 'My Forms' section of your account.

By following these steps, you can effectively secure your legal documents through US Legal Forms. Not only does this platform offer a robust collection of over 85,000 templates, but it also connects you with premium experts ready to assist with form completion.

Take control of your estate planning today and elevate your legal documentation process. Visit US Legal Forms now to begin!

Form popularity

FAQ

Yes, you can write your own irrevocable trust, but it is essential to ensure that all legal requirements are met. Start by researching the necessary clauses and provisions to include, such as defining the trustor, beneficiaries, and distribution terms. While drafting your trust, consider using resources from US Legal Forms. This platform can provide templates that simplify the process, helping you establish a legally sound irrevocable trust trustor for the trust.

Filling out an irrevocable trust requires careful attention to detail. First, gather necessary information about the trustor and beneficiaries; this includes names, addresses, and Social Security numbers. Then, outline the trust's assets and specify how they will be managed. Consider using a platform like US Legal Forms to help guide you through the process, ensuring that you accurately designate the irrevocable trust trustor for the trust.

The best person to appoint as trustee is someone who possesses both integrity and knowledge about trust management. Ideally, this person should understand your values and financial goals. As an irrevocable trust trustor for the trust, choose someone who can balance compassion with the necessary skills to uphold your trust’s intent.

The trustee manages the assets in an irrevocable trust, ensuring that they are used according to the terms of the trust. This individual is responsible for maintaining the trust’s integrity and making investment decisions in the best interest of the beneficiaries. As an irrevocable trust trustor for the trust, you define how these assets should be managed and distributed.

The main downside of an irrevocable trust is the loss of control over the assets you place in it. Once established, you cannot simply change the terms or take assets back. As the irrevocable trust trustor for the trust, it's essential to carefully weigh this decision, as it can limit your flexibility in managing financial resources.

Selecting the best trustee for an irrevocable trust is crucial for its success. Look for someone who is trustworthy, organized, and understands the responsibilities of managing assets. Whether it's a trusted family member, a professional, or a financial institution, the trustee should execute your wishes as the irrevocable trust trustor for the trust efficiently.

The assets in an irrevocable trust are owned by the trust itself, rather than the trustor or any beneficiaries. This means that once you transfer assets into the trust, you relinquish control and ownership. As an irrevocable trust trustor for the trust, your main role is to set up the trust according to your preferences and intentions, while the trust manages the assets.

In an irrevocable trust, the trustor relinquishes ownership of the assets transferred into the trust. Once the trust is created, the assets belong to the trust itself, not the trustor. This separation is important for tax and estate planning purposes, and understanding this distinction can help you navigate your role as the irrevocable trust trustor for the trust effectively.

One of the biggest mistakes parents often make when setting up a trust fund is failing to communicate their intentions clearly to their beneficiaries. This can lead to misunderstandings and conflicts in the future. To avoid this, it’s beneficial to work closely with a knowledgeable resource like USLegalForms, which can guide you through the process and help ensure that everyone understands the terms as the irrevocable trust trustor for the trust.

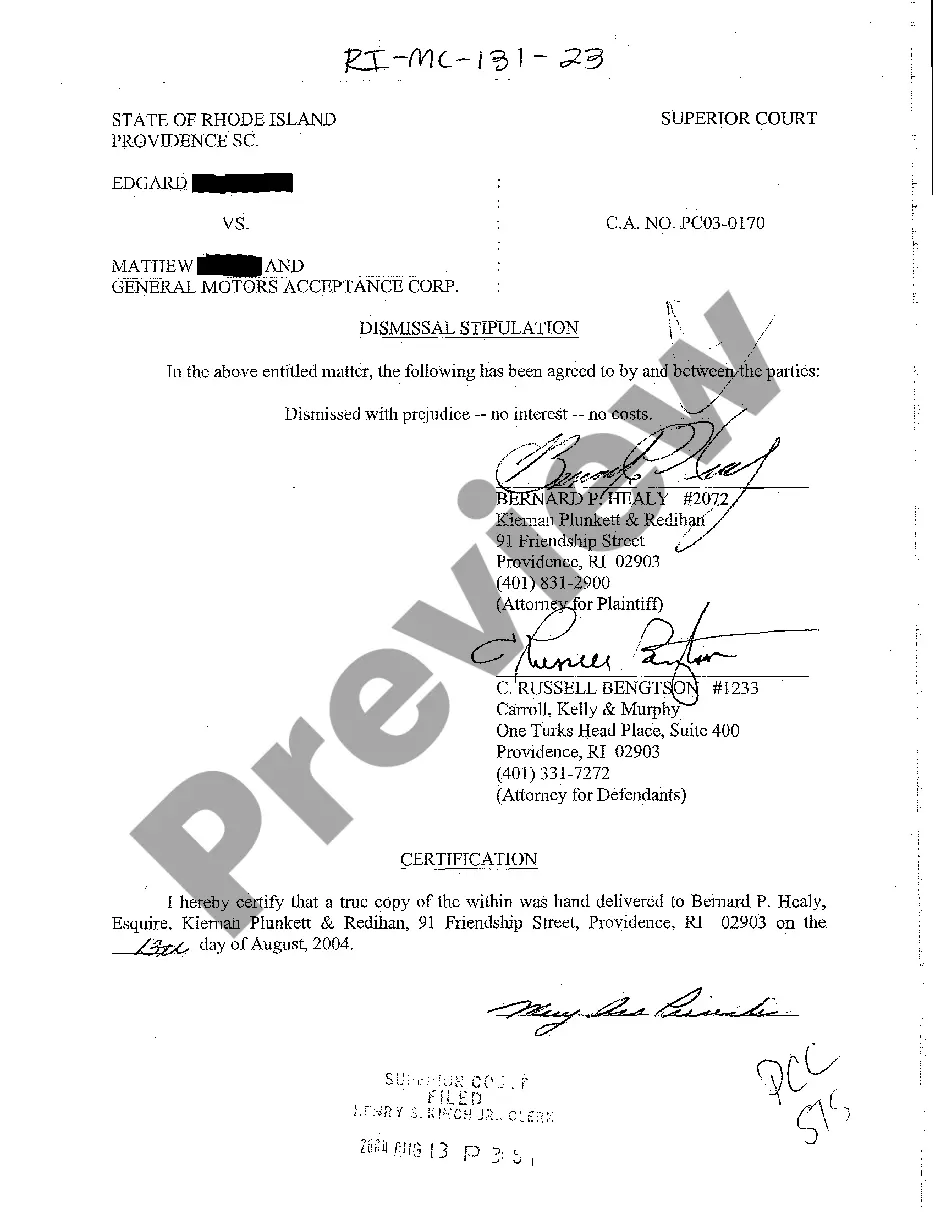

Whether an irrevocable trust must be filed with the court depends on state laws and the specific circumstances. Generally, most irrevocable trusts do not require court approval to be valid. However, consulting legal experts or using platforms like USLegalForms can help clarify these requirements and ensure compliance with local regulations.